Table of Contents

ToggleUnderstanding how to calculate salary and the detail of your paycheck is crucial not only for HR professionals but also for employees across all levels. Whether you’re evaluating a job offer, planning your budget, or simply curious about the deductions on your paycheck, having a solid grasp of salary calculations can empower you to make informed financial decisions. This comprehensive guide will walk you through the process, helping you understand the components that make up your salary and how to decipher your paycheck.

Understanding Gross Salary

Understanding salary calculations is crucial for both employers and employees to ensure transparency and fairness in compensation practices. A fundamental concept in this process is the gross salary, which represents the total earnings of an employee before any deductions are applied. Here’s a more detailed breakdown of the components that typically make up gross salary:

1. Basic Salary

The basic salary is the foundational component of an employee’s earnings, constituting a significant portion of the gross salary. It is a fixed amount paid before any extras are added or deductions made. The basic salary is determined by the employee’s role, industry standards, experience, and negotiation at the time of hiring. It’s important because it influences other salary components such as bonuses, overtime rates, and entitlements to various allowances.

2. Allowances

Allowances are additional financial benefits provided over and above the basic salary to cover specific expenses incurred by the employee as part of their job role or employment conditions. These allowances are usually tailored to the individual’s needs or job requirements and can significantly increase the gross salary. Common types of allowances include:

- Housing Allowance: A sum of money to help cover an employee’s housing expenses.

- Transportation Allowance: Compensation to cover travel expenses between home and the workplace or for work-related travel.

- Medical Insurance: While sometimes provided as a benefit in kind, this can also be an allowance contributing towards health insurance costs.

- Education Allowance: Assistance with the cost of education for employees or their children.

- Utility Allowance: A payment designed to help with the costs of utilities such as electricity and water.

3. Bonuses and Commissions

Bonuses and commissions are performance-related payments that can significantly enhance an employee’s gross salary. They are typically based on achieving specific targets or milestones:

- Bonuses: Often awarded annually, bonuses reward employees for their contributions to the company’s performance, profitability, or other predefined success criteria.

- Commissions: More common in sales roles, commissions are usually a percentage of the sales amount generated by the employee, incentivizing higher performance.

4. Overtime Pay

Overtime pay is compensation for hours worked beyond the standard working hours as defined by the employer’s policies or labor laws. The overtime pay rate is often higher than the normal hourly rate, recognizing the additional effort put in by the employee, including times when employees work on their scheduled days off. Regulations regarding overtime pay can vary significantly depending on the jurisdiction, including how many hours constitute a normal working week and the minimum overtime rates.

Additional Considerations

While these components form the bulk of gross salary, other elements can also contribute, such as:

- Profit Sharing: Some companies have profit-sharing plans where employees receive a share of the company’s profits, adding to their gross salary.

- Stock Options: In some employment packages, especially in startups and tech companies, stock options can be a part of the gross salary, allowing employees to purchase company stock at a lower price.

Understanding the various elements that make up the gross salary is crucial for both negotiating compensation and for financial planning. For employers, a transparent breakdown of gross salary components helps in attracting and retaining talent by clearly communicating the value of the total compensation package.

