As we enter 2026, companies are increasingly recognizing that leave management software aren’t just about compliance, they’re a critical part of shaping workplace culture, supporting employee well being, and staying competitive in the job market. Modern employees expect flexibility, inclusivity, and transparency, and the way companies handle time off directly impacts their ability to attract, retain, and motivate top talent.

Forward thinking organizations are moving away from rigid, one size fits all policies toward strategies that support mental health, diversity, family life, and professional growth. The right PTO approach can foster loyalty, reduce burnout, and boost overall productivity.

Here are the top 10 PTO policies employers should consider adopting in 2026 to align with evolving workplace trends and employee expectations.

Unlimited PTO: Flexibility and Trust

Unlimited PTO has become one of the most talked about policies in modern workplaces. It empowers employees to manage their own time off without being restricted to a fixed number of days. This model shows trust in employees, promotes autonomy, and encourages accountability.

Why it works: Employees no longer worry about “saving” days for emergencies and instead take time off when they genuinely need it. This prevents burnout and supports long term productivity.

Best practices for success:

Establish clear guidelines so employees understand when and how to take time off responsibly.

Train managers to ensure fairness and to monitor workloads so no one feels discouraged from using PTO.

Track usage trends to ensure employees are actually taking breaks rather than avoiding PTO due to pressure.

Mental Health Days: Prioritizing Employee Well being

With increasing awareness of workplace stress and mental health challenges, more companies are offering specific “mental health days” separate from sick leave or vacation. This type of PTO recognizes that wellness isn’t only about physical health, it’s about emotional and psychological balance too.

Why it matters: Encouraging employees to recharge mentally reduces absenteeism in the long run and fosters a supportive, stigma free environment.

Best practices:

Normalize the use of mental health days by discussing them openly in company communications.

Provide employees with access to wellness resources, such as counseling hotlines or mindfulness programs.

Encourage managers to lead by example by occasionally taking mental health days themselves.

Flexible Holiday PTO: Customizable for Diversity

Traditional holiday calendars often don’t reflect the diversity of today’s workforce. Flexible holiday PTO allows employees to swap company designated holidays with ones that align with their cultural, religious, or personal values.

Why it matters: This creates a more inclusive workplace where every employee feels respected and valued. It also fosters cultural awareness across teams.

Best practices:

Clearly outline how employees can exchange standard holidays for alternative ones.

Encourage teams to celebrate and acknowledge different cultural events to build understanding.

Use HR systems to track and approve holiday swaps fairly and efficiently.

Summer Fridays: Boosting Morale and Productivity

Summer Fridays, where employees leave early or take Fridays off during the summer months, are increasingly popular for boosting morale. Giving employees extra personal time during warm months can significantly increase happiness and engagement.

Why it works: Employees return refreshed, leading to higher focus and creativity during regular hours.

Best practices:

Offer rotating schedules so productivity isn’t compromised.

Track team output during these periods to ensure business objectives are still met.

Pair Summer Fridays with wellness initiatives like outdoor team building activities.

Extended Parental Leave: Supporting Families

Modern employees want employers who support their personal lives as much as their professional ones. Extending parental leave beyond the legal minimum for all parents, regardless of gender, role, or family structure, sends a strong message of support.

Why it matters: Longer and more inclusive parental leave helps retain talent, builds loyalty, and demonstrates commitment to diversity and equality.

Best practices:

Offer flexible options for taking parental leave, such as splitting it into blocks or part time arrangements.

Include adoptive, foster, and same sex parents in the policy.

Provide resources like parenting support groups or childcare guidance to ease the transition back to work.

Volunteer Time Off (VTO): Encouraging Community Engagement

Volunteer Time Off (VTO) gives employees paid days to contribute to causes they care about. This not only benefits communities but also deepens employees’ sense of purpose and belonging at work.

Why it matters: Employees who volunteer through company supported programs often report higher engagement and stronger connections to their teams.

Best practices:

Build partnerships with local charities and encourage team based volunteer activities.

Offer employees flexibility to choose their own volunteer causes.

Recognize and celebrate employees’ contributions to reinforce a culture of giving back.

Professional Development PTO: Investing in Growth

Providing time off specifically for professional development shows that the company values learning and long term career growth. Employees can use this PTO for workshops, certifications, conferences, or online courses.

