Table of Contents

ToggleManaging payroll for a global team can be a complex task, with varying regulations, tax laws, and payment structures to consider. However, with the right international payroll provider, you can streamline the process, reduce administrative burdens, and ensure your team is paid accurately and on time, no matter where they are located.

This guide dives deep into what international payroll solutions are, highlights the top providers in the market, and explains the essential features you should consider. Whether you’re a small startup or a multinational corporation, this article will help you find the right solution to simplify your payroll operations.

What Are International Payroll Solutions?

International payroll solutions are platforms or services that help businesses pay their employees and contractors across borders efficiently and compliantly. These tools cater to companies with a distributed workforce by managing payroll calculations, tax compliance, and multi-currency payments, among other tasks.

By outsourcing payroll to a dedicated provider, businesses can focus on growth without worrying about the complexities of adhering to local labor laws or filing taxes in multiple countries. Here’s how these solutions work and why they’re indispensable for global operations:

Compliance Management:

Every country has its own set of labor laws, tax regulations, and employment standards. International payroll providers stay up to date on these requirements, ensuring businesses operate legally and employees receive their wages in full compliance with local laws.

Payment Processing:

These services support multi-currency payments, enabling companies to pay employees in their local currency. This reduces the risk of exchange rate issues and ensures timely payments.

Automated Tax Filing:

Tax regulations differ widely across countries. Payroll providers handle tax deductions, filings, and remittances, ensuring accuracy and avoiding penalties.

Time Savings:

By automating payroll processes, companies save countless hours on administrative tasks, freeing up resources to focus on their core operations.

Top International Payroll Providers

When choosing an international payroll provider, it’s important to understand the unique features and capabilities of each platform. Below, we’ll delve into six of the most trusted options, highlighting their advantages and potential drawbacks.

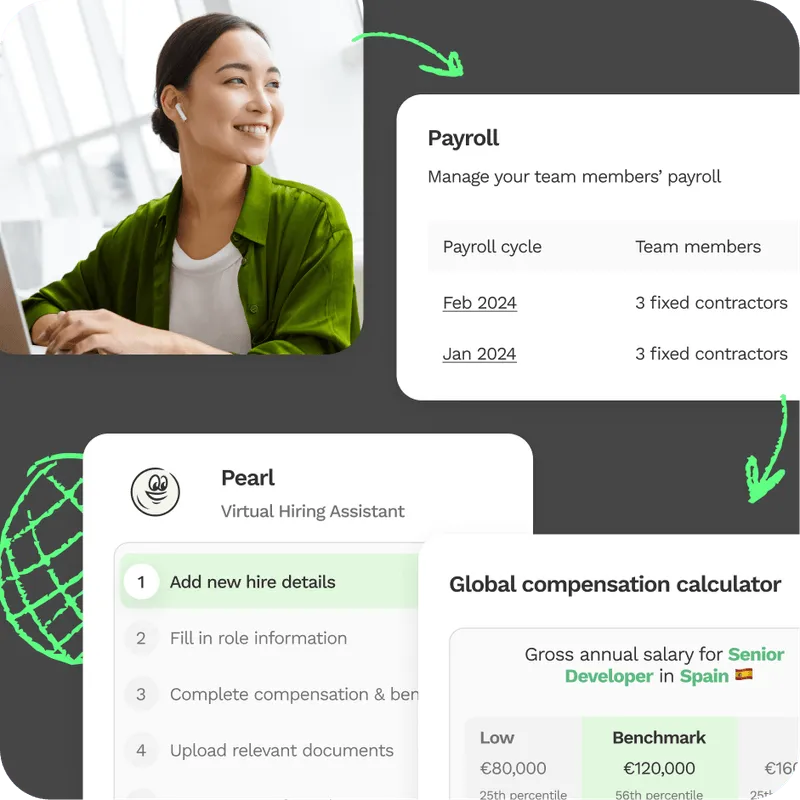

1. Oyster

Oyster is a comprehensive global employment platform designed for companies that want to manage their international workforce with ease. With coverage in 180+ countries, Oyster offers payroll, HR management, compliance support, and even tools for global talent sourcing.

Strengths:

- Wide Coverage: Oyster operates in over 180 countries, making it ideal for companies with teams in diverse locations.

