Table of Contents

TogglePaid Time Off (PTO) is a vital component of employee benefits packages, offering workers the flexibility to take time away from work without sacrificing their income. Understanding how PTO hours accumulate is crucial for both employers and employees to manage time off effectively. This guide will explain how PTO hours accumulate, the various systems employers use, and tips for managing and utilizing these benefits.

Paid Time Off (PTO) consolidates vacation, sick leave, and personal time into a single bank of hours that employees can use at their discretion. This approach contrasts with traditional systems that separate time off into categories. The flexibility of PTO is appealing because it empowers employees to make decisions about how best to use their time off based on their specific needs.

How PTO Hours Accumulate

The accumulation of PTO hours typically follows a policy set by the employer, which can vary widely from one organization to another. Here are the most common methods used to calculate PTO accrual:

Yearly Accrual

In a yearly accrual system, employees receive a fixed amount of PTO hours each year. For instance, an employee might be granted 120 hours of PTO each year. This method is straightforward but offers less flexibility for new hires who might need time off before they’ve worked a full year.

Accrual per Pay Period

Many employers opt for a pay-period accrual system, where employees earn a certain amount of PTO for each week, bi-week, or month they work. For example, if an employee accrues 4 hours of PTO every bi-weekly pay period, they would accumulate approximately 104 hours of PTO over a year. This method allows PTO to build gradually and can be used as it is accrued.

Accrual Based on Hours Worked

Some organizations link PTO accrual to the number of hours an employee works. This can be particularly beneficial for part-time employees, as their PTO grows in direct proportion to the time they’ve worked. For example, an employee might earn one hour of PTO for every 40 hours worked.

Frontloading PTO

An alternative to accrual during the year is frontloading, where the entire year’s PTO is available at the start of the year or on the anniversary of the employee’s start date. This method is simple to administer and makes it easy for employees to plan vacations early in the year.

Factors Influencing PTO Accrual

Understanding the factors that influence how Paid Time Off (PTO) accrues is crucial for both employers designing PTO policies and employees managing their benefits. Several variables can affect the rate at which PTO is accumulated, ranging from employment status and length of service to the employee’s specific job role.

Employment Status

Full-time employees typically accrue PTO at a faster rate than part-time employees. Companies often pro-rate PTO accrual based on the number of hours worked, especially when using a system that accrues PTO based on hours worked.

Length of Service

Many organizations increase the rate at which employees accrue PTO based on their tenure with the company. For example, a new employee might start by accruing two weeks of PTO per year, which could increase to three weeks after five years of service, and four weeks after ten years.

Job Position or Level

Sometimes, the accrual rate may also vary by job position or level within the company. Higher-level positions or those requiring more responsibility might accrue more PTO as part of a competitive benefits package.

When Does PTO have to be Paid Out?

The requirements for paying out Paid Time Off (PTO) upon an employee’s departure from a company largely depend on the jurisdiction’s labor laws and the company’s specific policies. Here’s a breakdown of when PTO might be required to be paid out:

State and Local Laws

In the United States, the obligation to pay out accrued PTO at termination varies by state. Some states, like California, Illinois, and Massachusetts, require employers to pay out all unused PTO as it is considered earned wages. Other states allow employers to set their own policies regarding whether PTO is paid out at termination, provided these policies are clearly communicated and applied consistently. It’s important to check the specific laws in your state to understand the legal obligations.

Company Policy

Outside of legal requirements, whether PTO must be paid out upon termination often depends on the company’s policy. Companies may choose to pay out PTO for various reasons, such as maintaining a competitive benefits package or incentivizing long-term employment. Policies typically specify:

- Whether PTO is paid out at termination.

- Under what conditions PTO may be paid (e.g., resignation vs. termination).

- Any caps or limits on the amount of PTO that can be paid out.

Employment Contracts

In some cases, individual employment contracts or union agreements may dictate terms regarding PTO payout. These contracts can override general company policies if they provide specific stipulations about compensating unused time off.

Type of Termination

Some companies differentiate between different types of termination when deciding on PTO payout. For example, some policies may state that employees who are terminated for cause might not receive a payout of accrued PTO, while those who leave voluntarily or are laid off might be eligible for full payout.

