Managing employee time off requests and tracking paid time off (PTO) can be a daunting task for businesses of all sizes. To streamline this process, many companies turn to time-off trackers, which help employers manage vacation requests, sick leave, and other absences efficiently. While many time-off tracking solutions are available, not all of them come with hefty price tags. There are several free employee time off tracker that offer robust features to help businesses organize and track their employees’ leave.

One such solution is Day Off, a completely free tracker app that simplifies leave management for both employers and employees.

Why Use a Time-Off Tracker?

Tracking time off manually, using spreadsheets or paper-based systems, can lead to confusion, missed deadlines, and administrative errors. A dedicated time-off tracker offers many benefits, including:

- Automation: Automated systems reduce the likelihood of human error and ensure that no request or approval is missed.

Transparency: Both employees and managers can easily view available PTO, pending requests, and upcoming time off in one place.

Efficiency: A time-off tracker streamlines the entire process from request to approval, saving HR departments time.

Policy Compliance: Trackers can help ensure that employees adhere to company policies, such as blackout periods or leave limits.

Features of a Good Free Employee Time Off Tracker

When selecting a free employee time-off tracker, it’s important to ensure that the tool offers the core features necessary for effective leave management. Here are the key features you should look for:

User-Friendly Interface: Employees should be able to submit requests easily, and managers should find it simple to review and approve them.

