In the evolving landscape of business operations, payroll software has become an indispensable tool for managing employee compensation, taxes, and other payroll-related tasks efficiently. The right payroll software can save time, reduce errors, and enhance compliance with tax laws and regulations. As we move further into 2024, several payroll software options stand out for their robust features, user-friendly interfaces, and adaptability to various business needs. Here, we delve into the top payroll software choices for businesses in 2024, offering a detailed exploration of their features, benefits, and what makes them essential for modern businesses.

1. Gusto

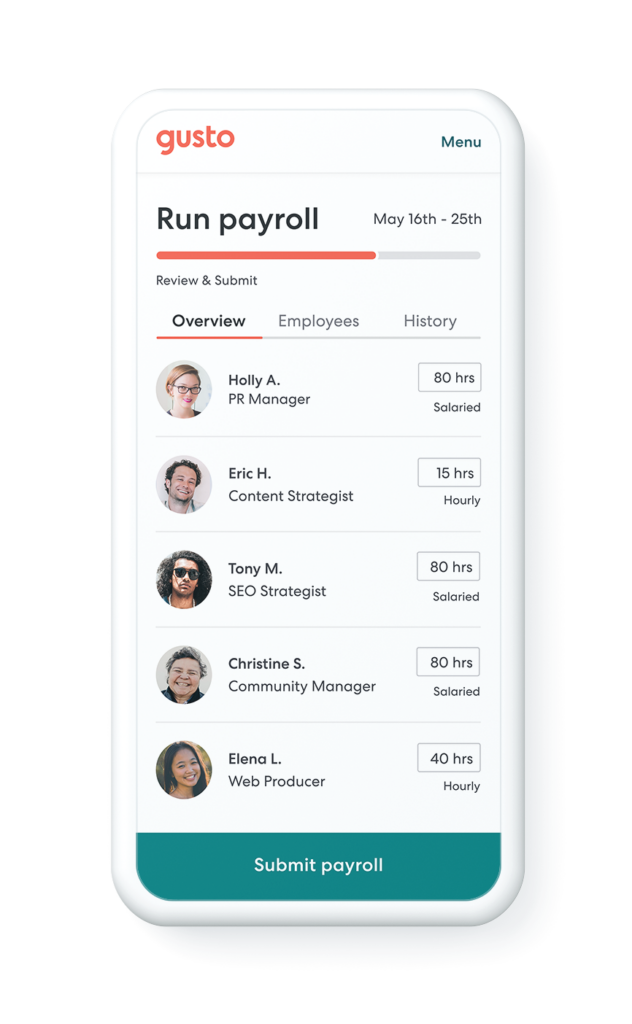

Gusto continues to lead the payroll software market with its comprehensive suite of HR tools and services. Designed for small to medium-sized businesses, Gusto offers a user-friendly platform that automates payroll, tax filings, and employee benefits management. Its key features include automatic payroll processing, integrated benefits administration, and a plethora of HR resources. Gusto’s ability to manage complex payroll calculations and comply with state and federal tax laws makes it an invaluable asset for businesses looking to streamline their HR processes.

Key Features:

- Automatic payroll processing

- Compliance with tax laws and regulations

- Integrated HR, benefits, and payroll

2. ADP Workforce Now

ADP Workforce Now is a scalable payroll solution that caters to businesses of all sizes. This software is known for its robustness, offering extensive payroll features, including time and attendance tracking, HR management, and compliance support. ADP stands out for its global payroll capabilities, making it a preferred choice for companies with international employees. Its analytics and reporting tools provide valuable insights into payroll and HR operations, helping businesses make informed decisions.

