Managing finances is a crucial aspect of running any business, and having the right Accounting Software can significantly streamline this process. From tracking expenses and managing invoices to preparing financial reports, accounting tools can take the burden off business owners and financial teams, allowing them to focus more on growth. With so many options on the market, it can be difficult to find the perfect fit, especially when considering factors like ease of use, functionality, and price.

In this article, we explore the top 10 accounting software solutions that cater to a variety of business needs. Whether you’re a small business owner looking for simplicity or a large corporation seeking comprehensive financial management, these tools offer features that can help you stay on top of your finances. From basic bookkeeping to advanced reporting and compliance features, there’s an accounting solution for every type of business.

Each software on our list offers unique advantages, from user-friendly interfaces to seamless integrations with other business tools like CRM or payroll systems. Some solutions prioritize automation, helping to save time on repetitive tasks, while others focus on customization and scalability to adapt to growing businesses. Understanding what your business needs in terms of functionality and support will help in choosing the right option.

As we dive into these top 10 accounting software solutions, we will highlight their standout features, pricing models, and ideal use cases. Whether you need robust financial reporting, tax compliance, or simple invoicing capabilities, this list will guide you toward the best choice for your business.

Top 10 Accounting Software

Here’s a roundup of the top 10 accounting software for 2025, tailored to various business needs.

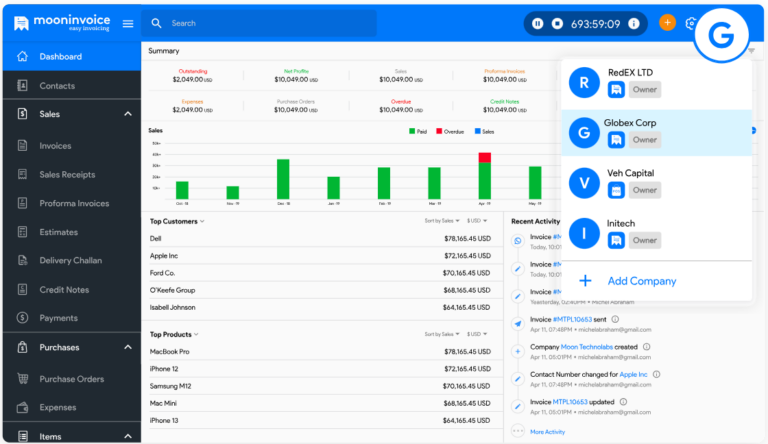

Key Features

Invoice & Estimates: Make invoices and estimates professionally in less than 2 minutes

Customizable Templates: Use readymade templates to generate invoices without any hassle.

Purchase order: Generate error-free purchase orders to foster healthy relations with vendors or suppliers.

Proforma Invoice: Create a proforma invoice and easily convert it to an invoice after confirmation.

WhatsApp & Email Send: Share invoices, estimates, and receipts with a single click of the button.

Payment Tracking: Hassle-free track unpaid or paid invoices rather than making unnecessary phone calls.

Business Reports: View 15+ high-quality business reports to make strategic decisions.

Expense Tracking: Monitor your business spending by centralizing your expense data on invoicing software.

Payment Integration: 20+ payment gateways to make sure you get paid in a timely manner.

24/7 Support: Seek the expert’s help by contacting us through an email or live chat.

Cloud Sync: Real-time cloud sync to make sure no business data loss and easy accessibility.

$5.47 per month • Trial: Yes • Free Plan: No.

Pros

User-friendliness: Invoicing software is so user-friendly that it doesn’t require any training session.

Accurate Reporting: It helps you perform accurate financial reporting to comply with tax laws.

Multi-currency Support: Moon Invoice offers more than 100 currencies to satisfy your clients across the globe.

Cloud Storage: It provides unlimited storage to keep your invoices, estimates and other important data safe.

Ideal for Growing Businesses: A go-to invoicing platform for small businesses to automate administrative tasks.

Cons

No Data Sync If No Internet: Data synchronization is only possible via Internet connectivity.

Limited Feature on The Basic Plan: Purchasing a standard plan will restrict the use of advanced features.