- Comprehensive Services: The platform covers everything from onboarding to payroll and offboarding, ensuring a seamless employee experience.

- Integrationen: Oyster integrates with over 15 third-party apps, allowing businesses to connect it with their existing tools.

- EOR Services: For companies without a legal entity in a specific country, Oyster acts as an Employer of Record (EOR), handling compliance and legal responsibilities.

Weaknesses:

- Higher Costs for Small Teams: Smaller businesses may find Oyster’s comprehensive suite of services to be more than they need—and more expensive than they can afford.

- Feature Overload: Some businesses might not require all of Oyster’s features, which could make the platform feel overwhelming.

2. Rippling

Rippling combines HR, IT, and payroll management into one streamlined platform. Its strong focus on automation makes it a favorite for businesses looking to save time while managing their international teams effectively.

Strengths:

- Rapid Onboarding: Rippling boasts a 90-second onboarding process for international employees and contractors, making it incredibly efficient.

- Extensive Integrations: The platform integrates with various tools, ensuring a seamless flow of data across HR, payroll, and IT systems.

- Global Tax Compliance: Rippling automates tax calculations and filings, reducing the risk of errors.

- Employee Reimbursements: Employees can receive reimbursements in over 100 currencies, further simplifying international operations.

Weaknesses:

- Opaque Pricing: Rippling doesn’t provide detailed pricing information online, requiring businesses to contact the provider for custom quotes.

- Costly for Large Teams: While affordable for small teams, the costs can add up quickly as businesses scale and add more users.

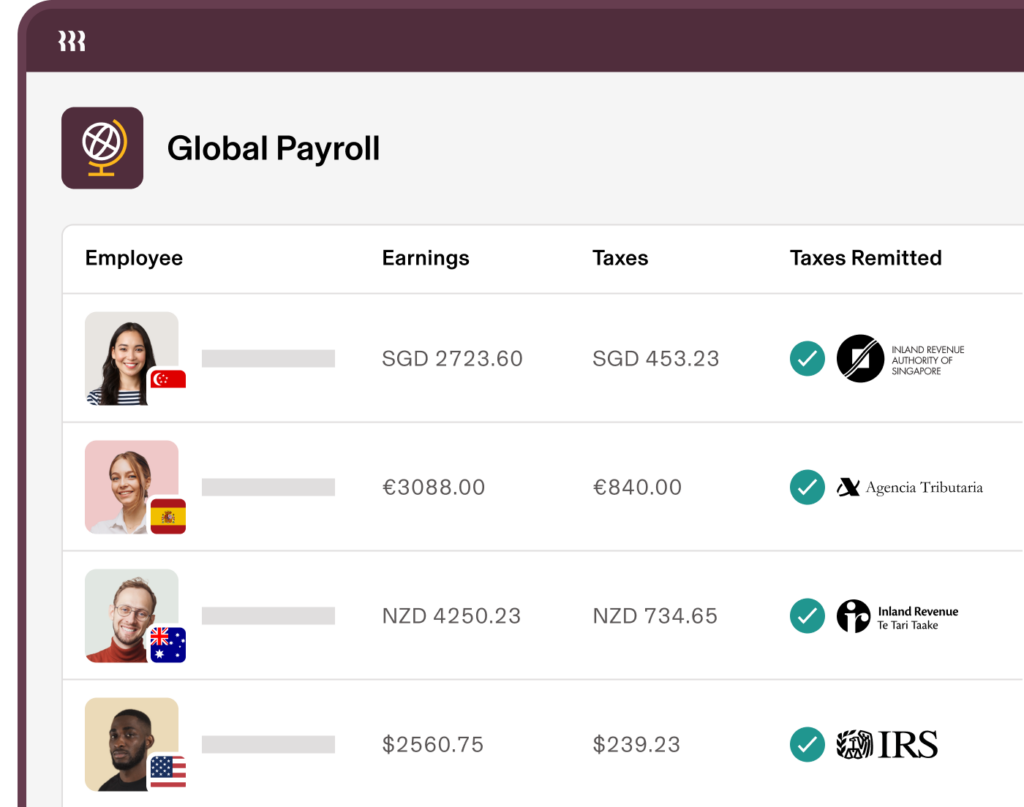

3. Papaya Global

Papaya Global is an excellent choice for larger businesses seeking a high level of payroll accuracy and compliance support. Operating in over 160 countries, it offers a wide range of features tailored to global enterprises.

