Table of Contents

TogglePaid Time Off (PTO) is a critical benefit for employees, providing them with the opportunity to take time off for personal or health reasons while still being compensated. Managing and tracking PTO is not just about keeping records; it is about ensuring that businesses comply with labor laws, maintain transparency, and avoid costly mistakes. Unfortunately, many companies still rely on outdated methods, such as paper forms or spreadsheets, to manage PTO. Although these manual tracking systems may appear convenient at first, they introduce significant risks related to compliance, audit difficulties, and potential liabilities.

In this article, we will explore the risks of manual PTO tracking systems and why businesses should consider adopting automated PTO management solutions to mitigate these risks and enhance operational efficiency.

Compliance Challenges

Changing Labor Laws and Regulations

Labor laws governing PTO, such as those related to accrual, carryover, and payout, are complex and continually evolving. These laws can vary significantly across regions and jurisdictions, making compliance a challenge for businesses with a diverse workforce. Manual systems are prone to errors when updating for new laws, potentially leading to violations.

Key Points:

Constant Changes in Laws: Local, state, and national regulations regarding PTO are frequently updated. Manual systems may not automatically reflect these changes, risking non compliance.

Difficulty in Tracking Regional Differences: For businesses with remote or distributed teams, keeping track of varying regulations across locations is nearly impossible with manual systems.

Cross Jurisdictional Issues

Companies that operate across different states or countries face the challenge of managing PTO in multiple jurisdictions, each with its own rules. This can lead to inconsistencies in the way PTO is tracked and managed.

Key Points:

Variation in PTO Policies: Each jurisdiction may have its own PTO rules regarding accrual rates, mandatory carryovers, and maximum PTO limits.

Risk of Inconsistent Application: Without automated tracking, companies may inadvertently apply incorrect policies to employees based on their location, leading to legal issues.

Difficulty Enforcing PTO Policies

Manually managing PTO makes it difficult to enforce policies consistently across the organization. Without clear visibility into real time data, employees may request time off without considering their available balance, or they may take time off without prior approval.

Key Points:

No Automatic Approval Workflow: Manual tracking lacks built in workflows to enforce approval processes, leading to unauthorized time off.

Inconsistent Policy Enforcement: Without an automated system, employees may be granted PTO inconsistently, causing frustration and potential disputes.

Audit and Record Keeping Risks

Inaccurate Record Keeping

Human error is a common issue when manually tracking PTO. Incorrect data entry, missing records, and miscalculation of PTO balances can lead to discrepancies. These errors can accumulate over time and lead to costly mistakes.

Key Points:

Data Entry Mistakes: Manual systems are prone to clerical errors such as wrong dates, missed entries, and miscalculated balances.

Unreliable Reports: When discrepancies occur, businesses may have to spend hours sifting through records to resolve the issue, which is inefficient and error prone.

Difficulty in Retrieving Records During Audits

Audits are an essential process for ensuring compliance and transparency. However, businesses that use manual systems often find it difficult to retrieve PTO records when needed. This lack of centralized data makes audits time consuming and prone to errors.

Key Points:

Time Consuming Data Retrieval: Retrieving records from paper forms or spreadsheets is slow and inefficient.

Lack of Audit Trails: Manual systems often don’t have detailed logs of PTO requests, approvals, or changes, making it difficult to trace discrepancies.

Lack of Clear Audit Trails

An automated PTO system maintains a detailed audit trail, recording every request, approval, and modification. Manual systems, however, often lack this level of detail, leaving gaps that complicate the audit process.

Key Points:

No Traceable History: In manual systems, it’s harder to verify who approved a request or when a PTO balance was updated.

Audit Inefficiencies: Without clear tracking, it becomes harder to resolve discrepancies during audits, which can result in delayed or failed audits.

Liability Issues

Accrued PTO Liabilities

Accrued PTO represents a financial liability for the company. If PTO is not tracked correctly, it can lead to inaccuracies in financial reporting and underestimations of liabilities. This can mislead stakeholders and complicate financial audits.

Key Points:

Incorrect Liability Calculations: Manual systems increase the risk of underreporting or overreporting PTO liabilities on the balance sheet.

Unforeseen Payouts: Inaccurate PTO tracking may lead to unexpected payouts when employees leave the company or use more PTO than they are entitled to.

Payouts Upon Employee Termination

When employees leave the company, businesses are typically required to pay them for any unused PTO. Manual tracking systems increase the risk of errors in calculating these payouts, which could either overpay or underpay employees.