Why it matters: When employees grow their skills, both the individual and the company benefit. This policy improves retention and reduces the risk of stagnation.

Best practices:

Create a structured application process for employees to request development PTO.

Encourage employees to share key takeaways with their teams after attending training.

Combine development PTO with reimbursement programs for training expenses.

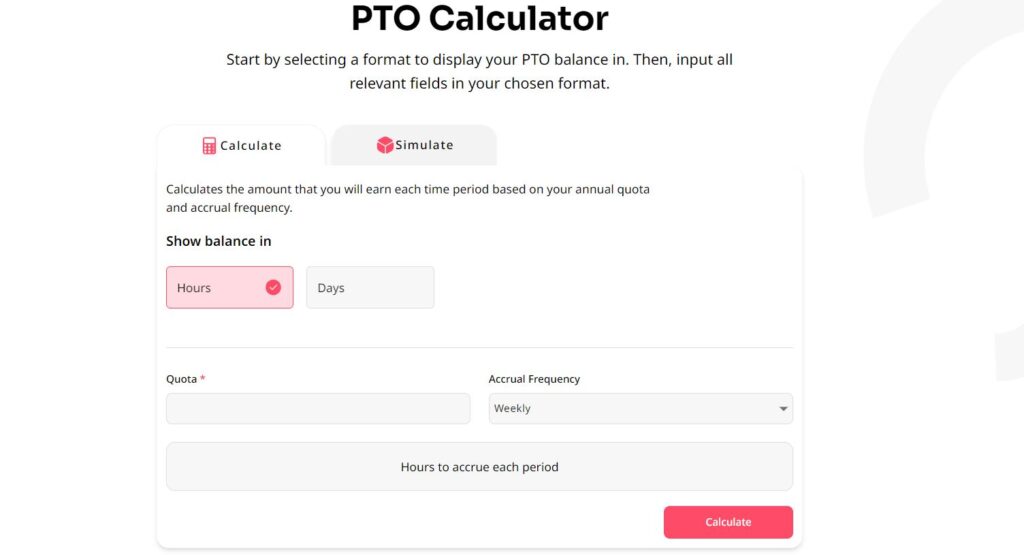

PTO Carry Over and Rollover Limits: Balancing Flexibility and Fairness

Carrying over unused PTO gives employees flexibility, but unlimited accumulation can create liability for companies. Striking the right balance between carry over and rollover limits ensures fairness while encouraging employees to take time off regularly.

Why it matters: Employees feel more secure knowing they won’t lose unused time, but limits prevent unhealthy hoarding and encourage regular breaks.

Best practices:

Offer a small grace period at the beginning of each year for leftover PTO.

Provide payout options for employees who prefer cash over rolling over unused days.

Communicate rollover rules clearly so employees can plan ahead.

Global PTO Policies: Ensuring Fairness Across Regions

For international companies, PTO can get complicated because labor laws and cultural expectations vary. A global PTO framework ensures consistency while still respecting regional differences.

Why it matters: Employees worldwide feel equally valued, regardless of where they’re based.

Best practices:

Adjust PTO offerings to meet local legal requirements while maintaining overall fairness.

