Reject employee’s leave request is not only a sensitive and challenging task but also one that has significant implications for both the employee and the organization. It demands a high level of tact, adherence to legal frameworks, and genuine empathy to manage the process effectively. This extended guide delves deeper into the considerations and best practices for handling such situations with care and professionalism.

Understanding the Grounds for Rejection

It is essential to have a solid, understandable basis for rejecting a leave request. Here are more detailed considerations for common grounds of rejection:

- Business Needs: Operational requirements often necessitate the presence of certain employees, especially in roles that are critical to the day-to-day operations or project deadlines. Managers should assess the impact of the employee’s absence on the workflow and deliverables.

- Staffing Levels: In industries such as healthcare, retail, and hospitality, certain times of the year—like holidays or summer months—can be exceptionally busy. If too many employees are absent simultaneously, it could severely impact service or operational capacity.

- Untimely Requests: Companies usually have policies stipulating how far in advance employees need to request leave. If an employee fails to adhere to these guidelines without a valid reason, their request may be justifiably denied.

- Previous Leave Patterns: If an employee frequently takes leave during critical business periods or there appears to be a pattern of absence that affects productivity, these factors may need to be considered. However, it’s crucial to ensure that any such decision is fair and consistent.

Legal Considerations

Understanding the legal landscape is crucial when denying any leave request. Here’s a more detailed look at legal considerations:

- FMLA and Other Protections: The Family and Medical Leave Act in the U.S., and similar laws in other countries, protect certain leave rights, such as for medical reasons or family care. Denying such leave without a substantiated and legally valid reason could lead to legal penalties.

- Discrimination Laws: Ensure that the decision does not discriminate based on age, sex, race, disability, or other protected characteristics. Consistency in how leave requests are handled across all employees is crucial to prevent discrimination claims.

- Local and National Laws: Different jurisdictions may have specific regulations about employee leave, including the minimum required notice periods, the maximum allowable leave durations, and the conditions under which leave can be denied.

Communicating the Decision

Expanding on the initial communication guidelines, here are more detailed suggestions:

Prepare for the Discussion

- Gather all pertinent facts and documents before the meeting. This includes the employee’s leave history, the specific operational needs for the period requested, and any previous communications related to leave requests.

Emphasize the Decision’s Reluctance

- Make it clear that the decision was not made lightly and that you understand the inconvenience or disappointment it may cause.

Documentation

- Documenting the conversation is not only a best practice but also a legal safeguard. It should include the date of the discussion, the reasons provided for the leave denial, any alternatives offered, and the employee’s response.

Handling Employee Response

Managing the aftermath of a leave denial is as important as the decision itself. Here are more strategies for dealing with the employee’s reaction:

- Offer Support and Understanding: Show empathy and offer support where possible. If the leave was denied due to timing, help the employee to plan a more suitable time for their leave.

- Future Planning Guidance: Help the employee understand the best times for leave requests in the future, considering both their needs and the organization’s operational requirements.

Preventing Future Issues

Proactively managing leave requests can significantly reduce the need for rejections:

- Advance Planning Tools: Implement systems or tools that allow for better tracking and management of leave requests to foresee and manage staffing needs effectively.

