In any organization, absence management requests and ensuring a smooth approval process are essential for maintaining productivity, balancing workloads, and promoting employee satisfaction. The shift from manual leave management methods to automated software solutions offers numerous advantages, transforming a complex process into an efficient, transparent, and compliant system. Below, we delve deeper into how employee vacation management software simplifies leave approvals, from centralization and automated workflows to compliance and real time insights.

Centralized Leave Request System

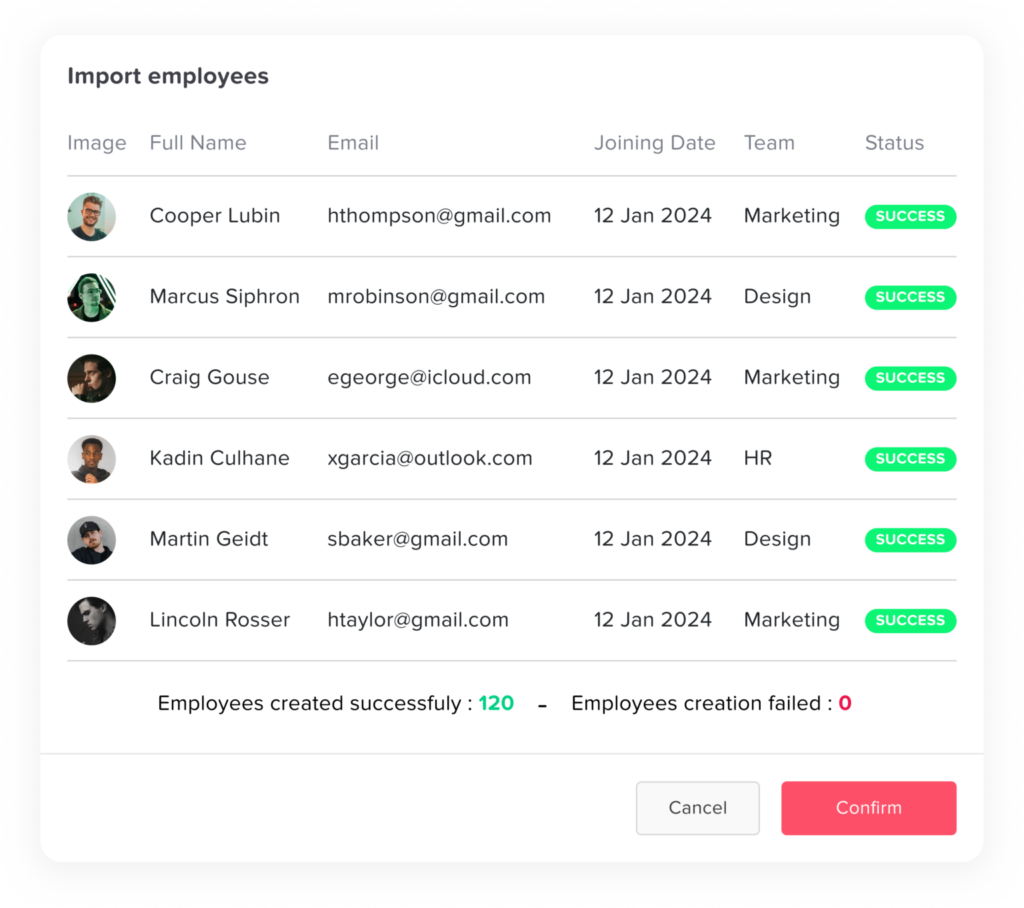

Traditional leave requests can be a cumbersome process, involving back and forth emails, manual record keeping, and potential for oversight. Employee vacation management software consolidates all leave requests within a centralized platform, enabling employees to submit requests, track approvals, and check their leave balances from a single interface.

For HR and management, this centralization means:

- Reduced Administrative Work: HR personnel can easily access all leave requests in one place, eliminating the need to track each request through multiple emails, spreadsheets, or physical forms.

- Increased Visibility: Managers gain a comprehensive view of all leave requests, helping them plan and manage team resources more effectively.