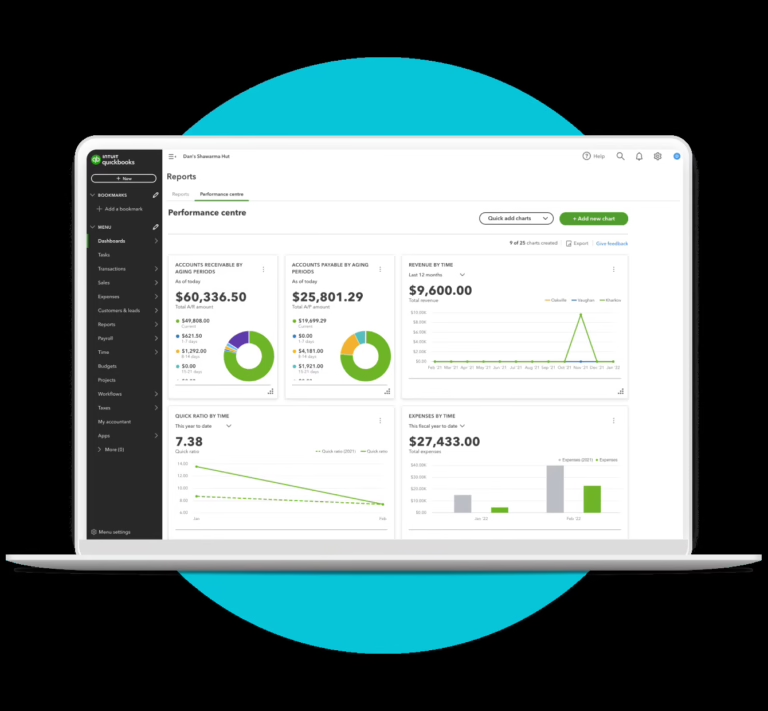

2. QuickBooks Online

Key Features

$30 per month • Trial: Yes • Free Plan: No.

Pros

Accessibility: Being cloud-based, it allows you to access your financial data from anywhere.

Easy to Use: Intuitive interface, especially for non-accountants.

Automation: Automates invoicing, payment reminders, and reconciliation.

Scalability: Suitable for small businesses with plans that scale as your business grows.

App Integration: Supports integration with many third-party apps for enhanced functionality.

Frequent Updates: Automatically updated software without the need for manual upgrades.

Collaboration: Allows multiple users to collaborate on the same data simultaneously.

Comprehensive Support: Extensive customer support and community forums.

Cons

Cost: Subscription-based pricing can be expensive for small businesses compared to one-time payment software.

Limited Features on Lower Plans: Some key features, like inventory tracking and project profitability, are only available in higher-tier plans.

Learning Curve: While user-friendly, it still requires time to learn for complete beginners.

Limited Customization: The platform has limited customization options for reports and invoices compared to other accounting software.

Reliance on Internet: As a cloud-based solution, it requires a stable internet connection to function.

Customer Support: Response times from customer support can be slow at times.

Data Limitations: Large companies with complex needs may find the data and file size limitations restrictive.

Security Risks: Although secure, being cloud-based always comes with the inherent risk of data breaches.

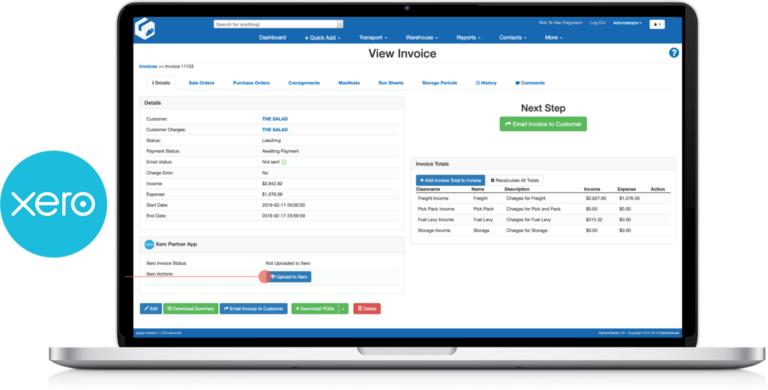

3. Xero

Key Features

$20 to $80 per month • Trial: Yes • Free Plan: No.

Pros

Ease of Use: Simple and intuitive interface, making it user-friendly even for non-accountants.

Comprehensive Features: Xero offers a wide range of features, including multi-currency, payroll, project management, and advanced reporting.

Collaboration: Allows multiple users with customizable access levels, enabling team collaboration and accountant access.