Key Points:

Underpayment or Overpayment: Manual systems increase the risk of mistakenly underpaying or overpaying employees for unused PTO.

Legal Disputes: Incorrect payouts can lead to employee disputes, legal challenges, or even lawsuits, especially if the error involves a large amount of PTO.

Incorrect Handling of Unpaid Leave

In some cases, employees may take unpaid leave, which should be tracked separately from PTO. Manual systems often struggle to account for unpaid leave accurately, which can result in financial inaccuracies.

Key Points:

Misleading PTO Balances: Without a clear separation between PTO and unpaid leave, businesses may inadvertently overstate PTO balances.

Payroll Errors: Incorrect PTO tracking can result in employees being underpaid or overpaid if unpaid leave is not properly deducted.

The Solution: Automating PTO Tracking

Given the significant risks associated with manual PTO tracking, businesses should consider adopting automated PTO management systems. These systems can help mitigate the risks discussed above and offer several advantages over traditional methods.

Key Points:

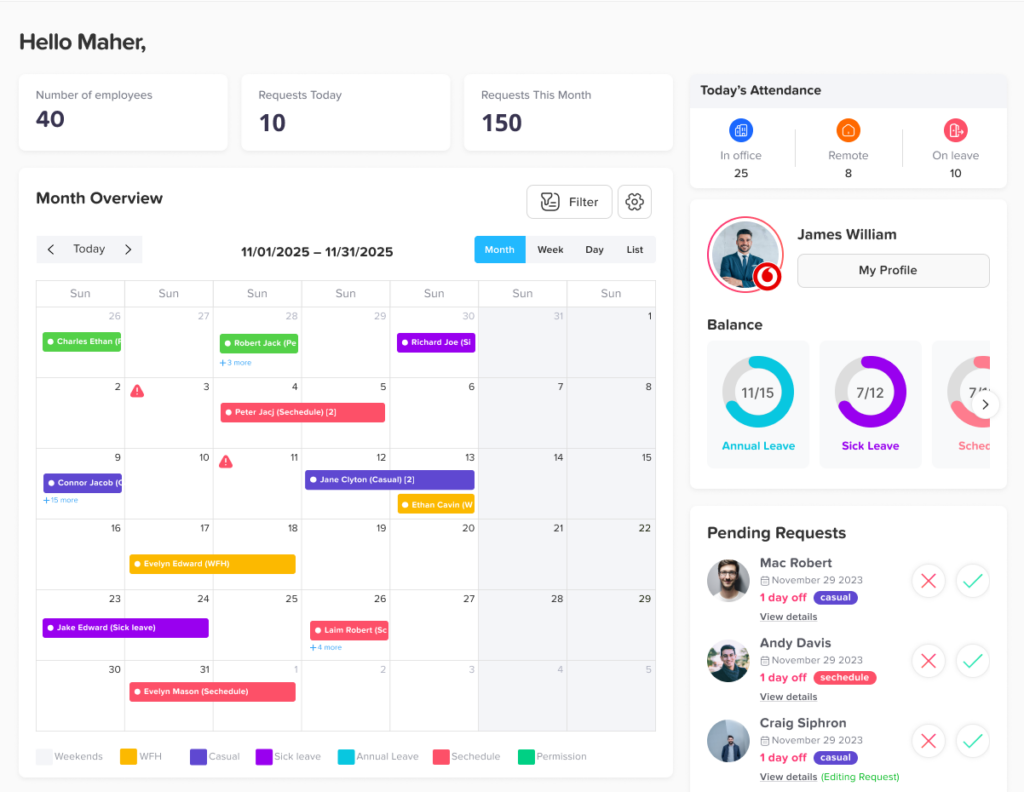

Real Time Updates: Automated systems update PTO balances in real time, ensuring that employees and managers have access to accurate, up to date information.

Reduced Human Error: Automated systems eliminate the risk of human error by calculating PTO balances, accruals, and carryovers automatically.

Easy Record Retrieval: With centralized digital records, businesses can quickly retrieve PTO data during audits or employee inquiries.

Accurate Liabilities Tracking: Automated systems track PTO accruals and liabilities in real time, ensuring accurate financial reporting and proper management of employee leave balances.

Customizable Policies: Automated systems can be tailored to meet the specific needs of a business, allowing for customizable PTO policies based on department, employee role, or geographic location.

Improved Employee Transparency: Employees can access their PTO balances and request updates easily through the system, fostering transparency and trust.

