Table of Contents

ToggleEmployee leave is more than a workplace benefit it is a form of deferred compensation that creates real financial and legal responsibilities for employers. When employees earn paid time off but do not immediately use it, that time accumulates as a leave liability. If left unmanaged, these liabilities can quietly grow, distort financial reporting, and expose companies to compliance risks.

Understanding how leave liabilities work, how accruals are calculated, and what obligations employers must meet is essential for building sustainable leave policies and avoiding costly surprises.

Understanding Leave Liabilities in Detail

Leave liabilities represent the future obligation a company holds toward employees for earned but unused time off. Unlike discretionary benefits, accrued leave is typically earned gradually and may be protected by labor laws, accounting standards, or employment contracts.

This means leave liabilities are not optional. Once leave is earned, employers often cannot retroactively remove or reduce it without violating legal or contractual obligations.

Leave liabilities usually apply to:

Vacation leave

Paid time off (PTO)

Compensatory time

Certain contractual leave entitlements

They usually do not apply to:

Unpaid leave

Jury duty leave

Bereavement leave

Sick leave that expires or is not payable on termination

The distinction is important because it determines whether leave must be financially accounted for.

Why Leave Accruals Exist

Accrual based leave systems are designed to create fairness and predictability. Employees earn time off gradually as they work, rather than receiving all leave upfront.

From a business perspective, accruals:

Spread leave costs over time

Reduce abuse of leave benefits

Align time off with employee tenure

From an employee perspective, accruals:

Create a sense of earned entitlement

Encourage retention

Provide flexibility for future planning

However, accruals also mean that unused leave accumulates, increasing the employer’s outstanding obligation.

Common Leave Accrual Structures Explained

Different organizations use different accrual models depending on industry, workforce type, and compliance requirements.

Period Based Accrual

Employees earn a fixed amount of leave per pay period, month, or year. This is the most common structure and is relatively easy to track.

Hourly Accrual

Leave accrues based on hours worked, which is common for part time, hourly, or shift based employees. This method requires precise tracking to remain compliant.

Front Loaded Accrual

Employees receive their full annual leave balance at the start of the year. While simple, this method can increase risk if employees leave before “earning” the time.

Tenure Based Accrual

Accrual rates increase with length of service. This encourages retention but often leads to higher long term liabilities.

Each structure impacts how quickly leave liabilities grow and how predictable they are for finance teams.

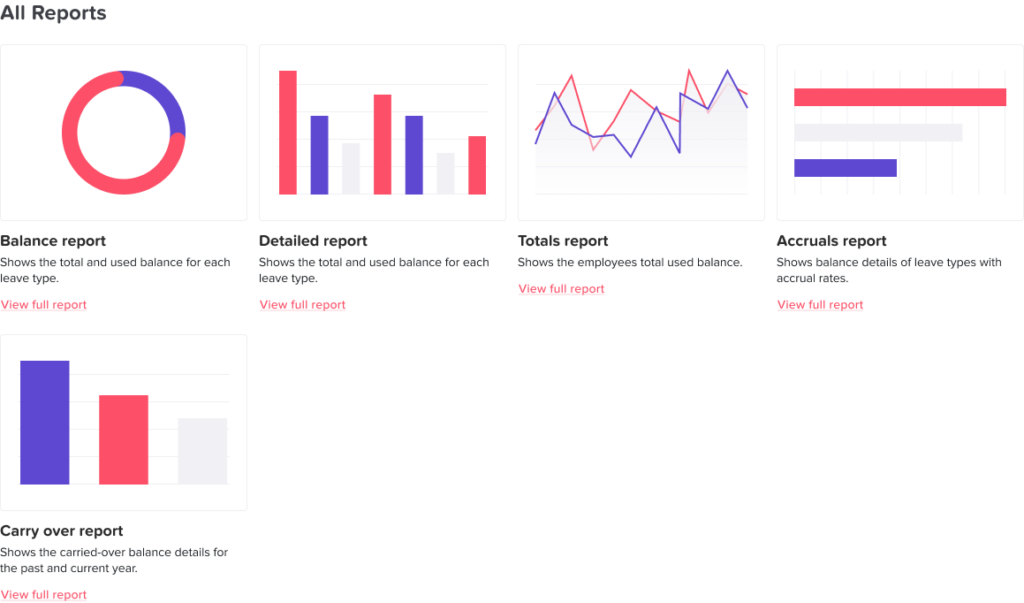

How Accruals Work in Day Off

With Day Off, leave accruals are calculated automatically based on your policy settings. The system updates balances continuously as employees earn time off, making it easy to track both used and remaining leave.

Key accrual capabilities include:

Accruing leave monthly, Semi-monthly, Weekly, bi-weekly and based on your chosen cycle

Supporting different accrual rates for different leave types

Automatically updating balances as leave is earned or used

Applying accrual rules consistently across teams and locations

Maintaining a clear history of balance changes for transparency

How to Set Up Leave Accruals in Day Off

Setting up accruals in Day Off is simple and flexible, allowing you to match your internal policies without manual work.

