Managing employee vacations and leaves is a crucial component of any business’s operations. With a growing workforce and diverse leave types, ensuring that leave is tracked efficiently can be a complex task. Traditional methods of manually tracking leaves can lead to inefficiencies, human errors, and administrative headaches. This is where Employee Vacation and Leave Tracking Systems come into play.

In this article, we’ll delve into the importance of vacation and leave tracking systems, how they work, their key features, best practices, and how they can benefit your organization. Additionally, we’ll explore how Day Off Leave Tracker, a modern leave management tool, is transforming the way businesses handle time off.

What is an Employee Vacation and Leave Tracker?

An Employee Vacation and Leave Tracker is a software tool that helps organizations manage and monitor the various types of leave that employees are entitled to, such as vacation days, sick leave, personal days, public holidays, and other types of leave (maternity, paternity, jury duty, etc.). These systems automate the process of requesting, approving, and tracking leave, allowing for better organization and minimizing the errors inherent in manual tracking.

While HR departments can use these systems to manage leave records and enforce company policies, they also offer self-service capabilities for employees, enabling them to check their leave balances, submit requests, and track approval status. Essentially, a leave tracker centralizes all leave-related activities in one platform, enhancing transparency and reducing workload for HR teams.

Why is an Employee Vacation and Leave Tracker Important?

Effective leave management is crucial for both organizational efficiency and employee satisfaction. Here’s why using a vacation and leave tracker can benefit your organization:

Improved Efficiency and Accuracy

Manually tracking employee time off through spreadsheets or paper forms is time-consuming, error-prone, and highly inefficient. These methods often lead to inconsistencies, mistakes, and confusion about leave balances. By using a leave tracker, the process becomes automated and streamlined. Employees and managers can quickly see leave balances, approve or deny requests, and track all absences in one centralized system. Automated calculations eliminate human error and ensure accuracy, providing both employees and HR teams with up-to-date information.

Furthermore, an automated system reduces the chances of approving more leave than an employee is entitled to or overlooking requests that should have been addressed.

Reduced Administrative Burden

Without an efficient leave management system, HR personnel are often responsible for manually updating leave balances, managing leave requests, and keeping track of approvals. This can quickly become overwhelming, especially in larger organizations where employees may submit numerous requests each day.

Leave tracking systems provide a self-service portal where employees can submit leave requests and check their leave balances without involving HR personnel for every minor query. Managers can also approve or reject requests at the touch of a button. This drastically reduces the time spent on administrative tasks, freeing HR staff to focus on more strategic functions like recruitment, training, and employee development.

Clear Leave Policies and Legal Compliance

Each organization has unique leave policies, which may include different entitlements for vacation days, sick leave, paid time off (PTO), maternity/paternity leave, and more. These policies must be well-defined and consistently enforced to avoid confusion and potential conflicts.

A leave tracker ensures that employees receive the correct amount of time off based on their contract, seniority, and applicable labor laws. By automating leave accruals (e.g., PTO accrued monthly), carryover policies, and tracking different leave types, the system ensures compliance with legal requirements. For example, in some countries, businesses must provide employees with a specific number of paid sick days or parental leave. A leave tracker makes sure that these rules are followed without the need for HR teams to manually monitor every individual employee’s leave status.

Increased Employee Satisfaction

Employees value transparency and the ability to easily manage their time off. A leave tracking system provides employees with immediate access to their leave balances, allowing them to make informed decisions about when to request time off. Employees no longer need to wait for HR to confirm leave balances or approval.

When employees can easily submit requests, track their leave status, and get quick approvals, it fosters a sense of trust between employees and the organization. Employees are more likely to be satisfied with their job when they know that their time off is being tracked efficiently and fairly.

Better Resource Management and Planning

For managers, anticipating and planning for employee time off is essential for maintaining productivity. If a team member is absent for an extended period, it can disrupt workflows, lead to project delays, and cause additional strain on other team members.

A vacation and leave tracker provides managers with visibility into upcoming employee absences. By having a real-time view of who is off and when, managers can make adjustments to staffing levels or redistribute workloads to ensure that critical tasks are not delayed. Additionally, when employees plan time off in advance, it allows management to organize work schedules accordingly.

