Table of Contents

TogglePaid Time Off (PTO) accrual calculators are essential tools for both employers and employees. These calculators help determine how much leave time employees have earned based on the company’s PTO policy. This article will delve into the intricacies of vacation accrual calculator, using the tool from Day Off as a detailed example to explain how it works and its benefits

What is a Vacation Accrual Calculator?

A PTO accrual calculator is a software tool used to calculate the amount of paid time off an employee has accumulated over a period. PTO typically includes vacation days, sick leave, and sometimes personal days. The calculator helps manage this process by providing an accurate and easy way to track and calculate accrued time.

Why Use a PTO Accrual Calculator?

- Accuracy: PTO accrual calculators provide precise calculations, eliminating the risk of human error in tracking leave balances. This accuracy ensures that employees receive the correct amount of PTO, which helps avoid disputes and maintains trust.

- Efficiency: Automating PTO calculations saves significant time and resources compared to manual methods. This efficiency allows HR personnel to focus on more strategic tasks, improving overall productivity.

- Compliance: PTO accrual calculators help ensure that companies adhere to labor laws and internal policies. By automatically applying rules and regulations, these tools reduce the risk of non-compliance, which can result in legal issues and financial penalties.

- Employee Satisfaction: Transparent and accurate PTO tracking fosters a positive work environment. When employees can clearly see and trust their PTO balance, it enhances their overall satisfaction and loyalty to the company.

Benefits of PTO Accrual Calculators for Employees

- Transparency: Employees have easy access to their accrued PTO, which is updated in real-time. This transparency helps employees trust the system and feel confident about their leave balances.

- Planning: With clear visibility into their PTO balance, employees can better plan vacations and personal time off. This ability to plan effectively contributes to better work-life balance and reduces last-minute disruptions.

- Fairness: A standardized and automated accrual process ensures that all employees are treated equally, regardless of their position or department. This fairness in PTO management promotes a sense of equity and reduces grievances related to perceived favoritism.

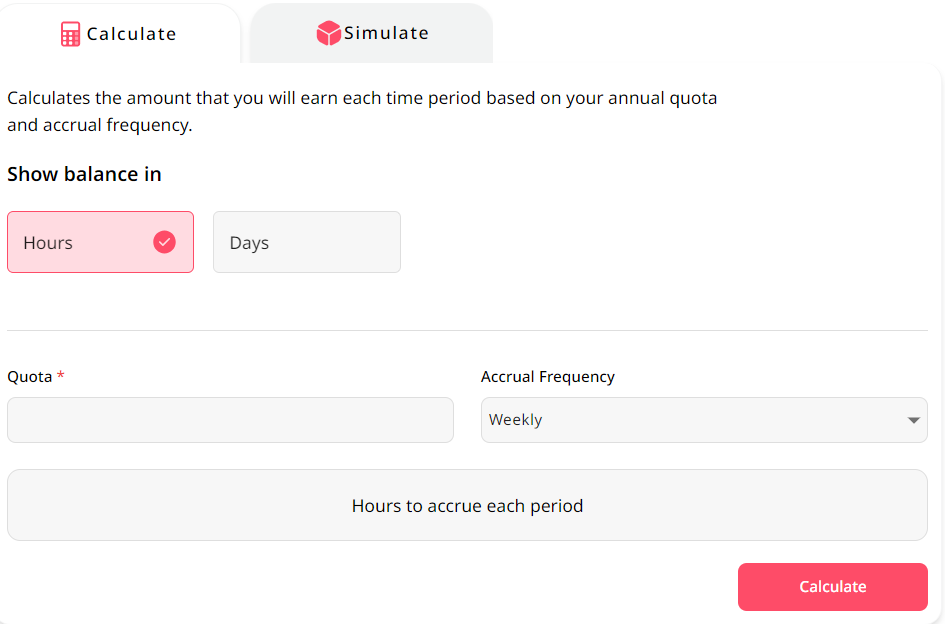

Using Day Off PTO Accrual Calculator

When using a PTO accrual calculator, one essential aspect is calculating the amount of PTO an employee earns each time period based on their annual quota and accrual frequency. Here’s a detailed breakdown of how this calculation is performed and what each component means:

Key Components of the Calculation

Annual Quota: This is the total amount of PTO (in hours or days) an employee is entitled to in a year. For example, an annual quota might be 120 hours.

Accrual Frequency: This defines how often the PTO is accrued. Common frequencies include:

- Weekly: PTO is accrued every week.

- Bi-weekly: PTO is accrued every two weeks.

- Monthly: PTO is accrued every month.

- semimonthly: PTO is accrued twice per month.