App Ecosystem: Large selection of third-party integrations, allowing businesses to extend functionality based on their needs.

Scalable: Suitable for a range of businesses, from freelancers and startups to larger enterprises with more complex needs.

Automation: Automates invoicing, reconciliation, and tax filing, reducing manual entry and saving time.

Frequent Updates: Regular updates to improve features and security.

Unlimited Users: Xero allows unlimited users in all pricing plans, a significant advantage over competitors that restrict user numbers.

Cons

Price: Xero can be expensive, especially for small businesses, and some advanced features are only available in higher-tier plans.

Limited Customer Support: Xero offers only online customer support, with no phone support option, which can delay resolution for urgent issues.

Complexity for Beginners: While user-friendly, the depth of features may overwhelm users with no prior accounting knowledge.

Limited Payroll in Some Regions: Payroll features are only available in certain countries (e.g., U.S., UK, Australia, and New Zealand), which may be a limitation for businesses in other regions.

Learning Curve for Advanced Features: Although basic tasks are simple, more advanced features, like customization of reports, can have a steep learning curve.

Add-Ons Cost Extra: While Xero integrates with many apps, some important tools like payroll, expenses, and projects require additional subscriptions, adding to the overall cost.

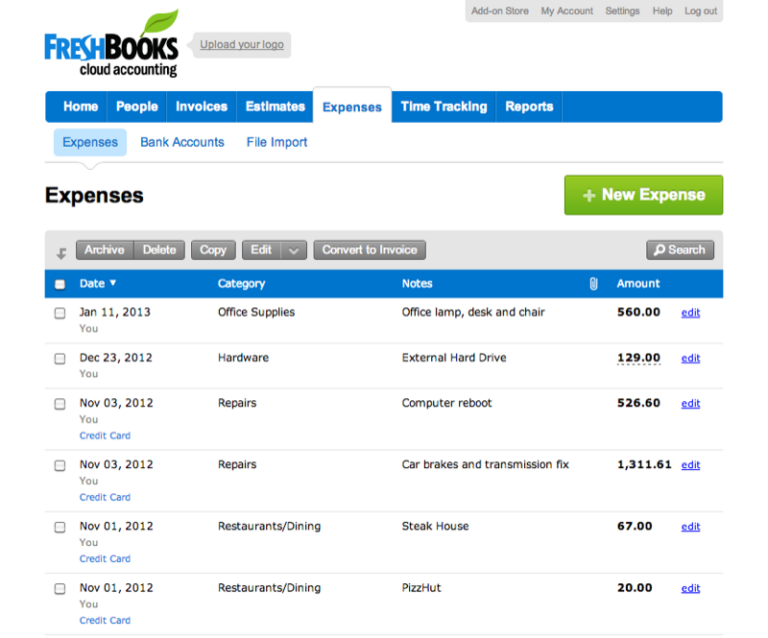

4. FreshBooks

Key Features

$17 to $55 per month • Trial: Yes • Free Plan: No.

Pros

Easy to Use: FreshBooks has a user-friendly interface that simplifies invoicing, expense tracking, and reporting for non-accountants.

Customizable Invoices: Ability to customize invoice templates to fit your brand, add due dates, and automatically send payment reminders.

Time Tracking Integration: Built-in time tracking is a great feature for freelancers or small teams that need to bill hourly.

Good for Small Service Businesses: Offers excellent features for freelancers, small businesses, and service-based companies.

Client Portal: Clients can view, print, and pay invoices online, creating a seamless experience for both parties.

Responsive Support: FreshBooks offers award-winning customer support through email and phone.

Automation: Automates recurring invoices and payment reminders, helping you save time on routine tasks.

Cons

Limited Features for Larger Businesses: FreshBooks is ideal for freelancers and small businesses but lacks some features needed for larger enterprises (e.g., advanced inventory management).

Limited Number of Billable Clients: The basic plans only allow a limited number of billable clients (5 for the Lite plan), which may be restrictive for growing businesses.

Pricey for Large Teams: FreshBooks charges extra for additional users, which can make it costly for teams.

Limited Customization in Reports: While reports are easy to generate, there is less flexibility for customization compared to other accounting software like QuickBooks.

No Native Payroll: Payroll features are not included and require integration with a third-party service like Gusto, adding to costs.

No Inventory Management: FreshBooks lacks built-in inventory management, which might be a drawback for product-based businesses.