Strengths:

- High-Volume Onboarding: Papaya can onboard up to 1,000 employees or contractors simultaneously, making it ideal for rapidly growing companies.

- Self-Service Features: Employees can access their own payroll information, reducing the administrative burden on HR teams.

- Language Support: The platform supports multiple languages, ensuring accessibility for diverse teams.

- Advanced Analytics: Papaya provides detailed reporting tools to help businesses analyze payroll data and make informed decisions.

Weaknesses:

- Expensive Plans: The platform’s pricing can be prohibitive for smaller businesses with limited budgets.

- Complex Interface: New users may find the dashboard confusing, requiring time to navigate effectively.

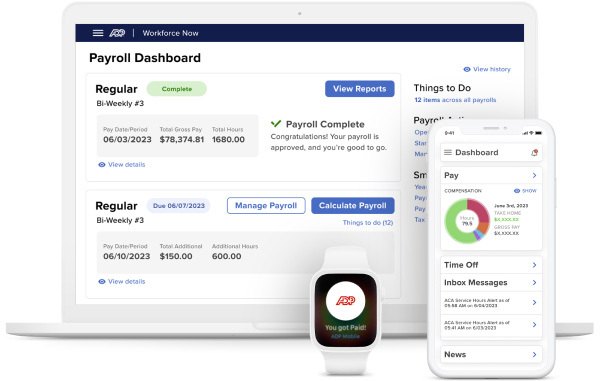

4. ADP GlobalView Payroll

ADP GlobalView Payroll is a trusted solution for large organizations managing payroll for 500+ employees in a single country. Its tools simplify multi-country payroll management, ensuring compliance and efficiency.

Strengths:

- Centralized Payroll Management: ADP consolidates payroll processes across countries, standardizing workflows.

- Localized Mobile Apps: Employees can access payroll information through apps tailored to their location.

- Compliance Expertise: With over 3,000 experts worldwide, ADP ensures businesses meet local regulatory requirements.

- Document Management: Payroll documents can be uploaded and accessed easily, keeping records organized.

Weaknesses:

- Premium Pricing: ADP’s advanced features come with a high price tag, making it more suitable for large enterprises.

- Add-On Costs: Many HR features are only available through paid add-ons, increasing overall costs.

Remote specializes in EOR services and provides end-to-end solutions for hiring, onboarding, payroll, and compliance. It’s a great choice for companies looking for strong employee support.

Strengths:

- Focus on Compliance: Remote prioritizes legal compliance, reducing risks for businesses.

- Employee Support: The platform assists with visa sponsorships, relocation, and insurance, ensuring employees are well taken care of.

- Customizable Contracts: Remote allows businesses to tailor contracts to specific roles and countries.

Weaknesses:

- High Costs for Small Companies: Remote’s pricing may not be feasible for startups or small businesses.

- Limited to EOR Services: Companies seeking broader payroll features may need to look elsewhere.

