In the U.S., general compliance covers key areas such as wage and hour laws, paid leave regulations, anti-discrimination policies, and proper employee classification. Understanding these areas helps businesses operate lawfully and avoid costly penalties.

General Compliance For US

At Day Off, we know that managing employee leave isn’t just about keeping schedules aligned, it’s about ensuring that your business complies with local, state, and federal employment laws.

General compliance for the USA refers to the overall set of laws, regulations, and best practices that businesses operating in the United States must follow to remain legally and ethically responsible. It covers a wide range of areas including labor law, tax obligations, data privacy, workplace safety, anti-discrimination, and industry-specific regulations. At Day Off, we know that managing employee leave isn’t just about keeping schedules aligned, it’s about ensuring that your business complies with local, state, and federal employment laws. With evolving regulations and differing requirements across the United States, leave compliance can become overwhelming. That’s where we come in. Our platform is designed to simplify leave tracking while helping your organization stay fully compliant with labor standards in the U.S. Whether you're handling Paid Time Off (PTO), unpaid leave, sick days, or FMLA, we give you the tools to manage it all with confidence.

Why Compliance Matters

Day Off provides an easy-to-use, automated solution that helps employers align their policies with these varied requirements while delivering a seamless experience for employees.

Failing to comply with labor and leave laws in the U.S. can lead to serious consequences from financial penalties and lawsuits to damage to your company’s reputation. Beyond legal risks, non-compliance can erode employee trust and morale, leading to higher turnover and lower productivity.

However, maintaining compliance is not always straightforward. Federal laws provide a baseline, but each state and sometimes even individual cities can enforce additional regulations, such as mandatory sick leave or paid family leave. Employers must also accommodate a wide range of situations including medical issues, military leave, and parental leave.

Labor and Employment Law Compliance

Staying compliant with labor and employment laws is essential for every organization. Our platform helps ensure your leave policies align with legal standards, reducing the risk of violations and supporting fair workplace practices.

1. Wages and Hours – The Fair Labor Standards Act (FLSA)

The FLSA, enforced by the U.S. Department of Labor, sets the national standards for:

Minimum wage: As of now, the federal minimum wage is $7.25/hour, but many states and cities have higher rates. Employers must follow the rate that benefits the employee the most (typically the higher state or local rate).

Overtime pay: Non-exempt employees are entitled to 1.5x their regular rate for hours worked beyond 40 in a workweek. Proper time tracking is essential to avoid wage disputes.

Employee classification: Workers must be properly classified as exempt or non-exempt based on their job duties and salary. Misclassifying employees can lead to back pay claims, audits, and fines.

Recordkeeping: Employers must keep detailed records of hours worked, wages paid, and deductions for at least three years. This data supports compliance audits and wage claims.

2. Family and Medical Leave Act (FMLA)

The FMLA provides eligible employees with up to 12 weeks of unpaid, job-protected leave per year for qualified family and medical reasons, including:

The birth or adoption of a child

Serious health conditions of the employee or a close family member

Military caregiver leave or exigencies

Key requirements:

Applies to employers with 50 or more employees within a 75-mile radius.

Employees must have worked at least 12 months and logged 1,250 hours in the past year.

Employers must continue group health insurance and reinstate the employee to the same or equivalent role after leave.

Notice and documentation are required, and denial of qualified leave can result in legal action.

3. Equal Opportunity and Anti-Discrimination Laws

Employers must provide a workplace free from discrimination, harassment, and retaliation. Key federal laws include:

Title VII of the Civil Rights Act – Prohibits discrimination based on race, color, religion, sex, or national origin.

Age Discrimination in Employment Act (ADEA) – Protects workers age 40 and over.

Americans with Disabilities Act (ADA) – Requires reasonable accommodations for qualified employees with disabilities.

Pregnancy Discrimination Act (PDA) – Prohibits discrimination based on pregnancy, childbirth, or related conditions.

Genetic Information Nondiscrimination Act (GINA) – Prevents misuse of genetic information in employment decisions.

These laws are enforced by the Equal Employment Opportunity Commission (EEOC), and employers must:

Implement anti-discrimination policies

Provide training for managers and staff

Investigate complaints thoroughly

Retaliation against employees who report or participate in investigations is strictly prohibited

4. Workplace Harassment and Bullying

Employers must take proactive steps to prevent and address workplace harassment, especially sexual harassment, which violates Title VII. Requirements may include:

Mandatory annual training (e.g., in California, New York)

Clear reporting procedures

Prompt and confidential investigations

Disciplinary measures for offenders

A culture of respect and fairness, backed by consistent enforcement, is essential to maintaining compliance and avoiding litigation.

