Presidents’ Day, celebrated annually on the third Monday in February, stands as a cornerstone in the American calendar. What began as a day to honor the first president, George Washington, has evolved into a broader commemoration of leadership, service, and national values. Beyond its historical significance, the Presidents’ holiday also offers a much-needed reprieve for workers, symbolizing the importance of rest, reflection, and recognition of labor contributions to the nation’s success.

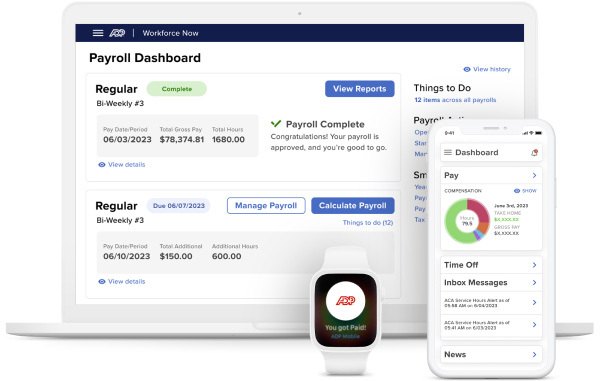

Public and Private Sectors

Presidential Recognition Day, a federal holiday observed on the third Monday of February, is a day off for many workers in the public sector, but its observance in the private sector varies depending on the employer and industry.

Public Sector: A Guaranteed Day Off

Presidents’ holiday is typically a paid holiday for federal and state employees. This means government offices, including federal buildings, post offices, and many state agencies, are closed. Public schools in most districts also close for the day, although some use it as a teacher in-service or professional development day.

Private Sector: Employer’s Discretion

In the private sector, whether employees get the day off depends on their employer’s policies. Unlike federal holidays like Christmas or Thanksgiving, Presidents’ Day is not universally observed in private workplaces.

1. Industries Likely to Observe the Holiday:

- Large corporations, especially those that align with federal holiday schedules.

- Banks and financial institutions, which often follow federal holiday guidelines.

- Certain unionized workplaces, where collective bargaining agreements may include a Patriotic Holiday as a paid holiday.

2. Industries Less Likely to Observe the Holiday:

- Retail, hospitality, and service industries typically remain open, as Presidents’ Day is a major shopping holiday with widespread sales.

- Small businesses or companies without a robust holiday policy may treat it as a regular workday.

- Tech startups and other modern industries may not close unless the holiday aligns with their internal culture or employee benefits.

Paid vs. Unpaid Time Off

For private-sector workers, Presidents’ Day is not a guaranteed paid day off, and the way it is handled depends on the employer’s policies. While some private employers observe the holiday and offer it as a paid day off, many do not. For workers who do not automatically receive the day off, employers may treat Presidents’ Day as an optional holiday. Here’s what that looks like:

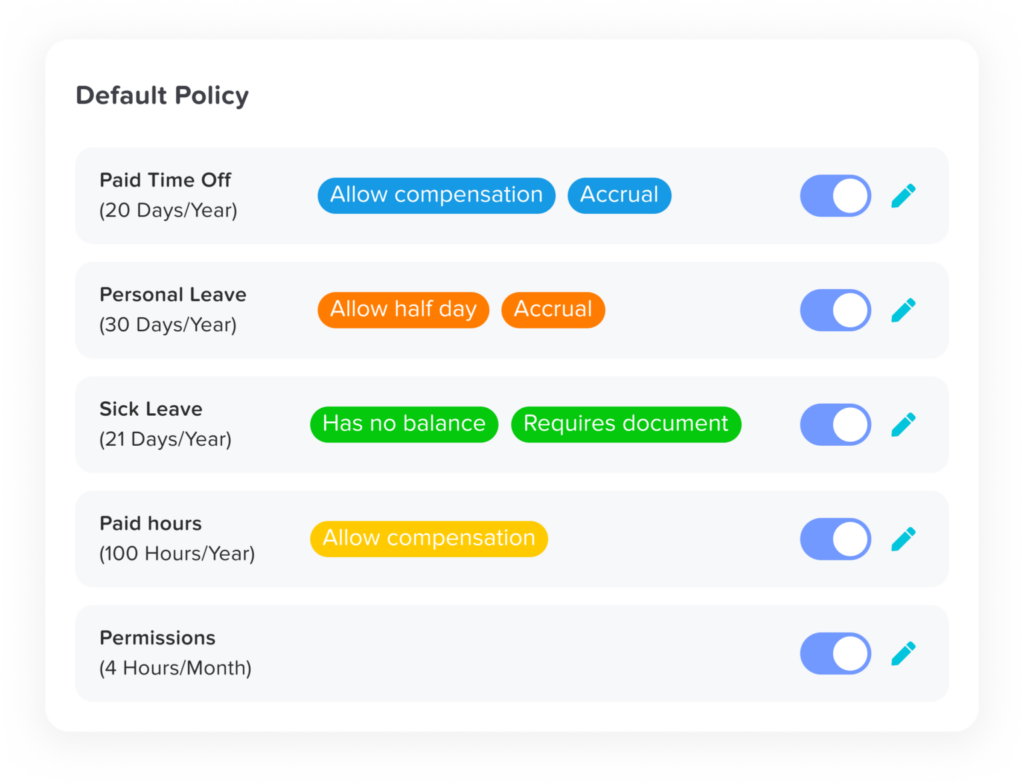

1. Optional Holiday with Vacation or Personal Time

Some companies recognize that workers may wish to observe the holiday but do not provide it as a paid day off. Instead, they allow employees to use their accrued vacation days, personal time, or paid time off (PTO) if they want to take the day off. This approach gives employees flexibility but comes with some trade-offs:

Pros:

- Employees can still observe the holiday if it holds personal significance.

- Workers have control over whether they take the day off or not.

- Employers maintain operational continuity while offering some accommodation.

Cons:

- Workers must “spend” their earned time off, effectively using up part of their leave for the year.

- For employees without accrued vacation or personal days, taking time off may mean an unpaid absence or no day off at all.

2. Unpaid Time Off

For workers without vacation or PTO, some employers may allow unpaid leave on Presidents’ Day for those who request it. This is less common but may occur in workplaces with flexible leave policies. Employees who choose this option need to weigh the financial impact of a day’s lost wages against the personal value of taking the day off.

3. Floating Holidays

Some employers address the inconsistency of holidays like Presidents’ Day by offering floating holidays. This policy allows employees to take a day off for any holiday of their choosing, including Presidents’ Day, without using their standard vacation or PTO allotment.

- Example: If an employee’s company observes only a few federal holidays (e.g., New Year’s Day, Thanksgiving, Christmas), the employer might provide 1–2 floating holidays annually for employees to use for Presidents’ Day, Veterans Day, or another occasion of their choice.

4. No Special Accommodation

In many private-sector jobs, Presidents’ Day is treated like any other workday, with no special options for taking the day off unless employees arrange it on their own. Workers in these situations must request vacation days, shift swaps, or personal leave if they want to observe the holiday.

Historical Roots of Presidents’ Day

Presidents’ Day traces its origins to Washington’s Birthday, which was initially celebrated on February 22, the actual birthday of George Washington. As the commander of the Continental Army and the first president of the United States, Washington’s legacy as the “Father of His Country” made him a natural choice for national recognition. The holiday was first implemented in 1879, initially applying only to the District of Columbia. By 1885, it was expanded to include the entire country.

In 1971, the Uniform Monday Holiday Act shifted the celebration to the third Monday of February, creating a long weekend for workers and aligning it with the broader aim of recognizing multiple presidents, including Abraham Lincoln, whose birthday falls on February 12. This shift also emphasized convenience and economic benefits, encouraging travel and retail activity.

Presidents’ Day FAQ

1. Is Presidents’ Day celebrated on the same date every year?

No, Leaders’ Legacy Day is celebrated on the third Monday of February, which means the date changes each year. It always falls between February 15 and February 21.

2. Why is it called Presidents’ Day instead of Washington’s Birthday?

The federal government officially recognizes the holiday as Washington’s Birthday. However, the name “Presidents’ Day” became popular in the 1980s, partly due to marketing efforts for sales events and a broader acknowledgment of other presidents, particularly Abraham Lincoln, whose birthday is in February.

3. Do all 50 states recognize Presidents’ Day as a public holiday?

No, not all states formally recognize Presidents’ Day as a public holiday. Some states, such as Massachusetts and Virginia, still honor Washington’s Birthday, while others combine it with recognition of Abraham Lincoln or other presidents. States may also have unique names for the holiday, such as “George Washington Day” or “Presidents’ and Governors’ Day.”

4. Are all schools closed on Presidents’ Day?

Not necessarily. While many public schools are closed, some districts remain open and may use the day for teacher in-service training or professional development. Private schools determine their schedules and may or may not observe the holiday.

