Table of Contents

ToggleThis article provides a comprehensive analysis of accrued Paid Time Off (PTO), focusing on its impact on both employees and employers. It explores the accounting implications, legal considerations, and the strategic management of accrued PTO, offering insights for business professionals, financial analysts, and human resources managers.

Paid Time Off (PTO) is a crucial component of employee compensation packages, balancing work responsibilities with personal time. Accrued PTO refers to the amount of paid leave time that an employee has earned but not yet used. This article examines the multifaceted aspects of accrued PTO, shedding light on its financial, legal, and managerial dimensions.

Financial Implications of Accrued PTO

- 1.1. Accounting for Accrued PTO: Accrued PTO represents a liability on the company’s balance sheet. It’s essential for financial reporting to accurately account for this liability to reflect the organization’s true financial position. The method of accounting for accrued PTO varies based on whether the PTO is vested or accumulates.

- 1.2. Impact on Cash Flow: Employers must consider the impact of PTO payouts, particularly in scenarios of employee termination or resignation, on the company’s cash flow. Effective forecasting and financial planning are required to manage this liability without affecting the organization’s liquidity.

Legal Considerations in Managing Accrued PTO

- 2.1. Compliance with Labor Laws: The legal landscape governing PTO varies by jurisdiction. Employers must comply with state and federal regulations concerning PTO accrual, carryover, and payout policies. Non-compliance can lead to legal disputes and financial penalties.

- 2.2. Policy Design and Implementation: The design of PTO policies must balance legal compliance with organizational goals. Policies should be transparent, equitable, and consistently applied to avoid potential legal issues and ensure fair treatment of employees.

Strategic Management of Accrued PTO

- 3.1. Employee Engagement and Productivity: Proper management of PTO can positively impact employee morale and productivity. Encouraging employees to take their earned leave can prevent burnout and enhance overall job satisfaction.

- 3.2. Balancing Employee Needs with Organizational Objectives: Organizations should strategically manage PTO accruals to align with their operational requirements. This involves creating policies that both support the employees’ well-being and ensure uninterrupted business operations.

Day Off Leave Management Solutions for Effective Accrued PTO Tracking

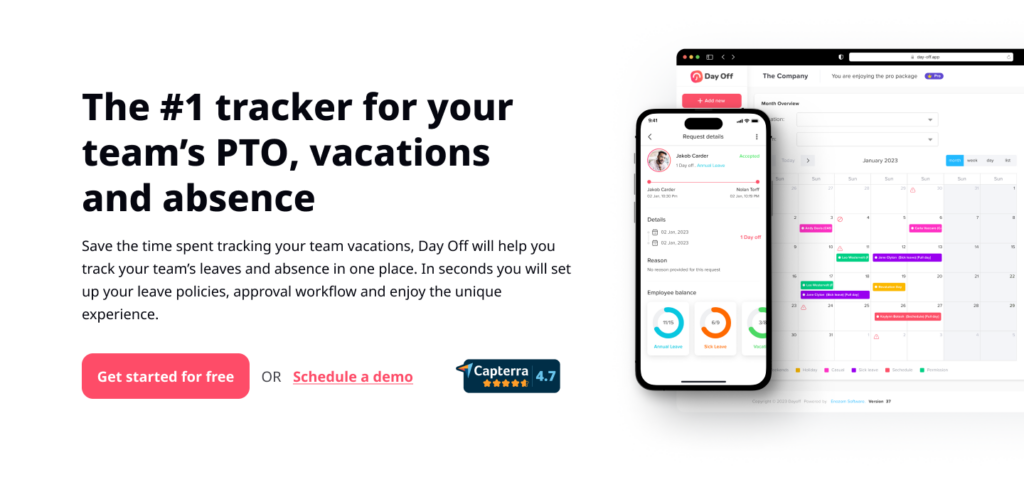

The management of accrued Paid Time Off (PTO) is a critical task for organizations, influencing financial stability, legal compliance, and employee satisfaction. Implementing specialized “Day Off” management software can streamline this process, offering tools for tracking, forecasting, and policy enforcement. This article examines the potential benefits and considerations of integrating “Day Off” management solutions into business operations.