5. Hiring and Termination Practices

Employment laws govern every stage of the employment relationship—from recruitment to offboarding.

Fair hiring: Job ads, interviews, and background checks must comply with anti-discrimination laws.

I-9 verification: Employers must verify the legal right of employees to work in the U.S.

Offer letters and contracts: Must clearly define terms of employment, compensation, benefits, and at-will status (if applicable).

Terminations: Must be handled fairly, lawfully, and with proper documentation. Wrongful termination claims often arise from inadequate documentation or perceived discrimination.

6. Wage Transparency and Pay Equity

Many states (e.g., California, Colorado, New York) have passed pay transparency laws requiring employers to:

Include salary ranges in job postings

Provide equal pay for substantially similar work regardless of gender or protected status

Prohibit retaliation against employees who discuss or disclose wages

Employers should conduct internal pay audits and ensure fair compensation practices.

7. State and Local Law Variations

U.S. federal laws set minimum standards, but many states and cities impose stricter requirements. Examples include:

Mandatory paid sick leave (e.g., New York, Massachusetts, Arizona)

Predictive scheduling laws for shift workers (e.g., San Francisco, New York City)

Anti-retaliation laws and whistleblower protections

Employers must monitor these laws by location and apply different rules for employees in different states or cities.

8. Leave and Time Off Policies

Beyond FMLA and sick leave mandates, employers often offer:

Paid Time Off (PTO)

Parental leave

Bereavement leave

Jury duty, military, or voting leave

Leave policies must be applied consistently and documented clearly. Failure to honor promised leave or accruals can lead to legal claims.

How Day Off Helps with Labor Compliance

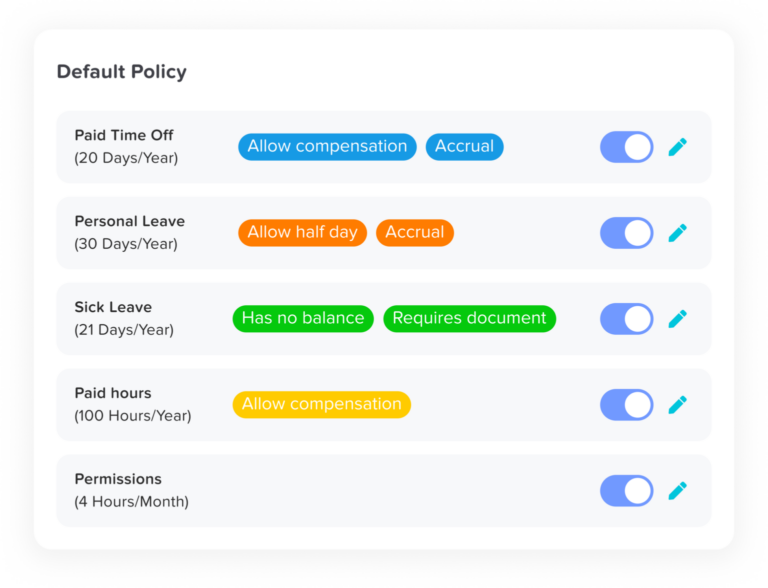

Day Off simplifies labor compliance by automating leave tracking, enforcing time-off policies, and maintaining accurate records. This ensures your business stays aligned with legal requirements while reducing administrative burden.

1. Accurate Leave Tracking (FLSA)

Automates PTO, sick leave, and custom accruals.

Tracks time off usage with audit-ready records.

Supports hourly and salaried employees for proper overtime calculations.