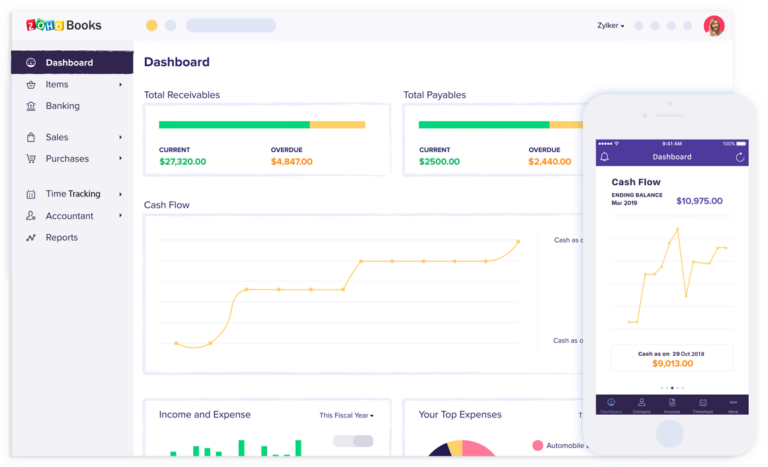

5. Zoho Books

Key Features

$20 to $275 per month • Trial: Yes • Free Plan: Yes.

Pros

Affordable: Competitive pricing with comprehensive features.

User-Friendly Interface: Easy for non-accountants to navigate.

Integration: Seamlessly integrates with other Zoho products and third-party apps.

Multi-Currency and Multi-Language: Suitable for international businesses.

Automation: Automates invoicing, reminders, and workflows, saving time.

Cons

Limited Payroll Features: No native payroll integration; requires third-party services.

Limited Users: Basic plans limit the number of users.

Customer Support: May lack phone support in certain regions.

Learning Curve: Some advanced features might be complex for new users.

Limited Inventory Management: More robust inventory features available in higher-tier plans.

6. Wave Accounting

Key Features

$20 to $40 per month • Trial: No • Free Plan: Yes.

Pros

Completely Free: Most of the core accounting tools are free, making it ideal for freelancers and small businesses on a budget.

User-Friendly Interface: Simple and intuitive, allowing non-accountants to manage their finances easily.

Unlimited Invoicing: No limits on the number of invoices you can send, even in the free version.

Receipt Scanning: Ability to scan and organize receipts directly from a mobile app.

Built-In Payment Processing: Accept credit card and ACH payments directly through the software (fees apply).

Good for Small Businesses: Ideal for freelancers, solopreneurs, and small businesses that need basic accounting features without complex integrations.

Cons

Limited Features for Larger Businesses: Lacks advanced features like inventory management or project accounting, making it less suitable for larger businesses.

Paid Payroll: Payroll services are only available in the U.S. and Canada and come with additional fees.

No Time Tracking: Does not offer built-in time-tracking features, which may be a disadvantage for service-based businesses.

Customer Support: While it offers free help center access, direct support (chat, email) is limited to paid customers.

Limited Integrations: Compared to other accounting platforms, Wave has fewer integration options with third-party applications.

Transaction Fees: While invoicing is free, payment processing fees apply when accepting payments via credit card or ACH.

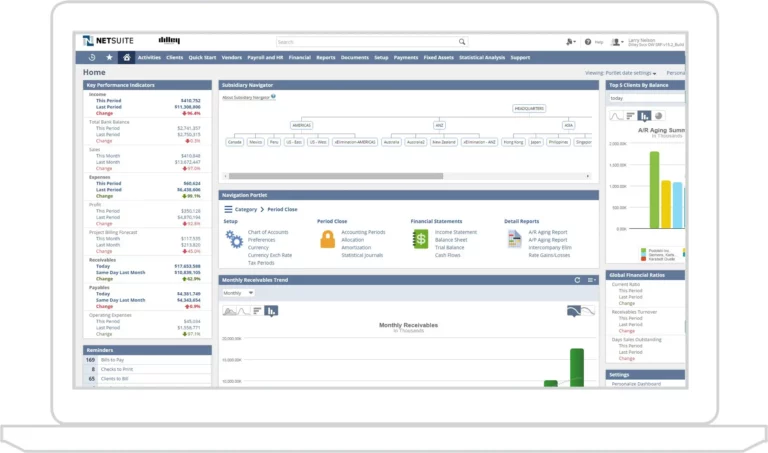

7. NetSuite ERP

Key Features

$999 per month • Trial: No • Free Plan: No.

