Table of Contents

ToggleIn today’s competitive work environment, understanding the intricacies of employee benefits, such as Paid Time Off (PTO), is essential for both employers and employees. One concept that often raises questions is “PTO rollover.” This article dives deep into the topic, exploring what PTO rollover means, its benefits, challenges, legal considerations, and best practices for effective implementation. Whether you are an employee seeking to maximize your benefits or an employer aiming to create a fair and effective policy, this guide is for you.

What is PTO Rollover?

PTO rollover refers to the policy that allows employees to carry over unused paid time off from one calendar or fiscal year to the next. Instead of forfeiting unused vacation, sick, or personal days, employees retain the opportunity to use them in the future. However, the specific terms governing PTO rollover can vary widely among organizations and are often influenced by regional labor laws.

A Practical Example:

Consider an employee who accrues 20 PTO days per year but uses only 15. Under a PTO rollover policy, the remaining five days might be carried into the next year. Depending on company policy, these days may need to be used within a certain period or accumulate indefinitely.

Understanding the nuances of PTO rollover policies is essential for both parties. Employees can better plan their time off, while employers can create systems that balance flexibility and operational efficiency.

Why PTO Rollover Matters

For Employers:

Financial Liabilities:

Unused PTO represents an accrued financial liability on the company’s balance sheet. This is particularly relevant if the company allows indefinite rollover or pays out unused PTO.Operational Disruptions:

Allowing employees to accumulate large amounts of PTO can lead to extended absences that disrupt workflow. Employers must carefully manage and monitor PTO balances to avoid this issue.Complex Policy Management:

Drafting, implementing, and managing a PTO rollover policy requires clear guidelines and regular updates. Policies need to balance fairness to employees with the company’s operational needs.

For Employees:

Procrastination Risks:

Employees may delay taking PTO indefinitely, potentially leading to burnout. Over time, they might not fully benefit from their earned time off.Confusion Around Policies:

Vague or overly complex policies can lead to misunderstandings and disputes. Employees need clarity on rollover limits, expiration periods, and other terms.

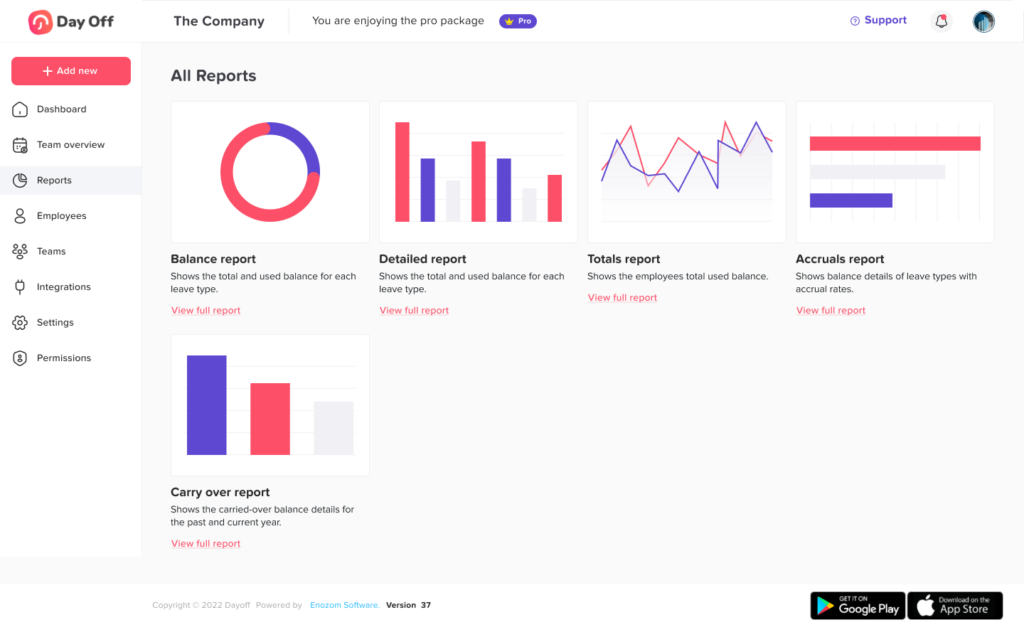

Day Off Leave Tracker Software

Day Off is a versatile leave management platform that can effectively support your company’s Paid Time Off (PTO) rollover policies. Here’s how you can utilize its features to manage PTO rollovers:

Day Off Features:

Customizable Leave Policies:

Day Off allows you to define multiple leave types and assign specific rules to each. You can set up accrual systems where employees earn leave based on tenure or hours worked. Additionally, you can establish rollover rules that permit employees to carry over unused leave from one period to the next, with options to place caps on the amount of leave that can be rolled over.

Accrual and Carryover Settings:

Within the leave policy settings, you can configure accruals and carryover rules for each leave type. This includes setting earned balances, enabling half-day options, allowing negative balances, and specifying carryover limits. These settings ensure that your PTO rollover policies are accurately reflected and automatically managed within the system.

Employee Self-Service:

Employees can view their leave balances in real time, submit time-off requests, and understand their available PTO, including any rolled-over days. This transparency helps employees plan their time off effectively and ensures they are aware of their entitlements.