Key Features:

- Scalable solutions for all business sizes

- Global payroll capabilities

- Advanced analytics and reporting

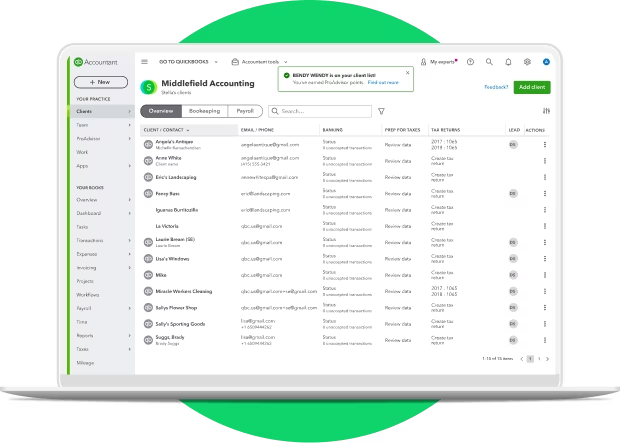

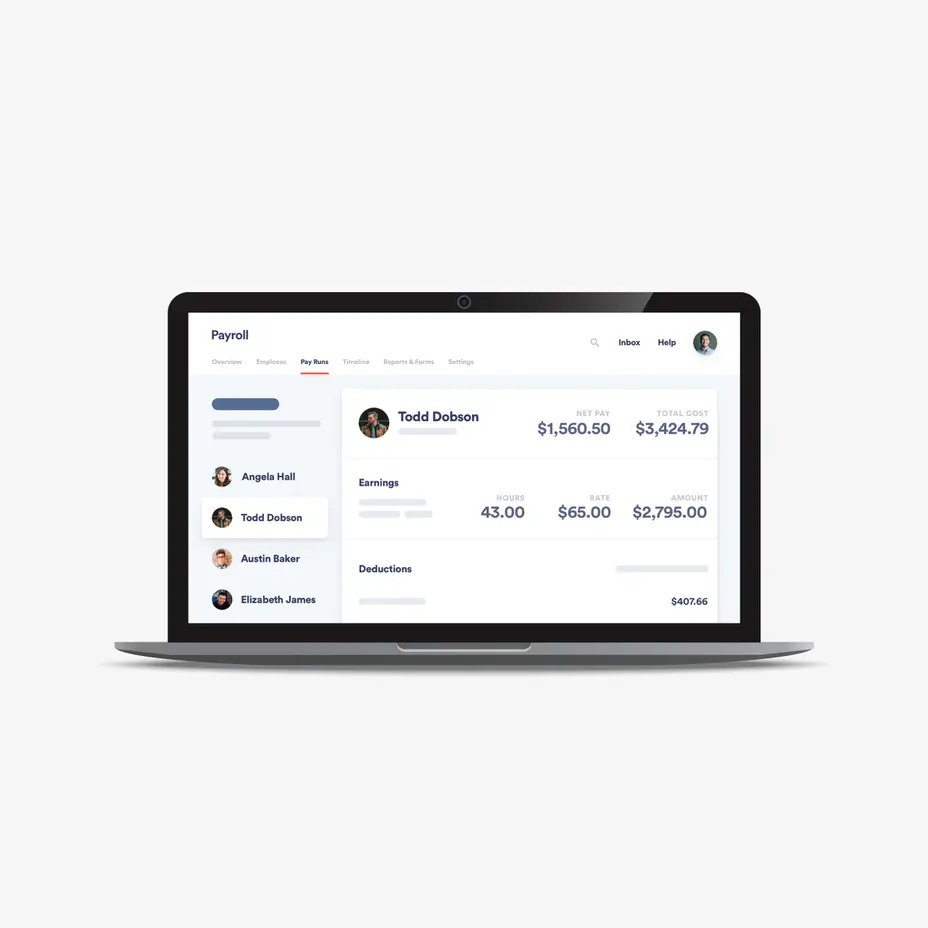

3. QuickBooks Payroll

QuickBooks Payroll is an excellent option for small businesses that already use QuickBooks for accounting. It offers seamless integration with QuickBooks accounting software, simplifying the payroll process. Features include automatic payroll runs, tax calculations, and filings, as well as direct deposit options. QuickBooks Payroll also provides a self-service portal for employees, allowing them to view pay stubs and tax information, enhancing the overall payroll experience.