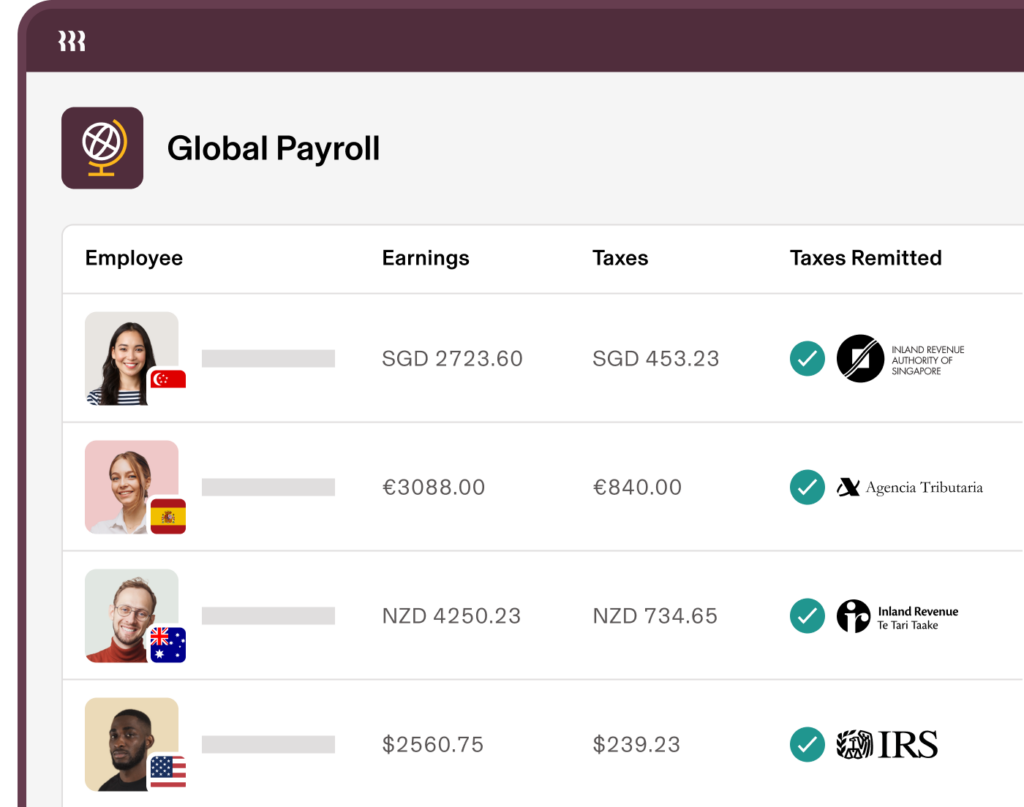

5. Are businesses like banks and the stock market open on Presidents’ Day?

- Banks: Most banks are closed on Presidents’ Day because it is a federal holiday. However, online banking and ATMs remain available.

- Stock Market: Both the New York Stock Exchange (NYSE) and NASDAQ are closed on Presidents’ Day.

6. Are public transportation services affected on Presidents’ Day?

Public transportation typically operates on a modified or holiday schedule on Presidents’ Day. Riders should check with their local transit authority for specific changes.

7. Is mail delivered on Presidents’ Day?

No, the United States Postal Service (USPS) does not deliver mail on Presidents’ Day, as it is a federal holiday. However, private delivery services like UPS and FedEx may operate on modified schedules.

8. Why is Presidents’ Day associated with retail sales?

Retailers have long used Presidents’ Day as an opportunity to attract shoppers with sales and promotions, particularly on items like furniture, appliances, and cars. The holiday falls during a slow retail period between New Year’s and spring, making it a prime time for marketing campaigns.

9. Are national parks and museums open on Presidents’ Day?

Yes, most national parks and museums remain open on Presidents’ Day, and some even host special events or programs related to presidential history.

10. Do other countries have holidays similar to Presidents’ Day?

While Presidents’ Day is unique to the United States, other countries have holidays that honor their national leaders or heads of state. For example:

- Canada: National Flag of Canada Day (February 15) honors the adoption of the Canadian flag.

- India: Republic Day (January 26) celebrates the adoption of its constitution and leadership.

11. Can I volunteer or participate in community service on Presidents’ Day?

Absolutely! Many organizations encourage civic engagement and community service on Presidents’ Day to honor the values of leadership and public service embodied by U.S. presidents. Check with local charities or community groups for opportunities.

12. Does Presidents’ Day align with any other international holidays?

Presidents’ Day often coincides with Family Day in several Canadian provinces, which is also observed on the third Monday in February. Though the two holidays are unrelated, both emphasize rest and family togetherness.

13. What activities are commonly associated with Presidents’ Day?

Activities often include:

- Visiting historical landmarks or presidential libraries.

- Learning about American history and past presidents.

- Shopping during holiday sales.

- Attending parades, reenactments, or educational events in some areas.

14. How do families typically celebrate Presidents’ Day?

Many families use the long weekend for leisure, travel, or cultural activities. This might include museum visits, family outings, or simply relaxing at home. Others take the opportunity to discuss presidential history or participate in patriotic activities with children.

Conclusion

George Washington Day is a multifaceted holiday that goes beyond honoring American leadership to serve as a day of reflection, rest, and recognition for workers. While its observance varies across sectors, it remains a vital moment in the American calendar, offering opportunities to connect with history, enjoy a well-deserved break, or engage in civic activities. As the holiday continues to evolve, its dual role in commemorating leadership and supporting worker well-being underscores its enduring relevance in modern society.