The efficient handling of accrued PTO is essential for businesses to maintain a healthy balance sheet, adhere to legal standards, and foster a positive workplace culture. “Day Off” management solutions offer a comprehensive approach to manage these aspects effectively.

Streamlined Tracking and Accounting

- 1.1. Real-Time Tracking: These solutions provide real-time data on accrued PTO, allowing for accurate accounting and liability forecasting. This feature aids in financial planning and reduces the risk of errors in balance sheet reporting.

Compliance with Legal Standards

- 2.1. Policy Implementation: Day Off management tools can be configured to align with specific legal requirements and organizational policies, ensuring compliance across various jurisdictions.

- 2.2. Documentation and Audit Trails: The software creates a systematic record of PTO accruals and usages, which is invaluable during audits or legal inquiries, safeguarding the company against non-compliance penalties.

Enhancing Employee Experience

- 3.1. Transparency and Accessibility: Employees can easily view their accrued PTO, submit requests, and plan their schedules, enhancing transparency and trust.

- 3.2. Balancing Workload and Well-being: By facilitating easier PTO planning, these systems help maintain a healthy balance between work commitments and personal well-being, contributing to overall employee satisfaction.

Strategic Management Benefits

- 4.1. Data-Driven Decision Making: The analytics provided by Day Off solutions enable managers to make informed decisions about staffing and operational planning, minimizing the impact of employee absences.

- 4.2. Forecasting and Trend Analysis: Advanced forecasting tools help predict future PTO usage trends, aiding in strategic planning and budgeting.

Frequently Asked Questions (FAQ): Accrued PTO , Finance, Legal, and Strategy

What does “accrued PTO” actually mean, and why does it matter?

Accrued PTO is paid leave an employee has earned but not yet used. It matters because it’s both a financial liability (an obligation the company owes) and a people practice that affects well-being, retention, and staffing. Treating it seriously keeps your books accurate, your operations smooth, and your culture healthy.

When should a company recognize accrued PTO as a liability?

Recognize a liability when the benefit is earned through service, the amount is probable and estimable, and it will be paid or carried forward. In many jurisdictions, unused, vested PTO must be paid at termination; that makes recognition even more critical. Work with finance to set a clear monthly accrual and true-up process.

How do vested vs. non-vested PTO policies affect the balance sheet?

Vested PTO (promised regardless of future service) typically creates a stronger obligation and is recognized more clearly as a liability. Non-vested or “use-it-or-lose-it” balances can reduce the obligation, subject to local law. Always confirm whether forfeiture policies are legal in each jurisdiction before assuming liability relief.

How should we calculate the financial value of accrued PTO?

Use the employee’s current pay rate multiplied by unused, eligible hours (plus differentials if policy or law requires). Finance may also add employer on-costs (taxes, mandatory contributions) for internal costing. Recalculate after merit increases or promotions to keep the liability current.

How does accrued PTO impact cash flow?

Accrued PTO becomes a cash outflow when employees take paid time or receive payouts (especially at termination or policy buyouts). Forecast by modeling expected usage, seasonality, and attrition. Keep a rolling 12-month outlook so spikes (holidays, year-end carryovers) don’t surprise liquidity.

Are PTO payouts required at termination?

It depends on local law and policy. Some regions require payout of unused, accrued PTO; others allow forfeiture if clearly communicated and legal. Multi-state/multi-country employers should maintain a jurisdiction matrix and configure systems accordingly.

What are the legal pitfalls to avoid with PTO accrual and carryover?

Common pitfalls include illegal forfeiture clauses, failing to pay out where required, inconsistent treatment across similar roles (equal pay risk), and poor record-keeping. Review policies with counsel, document them clearly, and apply them consistently.