Pros

Comprehensive Solution: NetSuite offers a wide range of ERP functionalities, making it an all-in-one platform for businesses of all sizes.

Scalability: Suitable for growing businesses, with flexible modules that can scale as a company expands.

Cloud-Based: Being cloud-native, it offers global accessibility, real-time updates, and lower infrastructure costs.

Customization: Highly customizable through SuiteScript, workflows, and SuiteFlow to meet unique business requirements.

Global Reach: Ideal for multinational companies, with built-in support for multiple currencies, languages, and tax regulations.

Strong Analytics and Reporting: Provides advanced reporting tools, KPIs, and real-time dashboards, offering deep insights into business performance.

Excellent Integration: Easily integrates with third-party applications and other Oracle products, offering seamless data flow between systems.

Automation: Automates financial and operational processes, reducing manual tasks and minimizing errors.

Cons

High Cost: NetSuite ERP can be expensive, especially for small and mid-sized businesses. Costs increase as more features and modules are added.

Complex Implementation: Implementation can be time-consuming and complex, often requiring professional services or consultants.

Steep Learning Curve: Due to the depth of functionality, users may face a learning curve when using the system, especially for non-technical employees.

Customization Requires Expertise: While customizable, advanced customization often requires specialized technical knowledge of SuiteScript and SuiteFlow.

Performance Issues for Large Data Sets: Some users report performance slowdowns when handling very large data sets or complex reporting.

Limited Customer Support: Some users have reported slow response times or difficulty getting issues resolved without paying for higher-tier support plans.

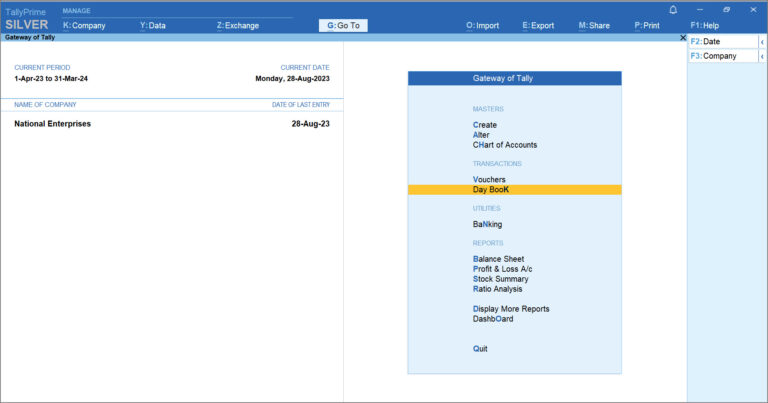

8. TallyPrime

Key Features

$7 per month • Trial: Yes • Free Plan: No.

Pros

User-Friendly Interface: TallyPrime has a simple, easy-to-navigate interface that reduces the learning curve for new users.

Comprehensive GST Features: Strong support for GST, making tax compliance easy for businesses in India.

Customization: Offers customizable features and flexible configurations, making it suitable for various business needs.

Affordable: TallyPrime is cost-effective, especially for small and medium-sized enterprises.

Inventory and Accounting Integration: Integrated accounting and inventory management allow businesses to track financials and stock in real time.

Multi-User and Multi-Currency Support: These features make it scalable and versatile for businesses operating internationally or with multiple locations.

Regular Updates: The software is regularly updated to comply with changing tax regulations and provide new features.

Cons

Limited Payroll Management: While TallyPrime offers payroll features, they are not as advanced or comprehensive as dedicated payroll software.

Lacks Cloud Integration: Although TallyPrime provides remote access, it lacks true cloud functionality, which some competitors offer.

Complex Customization: Customization in TallyPrime often requires technical knowledge, which may pose a challenge for non-technical users.

Not Ideal for Large Enterprises: TallyPrime is designed primarily for small to mid-sized businesses, and its features might not be enough for large, complex organizations.

Limited Integration with Other Software: Unlike cloud-based ERP systems, TallyPrime has fewer integration options with third-party tools.