Key Features of an Employee Vacation and Leave Tracker

The best vacation and leave management systems come with a wide range of features designed to improve the process of leave request management. Here are some of the key features to look for:

Leave Request and Approval Workflow

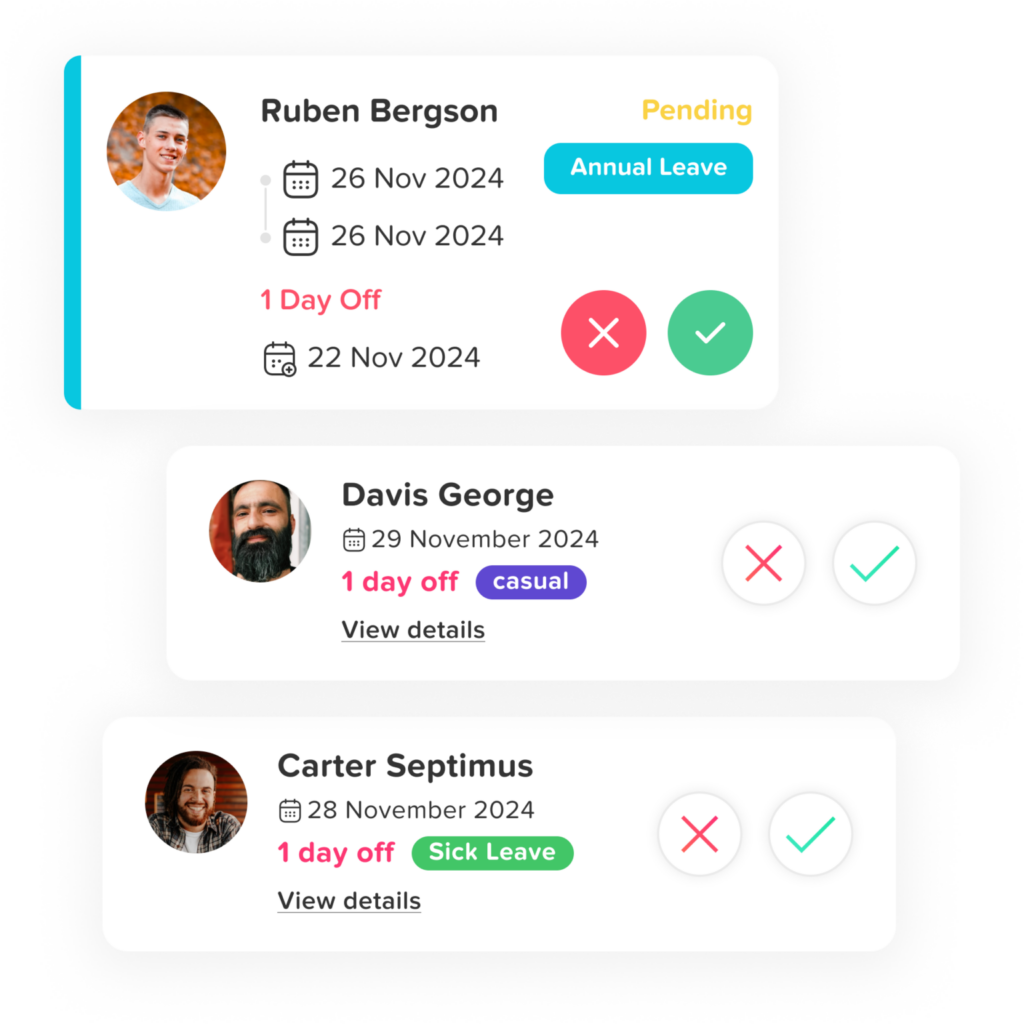

A robust leave tracker allows employees to request time off electronically and enables managers to approve or reject these requests quickly. The process should be intuitive, with employees able to view their leave balances and submit requests with minimal steps. Managers should be able to easily review pending requests, ensure there are no scheduling conflicts, and make approvals or denials in one seamless workflow.