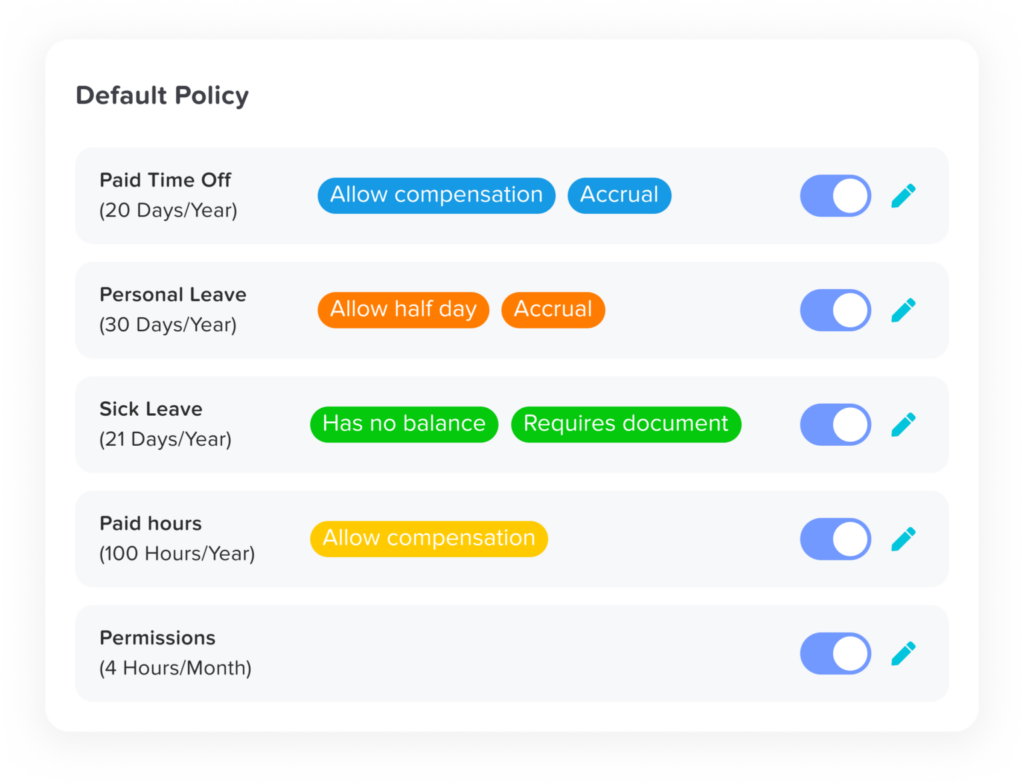

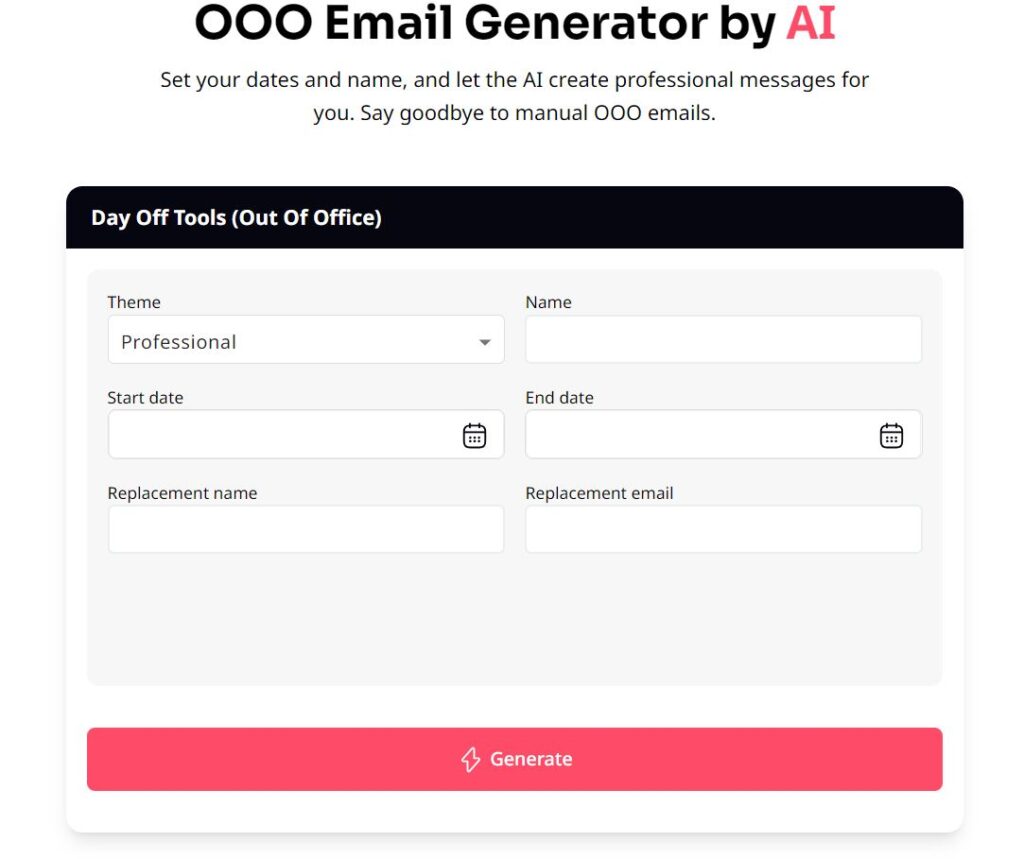

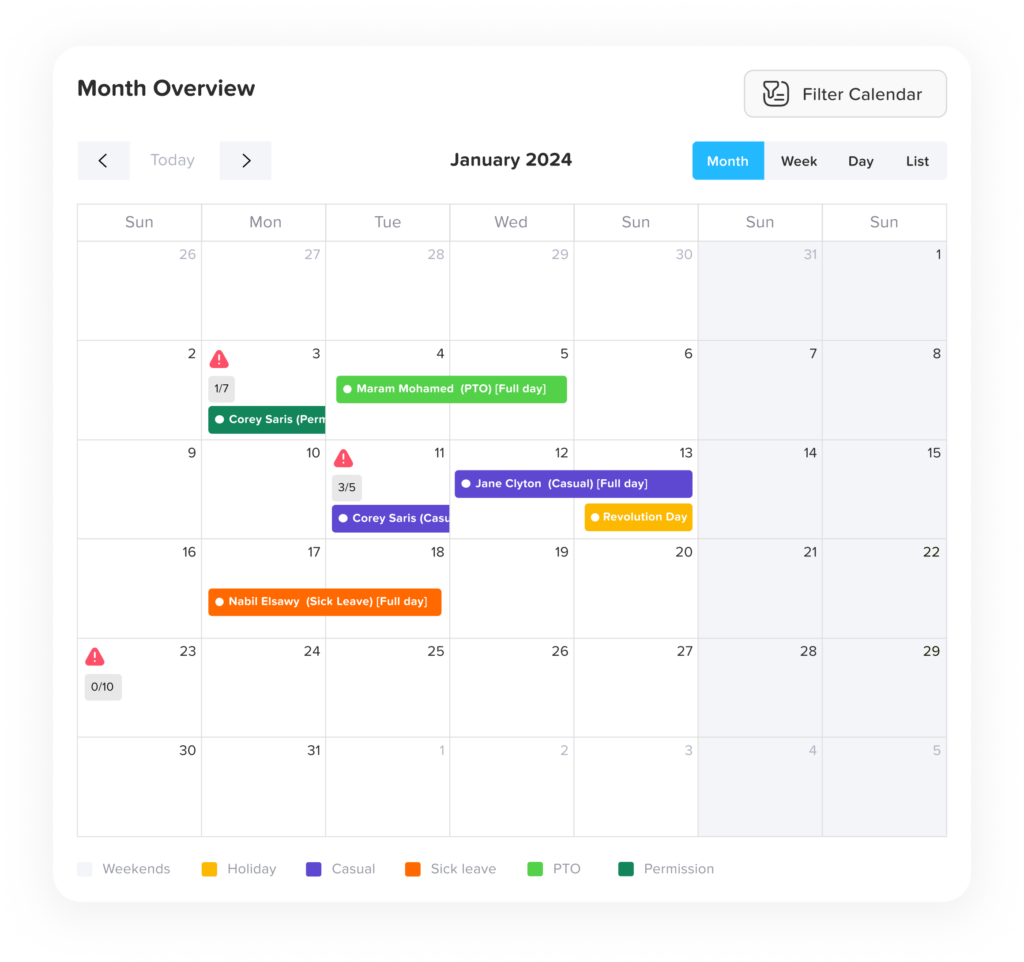