Streamlined Approval Workflow: Automated PTO systems facilitate an approval process, enabling managers to review and approve requests quickly, reducing delays and ensuring compliance with company policies.

Scalability: As businesses grow, automated systems can scale to handle more employees, different types of leave, and more complex policies, without requiring additional resources or significant manual intervention.

Cost Savings: Over time, the time saved from reducing manual administration and avoiding costly errors can offset the initial investment in the automated system.

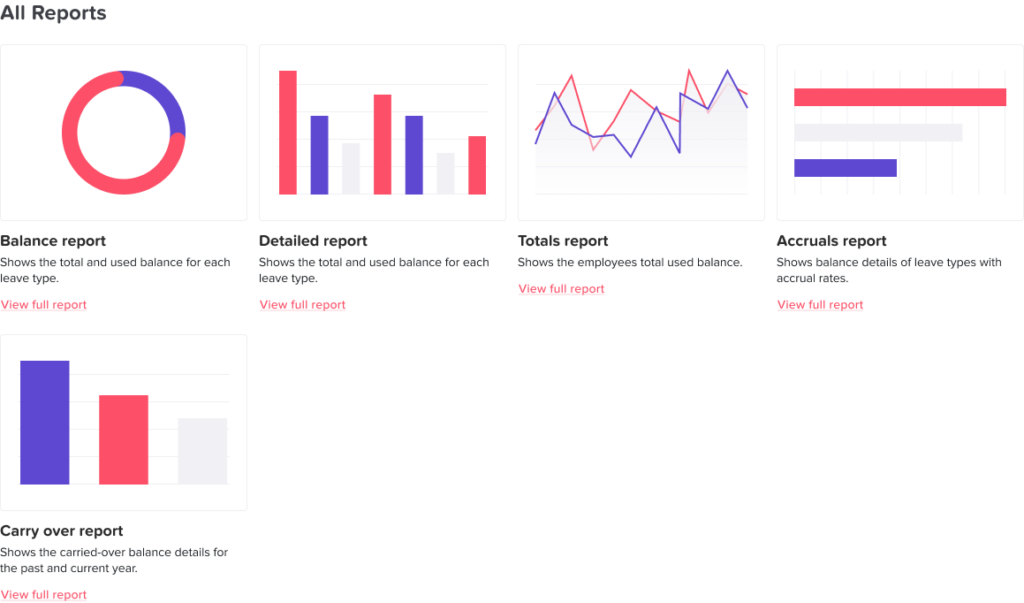

Accurate Reporting: Automated systems provide robust reporting features that allow businesses to track PTO usage, accruals, and trends, providing valuable insights for future planning and decision making.

Enhanced Data Security: Digital systems offer secure storage for PTO data, reducing the risk of data loss or theft compared to paper based systems.

Employee Self Service: Many automated systems allow employees to manage their own PTO requests and balances, reducing the workload on HR and improving overall employee satisfaction.

FAQ

Why is manual PTO tracking risky for businesses?

Manual PTO tracking is risky because it is prone to human error, such as miscalculations, missed records, and incorrect data entry. Additionally, manual systems are difficult to update with changing labor laws, and they lack the transparency and efficiency of automated systems. This can lead to compliance issues, audit challenges, and financial liabilities for businesses.

What are the compliance risks associated with manual PTO tracking?

Manual PTO tracking increases the risk of non compliance with labor laws, especially as regulations change across regions. For instance, manual systems may fail to track regional or national differences in PTO entitlements, accruals, carryovers, or payouts, leading to legal penalties and lawsuits if employees are not granted the time off or pay they are entitled to under local regulations.

How can manual PTO tracking impact audits?

Manual PTO systems make audits challenging because they lack a centralized, transparent record of PTO requests, approvals, and usage. During an audit, businesses may struggle to provide accurate records or resolve discrepancies quickly. Additionally, human errors or missing documentation could lead to audit findings that indicate non compliance, resulting in fines or legal consequences.

How do manual PTO systems affect a company’s liability?

PTO is considered a liability for businesses, as it represents time that employees are entitled to but have not yet taken. If PTO is not tracked correctly, businesses may misreport their liabilities, leading to significant financial misstatements. This can result in unexpected costs, such as overpaying employees upon termination or failing to pay the correct amount for unused PTO. Improper handling of unpaid leave could also lead to financial discrepancies.

What are the potential consequences of incorrect PTO payouts upon employee termination?