- Enhanced Coordination Across Departments: A centralized platform ensures that HR, managers, and employees are all on the same page, reducing misunderstandings and improving communication regarding leave policies.

Automated Approval Workflows

With automated workflows, employee vacation management software routes leave requests to the appropriate approver based on predefined criteria, such as employee role, type of leave, or department. This automation ensures a consistent and efficient process:

- Predefined Approval Chains: The software can be configured to send requests to multiple approvers sequentially or to specific individuals depending on the request. For example, a leave request from a team member might go first to their direct manager, then to HR if it involves extended leave.

- Automated Notifications: The software automatically notifies the next approver when action is required, as well as the employee when the request is approved or denied. This proactive notification system eliminates bottlenecks, enabling faster processing times.

- Reduced Risk of Errors and Bias: By standardizing the approval process, the software minimizes the chance of errors and ensures fair treatment of each request according to company policy.

Real Time Availability Tracking and Calendar Integration

Knowing who is available and who has already requested time off is critical for effective scheduling. Employee vacation management software typically includes a real time calendar view and team availability tracker:

- Calendar Integration: Many solutions integrate with popular calendar apps (like Google Calendar or Outlook), allowing leave dates to sync directly into organizational calendars. This way, managers can easily visualize absences across teams and plan accordingly.

- Conflict Prevention: With an overview of existing leave schedules, managers can quickly identify potential scheduling conflicts, such as multiple team members requesting leave for the same period, which could hinder project deadlines.

- Data Driven Decisions: Real time availability insights help managers make decisions that are informed by data, leading to a more balanced distribution of workload and minimizing disruption.

Self Service for Employees

Employee vacation management software empowers employees by offering self service functionality, allowing them to manage their leave requests and check their status independently. Self service features include:

- Leave Balance Visibility: Employees can view their accrued leave and balances, removing the need to contact HR for updates. This information is accessible at any time, which helps employees plan their time off in advance.

- Request Amendments and Cancellations: Employees can modify or cancel leave requests directly in the system if their plans change, and the software will automatically notify relevant parties of the update.

- Access to Leave History: By tracking and displaying historical data, the software helps employees stay informed of their past leave usage, encouraging responsible planning of future vacations.

Integrated Leave Policies and Compliance

One of the key features of advanced employee vacation management software is the ability to embed organizational leave policies directly into the system. This capability ensures that leave requests comply with company rules without requiring manual oversight:

- Policy Driven Approvals: Leave requests are automatically evaluated against company policies, such as the maximum allowable leave for a given period, accrued balance requirements, and blackout dates.

- Customized Leave Types: Companies can create custom leave categories (like sick leave, vacation, or bereavement) and set unique rules for each type, simplifying compliance and ensuring fair application of policies.

- Proactive Policy Updates: As policies change, HR can easily update the system’s parameters, ensuring ongoing compliance and accuracy across all future leave requests.

Compliance and Legal Record Keeping

Compliance with labor laws and record keeping are essential aspects of leave management. Employee vacation management software includes features to help organizations meet regulatory requirements and maintain accurate records:

- Automated Audits: The software automatically logs every action taken within the system, including approvals, denials, and cancellations. These logs are essential for internal audits or compliance reviews.

- Detailed Leave Reports: HR teams can generate detailed reports showing leave usage by department, employee, or type of leave. These reports help demonstrate compliance with labor laws and provide HR insights into leave patterns.

- Consistent Leave Policy Application: Automated policy enforcement reduces the risk of legal issues arising from inconsistent application of leave policies. For instance, the software ensures that overtime pay is correctly accounted for or that leave types are accurately deducted from employee balances.

Mobile Access for Flexibility

For employees and managers on the go, mobile accessibility has become a standard feature in vacation management software, offering convenient access to the platform anytime, anywhere:

- Mobile App Functionality: Many software providers offer mobile apps, allowing employees to submit leave requests, view balances, and receive notifications via their smartphones.

- Remote Management for Approvers: Managers can review and approve requests from their mobile devices, ensuring that approvals are timely, even when they’re out of the office.

- Push Notifications: The mobile app can send push notifications to alert managers of pending approvals or notify employees of updates, such as request approvals or denials.

