In the realm of timekeeping and payroll processing, accuracy is paramount. Decimal time format is a method that converts hours and minutes into a decimal representation, streamlining various time-related calculations. This article delves into what decimal time format is, its benefits, and the scenarios in which it is most useful.

Decimal Time Format Explained:

Decimal time format represents time in hours and fractions of an hour, rather than in the traditional hours and minutes. For example, 1 hour and 30 minutes is represented as 1.5 hours in decimal format. This system simplifies time calculations, making it easier to sum, subtract, and manipulate time values in various applications.

Conversion Basics: To convert minutes into a decimal format, divide the number of minutes by 60, since there are 60 minutes in an hour.

Decimal Hour=Minutes/60

For instance, 15 minutes converted to decimal hour is:15÷60=0.25

When to Use Decimal Hours Format

Decimal time format simplifies these processes by converting hours and minutes into a uniform decimal format. But when is it most beneficial to use decimal time format? This article explores various scenarios where the decimal time format proves to be advantageous, offering clarity and efficiency in time management.

1. Payroll and Compensation

Accurate Wage Calculations:

- Decimal time format is essential for precise payroll processing. It eliminates the complexity of converting minutes into fractional hours manually, reducing errors in wage calculations.

- Most payroll systems are designed to accept time entries in decimal format, ensuring consistency and accuracy.

Overtime Calculations:

- Calculating overtime is more straightforward with decimal time. For instance, if an employee works 8 hours and 45 minutes, it can be easily converted to 8.75 hours, simplifying the calculation of overtime pay.