Automated Notifications:

The platform sends automated notifications to both employees and managers regarding leave requests, approvals, and any changes to leave balances. This keeps all parties informed about PTO statuses, including rollover balances, reducing misunderstandings, and ensuring compliance with company policies.

Reporting and Analytics:

Day Off provides detailed reports and analytics on employee leave, including PTO usage and balances. These insights help HR and management monitor leave trends, ensure compliance with rollover policies, and make informed decisions about workforce planning.

Common PTO Rollover Models

PTO carryover policies can vary significantly depending on organizational priorities and budget constraints. Below are some common models:

Unlimited Rollover:

Employees can carry forward all unused PTO without restrictions. While this model is highly employee-friendly, it can lead to significant financial liabilities for employers.Capped Rollover:

A limit is set on the number of PTO days employees can carry over. For example, a company might allow only 5 or 10 unused days to roll over.Expiration Policies:

Rolled-over PTO must be used within a certain timeframe, such as 6 months or a year. This encourages employees to utilize their PTO without creating indefinite liabilities.Cash-Out Options:

Instead of rolling over unused PTO, employees are compensated for unused days. This can be a win-win, as it eliminates the rollover liability for employers while providing employees with immediate financial benefits.

Legal Considerations for PTO Rollover

Labor laws governing PTO policies vary significantly by jurisdiction. Employers must ensure their policies comply with federal, state, and local regulations to avoid legal issues.

Key Points to Consider

Prohibition of Forfeiture

In certain states, such as California, “use-it-or-lose-it” policies are prohibited by law. Employers must either allow employees to roll over unused PTO or provide a payout for accrued time.Maximum Accrual Caps

Employers may establish limits on the maximum amount of PTO employees can accrue. However, in regions with stricter laws, earned PTO cannot be forfeited once the cap is reached. Instead, accruals may temporarily pause until the balance falls below the cap.Tax Implications

If employers offer cash-out options for unused PTO, they must account for payroll taxes and comply with reporting requirements. Proper handling of these obligations is essential to ensure accurate tax filings and avoid penalties.

FAQs About PTO Rollover

Can PTO rollover policies vary within the same organization for different employee groups?

Yes, PTO carryover policies can differ across employee groups based on factors such as job roles, seniority, or union agreements. However, it is essential to ensure that these variations comply with labor laws and are clearly communicated to employees to prevent misunderstandings.

What happens to PTO if an employee leaves the company?

In many jurisdictions, employers are required to pay out unused PTO when an employee leaves the company. This typically includes any rolled-over PTO, but specific policies and legal obligations vary by region. Employers should consult legal experts to ensure compliance.

How does PTO rollover impact employee morale?

PTO rollover can positively impact morale by providing employees with flexibility to manage their time off. However, unclear or overly restrictive policies may lead to frustration. Transparent communication and fair rollover terms are crucial for maintaining employee satisfaction.

Are there industries where PTO rollover is more common?

PTO rollover is more prevalent in industries with cyclical work patterns or high workload variability, such as healthcare, education, and project-based sectors. These policies help employees accommodate busy periods while ensuring they still benefit from time off.

Can PTO rollover be applied to other types of leave, such as sick or personal days?

Yes, employers can apply rollover policies to different types of leave, such as sick days or personal days, depending on their policy structure. However, these policies should be clearly defined to avoid confusion about which leave types qualify for rollover.

How does PTO rollover affect company budgets?

PTO rollover policies can create financial liabilities as unused PTO is often considered a payable expense. Employers should account for these liabilities in their budgets and use tools like caps or expiration policies to manage costs effectively.

What role does technology play in managing PTO rollover?

Leave management platforms like Day Off can automate and streamline PTO tracking, including rollover policies. These tools reduce administrative burden, improve transparency, and help ensure compliance with both internal policies and labor laws.

Can employees donate unused PTO instead of rolling it over?

Some organizations allow employees to donate unused PTO to a shared leave bank for colleagues in need, such as those dealing with medical or personal emergencies. This option promotes a culture of collaboration and support within the workplace.

How can employers encourage employees to use PTO instead of rolling it over?

Employers can encourage PTO usage by promoting work-life balance, reminding employees of the benefits of taking time off, and offering incentives or scheduling flexibility. Regular check-ins and wellness initiatives can also reduce the tendency to postpone PTO.

Are there risks associated with allowing unlimited PTO rollover?

Yes, unlimited PTO rollover can lead to significant financial liabilities and operational disruptions due to extended employee absences. Employers should carefully assess these risks and consider implementing capped or expiration-based rollover models for better control.

Conclusion

PTO rollover is a vital component of modern employee benefits, offering flexibility and satisfaction to employees while enhancing retention and morale for employers. However, crafting and managing an effective PTO rollover policy requires careful planning, legal compliance, and clear communication. By understanding its benefits and challenges, both employers and employees can make the most of PTO rollover, fostering a healthier work environment and a stronger work-life balance.

Whether you’re looking to implement a PTO carryover policy or navigate an existing one, this comprehensive guide serves as a valuable resource to ensure success.