Step by step setup:

Create or edit a leave type

Define the leave type (e.g. Vacation, PTO) and decide whether it is accrued over time or granted upfront.Choose the accrual method

Select how leave should accrue, such as monthly or yearly accrual, and set the total entitlement.Define accrual start rules

Specify when accrual begins, such as on the employee’s start date or after a probation period.Set carryover and limits

Configure carryover rules, expiration dates, or caps to control balance growth and manage leave liabilities.Assign the policy to employees or teams

Apply the accrual rules to specific employees, departments, or locations to support different policies.Review balances and reports

Use Day Off’s reporting and balance views to monitor accrued, used, and remaining leave in real time.

The Financial Impact of Leave Liabilities

Leave liabilities represent a deferred cost. While they may not immediately affect cash flow, they become very real when employees take extended leave or exit the company.

High accumulated balances can:

Increase termination costs

Create unexpected payroll spikes

Distort compensation expenses

Complicate budgeting and forecasting

For larger organizations, leave liabilities can represent a material line item that affects financial statements and business planning.

For startups and small businesses, they can strain cash flow during periods of turnover or rapid growth.

Leave Liabilities and Employee Termination

One of the most critical moments for leave liabilities is employee separation.

Depending on local laws and company policy:

Accrued leave may need to be paid out in full

Partial payouts may be required

Payment deadlines may be legally defined

Failure to pay out accrued leave correctly can result in:

Wage claims

Legal penalties

Damage to employer reputation

This makes accurate, up to date leave tracking essential.

Legal and Compliance Considerations

Leave liabilities are governed by a combination of:

National labor laws

Regional or state regulations

Collective bargaining agreements

Company policies

Jurisdictional Differences

Some countries and states treat accrued vacation as earned wages, while others allow more flexibility. Multinational companies must manage leave based on where the employee works, not where the company is headquartered.

Carryover and Expiration Rules

Some laws require employers to allow unused leave to carry over. Others permit “use it or lose it” policies under strict conditions. Incorrect implementation can invalidate these policies entirely.

Recordkeeping Obligations

Many regulations require employers to maintain:

Historical accrual data

Balance change logs

Clear documentation of policy rules

Poor recordkeeping weakens compliance defenses.

Accounting Treatment and Financial Reporting

From an accounting perspective, leave liabilities must be recognized when:

The leave is earned

The amount can be reasonably estimated

Payment or usage is expected

These liabilities may be classified as:

Short term (expected within 12 months)

Long term (expected after 12 months)

Regular reconciliation between HR records and payroll systems is critical to avoid misstatements.

Auditors often review leave liability calculations, especially during:

Annual audits

Company acquisitions

Investment due diligence

Operational Risks of Uncontrolled Leave Balances

Beyond finance and compliance, leave liabilities also affect operations.

Large leave balances can lead to:

Sudden staff shortages

Project delays

Uneven workload distribution

Managerial planning challenges

When many employees take leave simultaneously often due to accumulated balances business continuity can suffer.

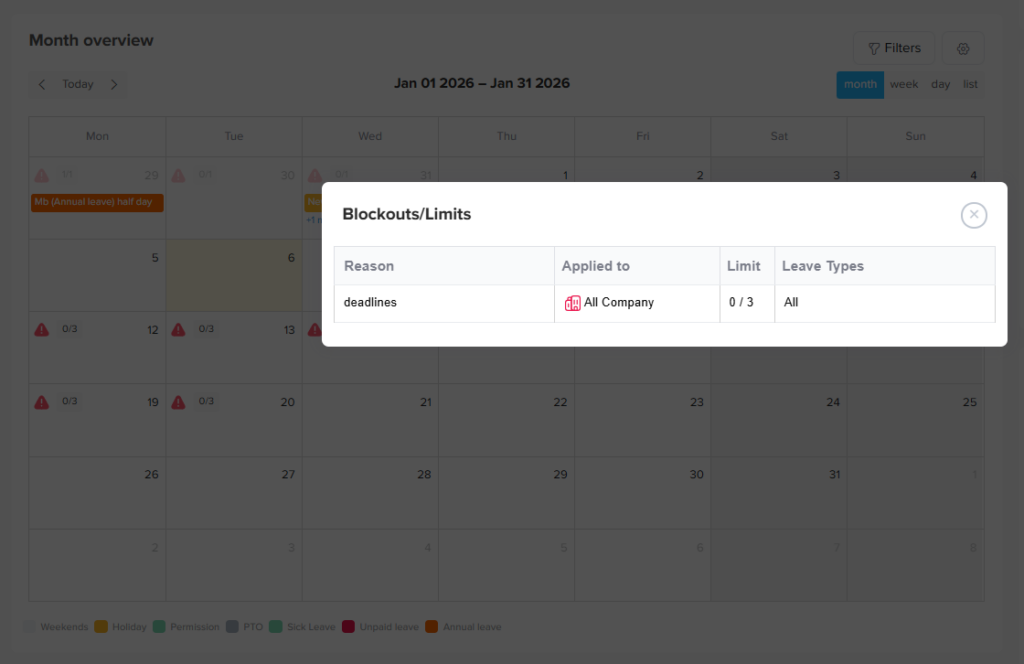

Leave management software like Day Off strengthens leave forecasting by allowing organizations to define blockout dates specific periods when time off is restricted due to business critical needs.

