Table of Contents

ToggleManaging Paid Time Off (PTO) is one of the key responsibilities of any HR department or business owner. As teams grow and leave policies become more complex, relying on manual tracking methods often leads to errors, confusion, and even compliance issues. That’s where a PTO accrual calculator becomes a powerful tool. It simplifies the process of calculating how much PTO each employee has earned over time—and ensures fairness and transparency across the organization.

In this article, we’ll explore how to use a PTO accrual calculator effectively, the types of accrual methods, common pitfalls to avoid, and how this tool can contribute to better leave management and employee satisfaction.

What Is a PTO Accrual Calculator?

A PTO accrual calculator is a tool that automatically determines the amount of leave an employee has earned based on your company’s time-off policy. These tools can be:

Manual (e.g., Excel spreadsheets)

Semi-automated (e.g., Google Sheets with formulas)

It calculates PTO based on factors like:

Hours worked

Length of service

Accrual rate

Time period

Leave already taken

The primary goal is to maintain accurate leave balances and ensure compliance with labor regulations.

Why Accurate PTO Tracking Is Essential

Mismanaging employee leave can have serious consequences. Here’s why using a PTO accrual calculator is essential:

Legal Compliance

Certain states (e.g., California, Massachusetts, Arizona) have laws that regulate PTO accrual, usage, and payouts. Inaccurate tracking may result in legal liabilities or fines.

Payroll Accuracy

Accurate PTO balances help ensure that payouts on termination or year-end are correct.

Employee Trust

Transparent PTO tracking builds employee confidence and prevents disputes related to leave balances.

Better Resource Planning

Knowing who is off and when helps managers allocate workload efficiently and prevent bottlenecks.

How Does PTO Accrual Work?

PTO is typically earned over time based on an accrual policy. Here are common methods companies use:

1. Per Hour Worked

Ideal for part-time or hourly workers. Employees earn PTO for every hour they work.

Example:

PTO Rate: 0.05 hours per 1 hour worked

Employee worked 160 hours this month → Earned PTO = 160 × 0.05 = 8 hours

2. Per Pay Period

Employees earn a fixed amount every pay period, regardless of hours worked.

Example:

15 days PTO annually = 1.25 days/month

After 6 months, PTO earned = 1.25 × 6 = 7.5 days

3. Annual Lump Sum

Employees receive their full PTO allowance at the beginning of the year or anniversary date.

Note: For new hires, this may need to be prorated based on the hiring date.

What Inputs Are Needed for the Calculator?

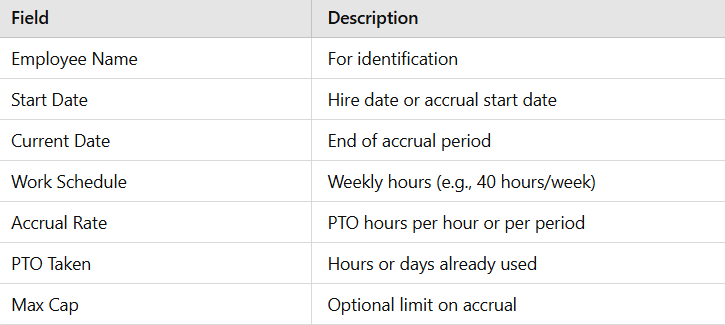

A PTO accrual calculator requires the following:

Step-by-Step Guide: How to Use a PTO Accrual Calculator

Let’s walk through the process using a per-hour worked example:

Employee Profile:

Name: Sarah Johnson

Start Date: January 1, 2025

Work Schedule: 40 hours/week

PTO Policy: 15 days (120 hours) per year

PTO Taken: 24 hours

Date Today: August 1, 2025

Step 1: Calculate Accrual Rate

Sarah works 2,080 hours/year (40 × 52).

PTO per hour = 120 ÷ 2080 = 0.0577 hours/hour

Step 2: Determine Hours Worked

From Jan 1 to Aug 1 = 7 months = ~30 weeks

Total hours worked = 40 × 30 = 1,200 hours

Step 3: Calculate Accrued PTO

PTO earned = 1,200 × 0.0577 = 69.24 hours

Step 4: Subtract PTO Used

69.24 earned – 24 used = 45.24 hours remaining

Sarah currently has 45.24 hours of available PTO.

Common Mistakes to Avoid

Even with a calculator, mistakes happen. Here are a few to watch out for:

Using incorrect accrual rates

Always confirm the rate is up to date with your HR policy.

Not updating PTO taken

Failing to subtract used PTO gives inflated balances.

Forgetting part-time status

PTO should be prorated for part-time or hourly staff.

Ignoring maximum caps

Many companies stop accrual once a PTO cap is reached.

Not accounting for leave without pay

PTO accrual should pause during unpaid leave in most cases.

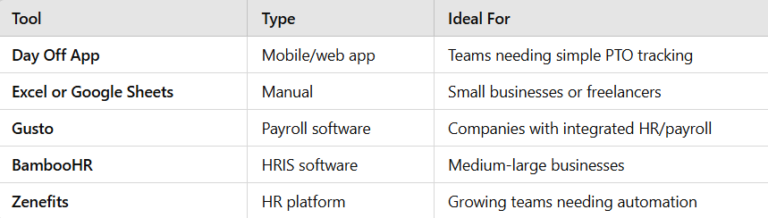

PTO Accrual Calculator Tools You Can Use

Here are a few options to consider:

PTO Accrual & Legal Compliance in the U.S.

States have varying PTO laws. Some require:

Accrual to start immediately

Unused PTO to be paid out on termination

A minimum accrual rate or carryover rules

Employers in California, Illinois, Arizona, and New York must be especially careful. Using a PTO calculator helps meet these requirements by ensuring no manual mistakes occur in tracking leave balances.

FAQs

Can I customize the calculator for my own PTO policy?

Yes. Most spreadsheet templates and software tools allow you to input your own accrual rate, caps, and policy details.

What if my company offers unlimited PTO?

In that case, you don’t need a calculator for accrual, but you’ll still need to track usage for planning and accountability.

How do I handle PTO for new hires mid-year?

Use a prorated accrual method. If someone joins mid-year, only calculate PTO from their start date onward.

Final Thoughts

Using a PTO accrual calculator is more than just a convenience it’s a necessity in today’s workplace. It helps reduce errors, improve compliance, and foster a more transparent leave management culture. Whether you’re a small startup or a large corporation, tracking PTO accurately can save your HR team time and keep your employees happy.

For a user-friendly PTO tracking experience, consider tools like Day Off, which simplify accruals and leave management for everyone involved.