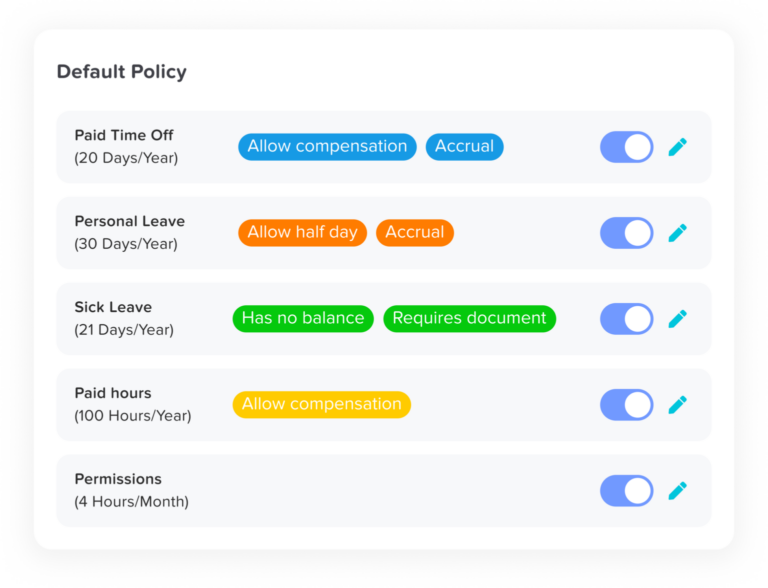

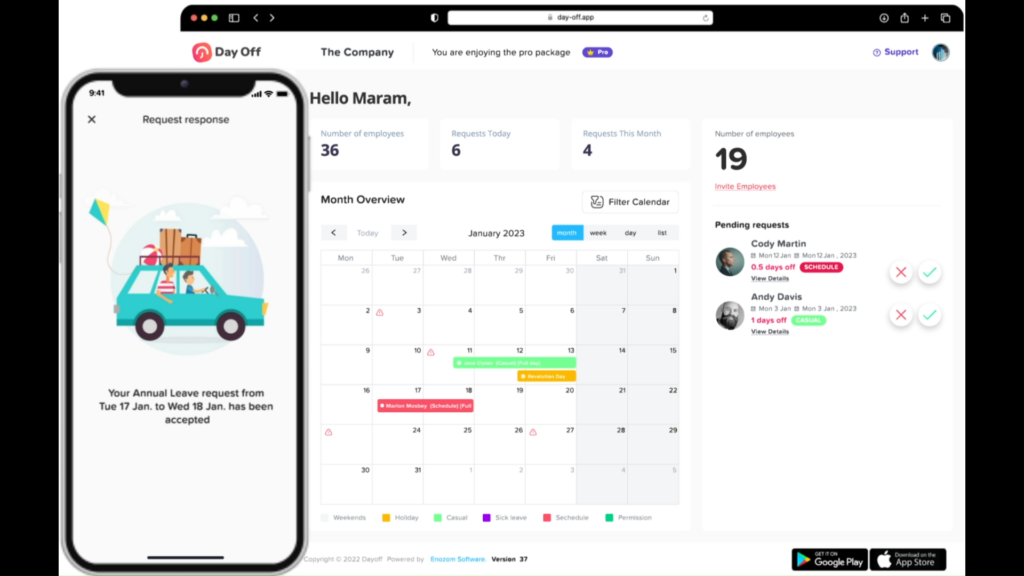

Use technology like the Day Off App to manage PTO across different time zones seamlessly.

Train managers on cultural differences in how time off is viewed and used.