Incorrect PTO payouts can have serious consequences. If an employee is underpaid, they may file a complaint or take legal action against the company. On the other hand, overpaying an employee for unused PTO can strain the company’s finances and lead to unnecessary costs. These errors are more likely to occur with manual PTO systems due to the complexities involved in calculating accrued and unused PTO.

How can automating PTO tracking reduce compliance risks?

Automating PTO tracking ensures that policies are applied consistently and accurately. Automated systems are programmed to comply with local, state, and national regulations, meaning businesses can easily stay up to date with changes in labor laws. This reduces the risk of non compliance and ensures that PTO balances, accruals, and payouts are handled correctly in accordance with the law.

What benefits does an automated PTO tracking system offer compared to manual methods?

An automated PTO tracking system offers several key benefits:

Real time updates: PTO balances are updated instantly, ensuring accuracy and transparency.

Compliance: Automation ensures that the system is always in line with the latest labor laws and regulations.

Reduced human error: Automated calculations eliminate the risk of mistakes caused by manual entry.

Efficiency: Automated systems streamline the PTO request and approval process, saving time and reducing administrative workload.

Audit trails: Automated systems maintain a clear, transparent audit trail, making it easier to provide accurate records during audits.

Can automated PTO tracking systems accommodate different PTO policies in different regions?

Yes, automated PTO tracking systems are highly customizable. They can be configured to accommodate various PTO policies based on location, department, or even individual employees. This feature is especially useful for companies with employees across multiple states or countries, as it ensures that local labor laws and regulations are applied correctly.

How do automated systems handle PTO requests and approvals?

Automated PTO tracking systems typically include built in workflows that allow employees to submit PTO requests electronically. Managers can then approve or reject the requests within the system, ensuring that all steps are documented and compliant with company policies. These systems can also include features like automated notifications for approval and real time updates of PTO balances, reducing the chances of errors or missed requests.

Is it expensive to implement an automated PTO tracking system?

While the initial investment in an automated PTO system may seem costly, the long term benefits outweigh the expense. By reducing administrative time, improving accuracy, and avoiding legal risks, companies often find that the system pays for itself over time. Additionally, automated systems help prevent costly mistakes related to compliance and liabilities, providing significant cost savings in the long run.

Can employees access their PTO balances in an automated system?

Yes, most automated PTO tracking systems allow employees to view their PTO balances in real time. This transparency helps employees plan their time off better and reduces confusion or disputes regarding leave entitlements. Some systems also allow employees to track the status of their requests and see how much PTO they have left at any given time.

How do automated systems ensure the accuracy of PTO calculations?

Automated systems are programmed to follow specific rules and formulas for PTO accruals, carryovers, and payouts. These systems calculate PTO based on the company’s policies and local laws, reducing the risk of human error. Additionally, they can factor in variables such as different accrual rates, carryover limits, and special leave entitlements, ensuring that the calculations are accurate and consistent.

Can automated systems integrate with other HR software or payroll systems?

Yes, many automated PTO tracking systems can integrate with other HR and payroll systems. This integration allows businesses to streamline their leave management process by synchronizing PTO data with payroll systems. For example, PTO accruals and usage can be automatically reflected in an employee’s paycheck, eliminating the need for manual data entry and reducing the likelihood of errors.

How can I transition from a manual PTO system to an automated one?

Transitioning from a manual PTO system to an automated one typically involves:

Choosing the right system: Select a PTO tracking solution that meets your company’s needs and complies with all relevant regulations.

Data migration: Transfer existing PTO data, such as accruals and balances, from your manual system to the new automated system.

Training: Train HR personnel and managers to use the new system effectively and ensure they understand the workflow.

Employee Communication: Inform employees about the new system, how to use it, and the benefits it offers.

The transition can be done smoothly with the right planning and support, and many automated PTO systems offer customer service to assist with the migration process.

Conclusion

Manual PTO tracking is a risky and inefficient method of managing paid time off. The complexities of changing labor laws, cross jurisdictional issues, human errors, and potential liabilities make it an unsustainable solution for businesses of all sizes. Automated PTO tracking offers a comprehensive solution to these challenges by streamlining the process, ensuring compliance, reducing errors, and providing clear and reliable records.

Investing in an automated PTO system not only protects a business from legal and financial risks but also improves overall efficiency and transparency, helping both employees and employers manage PTO more effectively. By making the switch to automation, companies can ensure that their PTO tracking is accurate, compliant, and ready for audit at any time, safeguarding both their workforce and their bottom line.