Hours to Accrue Each Period: This is the amount of PTO earned in each accrual period.

Calculation Formula

To determine the amount of PTO accrued each period, you use the following formula:

Hours to Accrue Each Period=Annual Quota/Number of Accrual Periods in a Year

Steps to Calculate PTO Accrual

Determine Annual Quota: Start with the total amount of PTO an employee is supposed to earn annually. For instance, 120 hours per year.

Select Accrual Frequency: Choose how often the PTO will be accrued. For example, weekly.

Calculate the Number of Accrual Periods:

- If weekly, there are 52 weeks in a year.

- If bi-weekly, there are 26 pay periods in a year.

- If monthly, there are 12 months in a year.

Calculate Hours to Accrue Each Period: Divide the annual quota by the number of accrual periods.

Example Calculation

Let’s go through an example with specific numbers:

- Annual Quota: 120 hours

- Accrual Frequency: Weekly

Number of Accrual Periods=52 (since there are 52 weeks in a year)

Hours to Accrue Each Period=120 hours/52 weeks≈2.31 hours per week

So, with an annual quota of 120 hours and a weekly accrual frequency, the employee will accrue approximately 2.31 hours of PTO each week.

Adjustments for Different Accrual Frequencies

If the accrual frequency changes, the number of periods will change accordingly:

Bi-weekly: Number of Accrual Periods=26

Hours to Accrue Each Period=120 hours/26 periods≈4.62 hours per period

- Monthly: Number of Accrual Periods=12

Hours to Accrue Each Period=120 hours/12 months=10 hours per month

Viewing the Balance

Once you know the hours accrued each period, the total PTO balance can be tracked by summing the accrued hours at each pay period and subtracting any taken leave. This provides a real-time balance that employees and employers can refer to for planning and managing time off.

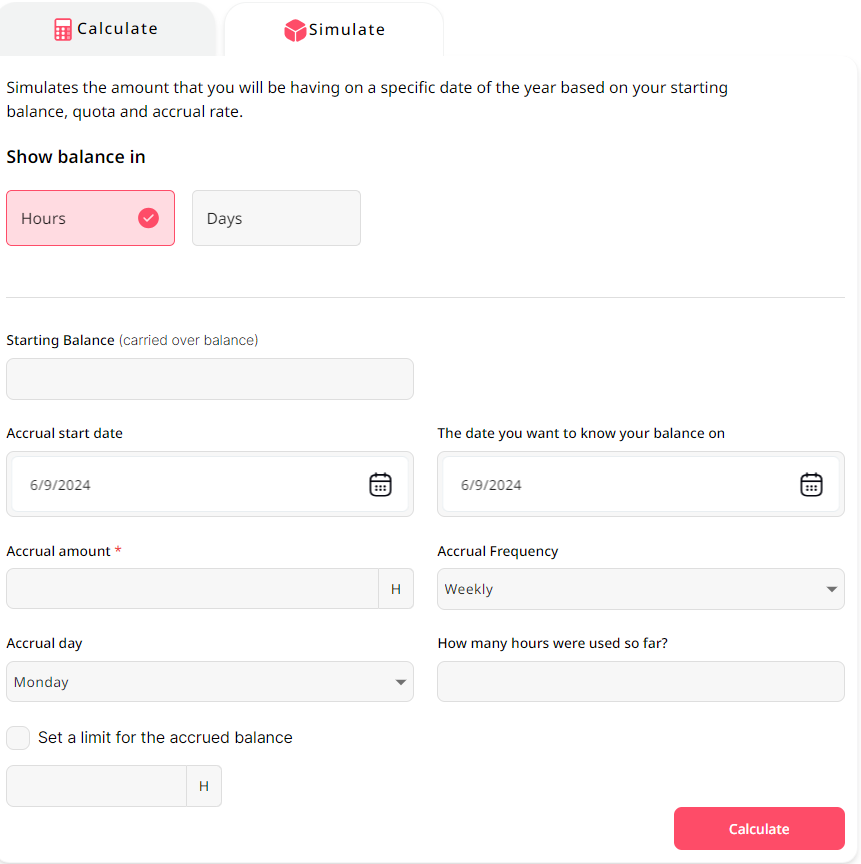

To simulate the amount of PTO you will have on a specific date based on your starting balance, quota, and accrual rate, you can use a Vacation accrual calculator. Here’s a detailed explanation using an example with specific inputs to understand how this simulation works.

Inputs for the Simulation

Starting Balance (Carried Over Balance): This is the amount of PTO you already have at the beginning of the accrual period. For instance, let’s assume you start with 10 hours.

Accrual Start Date: This is the date when the accrual period begins. In this example, the start date is 6/9/2024.