Leveraging Technology for PTO Management: Efficient and Transparent

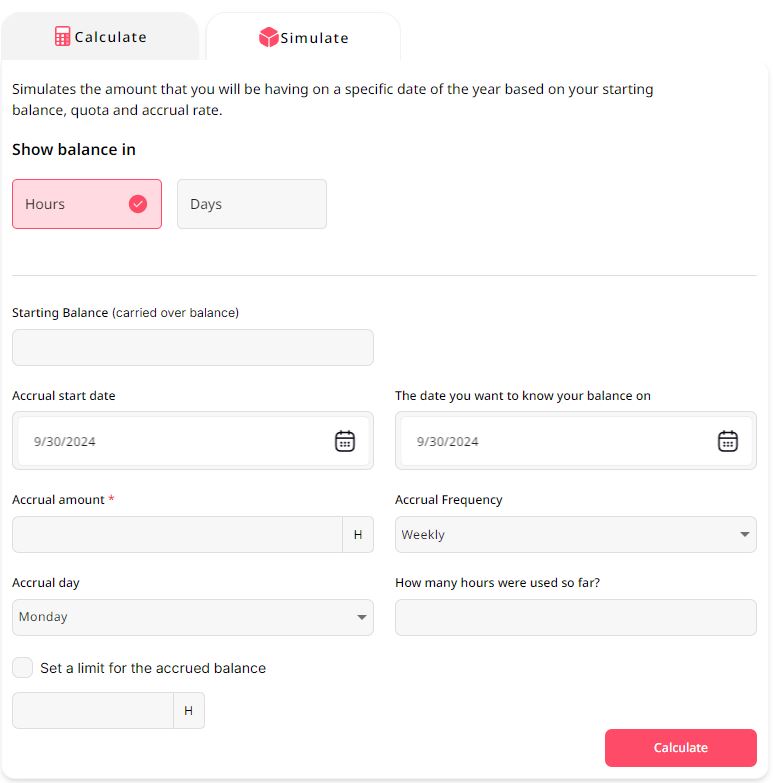

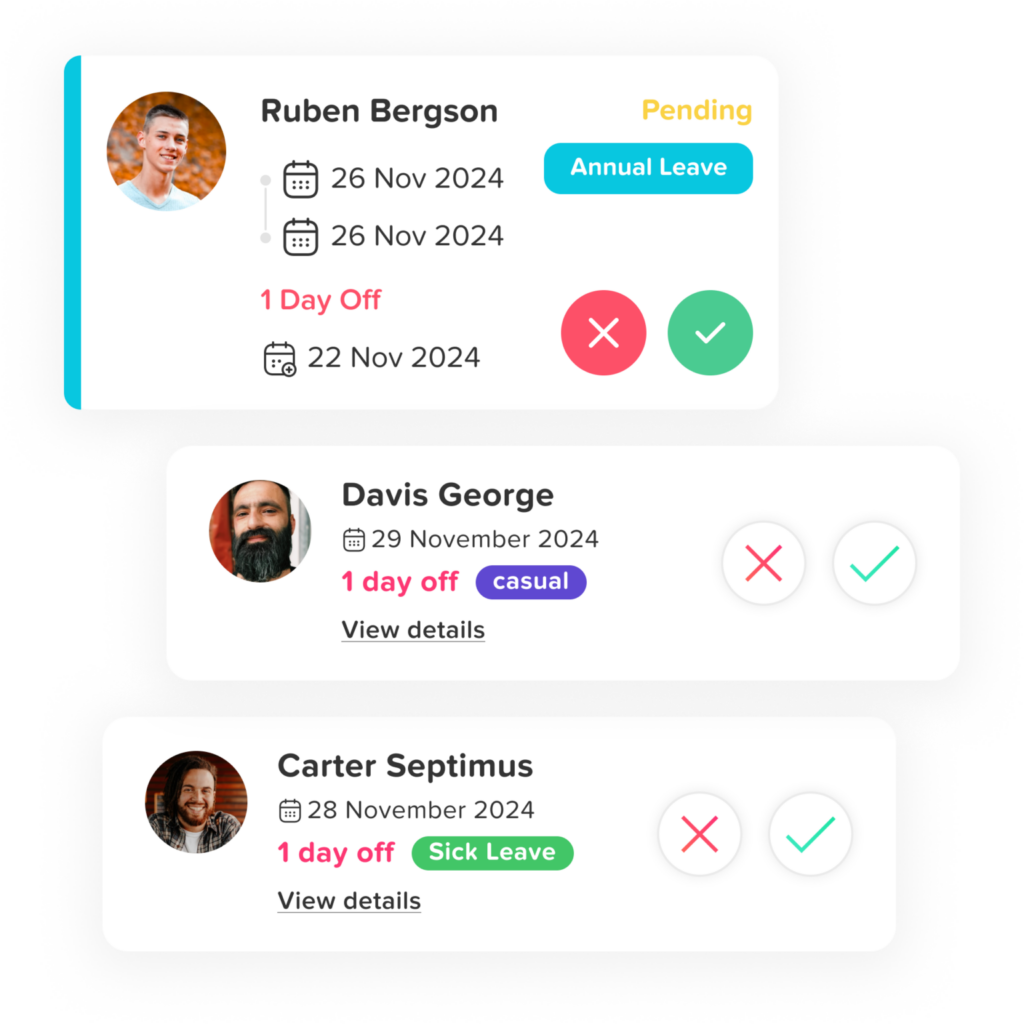

Modern PTO management tools are essential for keeping policies organized and transparent. Platforms like the Day Off App simplify the entire process of requesting, approving, and tracking PTO, while offering real time insights for managers and HR.

Why it matters: Clear, technology driven processes reduce disputes, prevent scheduling conflicts, and make employees feel empowered to take time off without hassle.

Best practices:

Choose user friendly software so adoption is smooth across the organization.

Use built in analytics to monitor patterns and adjust policies based on employee behavior.

Enable mobile access so employees can manage PTO on the go.