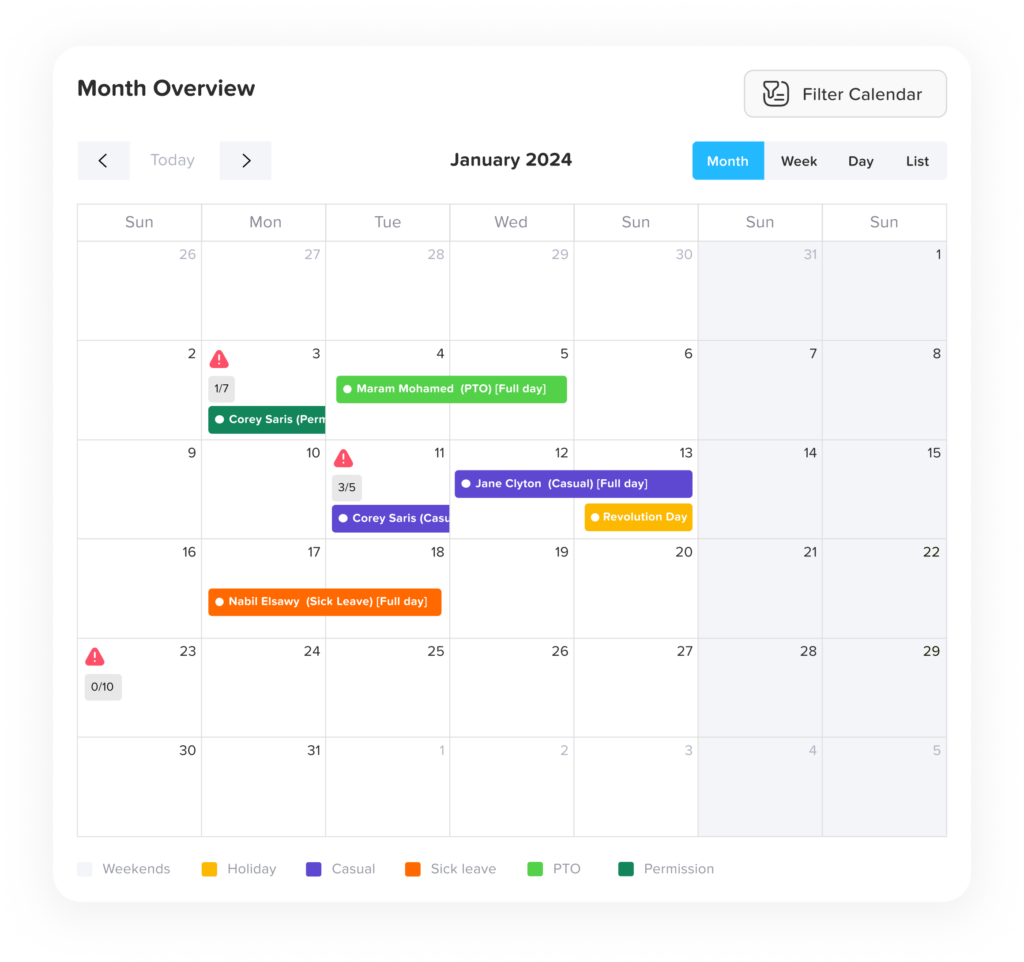

Calendar Integration: Integration with company calendars (Google Calendar, Outlook, etc.) can make it easier for managers to see who is taking time off and plan around these absences.

Custom Leave Types: The tool should allow you to define various types of leave (vacation, sick days, parental leave, etc.) according to your company’s policies.

Mobile Access: A good time-off tracker should allow employees to submit requests and check their PTO balances from their phones.

Notifications and Alerts: Managers and employees should receive notifications when requests are submitted, approved, or denied.

Free Tier with Adequate Functionality: While some tools offer free plans, ensure that the basic version provides enough features for effective leave management.

Day Off: A Free Time Off Solution

Day Off is an excellent example of a free and tracker-free employee time-off tracker that caters to small and medium-sized businesses. Unlike other tools that may collect user data for marketing purposes, Day Off is focused on maintaining user privacy while offering essential features for managing employee leave.

Key Features of Day Off:

No Tracking or Data Collection: As a tracker-free app, Day Off does not collect or sell user data. This makes it an appealing choice for businesses that prioritize privacy and data security.

Free to Use: Day Off offers its core features completely free of charge, allowing businesses to manage employee time off without incurring extra costs.