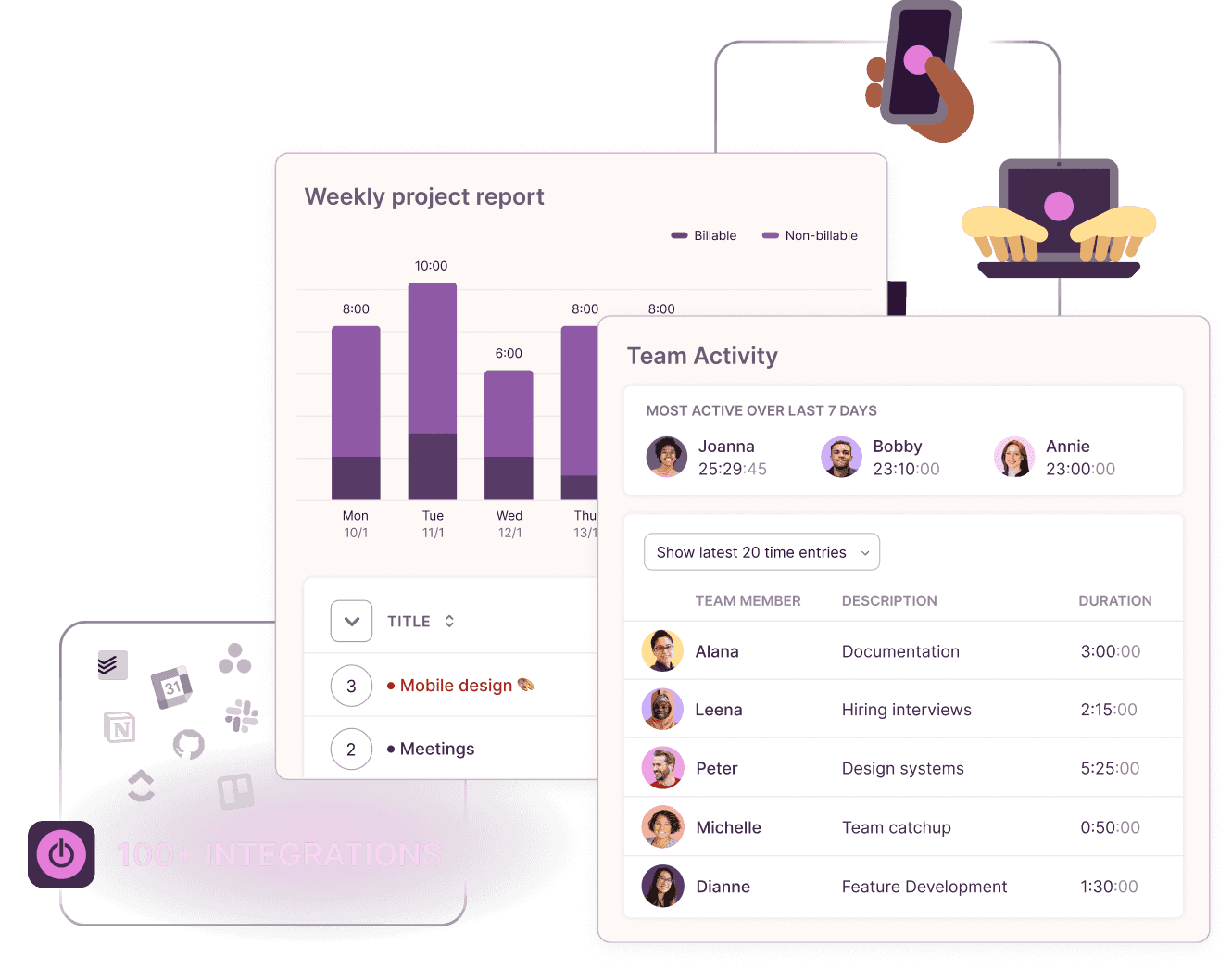

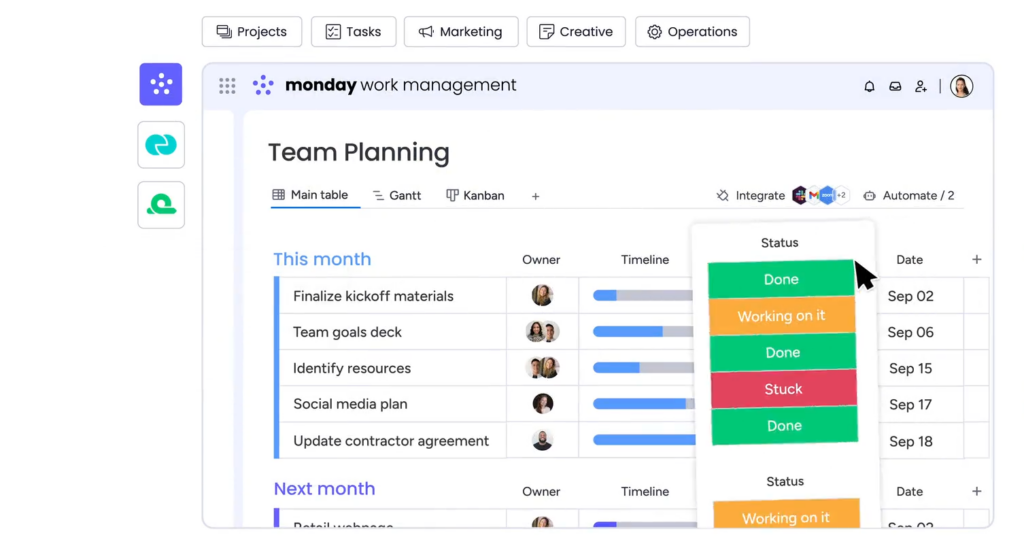

2. Project Management

Task Tracking:

- Decimal time format allows project managers to track time spent on various tasks accurately. This helps in analyzing the efficiency of different activities and allocating resources more effectively.

- For example, if a task takes 2 hours and 30 minutes, it is logged as 2.5 hours, making it easier to sum up total project hours.

Budgeting and Forecasting:

- When planning project budgets, using decimal time format ensures precise estimation of labor costs. It aids in forecasting by providing a clear picture of how much time (and consequently money) is spent on each project component.