The Date You Want to Know Your Balance On: This is the target date for checking the PTO balance. Let’s use 12/31/2024 as an example.

Accrual Amount: The number of hours earned per accrual period. Assume it’s 2 hours per week.

Accrual Frequency: How often PTO is accrued. Here, we use weekly.

Accrual Day: The day of the week when PTO is added. We’ll use Monday.

How Many Hours Were Used So Far: The amount of PTO taken during the period. Suppose 20 hours were used.

Set a Limit for the Accrued Balance: The maximum amount of PTO that can be accumulated. Assume the limit is 80 hours.

Calculation Process

Identify the Time Frame: Calculate the number of weeks between the accrual start date and the target date.

- From 6/9/2024 to 12/31/2024, there are approximately 29 weeks (counting Mondays).

Accrual Calculation:

- Weekly Accrual: 2 hours per week.

- Total Accrual: 2 hours/week * 29 weeks = 58 hours.

Total PTO Calculation:

- Starting Balance: 10 hours.

- Accrued Hours: 58 hours.

- Used Hours: 20 hours.

Simulate Balance on Target Date:

- Initial PTO: 10 hours.

- Accrued PTO: 58 hours.

- Used PTO: 20 hours.

So, the balance on 12/31/2024 will be: Balance=Starting Balance+Accrued PTO−Used PTO

Balance=10 hours+58 hours−20 hours=48 hours

Check Against Maximum Accrual Limit:

- Ensure the final balance does not exceed the set limit (80 hours in this case).

- Since 48 hours is less than 80 hours, no adjustment is needed.

Practical Example Using the Day Off Vacation Accrual Calculator

Using the Day Off PTO Accrual Calculator, follow these steps:

- Input Starting Balance: Enter 10 hours.

- Set Accrual Start Date: Enter 6/9/2024.

- Set Target Date: Enter 12/31/2024.

- Accrual Amount: Enter 2 hours.

- Accrual Frequency: Select Weekly.

- Accrual Day: Select Monday.

- Hours Used: Enter 20 hours.

- Maximum Accrual: Enter 80 hours.

The calculator will process these inputs and show the balance as of 12/31/2024.

Step-by-Step Explanation

- Starting Balance: The initial PTO carried over is 10 hours.

- Accrual Period: Begins on 6/9/2024, with PTO accruing every Monday.

- Target Date: The balance is calculated for 12/31/2024.

- Accrual Frequency and Amount: 2 hours of PTO accrue every Monday.

- Hours Used: 20 hours of PTO have been used during the period.

- Calculate Total Accrued:

- 29 weeks between the start date and the target date.

- 2 hours/week * 29 weeks = 58 hours accrued.

- Adjust for Usage:

- Starting Balance: 10 hours.

- Accrued Hours: 58 hours.

- Used Hours: 20 hours.

- Ending Balance: 10 + 58 – 20 = 48 hours.

The simulation will show that the PTO balance on 12/31/2024 is 48 hours, which is within the maximum limit of 80 hours.

Legal and Regulatory Considerations

Paid Time Off (PTO) policies are influenced by a variety of federal, state, and local laws that companies must adhere to. These laws are designed to protect employee rights and ensure fair treatment in the workplace. Understanding these legal requirements is crucial for both employers and employees to avoid legal issues and ensure compliance.

Federal Laws and Regulations

At the federal level, there is no specific law mandating PTO. However, several federal regulations indirectly affect PTO policies:

- Fair Labor Standards Act (FLSA): While the FLSA does not require PTO, it does regulate aspects of compensation and overtime, which can impact how PTO is accrued and paid out.

- Family and Medical Leave Act (FMLA): Provides eligible employees with up to 12 weeks of unpaid leave for certain family and medical reasons, which can intersect with PTO policies.

- Americans with Disabilities Act (ADA): Requires reasonable accommodations for employees with disabilities, which may include the provision of additional leave.

State and Local Laws

State and local laws often have more direct implications for PTO management. These laws can vary significantly by jurisdiction:

- Paid Sick Leave Laws: Many states and cities have enacted laws requiring employers to provide paid sick leave. These laws specify accrual rates, usage, and carryover provisions.

- Example: California’s Paid Sick Leave law mandates that employees accrue at least one hour of sick leave for every 30 hours worked.

- Vacation Pay Laws: Some states, such as California, consider accrued vacation as earned wages, meaning it must be paid out upon termination.

- Local Ordinances: Cities like San Francisco and New York City have their own regulations that may impose additional requirements on top of state laws.