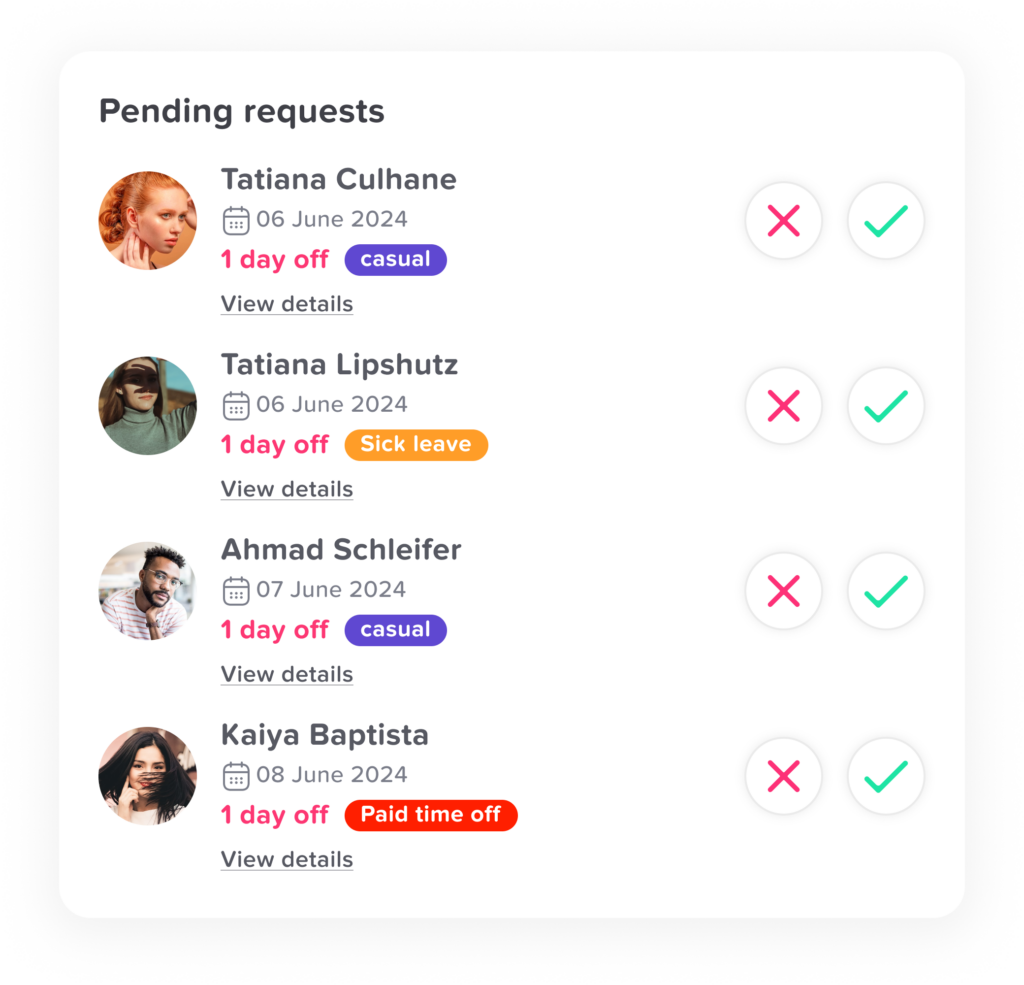

Simple User Interface: The platform is designed with ease of use in mind. Employees can submit time-off requests, and managers can approve them with just a few clicks.

Leave Calendar: The app includes a calendar view, making it easy for managers to see upcoming time off and plan for any staffing gaps.