How is PTO payout calculated

PTO payout calculations can vary significantly depending on the company’s policy, local laws, and the terms of employment contracts. Generally, PTO (Paid Time Off) payout occurs when an employee leaves the company, either through resignation, termination, or retirement, and they have unused accrued PTO. Here is a general overview of how PTO payout is typically calculated:

Understanding Company Policy

The first step in determining how PTO payout is calculated is to refer to the company’s specific PTO policy. This policy should outline whether PTO is payable upon termination and under what conditions. Not all companies pay out unused PTO, and some may only pay out a portion based on tenure or other factors.

Common Methods of PTO Payout Calculation

Standard Accrual Rate

If a company pays out unused PTO, the calculation is often straightforward. It is typically based on the accrued PTO balance at the employee’s standard hourly rate. For example:

- Accrued PTO Hours: 80 hours

- Hourly Rate: $25

- PTO Payout: 80 hours x $25/hour = $2,000

Pro-Rata Basis

For employees who leave partway through the year, some companies calculate the payout on a pro-rata basis. This means the payout is based on the amount of PTO accrued during the period worked in the final year of employment. For instance, if an employee earns 10 days per year and leaves halfway through the year, they would be eligible for 5 days’ worth of PTO payout if they haven’t used those days.

Cap on Payout

Some companies set a cap on how much PTO can be paid out. This cap may be a certain number of days or hours, beyond which PTO will not be compensated. This cap often exists to encourage employees to take time off during their employment rather than accumulating it.

Conditioned Payouts

Certain conditions might affect whether and how PTO is paid out. For instance, some policies require employees to provide a minimum notice period (e.g., two weeks) to qualify for a PTO payout. Failing to provide such notice may result in forfeiting some or all of the accrued PTO payout.

Legal Considerations

It’s important to note that legal requirements for PTO payout vary by region. Some states or countries require employers to pay out all unused PTO, while others do not. Employers must comply with local labor laws to avoid legal penalties.

Example Calculation

Let’s consider an example where an employee has accrued 120 hours of PTO and earns $30 per hour. Assuming the company’s policy and local laws stipulate full payout of accrued PTO:

- Accrued PTO Hours: 120 hours

- Hourly Rate: $30

- PTO Payout: 120 hours x $30/hour = $3,600

Calculating PTO payout requires a clear understanding of company policies and local labor laws. Employees should familiarize themselves with the specific terms and conditions laid out in their employment agreements or employee handbooks regarding PTO. Both employers and employees benefit from transparent and fair policies that clearly define how PTO is accrued, used, and paid out upon termination of employment.

Which States Require PTO to be Paid Out?

In the United States, the rules around whether employers must pay out accrued but unused Paid Time Off (PTO) at the end of employment depend on state laws. There is no federal law mandating PTO payout, so it varies significantly from state to state. Below is an overview of some states that require employers to pay out unused PTO, under specific conditions:

States That Require PTO Payout

California

California law treats accrued vacation time as earned wages, which must be paid out upon termination of employment at the employee’s final rate of pay. This applies to all unused vacation time or PTO that is provided in lieu of vacation.

Illinois

In Illinois, employers are not required to provide vacation benefits, but if an employer chooses to do so, they must pay out accrued vacation upon termination as per the Illinois Wage Payment and Collection Act, provided there is no valid, enforceable employment policy to the contrary.

Massachusetts

Massachusetts requires employers to pay out all accrued, unused vacation time at the end of employment, as it is considered wages.

Montana

Montana, unlike most states, is not an “at-will” state. Upon termination, employers must pay out accrued PTO unless the employer has a policy that limits the compensation of accrued PTO to certain types of termination such as layoffs or resignations, but not firings.

States With Specific Conditions or Exceptions

Several states allow companies to establish their own policies regarding whether accrued vacation must be paid out upon termination, provided these policies are clearly communicated to the employees and applied consistently. For example:

New York and Texas: These states do not have specific statutes requiring employers to pay out unused vacation time. Employers may establish their own policies regarding vacation payout, provided those policies are clearly communicated and consistently followed in accordance with employment agreements or company guidelines.

Ohio and Florida: These states also allow employers to set their own policies concerning vacation payout and do not mandate the payout of unused PTO. Employers must comply with the terms outlined in their established policies or employment contracts.