Frequently Asked Questions (FAQ)

Should small businesses adopt advanced PTO policies?

Absolutely. PTO policies are not just for large corporations, they can be a competitive advantage for small businesses too. Even a small company can stand out by offering flexible holiday options, volunteer time off, or professional development leave. These perks don’t always require large budgets but signal that the business values its employees. For smaller teams, PTO policies also help prevent burnout since every absence has a bigger impact.

How can companies prevent abuse of unlimited PTO policies?

Unlimited PTO only works when expectations are clear. The key is balancing flexibility with accountability. Employers should set transparent guidelines, such as requiring approval for extended absences, monitoring workloads, and tying PTO use to performance outcomes. Managers should also lead by example, taking reasonable time off themselves while ensuring projects stay on track. With the right culture, unlimited PTO encourages trust rather than abuse.

Are mental health days separate from sick days?

Ideally, yes. Treating mental health days as distinct from sick leave sends a powerful message that psychological well being is just as important as physical health. When grouped only under “sick leave,” employees may feel discouraged from taking them. Offering designated mental health days normalizes conversations around stress, burnout, and emotional health, which helps reduce stigma and encourages healthier work habits.

What’s the risk of allowing unlimited PTO carry over?

Allowing all unused PTO to roll over indefinitely can create financial and operational risks. For the company, large PTO balances can become a liability if they need to be paid out when employees leave. For employees, hoarding PTO often means they are not taking regular breaks, which increases burnout risk. A balanced policy caps rollover but still gives flexibility, such as allowing 5–10 days to carry over or offering cash payouts for unused time.

How do global PTO policies handle different legal requirements?

Global PTO policies work best as frameworks rather than strict one size fits all rules. Each country has unique labor laws regarding minimum vacation days, holidays, and leave entitlements. A global policy should set overall principles of fairness and inclusivity, while local offices customize the details to comply with their regulations. Technology tools like the Day Off app make it easier to standardize tracking while accommodating regional differences.

How does PTO affect employee retention?

PTO directly influences whether employees feel valued. Workers who can take time off without guilt or barriers are less likely to burn out and more likely to stay long term. Generous, flexible policies, such as extended parental leave or mental health days, show employees that the company respects their lives outside of work. This builds loyalty and reduces turnover, which ultimately saves the company recruitment and training costs.

What role does technology play in PTO management?

Technology is essential for modern PTO policies. Manual spreadsheets often lead to errors, confusion, or even conflicts between employees and managers. With PTO management tools like Day Off, employees can see their balances in real time, submit requests easily, and get approvals quickly. For managers, technology offers visibility into team schedules, prevents overlaps, and provides data driven insights to refine policies. This reduces friction and makes PTO a positive experience for everyone.

How can managers encourage employees to actually take PTO?

Managers set the tone. They should proactively remind employees to use their PTO and reassure them that taking time off will not harm career progression. Leading by example is also powerful, when managers take breaks themselves, employees feel more comfortable doing the same. Some companies even send automated nudges to employees who haven’t taken time off in months, reinforcing that rest is encouraged. The goal is to build a culture where using PTO feels normal, not risky.

Can PTO policies be customized for different departments or roles?

Yes, and in some cases, they should be. For example, customer facing teams may need stricter scheduling rules to ensure coverage, while creative teams might benefit from more flexible PTO arrangements. However, any customizations must remain fair and transparent across the company. Differences should be based on business needs, not favoritism. Communicating these nuances clearly helps avoid misunderstandings.

What trends will shape PTO policies beyond 2026?

Future PTO policies will likely become even more flexible and personalized. Trends include offering “life leave” for major personal milestones, expanding wellness leave, and integrating PTO with employee wellness programs. As remote and hybrid work continue to evolve, companies may shift toward results based models, where the focus is on outcomes rather than time spent at a desk. Technology will also continue to shape how PTO is managed, with analytics helping companies refine policies to match workforce needs.

Conclusion

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar.

Adapting PTO policies to fit the evolving needs of the workforce is crucial for building a supportive and productive environment. Employers should strive for flexibility, inclusivity, and transparency to stay ahead. By adopting these top PTO policies in 2026, businesses can ensure their teams are motivated, engaged, and valued.

With Day Off, companies can seamlessly implement these policies, making PTO management simple and efficient. Explore how our app can transform your company’s PTO strategy today.