Key Features:

- Seamless integration with QuickBooks accounting

- Automatic tax calculations and filings

- Employee self-service portal]

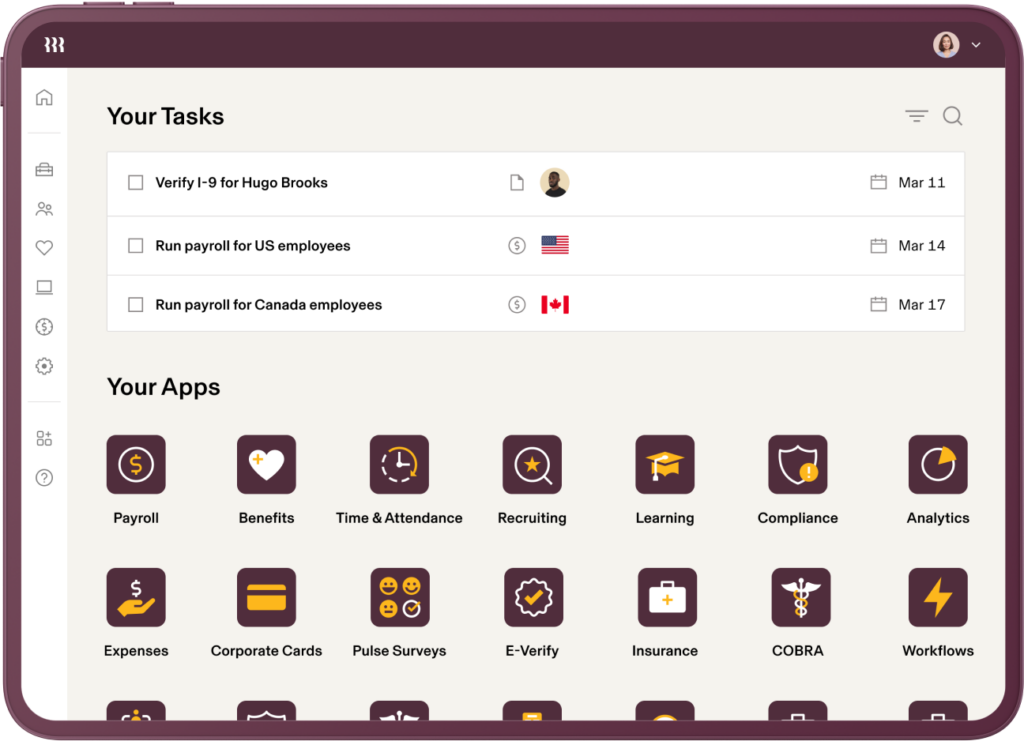

4. Rippling

Rippling has made a significant impact in the payroll and HR management software market, particularly for its ability to seamlessly integrate a wide range of business operations. Beyond just payroll, Rippling offers a comprehensive Employee Management Platform, which includes IT and HR solutions. This makes it an excellent choice for businesses looking for a unified system to manage payroll, benefits, HR, and even their IT infrastructure, such as device management and app provisioning.

Key Features:

- Integrated Employee Management: Rippling provides a unified platform for payroll, HR, benefits administration, and IT, streamlining multiple aspects of business management.

- Automated Workflows: It automates various processes, including onboarding, offboarding, and employee changes, directly affecting payroll and HR tasks.

- Customizable Solutions: Businesses can tailor Rippling’s services to their needs, choosing from a wide array of modules and integrations with other software.

- Advanced Security Measures: With a strong focus on security, Rippling ensures that sensitive employee and company data are protected with industry-leading protocols.