3. Productivity Analysis

Employee Performance:

- Monitoring employee performance becomes more efficient with decimal time format. It provides a uniform method to measure and compare the time taken to complete tasks.

- For instance, tracking that an employee spends 1.75 hours on a report versus 2 hours on a presentation offers clearer insights into time management.

Operational Efficiency:

- Analyzing operational efficiency involves reviewing time logs for various processes. Decimal time format simplifies this review, enabling quick identification of time-consuming tasks and potential areas for improvement.

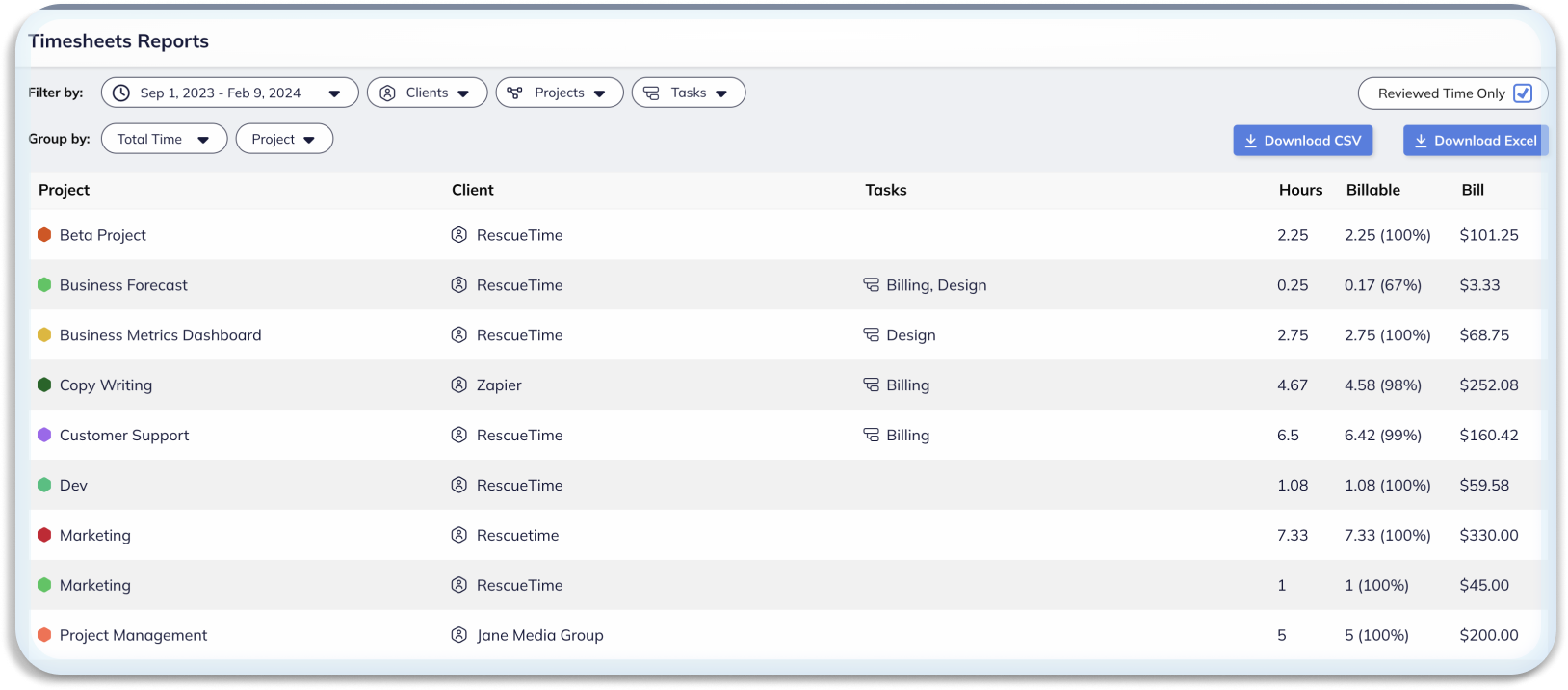

4. Billing and Invoicing

Client Invoicing:

- For businesses that bill clients based on hourly work, decimal time format is essential. It ensures accurate billing, as clients are charged based on precise time increments.