Best Practices

Employers should clearly state their PTO and vacation policies, including whether PTO is paid out upon termination, in an employee handbook or a written contract. This practice not only ensures compliance with state laws but also provides clear expectations for employees regarding their benefits.

If you are an employee or an employer unsure about the specific laws in your state, it may be beneficial to consult with a legal expert specializing in employment law to ensure compliance and understand your rights or obligations.

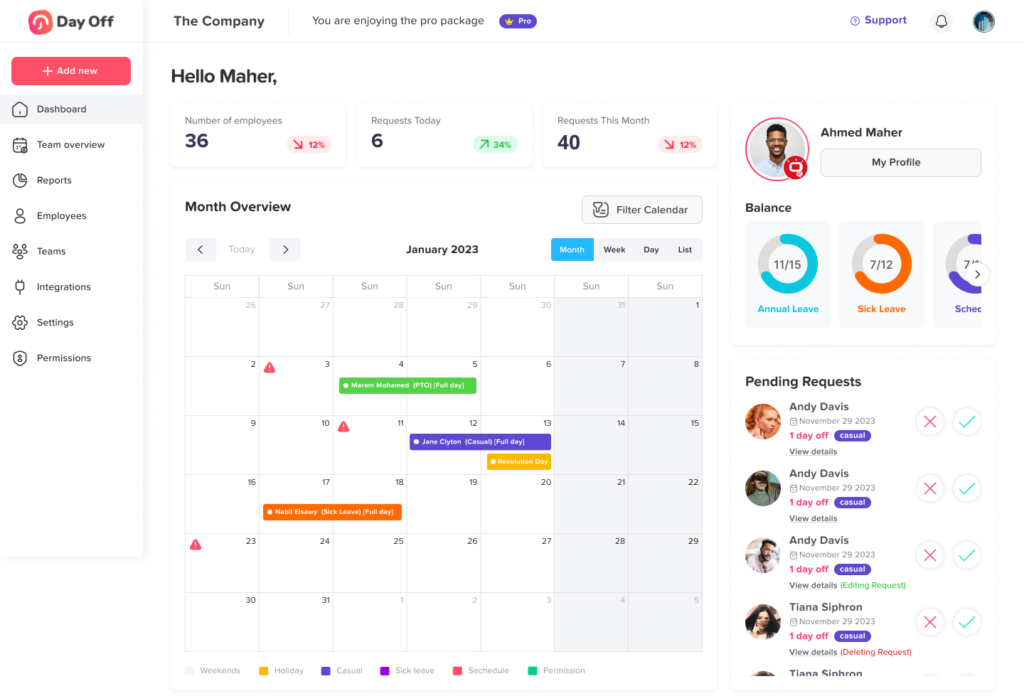

Day Off Vacation Tracking Software designed to assist both employers and employees in managing Paid Time Off (PTO) effectively. Here’s how you can use this platform to streamline the process of handling PTO:

For Employers:

Setting Up Company PTO Policies

Configure Policies: Begin by setting up your company’s specific PTO policies within the platform. This includes defining accrual rates, carryover limits, and the types of leave available (such as vacation, sick leave, and personal days).

Customize Settings: Adjust the settings to align with different employment types or departments, accommodating various accrual methods, eligibility criteria, and other role-specific requirements.

Employee Management

Add Employees: Enter employee details into the system, including start dates, employment status (full-time or part-time), and any other relevant information that impacts PTO accrual and eligibility.

Track Employee PTO: Monitor accruals, time used, and remaining balances in real time to maintain transparency and help prevent disputes or misunderstandings.

Approval Workflow

Review Requests: Implement an approval workflow that enables employees to submit PTO requests directly through the platform. Managers can then review, approve, or decline requests based on team availability and individual PTO balances.

Notifications: Configure automated notifications to promptly alert managers of new PTO requests, ensuring timely review and response.

Reporting and Analytics

Generate Reports: Utilize the platform’s reporting tools to gain insights into PTO usage patterns, identify trends, and plan effectively for peak vacation periods.

Compliance Monitoring: Leverage analytics features to ensure compliance with local labor laws by monitoring adherence to PTO regulations and company policies.