Having a clear request-and-approval workflow ensures that leave is handled efficiently, reduces misunderstandings, and helps organizations avoid conflicts due to overlapping absences.

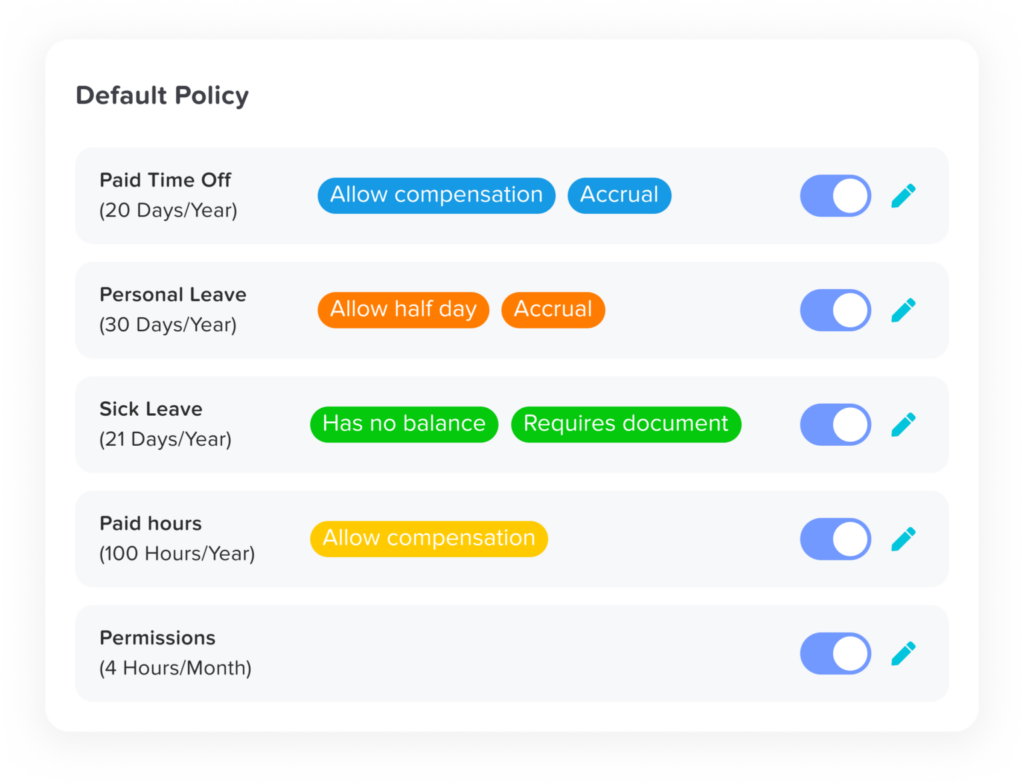

Customizable Leave Policies

Every business has different policies regarding leave entitlements. Whether it’s the number of vacation days, sick leave, personal days, or other types of leave, these policies should be customizable to suit your organization’s needs. A leave tracker should allow HR administrators to define and update various leave policies based on factors such as seniority, contract type, or employee classification.

For instance, some companies offer more leave days to long-term employees, while others may have specific rules for carryover days (e.g., employees can carry over a maximum of five unused leave days per year). A flexible system can accommodate these varying policies and ensure accurate leave calculations.