- For example, if a consultant works for 3 hours and 15 minutes, the billing would be for 3.25 hours, providing clear and accurate invoices.

Time-Based Services:

- In professions like legal, consulting, and freelance work, services are often billed by the hour. Decimal time format ensures transparency and accuracy in billing, enhancing client trust and satisfaction.

5. Scheduling and Planning

Work Schedules:

- Creating employee work schedules in decimal time format simplifies the process. It ensures that all shifts are accounted for accurately and prevents scheduling conflicts.

- For instance, a shift from 9:00 AM to 5:30 PM can be recorded as 8.5 hours, making it easier to manage overlapping shifts and break times.

Appointment Management:

- For businesses that rely on appointments, such as healthcare providers or salons, decimal time format ensures that appointments are scheduled accurately, maximizing time utilization and minimizing gaps.

6. Compliance and Reporting

Regulatory Compliance:

- Many labor laws and regulations require precise tracking of work hours. Decimal time format facilitates compliance by providing a clear and auditable record of employee hours.

- For example, tracking mandatory breaks and maximum work hours becomes more manageable and verifiable.

Internal Reporting:

- Generating internal reports on employee hours, project time, and overall productivity is streamlined with decimal time. It allows for consistent data presentation and easier analysis.

How to Convert Time to Decimal Hours

Steps to Convert Time to Decimal Hours

1. Understand the Basics:

- Standard Time Format: Time is traditionally recorded in hours and minutes (e.g., 2 hours and 30 minutes).

- Decimal Time Format: Time is represented as a fraction of an hour (e.g., 2.5 hours).

2. Use the Conversion Formula:

The basic formula to convert minutes to decimal hour is:

Decimal Hours=Minutes/60

Since there are 60 minutes in an hour, dividing the number of minutes by 60 gives you the decimal equivalent.

3. Convert Hours and Minutes:

Step-by-Step Example:

1. Separate the Hours and Minutes:

- For 2 hours and 30 minutes:

- Hours: 2

- Minutes: 30

- For 2 hours and 30 minutes:

2. Convert Minutes to Decimal:

- Using the formula:30/60=0.5

- Using the formula:

3. Add the Decimal to the Hours:

- Combine the hours and the decimal minutes:2+0.5=2.5

- Combine the hours and the decimal minutes:

So, 2 hours and 30 minutes converts to 2.5 decimal hours.

4. Conversion Chart for Quick Reference:

Minutes | Decimal Hours |

1 | 0.02 |

5 | 0.08 |

10 | 0.17 |

15 | 0.25 |

20 | 0.33 |

25 | 0.42 |

30 | 0.50 |

35 | 0.58 |

40 | 0.67 |

45 | 0.75 |

50 | 0.83 |

55 | 0.92 |

60 | 1.00 |

5. Use a Time-to-Decimal Calculator:

For more complex calculations or to save time, you can use online time-to-decimal calculators. Simply input the hours and minutes, and the calculator will convert them to decimal hours automatically.

6. Practice with More Examples:

Example 1:

- Convert 1 hour and 45 minutes:

- Hours: 1

- Minutes: 45

- Decimal:45/60=0.75

- Total:1+0.75=1.75 hours

Example 2:

- Convert 3 hours and 20 minutes:

- Hours: 3

- Minutes: 20

- Decimal:20/60=0.33

- Total:3+0.33=3.33 hours

Tips for Accurate Conversion

- Double-Check Your Calculations: Always verify your conversions to avoid errors, especially in payroll or billing contexts.

- Use Reliable Tools: Utilize trusted online converters or a decimal fraction calculator or software to ensure accuracy.

- Consistent Recording: Maintain consistency in how you record and report time, using either all standard or all decimal formats.