For Employees:

Submitting PTO Requests

- Submit Requests: Easily submit PTO requests by selecting dates and the type of PTO you are requesting. You can view your accrued PTO balance to make informed decisions about your time off.

Managing PTO

View PTO Balance: Access your current PTO balance at any time to see how much leave you have available.

Track Request Status: Monitor the progress of your PTO requests, from submission to approval or denial, so you can plan accordingly.

Notifications

- Stay Informed: Receive notifications regarding the approval status of your PTO requests, and upcoming scheduled PTO.

Integration and Accessibility

Mobile Access: Day Off offers a mobile-friendly version that allows employees to manage PTO requests and view balances on the go. Managers can also review and approve requests from anywhere, ensuring flexibility and timely responses.

Integration: The platform integrates with tools such as Google Calendar, Outlook, Slack, and Microsoft Teams, syncing PTO schedules across platforms to support better visibility and resource planning.

Frequently Asked Questions (FAQ) about PTO Accrual and Payout

How is PTO typically accrued in most companies?

Answer: Paid Time Off (PTO) is usually accrued based on the number of hours worked, pay periods completed, or on an annual basis. Most employers use a per-pay-period accrual system, where employees earn a fixed amount of PTO each pay period (e.g., weekly, biweekly, or monthly). Some organizations also grant the entire annual PTO balance upfront at the beginning of the year.

Can an employer refuse to pay out accrued PTO upon termination?

Answer: Whether an employer must pay out accrued PTO upon termination depends on state law and company policy. In some states, like California, all earned PTO is considered wages and must be paid out when employment ends. In other states, the payout may depend on the employer’s written policy, as long as it is clearly communicated and consistently applied.

Does PTO accrual carry over from year to year?

Answer: Carryover rules vary by employer. Some companies use a “use-it-or-lose-it” policy, requiring employees to use PTO by year-end, while others allow unused hours to carry over into the next year (often with a maximum limit). State laws may also restrict or prohibit strict “use-it-or-lose-it” policies, so always check local regulations and your company’s policy.

Are part-time employees eligible for PTO?

Answer: Many employers offer PTO to part-time employees, but it is typically accrued on a pro-rated basis according to hours worked. For example, a part-time employee working half the hours of a full-time employee might accrue PTO at half the rate.

How can employees track their PTO accrual?

Answer: PTO balances are usually tracked through the company’s HR or payroll system, where accruals and usage are updated each pay period. Employees should regularly review their PTO statements or online portals to ensure accuracy and transparency.

What happens to unused PTO if I quit or am terminated?

Answer: The treatment of unused PTO upon separation depends on state law and employer policy. Some companies pay out all accrued PTO, while others do so only if required by state law or under certain conditions. Always review your employee handbook or contract for specific details before leaving the company.

How do I calculate my PTO payout?

Answer: To calculate your PTO payout, multiply your accrued, unused PTO hours by your hourly pay rate.

Example: If you have 40 unused PTO hours and earn $25 per hour, your payout would be 40 × $25 = $1,000 before taxes.

Are employers required to provide PTO?

Answer: There is no federal law requiring private employers to offer PTO. However, many provide it as part of a competitive benefits package. Some states and localities mandate paid sick leave or paid time off, so eligibility can vary depending on your location and employer type.

Can my employer change the PTO policy after I’ve accrued time off?

Answer: Employers generally can modify their PTO policies, but changes typically apply only to future accruals, not PTO already earned. Accrued PTO is often protected under the policy in effect at the time it was earned. Employers must also provide reasonable notice before implementing policy changes.

What should I do if I believe my PTO payout is incorrect?

Answer: If you think your PTO payout was miscalculated, start by reviewing your company’s PTO policy and checking your pay stubs or HR records. Then, bring the issue to your HR or payroll department. If it remains unresolved, you may need to consult your state labor department or seek legal advice for further assistance.

Conclusion

In conclusion, understanding and managing Paid Time Off (PTO) effectively is crucial for both employers and employees. Employers need to develop clear, compliant PTO policies that align with state laws and meet the needs of their workforce, while employees must be proactive in understanding and managing their PTO to maximize its benefits. Utilizing tools like the Day Off can significantly streamline this process, providing a robust platform for tracking accruals, submitting requests, and ensuring that all parties are informed and compliant with regulations.