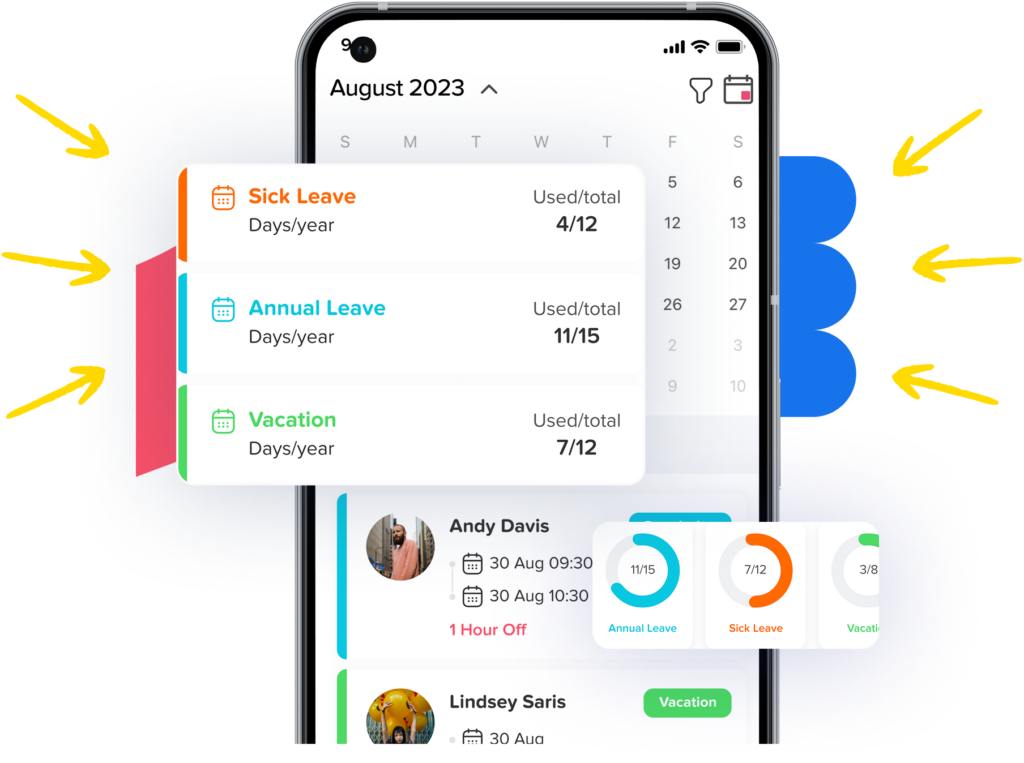

Real-Time Leave Balance Tracking

One of the most valuable features for employees is the ability to track their leave balances in real-time. A well-designed leave management system automatically updates an employee’s leave balance as time off is used. Employees can view how many vacation days, sick leave days, and other types of leave they have remaining, which helps them plan for future time off.

With real-time tracking, there’s less need for employees to contact HR for leave balance inquiries, which reduces unnecessary communication and improves overall efficiency.

Integration with Payroll Systems

Integrating the leave management system with your payroll software ensures that an employee’s leave affects their pay accurately. If an employee takes paid leave (e.g., vacation or PTO), the system should automatically adjust the payroll calculations to reflect the leave taken. In cases of unpaid leave, the tracker can flag the absence to prevent errors in salary payments.

By synchronizing the leave tracker with payroll, you minimize the risk of overpayments or underpayments and streamline payroll processing.

Reporting and Analytics

A leave tracking system should provide HR and management teams with easy-to-access reports on leave usage, trends, and employee attendance. For example, you may want to monitor the number of days employees take off for sick leave to identify patterns of absenteeism or excessive time off.

Customizable reports and analytics help organizations identify potential issues, optimize scheduling, and analyze overall employee engagement. These insights help improve decision-making and inform HR strategies, such as wellness programs or adjustments to leave policies.

Mobile Access

In an increasingly mobile world, employees expect to be able to access leave information on the go. A mobile-friendly leave tracker or dedicated mobile app allows employees to request time off, view leave balances, and check the status of their leave requests from their smartphones. This convenience not only saves time for employees but also helps keep the leave tracking process accessible and flexible.

Notifications and Reminders

Automated notifications ensure that both employees and managers stay informed about upcoming leave requests and approval statuses. For instance, employees might receive reminders when their leave request is approved or when their leave balance is low. Managers are also notified when a request is pending or when a certain number of employees are taking time off during a busy period.

These reminders ensure that no leave request slips through the cracks and that both employees and managers are aware of upcoming time off.

Types of Employee Leave

An employee vacation and leave tracker should be equipped to handle different types of leave. Here are some of the most common categories of employee leave:

Vacation Leave (Paid Time Off – PTO)

This is the most common type of leave, and it provides employees with paid time off for rest and relaxation. Vacation leave is usually accrued over time, typically on a monthly or annual basis. The amount of vacation leave employees are entitled to depends on company policy, contract terms, and sometimes seniority.