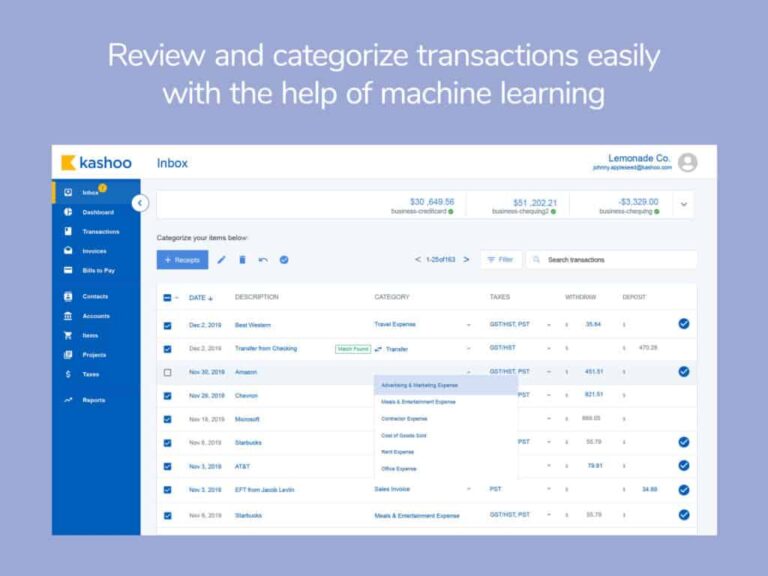

9. Kashoo

Key Features

$30 per month • Trial: Yes • Free Plan: No.

Pros

Easy to Use: Kashoo’s simple interface and straightforward features make it easy for small business owners or non-accountants to manage finances.

Affordable: Kashoo offers competitive pricing for its features, especially when compared to other accounting tools.

Mobile App: Provides a mobile app that allows users to manage their accounts on the go, including invoicing and expense tracking.

Strong Customer Support: Kashoo is known for responsive customer support through various channels.

Free Trial: Offers a 14-day free trial to help users explore its features before committing to a subscription.

Project Tracking: Great for freelancers and small businesses needing to track projects separately.

Cons

Limited Features: Kashoo lacks some advanced features like inventory management and payroll, which may limit its usefulness for growing businesses or those with complex needs.

Limited Integrations: While it integrates with key applications like Stripe for payments, Kashoo has fewer integrations compared to competitors like QuickBooks or Xero.

No Time Tracking: Kashoo does not include built-in time tracking, which could be a downside for service-based businesses or freelancers who bill by the hour.

Lack of Custom Reports: Although it offers basic reporting, it lacks in-depth or customizable reports that some larger businesses may require.

No Payroll: Payroll integration is not available, which could be a drawback for businesses with employees.

10. Odoo Accounting

Key Features

$25 to $37 per month • Trial: Yes • Free Plan: Yes.

Pros

Open-Source: Odoo is open-source, allowing for extensive customization to meet unique business needs.

All-in-One Solution: Integration with other Odoo modules makes it a complete ERP solution, covering everything from accounting to HR and inventory.

Affordable: Odoo is more cost-effective than many other ERP systems, especially given the breadth of its features.

Scalability: Suitable for businesses of all sizes, from small startups to large enterprises.

User-Friendly Interface: The interface is intuitive and easy to navigate, even for users with limited accounting knowledge.

Automation: Automates various accounting processes, including bank reconciliation, invoicing, and expense tracking, saving time and reducing manual errors.

Real-Time Reporting: Access to real-time financial reports helps businesses make informed decisions faster.

Multi-Currency and Taxation: Excellent support for multi-currency transactions and global tax compliance, making it ideal for businesses operating internationally.

Cons

Steep Learning Curve: While the interface is user-friendly, the depth of features in Odoo’s accounting module can be overwhelming for beginners or non-technical users.

Limited Customer Support: While there is a strong community for the open-source version, official support is limited unless you opt for the paid enterprise version.

Customization Requires Expertise: Although Odoo is highly customizable, advanced customization requires significant technical knowledge or the help of developers.

Initial Setup Can Be Complex: The setup process for integrating all desired modules can be complicated, particularly for businesses new to ERP systems.

Limited Out-of-the-Box Features in Free Version: The free version offers limited features, requiring paid upgrades for more advanced functionalities.

Third-Party Integrations: While Odoo integrates well with its own apps, its integration with external third-party software can sometimes be challenging without additional customization.