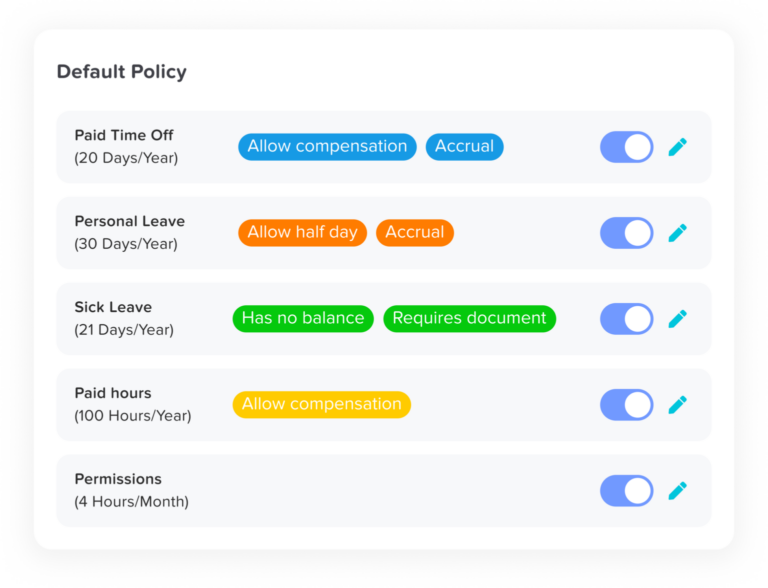

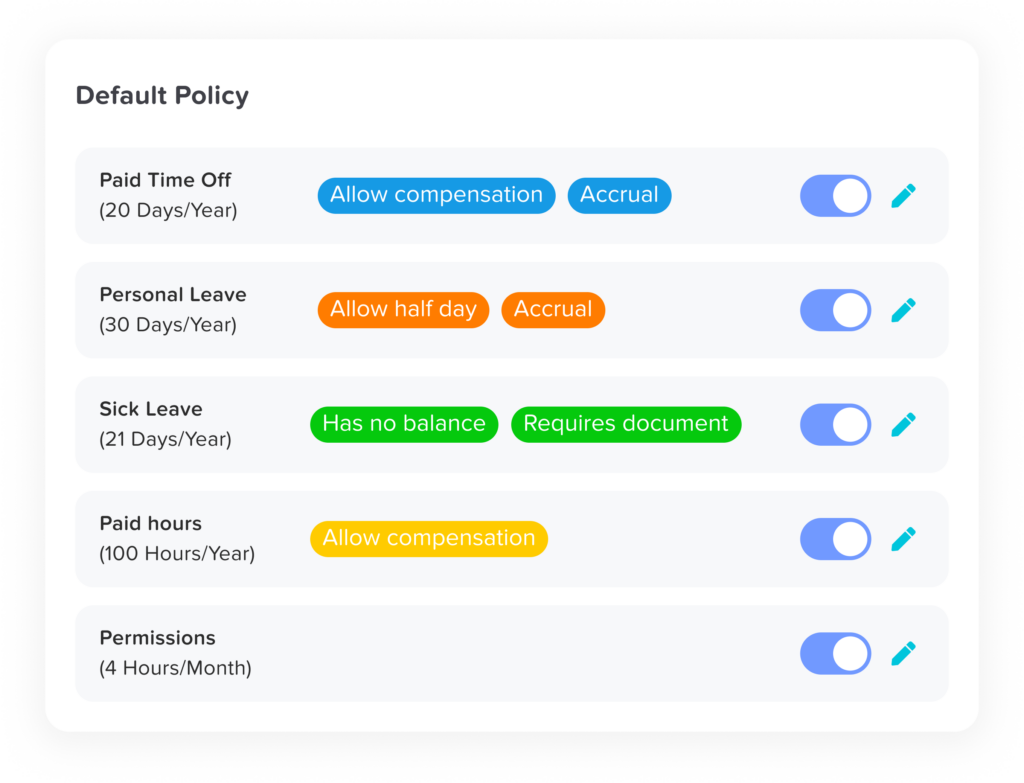

Custom Leave Types: Employers can customize the different types of leave available to their employees, ensuring the tool aligns with their policies.

Push Notifications: Both employees and managers receive notifications when requests are submitted or updated, ensuring everyone stays informed.