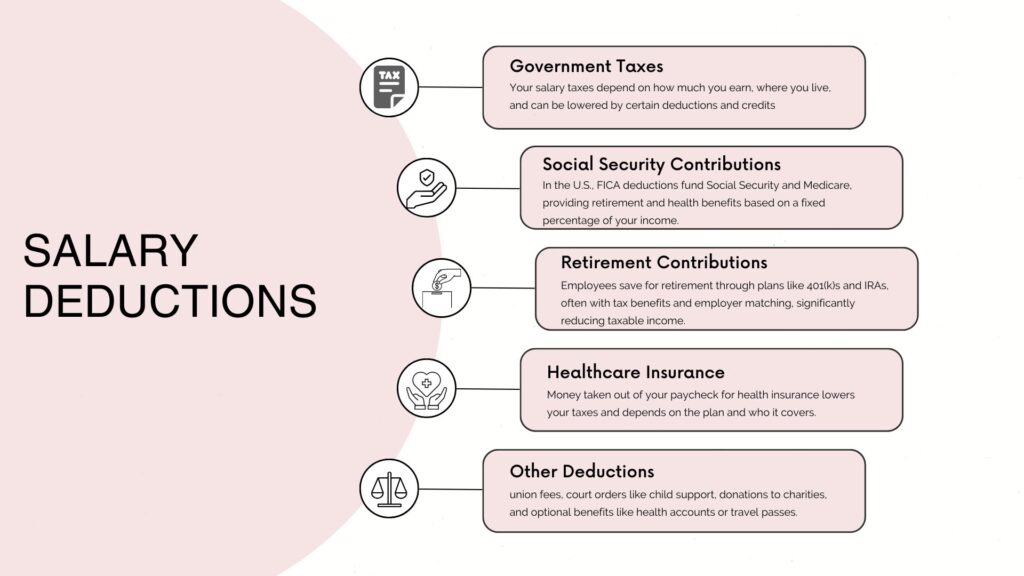

Deductions: From Gross to Net Salary

The journey from your gross to net salary encompasses a series of deductions that can significantly affect your take-home pay. Understanding these deductions in detail is crucial for both employers and employees to ensure transparency and accuracy in payroll processing. Let’s delve into each category to provide a more comprehensive understanding.

1. Taxes

Taxes represent one of the largest categories of deductions from your gross salary. The amount of tax you owe depends on your income level and your tax filing status, and it can include federal, state, and sometimes local taxes. Here’s how they work:

- Federal Income Tax: In countries like the United States, the federal tax system is progressive, meaning the rate increases as your income increases. These rates are determined by tax brackets, which segment income levels and assign a tax rate to each segment.

- State and Local Taxes: State income tax rates vary widely by state, with some states having high rates and others having no income tax at all. Local taxes, where they apply, can include city or county taxes, adding another layer to the complexity of payroll deductions.

- Tax Credits and Deductions: Various tax credits and deductions can reduce the amount of taxable income, such as education expenses, charitable donations, and specific tax credits for families and individuals. These can significantly impact the final calculation of your taxes.

2. Social Security Contributions

In many countries, social security contributions are mandatory, funding programs that provide benefits for retirees, disabled people, and children of deceased workers. In the U.S., this is known as FICA (Federal Insurance Contributions Act) and is divided into two parts:

- Social Security: A fixed percentage of your income (up to a certain limit) is deducted for Social Security, which provides benefits for retirees and disabled workers.

- Medicare: Another fixed percentage goes towards Medicare, providing health insurance for people over the age of 65 and for some younger individuals with disabilities.

3. Retirement Contributions

Many employees contribute to retirement savings plans, which can be a significant deduction from their gross salary. These contributions are often encouraged through tax advantages and employer match programs.

- 401(k), 403(b), IRAs, and Other Retirement Plans: Contributions to these plans can be made pre-tax, reducing taxable income. Employers may match a portion of these contributions, further incentivizing employees to participate in these savings opportunities.

4. Healthcare Insurance

Healthcare insurance premiums paid through your employer can also be deducted from your gross salary. These premiums can vary greatly depending on the type of plan, the coverage level, and whether family members are included.

Employer-Sponsored Health Insurance: Contributions towards health insurance are typically made pre-tax, reducing your taxable income. These plans can include a variety of health services and benefits, affecting the overall cost and coverage

5. Other Deductions

There are various other deductions that might appear on your paycheck, including but not limited to:

- Union Dues: For employees who are members of a labor union, dues are often deducted directly from their paychecks.

- Garnishments: Legal judgments such as child support, alimony, or debt collection can result in garnishments being taken directly from your earnings.

- Charitable Contributions: Some employers offer programs that allow employees to contribute directly to charitable organizations through payroll deductions.

- Voluntary Deductions: These can include contributions to flexible spending accounts (FSAs), commuter benefits, and other employee benefit programs.

Understanding these deductions in detail allows employees to better predict their take-home pay and plan their finances accordingly. It also underscores the importance of tax planning and the potential benefits of participating in employer-sponsored benefits programs. For HR professionals and business leaders, providing clear explanations and resources to help employees understand these deductions is part of creating a transparent and supportive work environment.