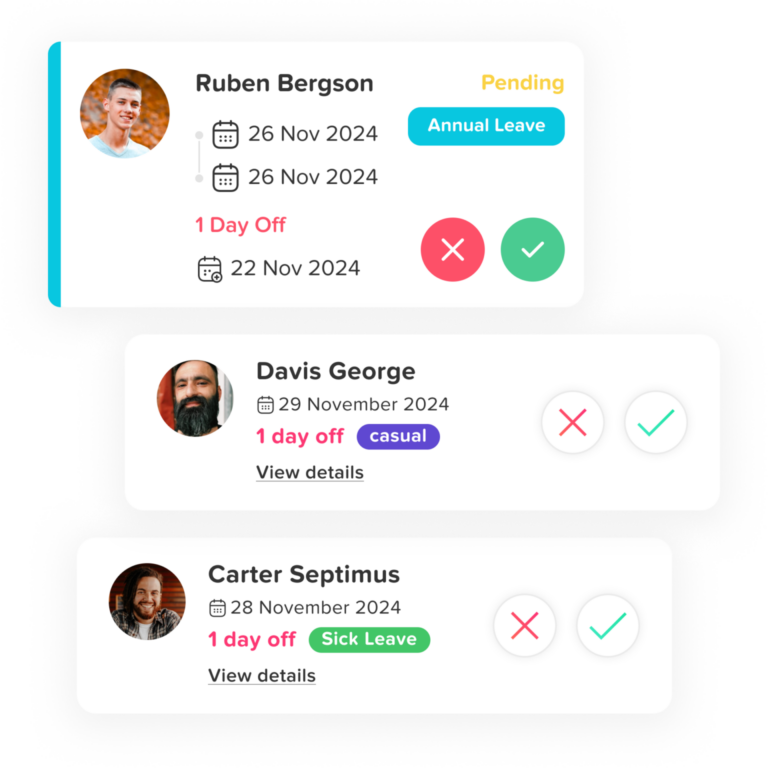

2. FMLA and Medical Leave Compliance

Tracks employee eligibility and usage of FMLA leave.

Stores documentation and alerts HR to upcoming limits.

Ensures job-protected leave is applied consistently.

3. Multi-State Leave Law Support

Configures policies based on state and city requirements.

Handles sick leave, paid family leave, and accrual rules for each location.

Keeps your policies aligned as local laws change.

4. Custom Leave Types for Full Coverage

Enables tailored leave options (e.g., bereavement, jury duty, parental).

Supports paid/unpaid classifications and probation rules.

5. Documentation and Audit Readiness

Maintains complete logs of all leave actions.

Provides exportable reports for audits or HR reviews.

Integrates with other systems for centralized compliance tracking.

6. Policy Transparency and Fairness

Gives employees real-time access to leave balances.

Ensures equal, consistent application of rules to prevent bias or legal risk.

7. Alerts and Notifications

Sends reminders for leave limits, resets, and pending requests.

Helps HR stay proactive with compliance tasks.

Core Areas of General Compliance in US

1. Labor and Employment Law Compliance

Employers must follow rules that govern how employees are hired, paid, treated, and managed.

Fair Labor Standards Act (FLSA): Sets minimum wage, overtime pay rules, and classifications (exempt vs. non-exempt).

Family and Medical Leave Act (FMLA): Provides eligible employees with up to 12 weeks of unpaid, job-protected leave.

Equal Employment Opportunity (EEO) Laws: Prohibit discrimination based on race, gender, age, religion, disability, etc.

Americans with Disabilities Act (ADA): Requires reasonable accommodations for qualified individuals with disabilities.

State Labor Laws: May require paid sick leave, meal breaks, vacation payout rules, and more.

2. Tax Compliance

Businesses must comply with tax laws at the federal, state, and local levels.

Employer Payroll Taxes: Includes Social Security, Medicare, federal and state unemployment taxes.

Income Reporting: Businesses must issue W-2s (employees) and 1099s (contractors) and file the correct tax returns.

Sales and Use Tax: Varies by state; must be collected and remitted accurately.

Corporate Income Taxes: Must be filed annually with the IRS and state tax authorities, depending on business structure.

3. Data Privacy and Security Compliance

Businesses are required to safeguard sensitive personal, financial, and health data.

HIPAA (for healthcare): Regulates protected health information (PHI).

GLBA (for finance): Protects consumers’ financial data.

CCPA/CPRA (California): Gives consumers rights to their personal data and requires transparency and opt-out mechanisms.

Best Practices: Include encryption, secure access controls, privacy policies, and breach notification protocols.

4. Workplace Safety Compliance

Under the Occupational Safety and Health Act (OSHA), employers must provide a safe, hazard-free environment.

Employers must assess risks, train staff on safety protocols, report injuries, and maintain inspection-ready records.

Industry-specific safety rules apply in construction, manufacturing, healthcare, and other sectors.

5. Licensing and Industry-Specific Regulations

Some industries have their own compliance requirements governed by federal or state regulators.

Healthcare: Must comply with HIPAA, CMS, and state health departments.

Finance: Must follow SEC, FINRA, and anti-money laundering (AML) rules.

Food & Beverage: Requires FDA/USDA oversight and local health inspections.

Education, transportation, legal services, and others have their own regulatory bodies.

6. Ethics and Governance

Good compliance includes corporate ethics and internal accountability:

Code of Conduct & Employee Policies: Clearly outline expected behavior, workplace rights, and disciplinary processes.

Training & Education: Keep employees informed of their rights and responsibilities.

Whistleblower Protections: Encourage internal reporting and protect employees who report violations.