How PTO Accrual Calculators Ensure Compliance

PTO accrual calculators play a crucial role in helping companies comply with these various regulations by:

- Automating Accrual Calculations: By automating the process, these calculators ensure that PTO is accrued accurately according to the relevant laws, reducing the risk of human error.

- Customizable Settings: Most PTO calculators allow for customization to adhere to specific state and local laws, ensuring that accrual rates, caps, and carryover policies meet legal requirements.

- Real-Time Tracking and Reporting: These tools provide real-time tracking of PTO balances and detailed reports, making it easier to demonstrate compliance during audits or legal reviews.

- Policy Enforcement: They help enforce company-specific PTO policies consistently across the organization, ensuring all employees are treated equally and fairly.

- Alerts and Notifications: Many calculators include features that alert HR personnel to important compliance-related events, such as when an employee is nearing the maximum accrual limit or when certain leave thresholds are met.

Practical Tips for Compliance Using PTO Calculators

- Stay Updated on Laws: Regularly review and update the PTO calculator settings to reflect changes in federal, state, and local laws.

- Audit Regularly: Conduct periodic audits of PTO records to ensure accuracy and compliance.

- Train HR Staff: Ensure that HR personnel are trained on how to use the PTO calculator and understand the legal implications of PTO management.

- Document Policies: Clearly document PTO policies and communicate them to employees. This helps in maintaining transparency and trust.

FAQs About PTO Accrual Calculators

1. What is a PTO accrual calculator?

A PTO accrual calculator is a tool that helps calculate the amount of paid time off an employee has accumulated over a specific period based on the company’s PTO policy. It can include vacation days, sick leave, and personal days.

2. Why should companies use a PTO accrual calculator?

Using a PTO accrual calculator ensures accuracy, efficiency, and compliance with labor laws, and improves employee satisfaction by providing transparent and real-time tracking of PTO balances.

3. How does a PTO accrual calculator work?

A PTO accrual calculator uses inputs such as the annual PTO quota, accrual frequency, and the number of accrual periods in a year to calculate how much PTO an employee earns each period. It can also track the balance by considering any PTO taken.

4. Can PTO accrual calculators handle different accrual frequencies?

Yes, PTO accrual calculators can handle various accrual frequencies, including weekly, bi-weekly, semi-monthly, and monthly accruals, allowing flexibility to match company policies.

5. How do PTO accrual calculators ensure compliance with labor laws?

PTO accrual calculators can be customized to reflect federal, state, and local regulations, ensuring that accrual rates, caps, and carryover policies meet legal requirements. They provide automated and accurate tracking, reducing the risk of non-compliance.

6. What if an employee’s PTO balance exceeds the maximum accrual limit?

PTO accrual calculators can be set to enforce maximum accrual limits. When an employee’s balance reaches this limit, the calculator can stop additional accruals until some PTO is used, ensuring compliance with company policies.

7. Can employees view their PTO balance using a PTO accrual calculator?

Many PTO accrual calculators offer employee self-service portals where employees can view their PTO balance, accrual history, and upcoming accruals in real time, enhancing transparency and planning.

8. How do you handle negative PTO balances?

If an employee takes more PTO than they have accrued, the calculator can record a negative balance. Companies should have policies in place for how to handle these situations, such as deducting the amount from future accruals or payroll.

9. Are PTO accrual calculators integrated with other HR systems?

Many PTO accrual calculators can integrate with payroll and HR management systems, streamlining data entry and ensuring consistency across different HR functions.

10. What are some best practices for implementing a PTO accrual calculator?

Best practices include choosing a customizable and user-friendly tool, training HR staff and employees, regularly auditing the system for accuracy, and keeping the calculator settings updated to reflect current laws and company policies.

11. Can a PTO accrual calculator be used for part-time employees?

Yes, PTO accrual calculators can be adjusted to calculate PTO for part-time employees based on their hours worked, ensuring fair and accurate accrual for all employees.

12. What happens to accrued PTO when an employee leaves the company?

The treatment of accrued PTO upon termination varies by company policy and state law. Some states require unused PTO to be paid out as part of the final paycheck, and a PTO accrual calculator can help ensure these balances are accurately calculated and paid.

Conclusion

Incorporating a PTO accrual calculator into your HR practices offers numerous benefits, from ensuring accurate and compliant PTO management to enhancing employee satisfaction through transparency and fairness. Tools like the Day Off PTO Accrual Calculator simplify the complexities of PTO tracking, enabling both employers and employees to manage leave balances efficiently and effectively. By automating accrual calculations, adhering to legal requirements, and providing real-time updates, these calculators play a crucial role in fostering a positive work environment and improving overall productivity. Embracing such technology is a strategic move that can lead to more streamlined operations and a more engaged workforce.