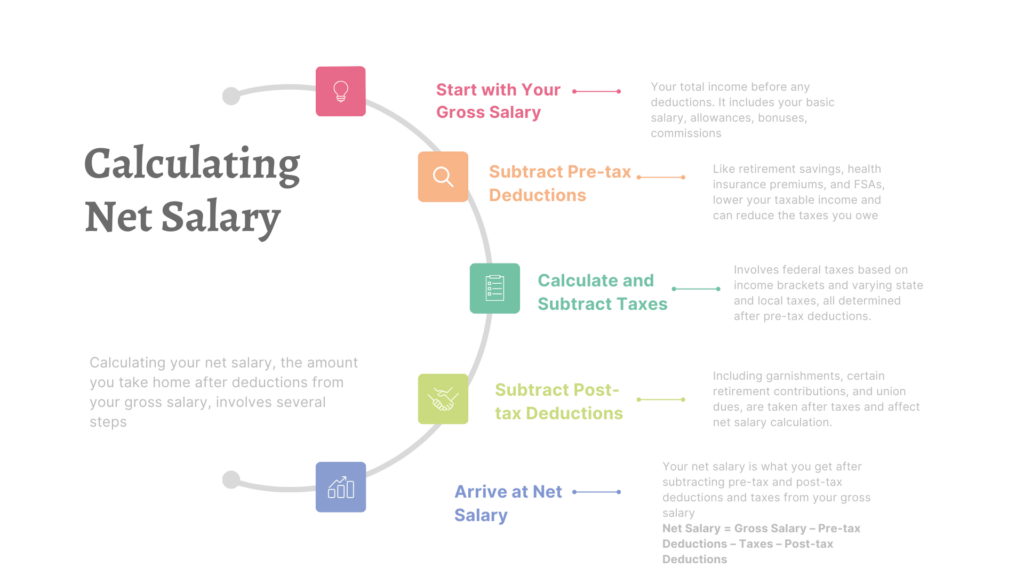

Calculating Net Salary

Calculating your net salary accurately requires a systematic approach to ensure that all components of your income and deductions are accounted for. Below is a detailed explanation of each step to guide you through determining your take-home pay.

1. Start with Your Gross Salary

Your Gross Salary is the sum of all the compensation you receive before any deductions. This includes:

- Basic Salary: The foundational part of your compensation package, often a fixed amount per pay period.

- Allowances: Additional monetary benefits over your basic salary, which can vary widely depending on your job, location, and company policy. Common allowances include housing, transportation, and meal allowances.

- Bonuses and Commissions: Extra earnings that may be based on performance, company profits, or other criteria. These can significantly increase your gross salary but may not be consistent.

- Overtime Pay: Compensation for hours worked beyond your standard contractual hours. The rate for overtime is often higher than the normal hourly rate.

Example: If your basic salary is $3,000, housing allowance is $500, transportation allowance is $300, and you received a bonus of $200, your gross salary would be $4,000.

2. Subtract Pre-tax Deductions

Pre-tax Deductions are subtracted from your gross salary before taxes are calculated. These deductions can lower your taxable income, potentially reducing the amount of tax you owe. Common pre-tax deductions include:

- Retirement Contributions: Contributions to retirement accounts like a 401(k) or 403(b), which are often encouraged by employers through matching contributions.

- Healthcare Premiums: Payments for health insurance plans provided by your employer.

- Flexible Spending Accounts (FSAs): Contributions to FSAs for medical expenses or dependent care, which are made with pre-tax dollars.

Example: If you contribute $400 to a retirement account and $200 to health insurance premiums, your total pre-tax deductions are $600.

3. Calculate and Subtract Taxes

Calculating taxes involves determining how much you owe in Federal, State, and Local Taxes based on the taxable income after pre-tax deductions.

- Federal Income Tax: Calculated on a progressive scale where higher income brackets are taxed at higher rates. You can find your tax bracket based on your taxable income and filing status.

- State and Local Taxes: These vary significantly depending on where you live. Some states have flat income tax rates, while others have progressive rates similar to federal taxes. Local taxes might include city or county taxes.

Example: After pre-tax deductions, your taxable income is $3,400. If your effective tax rate is 15% (combining federal and state taxes), your tax amount would be $510.

4. Subtract Post-tax Deductions

Post-tax Deductions are taken from your salary after taxes have been calculated. These deductions do not reduce your taxable income but are important for calculating your net salary. Common post-tax deductions include:

- Garnishments: Legal deductions like child support or debt repayments.

- Post-tax Retirement Contributions: Contributions to certain retirement accounts that are made with after-tax dollars.

- Union Dues: Fees paid to labor unions.

Example: If you have $50 in post-tax retirement contributions and $30 in union dues, your total post-tax deductions are $80.

5. Arrive at Net Salary

Your Net Salary, or take-home pay, is what remains after all deductions have been subtracted from your gross salary.

Example: With a gross salary of $4,000, pre-tax deductions of $600, taxes of $510, and post-tax deductions of $80, your net salary would be calculated as follows:

- Net Salary = Gross Salary – Pre-tax Deductions – Taxes – Post-tax Deductions

- = $4,000 – $600 – $510 – $80= $2,810

Your net salary of $2,810 is the amount you’ll actually receive in your paycheck.

By understanding each step of this process and the types of deductions that may apply to you, you can more accurately forecast your take-home pay and manage your finances effectively. Always keep abreast of changes in tax laws and deductions that may affect your calculations.