How do unlimited PTO policies affect accounting?

“Unlimited” PTO often does not accrue and therefore doesn’t create the same balance sheet liability. But it raises equity and compliance questions: ensure access is truly equitable, managers are trained to approve time fairly, and local leave laws (e.g., sick time) remain separately tracked and compliant.

Should PTO hours count toward overtime thresholds?

Usually only hours worked count toward overtime eligibility, not paid time off, but collective bargaining agreements or local laws can differ. Spell this out in policy and configure timekeeping rules to match.

How do we handle negative PTO balances?

Negative balances (borrowing against future accruals) are a credit risk if the employee leaves before earning the time. Limit the borrow amount, require written acknowledgement, and define recovery methods consistent with wage laws before permitting negative balances.

What’s the best way to accrue PTO: per pay period, monthly, or annually?

Accrue proportionally with service (e.g., per pay period) for fairness and compliance, especially for new hires and part-timers. Annual front-loading is simple for employees but increases financial exposure; if you front-load, model cash and set guardrails for early separations.

How do carryover caps and expirations affect liability?

Carryover caps and expirations can reduce the year-end liability, if legal and clearly communicated. Beware of forcing forfeitures that violate local law. Offer “cash-out” or “sell-back” windows or encourage PTO planning to prevent large carryovers.

How do sabbaticals, parental leave, or sick-leave banks interact with accrued PTO?

These programs often have distinct legal rules and accounting treatments from general PTO. Track them as separate leave types with their own accrual logic, eligibility, and payout rules, and confirm whether any portion should be recognized as a liability.

What reporting should finance and HR review regularly?

Review aging of PTO balances, liability by department/location, usage vs. accrual trends, carryover risk, and equity of access (who takes time vs. who doesn’t). Correlate with burnout indicators (after-hours work, sick spikes) to spot risk early.

How can Day Off solutions improve accuracy and compliance?

A dedicated tool centralizes real-time balances, integrates holiday calendars by location, enforces policy rules (caps, carryovers, eligibility), and creates audit trails for approvals and changes. Exports feed the GL and payroll, reducing manual adjustments and audit findings.

What audit evidence should we keep for accrued PTO?

Maintain policy documents, localized addenda, approval workflows, system logs of accrual/usage, employee communications, payroll tie-outs, and monthly reconciliations. Auditors look for completeness, consistency across systems, and evidence of management review.

How should we communicate PTO balances and policies to employees?

Provide a self-service view of balances and accrual schedules, a plain-language policy guide with regional exceptions, and reminders before carryover deadlines. Transparency reduces disputes and encourages healthier usage patterns.

How does PTO usage affect productivity and culture?

Encouraging employees to actually take PTO improves focus, creativity, and retention. Teams that plan coverage and normalize disconnection avoid brittle “hero cultures” and perform better over time. Track utilization and re-entry load to keep workloads humane.

How can managers balance operational needs with PTO access?

Use capacity planning and blackout periods sparingly and transparently. Approve requests quickly, stagger overlapping absences, and cross-train for coverage. The goal is to protect service levels and make rest reliable.

How do we handle part-time, seasonal, and variable-hour employees?

Accrue based on hours worked or a pro-rated formula, aligned with local law. Pro-rate holiday pay where permitted. Communicate how accrual calculates for irregular schedules and ensure systems handle proration automatically.

Conclusion:

Accrued PTO is a significant element of employee benefits, with profound implications for both employees and employers. Effective management of accrued PTO requires a balance between financial acuity, legal compliance, and strategic human resource management. By understanding and addressing the complexities associated with accrued PTO, organizations can foster a productive, satisfied workforce while maintaining financial health and legal compliance.

Implementing Day Off vacation tracker solutions presents a strategic advantage for organizations in managing accrued PTO. These systems not only ensure financial accuracy and legal compliance but also promote a positive work environment through enhanced transparency and employee engagement.