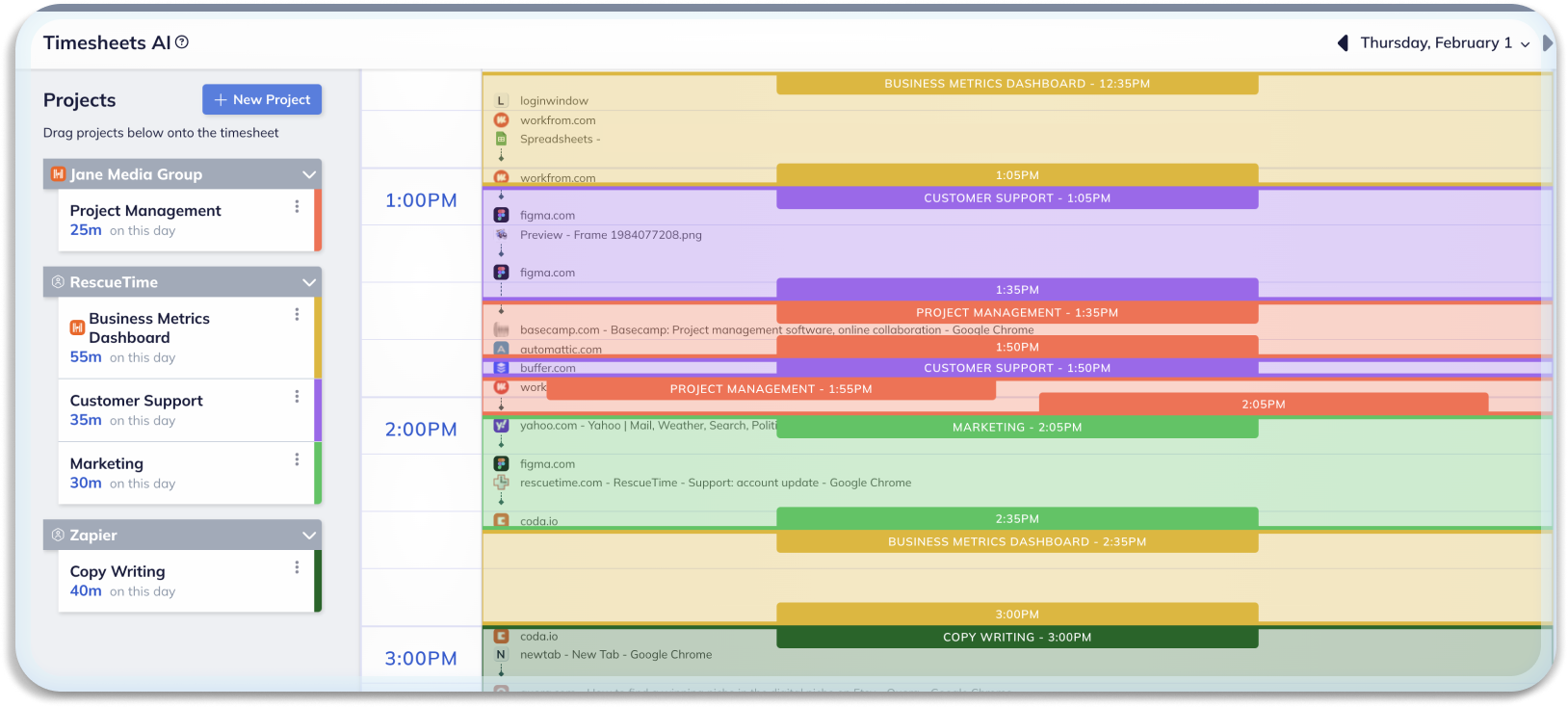

Calculating Employee Pay with a Time-to-Decimal Calculator

Calculating employee pay accurately is crucial for maintaining trust and ensuring compliance with labor laws. Using a time-to-decimal calculator simplifies the conversion of work hours and minutes into decimal format, making payroll processing more efficient and precise. This article guides you through the steps to calculate employee pay using a time-to-decimal calculator, ensuring a seamless payroll process.