How Day Off Works

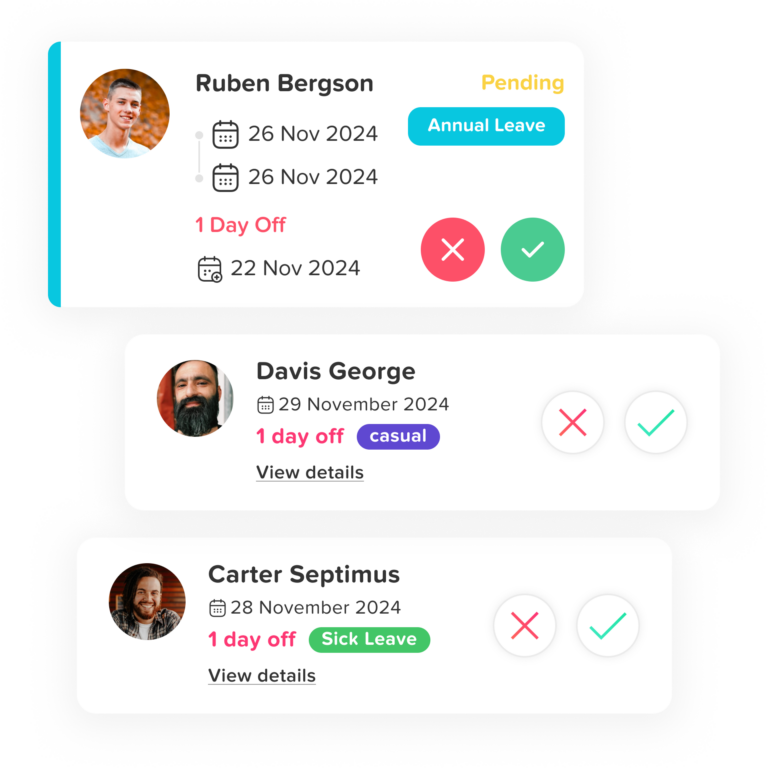

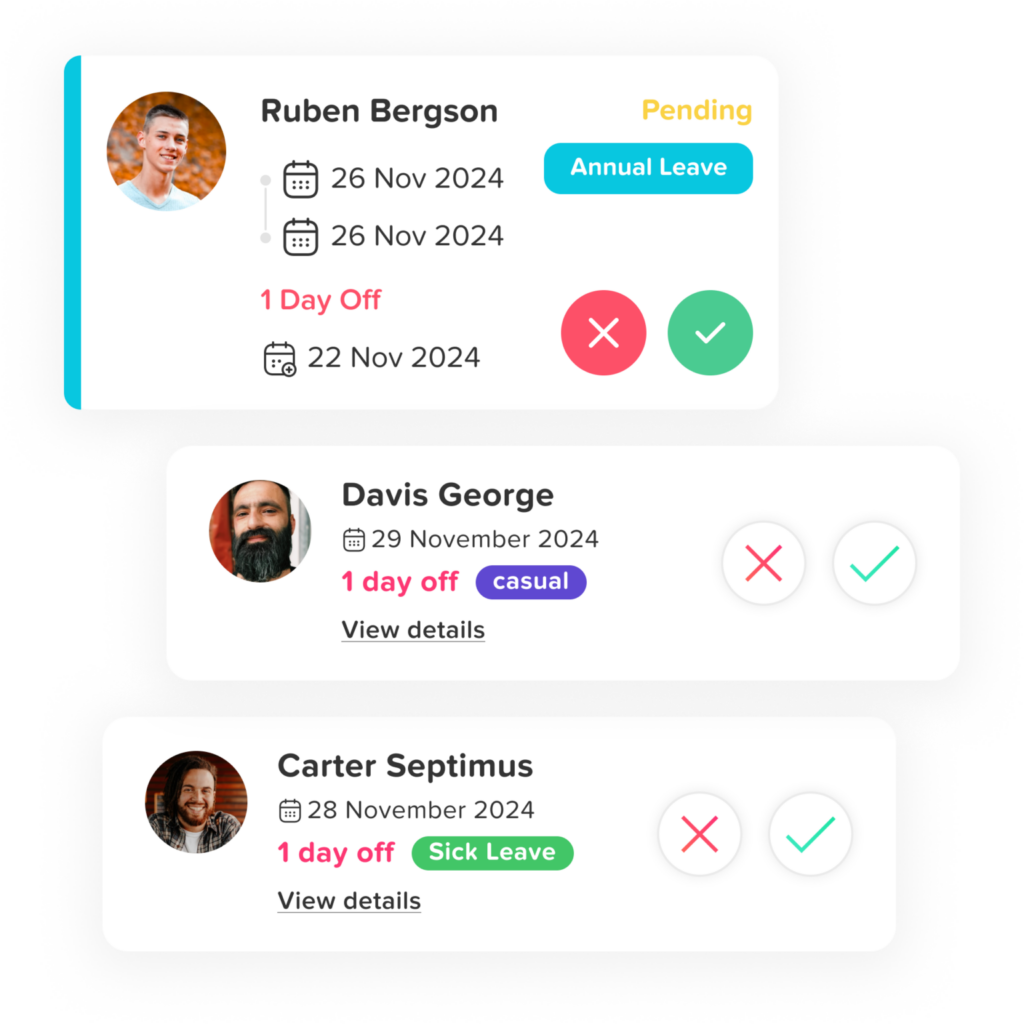

Employee Requests: Employees submit time-off requests directly through the app, selecting the type of leave and the desired dates.

Manager Approval: Managers are notified of the request and can review it. They can approve or deny the request with a simple click, and the employee is notified immediately.

Leave Calendar: The app keeps track of all approved time off in a central calendar, giving both employees and managers a clear view of upcoming leave.

PTO Balances: Employees can check their remaining PTO balances directly in the app, eliminating the need for HR to handle these inquiries manually.

Additional Free Time-Off Tracker Options

While Day Off is an excellent tool for small to medium-sized businesses, there are other free solutions worth considering:

- Clockify: Clockify is a time-tracking tool that also offers PTO management. Employees can request time off, and managers can approve or reject requests. It also generates reports, making it a solid option for both time tracking and leave management.