Sick Leave

Sick leave allows employees to take time off when they are ill or injured. Some businesses offer a separate sick leave policy, while others include sick days as part of PTO. A leave tracker should allow employees to report sick leave without the need for additional paperwork, making the process seamless.

Maternity/Paternity Leave

Maternity and paternity leave allow new parents to take time off after the birth or adoption of a child. The duration of this leave and whether it’s paid or unpaid depends on the organization and country regulations.

Personal Leave

Personal leave provides employees with time off for personal reasons, such as attending to family matters, personal health issues, or life events that do not qualify as sick leave or vacation.

Bereavement Leave

This leave is offered when an employee loses a loved one. It allows employees time to grieve and make funeral arrangements. Bereavement leave typically lasts from a few days to a week, depending on company policies.

Unpaid Leave

Unpaid leave occurs when employees take time off without pay. Employees may request this type of leave if they have exhausted their paid leave days or need time off for personal reasons not covered by paid leave policies.

Day Off Leave Tracker: A Modern Leave Management Solution

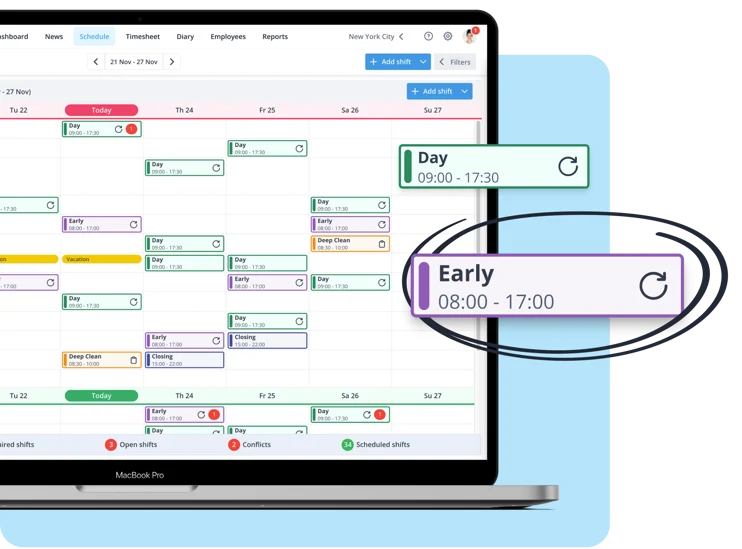

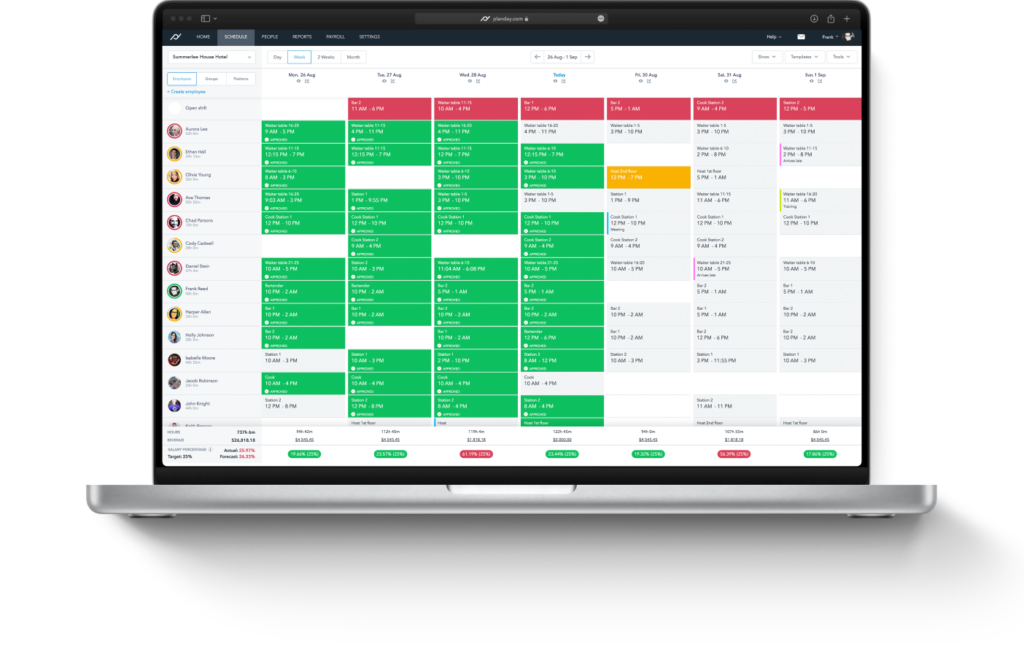

Day Off Leave Tracker is a modern employee vacation and leave tracking solution that simplifies the entire leave management process. With a user-friendly interface, real-time leave tracking, and advanced features, Day Off Leave Tracker is transforming the way organizations handle employee time off.

Key Features of Day Off Leave Tracker:

Simple Leave Requests: Employees can request leave with a few clicks, while managers can quickly approve or reject requests through an intuitive interface.

Real-Time Tracking: Both employees and managers can view current leave balances and upcoming time-off requests in real time, making it easier to plan.