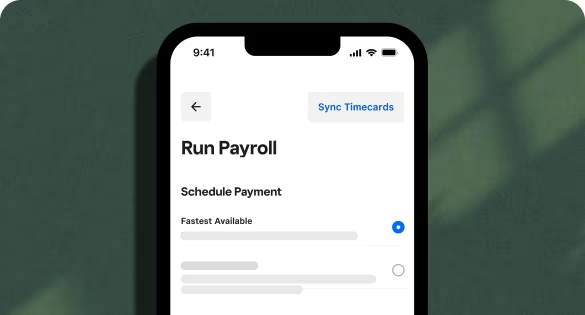

5. Square Payroll

Square Payroll, best known for its point-of-sale (POS) system, also offers a competitive payroll solution, especially for businesses with hourly employees. It provides features like automatic tax filings, tip integration, and timecard syncing with the Square POS system. This integration simplifies payroll processing for businesses in the retail and restaurant industries. Square Payroll is an affordable and efficient option for small businesses looking for a straightforward payroll solution.

Key Features:

- Integration with Square POS system

- Designed for hourly employees and industries like retail and hospitality

- Affordable pricing model

6. Zenefits

Zenefits has emerged as a strong contender in the payroll software arena, particularly for businesses that prioritize a seamless integration of payroll with HR and benefits administration. Unlike traditional payroll systems, Zenefits offers a broad platform that encompasses HR, benefits, time tracking, compliance, and payroll, all in one place. Its user-friendly interface and mobile app accessibility make it a popular choice among startups and small businesses looking for an all-in-one solution.

Key Features:

- All-in-one HR, benefits, and payroll platform

- User-friendly interface and mobile app

- Automatic compliance updates

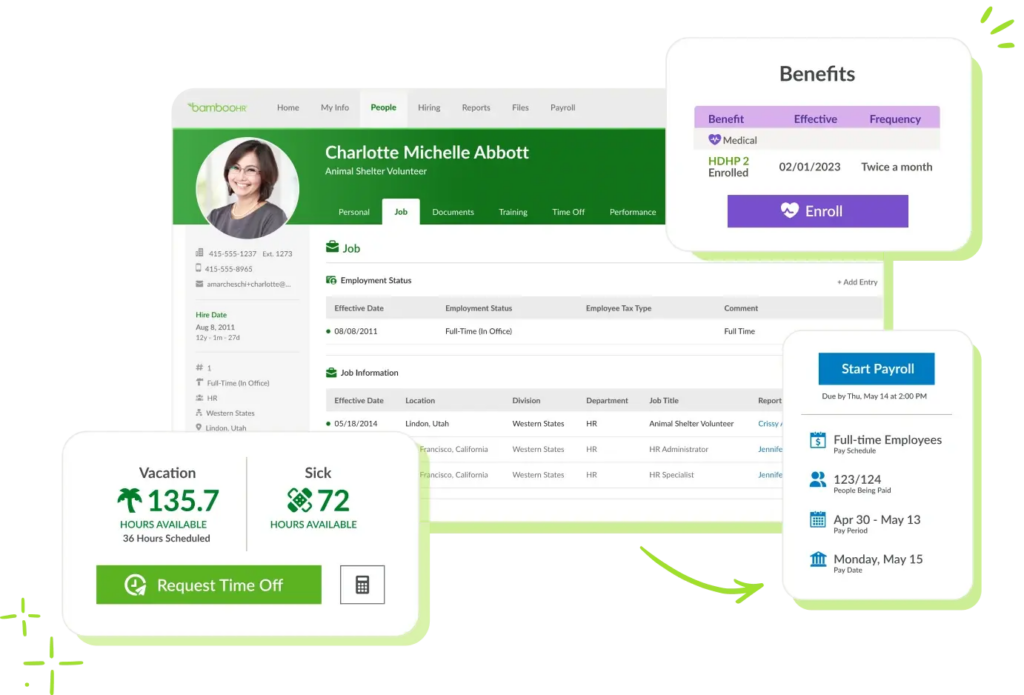

7. BambooHR

BambooHR stands out for its emphasis on serving small and medium-sized businesses with a focus on HR management in addition to payroll. While it’s best known for its HR capabilities, including applicant tracking, onboarding, and employee performance management, BambooHR also offers an efficient payroll module. This module integrates seamlessly with its HR features, ensuring a smooth transition from hiring and onboarding to payroll and performance management.