Hourly and Annually Rates

For many professionals, understanding the distinction and conversion between hourly and annual salary rates is crucial for financial planning, job negotiation, and evaluating job offers. Here’s how both rates are generally calculated and how you can convert between them:

1. Hourly Rates

An hourly rate is paid based on the number of hours worked. It’s common in part-time jobs, contract work, or professions with variable hours. For hourly employees, overtime pay (typically time-and-a-half) may apply for hours worked beyond the standard full-time hours (often considered 40 hours per week in countries like the United States).

Calculating Annual Income from Hourly Rate:

To estimate the annual income from an hourly rate, you can use the following formula, assuming a full-time schedule:

- Annual Income = Hourly Rate x Hours Worked per Week x Weeks Worked per Year

For a standard full-time job, this typically translates to:

- Annual Income = Hourly Rate x 40 hours/week x 52 weeks/year

Example: If you earn $25 per hour, working full-time: $25/hour x 40 hours/week x 52 weeks/year = $52,000/year

2. Annual Salary Rates

An annual salary is a fixed amount paid over the course of a year, divided into payments (e.g., monthly or bi-weekly). It’s common in full-time positions where employees have a set number of working hours and are sometimes expected to work additional hours without extra pay, depending on the job’s nature and level.

Calculating Hourly Rate from Annual Salary:

To calculate an hourly rate from an annual salary, you can reverse the process, using the formula:

- Hourly Rate = Annual Salary / (Hours Worked per Week x Weeks Worked per Year)

For a standard full-time job, this usually means:

- Hourly Rate = Annual Salary / (40 hours/week x 52 weeks/year)

Example: If your annual salary is $52,000: $52,000 / (40 hours/week x 52 weeks/year) = $25/hour

Considerations:

Overtime: For hourly workers, consider overtime rates if you regularly work more than the standard full-time hours. For salaried employees, overtime may not apply depending on exemption status and local laws.

- Benefits and Bonuses: Annual salaries often come with benefits (health insurance, retirement contributions) that may not be available to hourly workers. However, hourly workers may receive higher pay rates for overtime work. Bonuses and other forms of compensation should also be considered in your total compensation package but are not included in these basic calculations.

- Holidays and Vacations: The standard calculation assumes 52 weeks of work per year but does not account for vacation time, holidays, or unpaid leave, which can affect the actual number of working hours in a year.

What about Independent Contractors?

Independent contractors experience a different financial landscape when it comes to calculating take-home pay, primarily because their earnings and deductions don’t follow the traditional employee structure. As an independent contractor, you’re essentially running your own business, which means you’re responsible for managing your taxes, retirement savings, and other benefits. Here’s how the process differs:

1. Understanding Gross Income

For independent contractors, gross income is the total amount billed to clients before any expenses or taxes are deducted. Unlike traditional employees who receive a salary or wages, independent contractors earn income based on the services they provide, which can vary significantly from month to month.

2. Deducting Business Expenses

Before taxes, independent contractors can deduct business expenses from their gross income, which reduces the amount of income that is subject to taxes. Common deductible expenses include:

- Office expenses: Rent, utilities, office supplies.

- Travel expenses: Mileage, lodging, meals during business travel.

- Equipment and supplies: Computers, software, tools, and other equipment necessary for the work.

- Marketing and advertising: Costs associated with promoting your business.

- Health insurance premiums: If you’re self-employed, you can deduct premiums for medical, dental, and qualified long-term care insurance for yourself and your family.

- Retirement contributions: Contributions to SEP-IRA, SIMPLE IRA, or a solo 401(k) can be deducted.

3. Estimating and Paying Taxes

Independent contractors are responsible for estimating and paying their own taxes, including both income tax and self-employment tax, which covers Social Security and Medicare contributions. Since taxes aren’t automatically withheld from payments as they are for employees, independent contractors need to:

- Calculate estimated taxes: Determine how much you owe in federal, state, and possibly local taxes for the year. This involves estimating your annual income, deducting business expenses, and applying the relevant tax rates.

- Pay quarterly estimated taxes: The IRS and most state tax agencies require that you pay these taxes on a quarterly basis. Failure to do so can result in penalties.

4. Social Security and Medicare Contributions

Unlike employees, who share the cost of Social Security and Medicare contributions with their employers, independent contractors are responsible for the full amount. This is known as the self-employment tax, and it’s calculated on your net earnings from self-employment. The rate is 15.3%, covering both the employer and employee portions of Social Security and Medicare.

5. Retirement Contributions

Independent contractors have several options for retirement savings, such as SEP-IRA, SIMPLE IRA, and solo 401(k) plans. Contributions to these plans not only help secure your financial future but can also reduce your taxable income.