- Zoho People: Zoho People is a free HR software for small teams (up to five employees). It includes leave management, attendance tracking, and employee databases, making it ideal for businesses needing a broader HR solution.

- Jibble: Jibble offers basic time-off tracking alongside time tracking. Its simple interface allows employees to submit leave requests and managers to approve them, perfect for small teams needing straightforward functionality.

Toggl Plan: Toggl Plan focuses on project management but includes features for tracking team availability and PTO. It visually displays team leave, helping managers avoid scheduling conflicts.

FAQs: Common Questions About Employee Time Off Trackers

1. Can employees track their own PTO balances in a time-off tracker?

Yes, most employee time-off trackers, including Day Off, allow employees to view their remaining PTO balances. This feature helps employees stay informed about how much leave they have left without needing to ask HR or managers, streamlining the process for everyone.

2. Is a tracker-free time-off tracker secure?

Yes, a tracker-free time-off tracker like Day Off is focused on protecting user privacy. By avoiding third-party trackers and data collection, these platforms reduce the risk of personal data being exposed or misused. Tracker-free apps are generally more secure, as they limit the amount of information shared online.

3. How do time-off trackers handle sick leave vs. vacation days?

Most time-off tracking tools, including free options, allow you to categorize different types of leave, such as vacation days, sick leave, and personal time off. Employers can define and customize leave types based on company policies, ensuring that both employees and management can accurately track each type of time off.

4. Can time-off trackers be integrated with payroll systems?

While free versions of time-off trackers may have limited integrations, some tools allow integration with payroll systems. Paid versions or premium tools often offer more advanced features, such as integration with payroll, HR systems, or calendar apps. Day Off primarily focuses on time-off management, but advanced systems like Zoho People or Clockify may offer payroll integration.

5. How many employees can use a free time-off tracker?

Most free time-off trackers, like Day Off, cater to small and medium-sized businesses and typically do not impose strict limits on the number of employees who can use the app. However, some tools may restrict certain features or the number of users under their free plans. Always check the plan details to ensure it meets your business’s needs.

6. Can I use a time-off tracker to enforce company leave policies?

Yes, time-off trackers allow businesses to enforce company-specific leave policies. Employers can set up rules for different types of leave, blackout periods (times when leave is not allowed), and leave limits for employees. This ensures that the time-off system remains compliant with internal policies and helps manage leave more effectively.

7. Do free time-off trackers work on mobile devices?

Yes, many free employee time-off trackers, including Day Off, offer mobile access via an app or mobile-friendly website. This enables employees to request time off, check PTO balances, and receive notifications from their smartphones, making the process more convenient for teams that work remotely or are on the go.

8. What happens if multiple employees request time off on the same dates?

Most time-off trackers offer features that allow managers to see overlapping requests. This helps prevent scheduling conflicts and ensures that enough employees are available to cover essential business functions. Managers can then approve or deny time-off requests based on these insights.

9. Is there support for holidays and regional leave laws in free trackers?

Many time-off trackers include support for holidays, allowing employers to input public holidays or regional leave rules. Free solutions like Day Off and Clockify typically offer the ability to customize leave types and schedules, so you can manage holidays according to your company’s location and policies.

10. Can time off trackers be customized for different leave accrual methods?

Yes, time-off trackers often support various accrual methods. For instance, some companies offer PTO based on hours worked, while others may use an annual allotment. Tools like Day Off let you adjust accrual methods and leave policies to align with your company’s specific approach to time-off management.

Conclusion

Using a free employee time off tracker like Day Off Vacation Tracker can significantly improve the way businesses manage employee leave while keeping costs low and maintaining a high standard of privacy. With its user-friendly interface, essential features, and tracker-free approach, Day Off stands out as a practical choice for small businesses that need an effective solution without compromising on privacy. By automating leave management and providing transparency, free time-off trackers can save time, reduce errors, and help teams stay organized.