Key Features:

- Integrated HR and payroll solutions

- Employee self-service portal

- Customizable reports and analytics

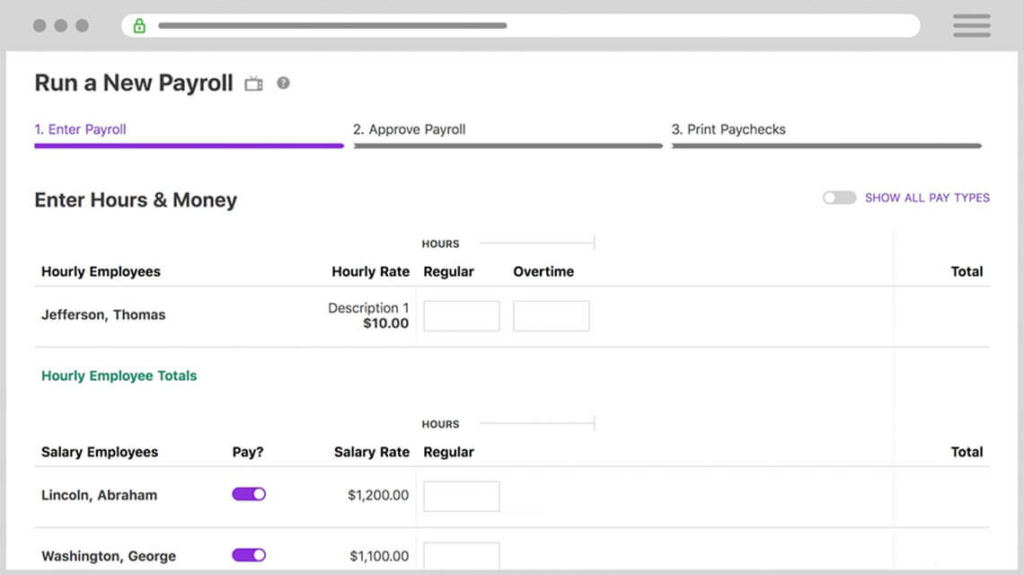

8. Patriot Software

Patriot Software is another excellent choice for small businesses seeking an uncomplicated yet effective payroll solution. It offers straightforward payroll services designed to make payroll processing as easy as possible for small business owners. Patriot Software stands out for its affordability and exceptional customer support, making it a favorite among startups and small enterprises that need reliable payroll services without the complexity or high cost of more extensive systems.

Key Features:

- Ease of Use: Patriot Software focuses on simplifying payroll for small business owners with an intuitive interface and straightforward setup process.

- Affordable Pricing: It offers competitive pricing with no hidden fees, making it accessible for businesses on a tight budget.

- Excellent Customer Support: Patriot Software provides US-based customer support, offering personalized assistance to ensure users can navigate and utilize the software effectively.

- Comprehensive Tax Filing Services: The software includes options for automatic tax calculations, filings, and payments, reducing the burden of payroll tax compliance for businesses.

Choosing the Right Payroll Software

Selecting the best payroll software for your business in 2024 requires careful consideration of your specific needs, including the size of your business, the complexity of your payroll requirements, and the need for integration with other systems. each offer unique features that cater to different business models and sizes. Whether you need an all-in-one HR and payroll solution, a system that grows with your business, or a platform capable of handling complex, global payroll requirements, there is a software solution out there that fits your needs.

As with any business decision, it’s essential to conduct thorough research, take advantage of free trials when available, and consider the long-term scalability of the payroll system you choose. Additionally, staying informed about changes in payroll legislation and ensuring that your chosen software complies with these changes is crucial for maintaining compliance and avoiding penalties.

Remember, while these software options can significantly ease the payroll process, it’s crucial to stay informed about the latest payroll regulations and ensure compliance. Consulting with a legal professional or payroll expert can provide additional peace of mind and ensure that your business operates smoothly and legally.