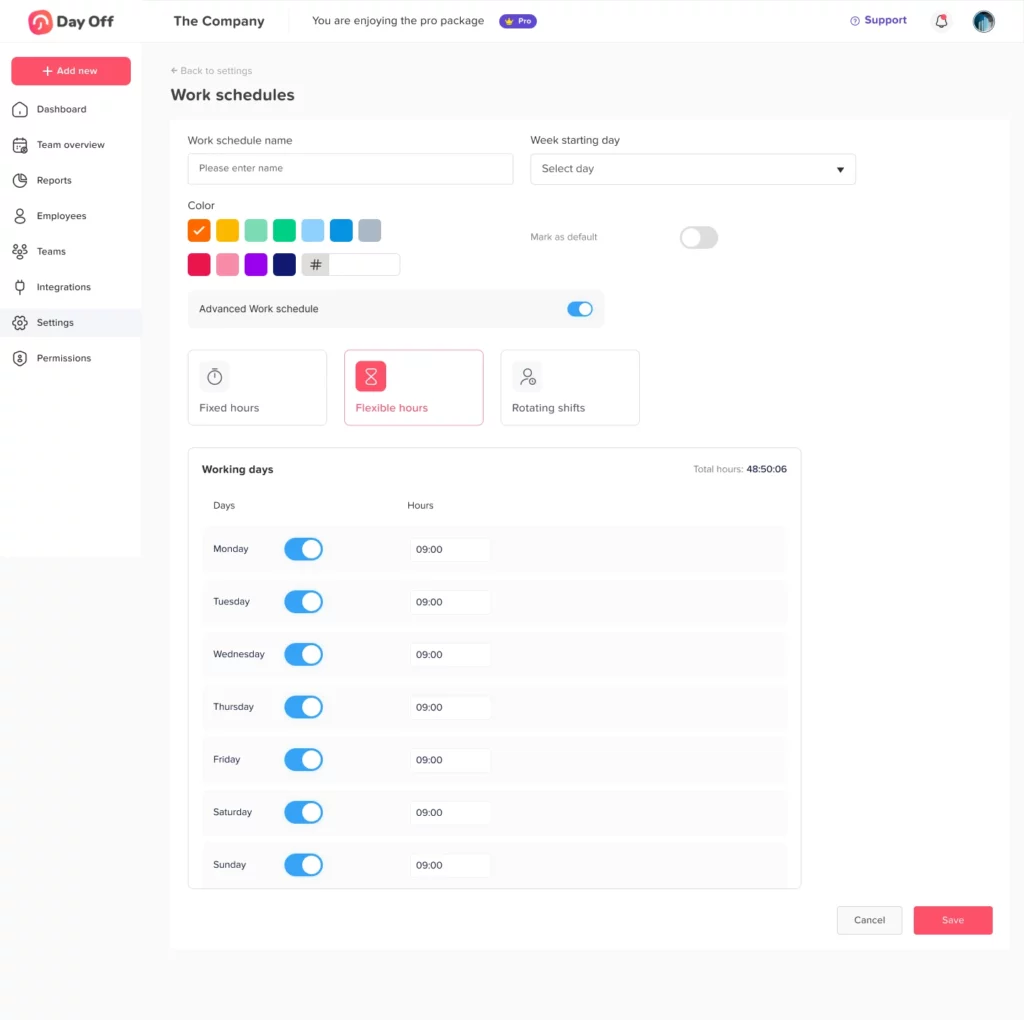

Customizable Policies: Organizations can set up flexible leave policies that fit their unique requirements, including vacation accrual rates, carryovers, and more.

Integrated Calendar: Day Off features an integrated calendar that syncs with team schedules, making it easier to coordinate and avoid overlap.

Mobile Access: Employees can submit leave requests and track their leave balances from anywhere using the Day Off mobile app.

Day Off Leave Tracker simplifies leave management for both employees and HR departments, improving workflow efficiency and employee satisfaction. By offering automation, transparency, and integration with other systems, Day Off Leave Tracker makes managing employee leave seamless and hassle-free.

FAQs

What is an employee vacation and leave tracker?

An employee vacation and leave tracker is a software tool that helps businesses manage all types of employee leave, including vacation, sick days, personal time, maternity or paternity leave, and public holidays. It automates the process of requesting, approving, and tracking leave, reducing errors and making it easier for HR teams to keep accurate records.

Why should my organization use a leave tracking system?

A leave tracking system improves efficiency, accuracy, and compliance with company policies and labor laws. Employees can quickly check their leave balances, submit requests, and track approval status, while managers gain visibility into team availability to plan projects and workloads effectively.

What are the key benefits of an automated leave tracker?

Automated leave trackers provide numerous advantages. They reduce human error, save HR time, enforce clear and consistent leave policies, and help managers plan resources better. They also increase employee satisfaction by making leave management transparent and simple to use.

What features should I look for in a leave management system?

Important features include easy leave request and approval workflows, customizable leave policies, real-time leave balance tracking, integration with payroll and calendars, reporting and analytics, mobile access, and automated notifications to keep both employees and managers informed.

Can leave trackers handle different types of employee leave?

