Teamwork lies at the heart of every successful organization. It fuels innovation, drives performance, and creates a sense of shared purpose that transforms ordinary groups into extraordinary teams. Yet, despite its importance, effective teamwork remains one of the most difficult goals to achieve.

In today’s rapidly evolving workplace, where remote collaboration, cross-functional projects, and diverse teams are the norm, the art of working together has become more complex than ever. Miscommunication, unclear expectations, cultural differences, and inconsistent leadership can all derail even the most talented groups.

Paid time off (PTO) isn’t just a benefits line item, it’s a teamwork enabler. Clear, fair PTO policies and transparent leave tracking protect teams from burnout, improve planning, and keep projects moving when people step away. When availability is visible and coverage is planned in advance, handoffs become smoother, knowledge is documented, and deadlines stay realistic.

Mature teams treat PTO as part of the workflow: they rotate ownership, maintain up-to-date runbooks, and sync calendars so time off doesn’t become a surprise firefight. Tools that centralize leave requests and integrate with Slack, Outlook, Google Calendar, or Teams (e.g., Day Off) help leaders balance workloads, respect regional holidays, and manage accruals and carryovers, creating a healthier cadence where people can recharge and return with higher creativity and focus.

The Power and Purpose of Teamwork

Behind every great achievement, whether it’s building a business, launching a product, or solving a global problem, stands a dedicated team. Effective teamwork is more than coordination; it’s about connection, trust, and a shared vision.

When teams function well:

They generate better ideas, blending diverse perspectives into innovative solutions.

They achieve goals faster, using complementary strengths to enhance efficiency.

They build resilience, supporting one another through uncertainty and change.

They increase engagement, because belonging to a high-performing team makes work more meaningful.

However, great teamwork doesn’t happen automatically. It must be nurtured through strong leadership, emotional intelligence, and systems that promote communication and accountability. Below are the most common barriers to effective teamwork and how to overcome them.

Diverse Work Styles and Personalities

Diversity in a team is both a strength and a challenge. Every individual brings unique experiences, communication habits, and ways of thinking. While this variety can spark creativity, it can also lead to misunderstandings and tension if differences aren’t acknowledged or appreciated.

Imagine a team composed of detail-oriented planners, visionary thinkers, and spontaneous doers. The planner might see the visionary as unrealistic, while the visionary might view the planner as rigid. These differences can cause frustration, but when managed effectively, they become complementary forces that balance innovation with practicality.

To turn diversity into an advantage, start by helping team members understand themselves and each other. Use tools like the Myers-Briggs Type Indicator (MBTI), DISC, or StrengthsFinder to explore personality traits and preferences. Encourage conversations about communication styles, feedback methods, and work rhythms.

When people feel seen, heard, and respected, they adapt more easily and learn to leverage each other’s strengths rather than clash over differences.

Communication Breakdowns

Few factors damage teamwork more than poor communication. Misunderstandings, fragmented updates, and unclear messaging lead to missed deadlines, duplicated work, and unnecessary frustration. In remote and hybrid settings, these problems are amplified because digital channels strip away many of the nonverbal cues we rely on to build understanding.

Communication is not simply the exchange of information, it’s the creation of shared meaning. Teams that communicate well know not only what’s happening, but why it matters.

Building that clarity requires a structured approach. Establish consistent communication channels and define their purposes:

Slack or Teams for quick updates and informal collaboration.

Zoom or Google Meet for team meetings and discussions.

Email or shared drives for documentation and long-term records.

Regular check-ins, transparent updates, and active listening keep teams aligned.

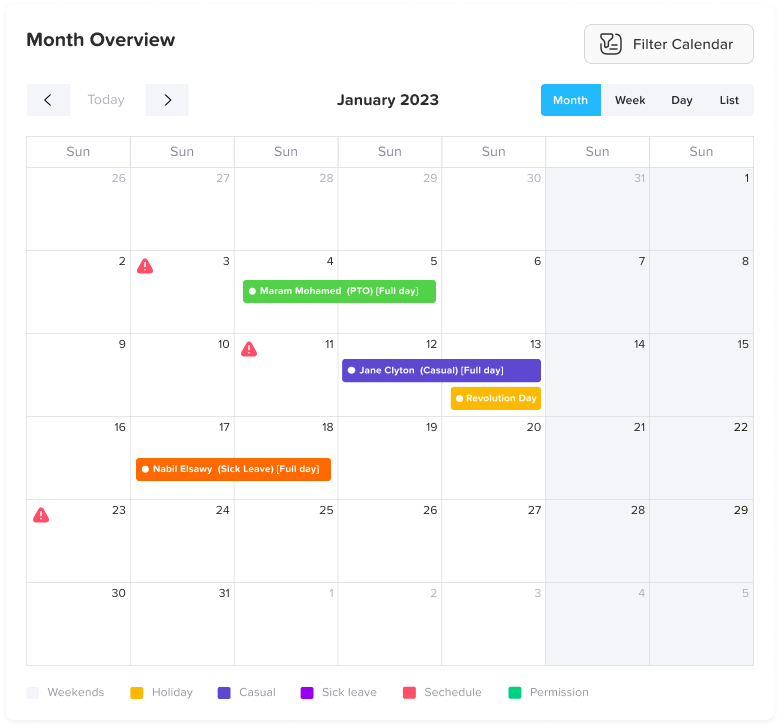

Visibility is also key. Tools like Day Off, a leave and absence management app, help teams stay informed about who’s working, who’s away, and how workloads are distributed. This transparency improves planning and prevents confusion.