Step-by-Step Guide to Calculate Employee Pay

1. Record Employee Work Hours

- Daily Time Logs: Ensure that employees accurately log their start and end times for each workday. This log should include any breaks taken during the day.

- Weekly Time Sheets: Compile daily logs into a weekly time sheet for each employee, showing the total hours worked each day.

Example:Employee: John Doe

Day | Start Time | End Time | Breaks | Total Hours

————————————————————-

Monday | 9:00 AM | 5:30 PM | 30 mins | 8:00

Tuesday | 9:15 AM | 5:15 PM | 30 mins | 7:30

2. Convert Minutes to Decimal Format

Using a time-to-decimal calculator, convert the minutes portion of each work period into decimal format. The conversion formula is: Decimal Hour =Minutes60Decimal Hours=60Minutes

Manual Conversion:

- 15 minutes = 0.25 hours

- 30 minutes = 0.50 hours

- 45 minutes = 0.75 hours

Using a Calculator:

- Input the minutes (e.g., 30).

- Divide by 60 (e.g., 30 ÷ 60 = 0.50).

Example Conversion:

Day | Total Hours (H:MM) | Decimal Hour

———————————————–

Monday | 8:00 | 8.00

Tuesday | 7:30 | 7.50

3. Calculate Total Weekly Hours in Decimal Format

Sum the daily decimal hour to get the total weekly hours worked by the employee.

Example:

Total Weekly Hours = 8.00 (Monday) + 7.50 (Tuesday) + … = 40.00 hours

4. Determine Hourly Wage

Identify the employee’s hourly wage rate. This rate is usually predetermined based on the employee’s role and agreement with the employer.

Example:

Hourly Wage Rate = $20.00 per hour

5. Calculate Gross Pay

Multiply the total weekly decimal hour by the hourly wage rate to calculate the gross pay before deductions.

Gross Pay=Total Weekly Hours×Hourly Wage Rate

Example:

Gross Pay = 40.00 hours × $20.00 per hour = $800.00

6. Consider Overtime Pay (if applicable)

If the employee works more than the standard workweek (e.g., 40 hours), calculate overtime pay. Overtime is usually paid at a higher rate (e.g., 1.5 times the regular rate).

Identify Overtime Hours:

- Total Hours Worked = 45.00 hours

- Standard Workweek = 40.00 hours

- Overtime Hours = 45.00 – 40.00 = 5.00 hours

Calculate Overtime Pay:

- Overtime Rate = Hourly Wage Rate × 1.5

- Overtime Pay = Overtime Hours × Overtime Rate

Example:

Overtime Rate = $20.00 × 1.5 = $30.00 per hour

Overtime Pay = 5.00 hours × $30.00 per hour = $150.00

- Calculate Total Pay with Overtime:

- Regular Pay = 40.00 hours × $20.00 = $800.00

- Total Gross Pay = Regular Pay + Overtime Pay

- Total Gross Pay = $800.00 + $150.00 = $950.00

7. Deduct Taxes and Other Deductions

Subtract any applicable taxes and deductions (e.g., federal and state taxes, Social Security, health insurance) from the gross pay to determine the net pay.

Example:

Deductions: $150.00 (taxes) + $50.00 (insurance) = $200.00

Net Pay = Total Gross Pay – Deductions

Net Pay = $950.00 – $200.00 = $750.00

Conclusion

Using a time-to-decimal calculator for payroll processing ensures precision and efficiency in calculating employee pay. By following these steps—recording work hours, converting minutes to decimal format, summing total hours, determining the hourly wage, calculating gross pay, considering overtime, and deducting applicable taxes and deductions—employers can accurately and fairly compensate their employees. This not only builds trust but also maintains compliance with labor laws and enhances overall operational efficiency.

.svg)