Best Practices for Reducing Leave Liability Risk

Create Policy Limits

Accrual caps and carryover limits help control liability growth while remaining compliant.

Encourage Regular Leave Usage

Normalizing time off reduces stockpiling and improves employee wellbeing.

Align HR and Finance Teams

Leave data should be shared between departments to support accurate planning.

Use Automated Leave Management

Automation reduces errors, improves transparency, and ensures compliance across locations.

Conduct Regular Reviews

Periodic audits of leave balances help identify risk early and support better forecasting.

Strategic Value of Understanding Leave Liabilities

When managed properly, leave liabilities become a planning tool rather than a risk.

They provide insight into:

Workforce engagement

Retention trends

Policy effectiveness

Long term compensation costs

Companies that proactively manage leave liabilities are better positioned to scale, remain compliant, and build trust with employees.

FAQ

What types of leave usually create liabilities for employers?

Leave liabilities most commonly arise from vacation leave and paid time off (PTO) that employees earn over time. These leave types are often considered earned compensation and may be payable if unused. Compensatory time can also create liabilities in certain roles or jurisdictions. Sick leave, bereavement leave, and other statutory or event based leave generally do not create liabilities unless local laws require payout.

Are leave liabilities considered wages?

In many jurisdictions, accrued vacation or PTO is legally treated as earned wages. This means employers may be required to pay it out upon termination and cannot remove it once earned. Whether leave qualifies as wages depends on local labor laws and the company’s written leave policy, making compliance especially important for multi location teams.

Do all companies need to record leave liabilities on their balance sheet?

Not all businesses are required to formally record leave liabilities, but many are. Companies that follow accrual accounting, undergo audits, seek investment, or operate at scale are often required to recognize leave liabilities when they are material. Even when not legally required, tracking leave liabilities is considered a best practice for financial planning and risk management.

How do leave liabilities affect cash flow?

Leave liabilities can impact cash flow when employees take extended leave or exit the company. Large payouts for unused PTO can create unexpected payroll expenses, especially during periods of high turnover or restructuring. Without forecasting, these costs can strain budgets and disrupt financial planning.

Can employers limit leave liability growth?

Yes, employers can reduce uncontrolled liability growth by implementing accrual caps, carryover limits, and clear expiration rules, as long as these comply with local laws. Encouraging employees to take leave regularly is another effective way to prevent excessive accumulation without reducing benefits.

What happens to accrued leave when an employee leaves the company?

This depends on jurisdiction and company policy. In many regions, accrued vacation or PTO must be paid out in full upon termination. In others, payout is only required if stated in the employment contract or leave policy. Employers must ensure their policies are compliant and consistently applied to avoid legal disputes.

How are leave liabilities handled in global or distributed teams?

For global teams, leave liabilities must be managed based on the employee’s work location, not company headquarters. Each country or region may have different rules regarding accruals, carryover, and payout. Centralized leave management systems help apply local rules correctly while maintaining global visibility.

Does unlimited PTO eliminate leave liabilities?

Unlimited PTO policies often reduce traditional leave liabilities because there is no formal accrual. However, they introduce other risks, such as inconsistent usage, unclear expectations, and potential compliance issues in regions that require minimum paid leave. Unlimited PTO does not automatically remove all legal or operational obligations.

Why do audits and acquisitions focus on leave liabilities?

During audits, mergers, or acquisitions, leave liabilities are closely examined because they represent future financial obligations. Undisclosed or underestimated leave liabilities can affect company valuation, deal terms, and post-acquisition costs. Accurate tracking protects both buyers and sellers from unexpected liabilities.

How can companies accurately track leave liabilities?

Accurate tracking requires:

Clear leave policies

Consistent accrual rules

Up to date employee records

Regular reconciliation between HR and payroll data

Automated leave management systems significantly reduce errors and provide real time visibility into accrued balances and liabilities.

Who should be responsible for managing leave liabilities?

Leave liabilities are a shared responsibility between HR, finance, and payroll teams. HR defines policies and employee experience, finance assesses financial impact, and payroll ensures accurate execution. Collaboration between these teams is essential for effective leave liability management.

What are the biggest mistakes companies make with leave liabilities?

Common mistakes include:

Poorly documented leave policies

Manual or inconsistent tracking

Ignoring jurisdiction specific laws

Allowing unlimited carryover without planning

Only reviewing liabilities during employee exits

Proactive management helps prevent these issues before they become costly problems.

Conclusion

Leave liabilities are an unavoidable part of offering paid time off. While they may seem administrative, they carry significant financial, legal, and operational implications.

By understanding how leave accruals create obligations, tracking balances accurately, and designing thoughtful policies, companies can protect themselves from risk while offering fair and sustainable benefits.

Strong leave liability management supports healthier finances, stronger compliance, and a more transparent employee experience.