About Day Off:

The Day Off platform enables teams to manage vacations, sick days, and absences effortlessly. It supports multiple leave types, integrates with Slack, Google Calendar, Outlook, and Teams, and allows managers to import public holidays and customize policies. By streamlining availability tracking, it helps teams maintain productivity even when members are out.

The rule of thumb: communicate clearly, frequently, and intentionally. A team that communicates well works well.

Unclear Roles and Responsibilities

Teams thrive when everyone knows their purpose and contribution. When responsibilities are vague or overlapping, confusion sets in. Tasks may be forgotten, duplicated, or delayed, and motivation often declines.

Many teams fall into this trap because leaders assume everyone understands their role. But in fast-paced environments, assumptions can quickly lead to misalignment.

To prevent this, clearly define roles and responsibilities at the outset of every project. Specify who owns which tasks, who makes final decisions, and who provides input. Use a RACI chart (Responsible, Accountable, Consulted, Informed) or project management tools like Asana, Monday.com, or Trello to keep accountability visible and transparent.

When expectations are explicit, people perform confidently, knowing exactly where they add value, and how their work supports the team’s larger objectives.

Ineffective Leadership

Leadership defines a team’s culture, pace, and performance. When leaders fail to provide direction, communicate clearly, or inspire trust, teams lose focus and motivation.

A strong leader doesn’t control every detail, they create an environment where people can succeed. Leadership is about clarity, empathy, and empowerment.

Effective leaders articulate a shared vision, set achievable goals, and trust their teams to execute. They communicate openly, listen actively, and give feedback constructively. They also know when to step back, allowing others to lead within their areas of expertise.

Organizations can strengthen leadership by investing in coaching, training, and mentoring programs. Encourage leaders to practice servant leadership, where their role is to support, not dominate. When leaders demonstrate respect, humility, and consistency, teams naturally respond with loyalty and high performance.

Conflict Among Team Members

Disagreements are inevitable when people with strong ideas collaborate. The issue isn’t whether conflict arises; it’s how teams handle it. Avoiding conflict may seem easier in the short term, but unresolved tensions often grow into bigger problems that erode trust.

Conflict can be constructive if managed respectfully. It can lead to better ideas, stronger relationships, and improved decision-making. The goal is not to suppress differences but to channel them productively.

Encourage open dialogue where team members can voice opinions without fear of backlash. Establish clear processes for addressing disputes—such as mediated discussions or feedback sessions, and ensure that disagreements focus on ideas, not individuals.

Train leaders and employees in communication and emotional intelligence so they can navigate tough conversations calmly. When handled thoughtfully, conflict becomes a sign of engagement, not dysfunction.

Resistance to Change

Change is constant in modern organizations, yet people often struggle to embrace it. New technologies, structures, or processes can spark anxiety about competence, job security, or identity. Without clear communication, resistance can quietly stall progress.

People resist change not because they dislike innovation, but because they fear the unknown. The solution lies in transparency and inclusion.

Communicate the purpose and benefits of the change early and clearly. Explain how it aligns with the team’s goals and what support will be provided during the transition. Offer training, encourage questions, and invite feedback.

Recognize that adaptation takes time. Celebrate small wins and highlight early successes to build momentum. When employees feel informed and supported, they move from resistance to ownership.

Lack of Accountability

Accountability is the backbone of high-performing teams. Without it, standards slip, deadlines are missed, and trust deteriorates. Teams without clear accountability often fall into a pattern of finger-pointing and disengagement.

True accountability isn’t about punishment; it’s about commitment and ownership. Each person understands what they’re responsible for and takes pride in delivering results.

To foster accountability, set measurable goals and regularly track progress using systems like OKRs (Objectives and Key Results) or performance dashboards. Encourage team members to celebrate their achievements and reflect on lessons learned when goals aren’t met.

Leaders play a key role by modeling accountability themselves. When leaders admit mistakes, take responsibility, and show integrity, their teams follow suit.

Misaligned Goals and Priorities

Even hardworking teams can underperform if their efforts aren’t aligned with organizational priorities. When objectives are unclear or inconsistent, teams expend energy on tasks that don’t contribute to the bigger picture.

Alignment begins with purpose. Every project and task should connect back to the company’s mission and long-term vision. Use SMART goals, Specific, Measurable, Achievable, Relevant, and Time-bound, to clarify direction and outcomes.

Regularly revisit these goals to ensure they remain relevant as circumstances evolve. When everyone understands how their work supports broader objectives, motivation rises, and collaboration becomes more meaningful.

Burnout and Overwork

In a world that prizes productivity, many teams push themselves relentlessly. While dedication is admirable, constant pressure without rest leads to burnout,diminishing creativity, engagement, and morale.

Burnout affects not just individuals but entire teams. It causes absenteeism, poor communication, and reduced collaboration.

To prevent it, promote work-life balance as a non-negotiable priority. Set realistic expectations, allow flexible schedules when possible, and ensure everyone takes time off. Tools like Day Off simplify this by making vacation planning transparent and easy to manage.

Encourage open discussions about mental health and well-being. When people feel cared for and supported, they return to work energized and more capable of contributing their best.