Yes. Modern leave trackers can handle vacation or paid time off (PTO), sick leave, maternity and paternity leave, personal leave, bereavement leave, and unpaid leave, allowing organizations to manage all leave types in one centralized system.

How does a leave tracker improve HR efficiency?

Leave trackers reduce administrative workload by automating leave approvals and updates. HR teams spend less time manually managing requests, updating spreadsheets, and calculating leave balances, allowing them to focus on strategic initiatives like employee engagement and development.

How does a leave tracker benefit employees?

Employees gain transparency and control over their time off. They can quickly see how much leave they have, submit requests without delays, and get approvals faster. This fosters trust, reduces confusion, and helps employees plan their personal and professional schedules more effectively.

Can leave trackers integrate with other systems?

Yes. Many leave tracking systems integrate with payroll, HR software, and calendar platforms. This ensures accurate payroll adjustments, avoids scheduling conflicts, and provides managers with a complete view of team availability.

Is a mobile app important for a leave tracker?

Absolutely. Mobile access allows employees to request leave, check balances, and track approvals from anywhere. For managers, it enables quick approvals on the go, making leave management more flexible and efficient, especially for remote or distributed teams.

How can a leave tracker help with compliance?

A leave tracker ensures that leave policies are consistently applied and that statutory requirements are met, such as paid sick days or parental leave. Automated tracking prevents errors and helps organizations stay compliant with labor laws without manual oversight.

Conclusion

An Employee Vacation and Leave Tracker is a critical tool for improving organizational efficiency and employee satisfaction. With a well-designed leave management system, businesses can automate leave requests, track absences, and ensure that both employees and HR are on the same page. Systems like Day Off provide an even more streamlined solution for managing leave, offering customizable policies, real-time tracking, and easy access for both employees and managers. By adopting a comprehensive leave tracking system, companies can ensure compliance, reduce administrative burden, and foster a positive work environment.