Data Driven Insights for Strategic Planning

Employee vacation management software provides valuable analytics and insights that help HR and management teams understand leave patterns and make informed decisions:

- Trend Analysis: The software can generate insights into peak leave periods, average leave duration, and leave utilization rates. This data helps companies anticipate and plan for periods of high absence.

- Forecasting and Capacity Planning: Insights into leave trends allow HR teams to adjust staffing models, hire temporary workers during peak leave periods, or reassign resources to ensure operational efficiency.

- Employee Engagement and Retention Analysis: By analyzing data on leave usage, companies can gain insights into employee engagement. Low vacation usage might indicate potential burnout, whereas frequent use of certain leave types could highlight areas where employee wellness initiatives are needed.

Increased Transparency and Employee Trust

A transparent leave management system builds trust between employees and management, reducing misunderstandings and fostering a culture of fairness and accountability:

- Clear Leave Policies and Communication: When policies are embedded in the software, employees know exactly how their leave requests will be evaluated, promoting a sense of fairness.

- Status Tracking: Employees can see the status of their requests at each step, reducing the need to follow up with HR or managers. This transparency helps employees feel valued and reassured that their requests are being managed responsibly.

- Employee Satisfaction: Simplified and clear leave management processes contribute to employee satisfaction. When employees feel their time off is handled fairly, they’re more likely to feel positive about their organization, increasing retention rates and reducing turnover.

Frequently Asked Questions (FAQ)

What is employee vacation management software?

Employee vacation management software is a digital solution designed to automate and simplify the process of requesting, approving, and tracking employee time off. It replaces manual systems like spreadsheets or email requests, providing a centralized platform for leave management.

How does vacation management software improve the leave approval process?

The software automates approval workflows based on company policies, sends real time notifications, and ensures that requests are reviewed promptly. This results in fewer delays, less manual intervention, and a fair, transparent approval process.

Can the software integrate with our existing calendars or tools?

Yes, most solutions offer integration with tools like Google Calendar, Outlook, and sometimes Slack or Microsoft Teams. This allows leave schedules to sync directly with team calendars, making planning and coordination much easier.

Is it possible to customize leave policies within the software?

Absolutely. The software allows you to define and update company specific leave types and policies, including vacation, sick leave, unpaid leave, and more, ensuring requests are automatically checked against your organization’s rules.

Can employees manage their own leave through the platform?

Yes, employee self service is a core feature. Staff can submit, edit, or cancel leave requests, view their leave balances, and check approval status, all without needing to contact HR directly.

How does the software help with compliance?

The system automatically tracks and logs all leave activity for auditing and compliance purposes. It helps ensure your organization follows labor laws and internal policies consistently, minimizing legal risks and inconsistencies.

Is mobile access available for remote or on the go teams?

Yes. Most platforms offer mobile apps or mobile optimized portals, allowing both employees and managers to access the system, make approvals, and receive notifications from anywhere.

What reporting features are available?

Vacation management software typically includes reporting tools that provide insights into leave trends, usage rates, peak absence periods, and more. These analytics support better resource planning and employee engagement strategies.

How does the software benefit employee satisfaction?

By providing a transparent, fair, and efficient way to manage time off, the software reduces misunderstandings and boosts trust between staff and management. This leads to higher employee morale and better retention.

Is it suitable for small businesses or only large organizations?

Many solutions offer scalable pricing and feature sets, including free or low cost plans, making them suitable for businesses of all sizes, from startups to large enterprises.

Conclusion

Employee vacation management software revolutionizes the leave approval process by offering centralized control, automation, real time insights, and data driven decision making capabilities. It empowers employees with self service options, streamlines compliance with company policies and legal requirements, and promotes a transparent and equitable system that builds trust. For organizations aiming to foster a balanced, fair, and efficient workplace, investing in a robust employee vacation management software solution is an invaluable step toward a smoother, more productive, and employee friendly environment.

By addressing all aspects of leave management and providing real time data and reporting, this software ultimately leads to better workforce planning, enhanced employee satisfaction, and a strong, resilient organization.