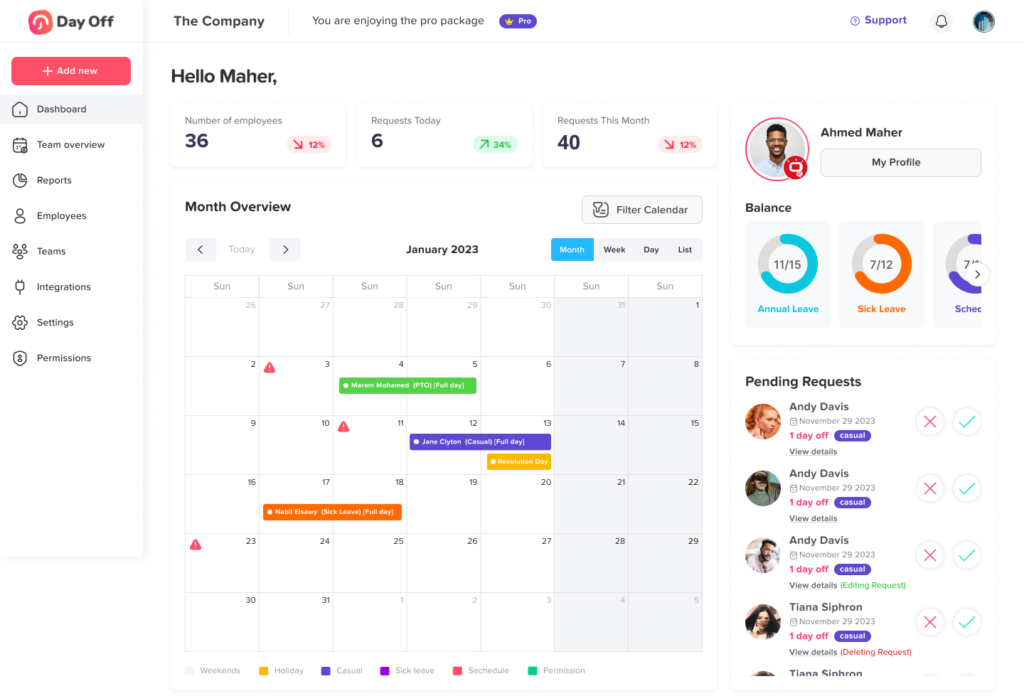

Day Off designed to assist both employers and employees in managing Paid Time Off (PTO) effectively. Here’s how you can use this platform to streamline the process of handling PTO:

For Employers:

1. Setting Up Company PTO Policies

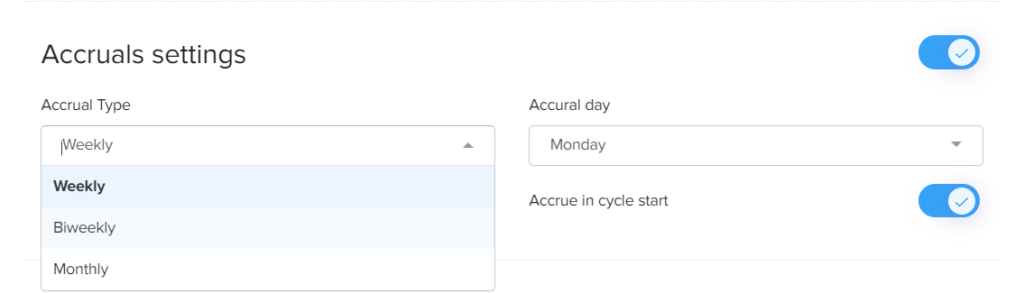

Configure Policies: Begin by setting up your company’s specific PTO policies within the platform. This includes defining accrual rates, carryover limits, and types of leave available (such as vacation, sick leave, and personal days).

Customize Settings: Adjust settings to match specific employment types or departments, accommodating various accrual methods or eligibility criteria.

2. Employee Management

Add Employees: Input details about your employees, including their start dates, employment status (full/part-time), and any other relevant information that affects PTO accrual.

Track Employee PTO: Monitor accruals, usage, and remaining balances in real-time, ensuring transparency and helping to prevent disputes or misunderstandings.

3. Approval Workflow

Review Requests: Implement an approval workflow where employees can submit PTO requests through the platform. Managers can review, approve, or Reject employee’s leave request based on team availability and individual PTO balances.

Notifications: Set up notifications to alert managers of new requests.

4. Reporting and Analytics

Generate Reports: Use the platform’s reporting tools to generate insights into PTO usage patterns, identify trends, or prepare for peak vacation times.

Compliance Monitoring: Ensure compliance with local labor laws by using analytics to monitor adherence to regulations concerning PTO.

For Employees:

1. Submitting PTO Requests

Submit Requests: Easily submit PTO requests by selecting dates and the type of PTO you are requesting. You can view your accrued PTO balance to make informed decisions about your time off.

2. Managing PTO

View PTO Balance: Check your current PTO balance anytime to see how much time you have available for use.

Track Status of Requests: Follow the progress of your PTO requests, from submission to approval or denial, and plan accordingly.

3. Notifications

Stay Informed: Receive notifications regarding the approval status of your PTO requests, and upcoming scheduled PTO.

Integration and Accessibility

Mobile Access: Day Off offers a mobile version, employees can manage their PTO requests and view balances on the go, while managers can approve requests, ensuring flexibility and responsiveness.

Integration: The platform offers integration with calendars like Google Kalender and Outlook, as well as Slack and Microsoft Teams, syncing PTO schedules across platforms for better resource planning.

- Employee Education Sessions: Regularly conduct sessions to educate employees about the leave policy, planning best practices, and the importance of early communication.

By enhancing your understanding and approach to Reject employee’s leave request, you can maintain a fair, legal, and supportive workplace environment that respects both the operational needs of the organization and the personal rights of the employees.