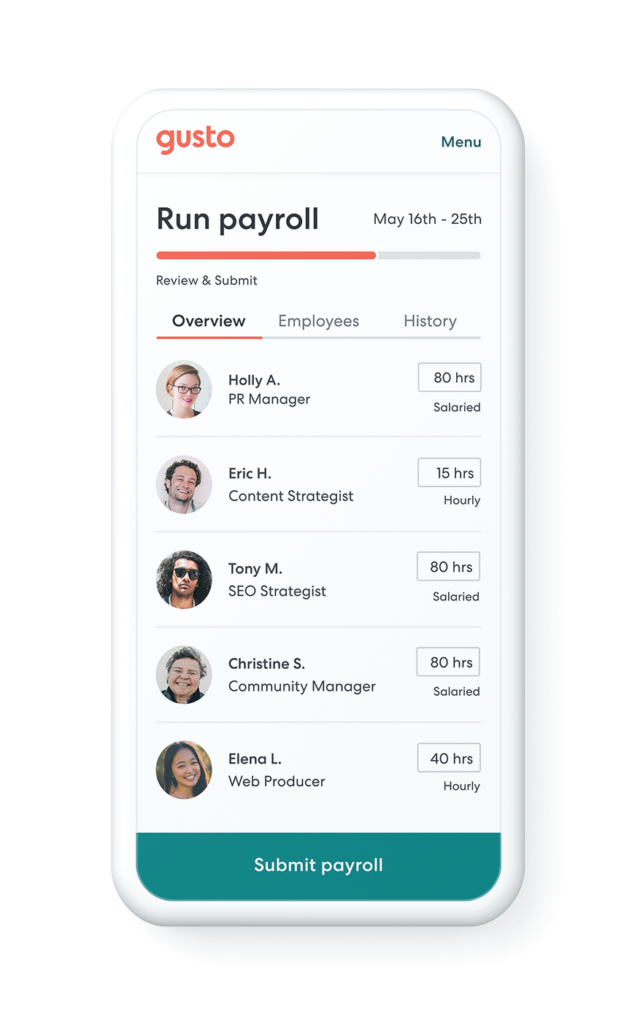

6. Gusto

Gusto offers a user-friendly platform for global payroll, particularly for businesses hiring international contractors. With coverage in 120+ countries, it’s an accessible option for companies of all sizes.

Strengths:

- Intuitive Interface: Gusto’s dashboard is easy to navigate, even for new users.

- Flexible Payments: The platform supports recurring payment schedules and payments in multiple currencies.

- Time Tracking Tools: Gusto includes geolocation and attendance tracking features to monitor employee hours.

Weaknesses:

- Limited HR Features: Gusto’s focus on payroll means it lacks some advanced HR functionalities.

- Domestic-Focused: While strong for global contractors, its offerings for full-time international employees are limited.

Key Features to Look for in International Payroll Solutions

When choosing an international payroll provider, focus on these essential features to ensure smooth operations and compliance:

Automated Payroll: Simplifies payments across countries, ensuring accurate salary, bonus, and tax calculations while reducing errors and administrative workload.

Compliance Tools: Keeps payroll aligned with local labor laws and tax regulations, safeguarding your business from legal risks and fines.

Multi-Currency Support: Enables seamless payments in employees’ local currencies, automating exchange rate calculations and ensuring timely transactions.

Tax Management: Automates tax deductions, filings, and document generation, ensuring compliance with international tax obligations and avoiding penalties.

Employee Self-Service: Provides employees access to pay stubs, tax documents, and payment history, reducing HR inquiries and improving transparency.

Integration Capabilities: Connects payroll with HR, accounting, and ERP systems for streamlined data management and more accurate reporting.

These features simplify global payroll processes, reduce risks, and enhance the experience for both employees and employers.

Choosing the Right Provider for Your Business

1. Service Coverage

Verify that the provider operates in all the countries where your team is based—and where you plan to expand. A provider with extensive geographic coverage will ensure that your payroll processes are compliant with local labor laws and tax regulations, no matter the location.

2. Experience and Reputation

You can choose a provider with a strong track record in your industry. Experienced providers are more likely to understand the specific challenges of managing payroll in your sector and offer tailored solutions. Assess their reliability and expertise by looking for testimonials, case studies, and third-party reviews.

3. Pricing Structure

Evaluate the provider’s pricing model to ensure it fits your budget. Look for transparent pricing that clearly outlines the costs for core services and any additional features you might need. Some providers charge a flat monthly fee, while others may include per-user fees or additional charges for specific services like compliance management.

4. Customer Support

Customer support is vital when managing payroll across borders, as issues may arise with compliance, payments, or system integration. Research how responsive and accessible the provider’s support team is by checking reviews and testimonials. Look for providers that offer 24/7 support or dedicated account managers who can address urgent issues quickly.

Conclusion

Managing payroll for an international workforce doesn’t have to be complicated. The right international payroll provider can simplify compliance, streamline operations, and ensure your team is paid accurately and on time, no matter where they are. By understanding your specific needs and prioritizing features like automated payroll, compliance tools, and multi-currency support, you can find a solution that fits your business. Whether you’re a startup or an established enterprise, a reliable provider is essential for scaling your global operations efficiently.