Net Income Calculation for Independent Contractors

For independent contractors, the formula to calculate net income after taxes and expenses would look something like this:

- Net Income = Gross Income – Business Expenses – Estimated Taxes – Other Deductions

Example: If an independent contractor earns $80,000 in gross income, has $20,000 in business expenses, and estimates $15,000 in taxes (including income and self-employment taxes), their net income would be:

- Net Income = $80,000 – $20,000 – $15,000 = $45,000

Being an independent contractor requires a more hands-on approach to financial management, especially regarding taxes and deductions. It’s often advisable to work with a tax professional or accountant to ensure you’re taking advantage of all available deductions and complying with tax laws.

Recommended Online Salary Calculators:

Here are several reputable online salary calculators you might link to. Each offers users the ability to estimate their net salary based on various inputs:

- ADP Salary Paycheck Calculator: Offers a comprehensive breakdown of payroll deductions and can accommodate different pay frequencies, federal filing statuses, and allowances. Visit ADP Salary Paycheck Calculator

- PaycheckCity Calculators: Provides a suite of calculators including salary, hourly, bonus, and 401(k) calculators. These tools are helpful for detailed paycheck modeling. Visit PaycheckCity

- SmartAsset Paycheck Calculator: Allows users to calculate their take-home pay after taxes and deductions in any part of the United States. It’s user-friendly and provides a good mix of simplicity and detail.

- NerdWallet Take-Home-Pay Calculator: Simplifies the calculation of net salary and provides insights into how much you’ll bring home after taxes and deductions.

FAQ Section on Salary Calculations

Q1: How do tax brackets work?

A: Tax brackets are ranges of income taxed at specific rates. If your income falls within a bracket, you only pay that rate on income within the bracket’s range. The rest is taxed according to the rates of the lower brackets. This means not all your income will be taxed at the same rate if you’re in a higher bracket.

Q2: What’s the difference between pre-tax and post-tax deductions?

A: Pre-tax deductions reduce your taxable income before taxes are calculated, potentially lowering your tax bracket and the amount of taxes owed. These include retirement plan contributions and health insurance premiums. Post-tax deductions occur after taxes have been applied to your income and do not affect your taxable income. Examples include Roth IRA contributions and some life insurance premiums.

Q3: How can I negotiate for better salary components?

A: To negotiate effectively, research industry standards for your position, including base pay, bonuses, and benefits. Present your case based on your experience, achievements, and the value you bring to the company. Consider negotiating for non-salary components if there’s little room to increase base pay, such as additional vacation time, flexible working hours, or professional development opportunities.

Q4: Why is my net salary different from my gross salary?

A: Your net salary, or take-home pay, is less than your gross salary due to deductions like federal and state taxes, Social Security and Medicare contributions, retirement savings, and health insurance premiums. Understanding these deductions can help you better plan your finances and understand where your money is going.

Q5: Are bonuses taxed differently than regular salary?

A: Yes, bonuses are considered supplemental income and may be taxed at a higher rate than your regular salary. The IRS specifies a flat rate for taxing bonuses, which might differ from your usual tax rate. However, the exact impact on your take-home pay can vary based on total income and deductions.

Q6: How can I reduce my taxable income?

A: Contributing to pre-tax retirement accounts like a 401(k) or an IRA can reduce your taxable income. Other strategies include utilizing health savings accounts (HSAs) for medical expenses, making charitable donations, and taking advantage of tax credits for education expenses or energy-efficient home improvements.

Q7: What are the benefits of understanding my paycheck?

A: Knowing the details of your paycheck helps you track where your money is going, plan your budget more effectively, and ensure you’re receiving all the benefits and compensation you’re entitled to. It also empowers you to ask informed questions and make changes if something doesn’t look right.

Q8: How can independent contractors save for retirement?

A: Independent contractors can contribute to self-employed retirement plans such as a SEP IRA, a Solo 401(k), or a SIMPLE IRA. These plans often allow for larger annual contributions than traditional or Roth IRAs, providing both a tax advantage and a means to secure financial stability in retirement.

Conclusion

Understanding the breakdown of your salary, from gross to net, is crucial for making informed financial decisions. This guide has explored the components of salaries, taxes, and deductions, equipping employees with the knowledge to navigate their paychecks, negotiate better, and optimize tax benefits. Employers and HR professionals gain insights for creating transparent compensation systems that attract and retain talent. Staying updated on tax laws and compensation strategies is key for everyone in the workforce to maximize earnings and plan for a secure financial future. In essence, a clear grasp of your salary details empowers you to manage your finances more effectively and ensures you’re making the most of your hard-earned money.