Table of Contents

ToggleSubscription-based businesses like Day Off Leave Tracker need reliable analytics tools to track revenue, monitor customer retention, and optimize financial performance. The right platform can help companies reduce churn, forecast cash flow, and make data-driven decisions for sustainable growth.

With so many options available, it’s essential to choose a tool that fits your business size, budget, and reporting needs. This article explores the best subscription analytics platforms, their key features, pricing, and alternatives to help you make an informed decision.

Top Subscription Analytics Platforms

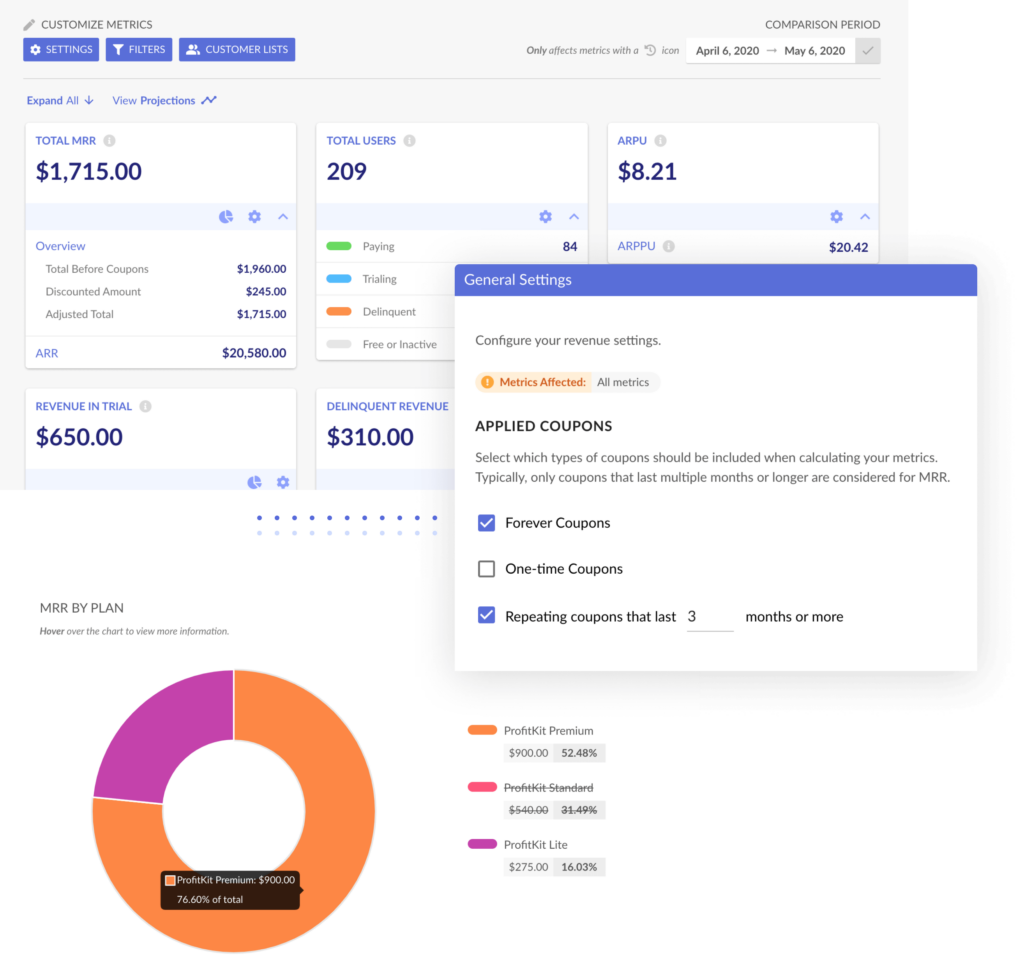

1. ProfitKit

Best for: Startups and small businesses looking for an affordable, easy-to-use analytics tool.

ProfitKit is designed to help early-stage businesses manage their subscriptions efficiently. It integrates directly with Stripe, providing clear financial insights without the complexity of larger enterprise tools. With a focus on automation, it allows businesses to track recurring revenue, manage payments, and forecast cash flow seamlessly.

🔹 Key Features:

✔ Subscription Analytics: Track Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and churn rate in real-time.

✔ Cash Flow Calendar: Predict future revenue and manage cash flow effortlessly.

✔ Automated Email Notifications: Keep customers updated on billing, failed payments, and renewals.

✔ Revenue Recovery Tools: Reduce involuntary churn by automating payment retries.

💰 Pricing: Starts at $19 per month, making it one of the most budget-friendly choices for small businesses.

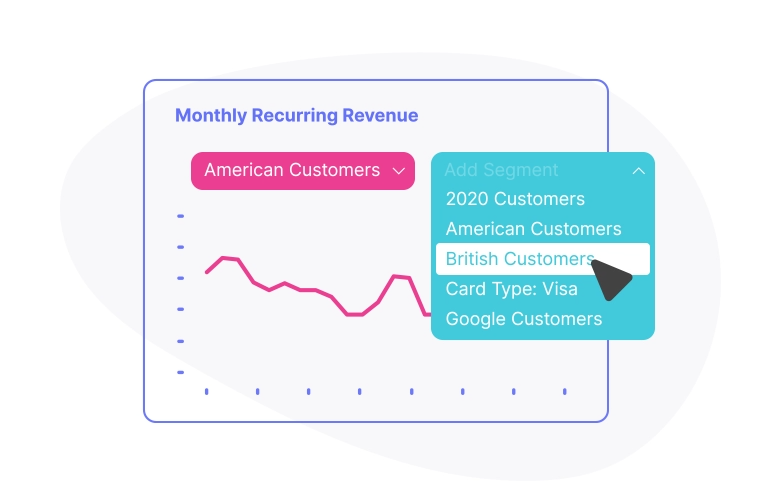

2. Baremetrics

Best for: Companies needing in-depth revenue insights and customer behavior tracking.

Baremetrics is a premium analytics platform designed for subscription-based businesses that want deep financial insights. It provides advanced revenue tracking, customer segmentation, and churn prediction, making it ideal for businesses scaling their operations.

🔹 Key Features:

✔ Real-Time Revenue Metrics: Monitor MRR, ARR, churn, and customer lifetime value (LTV) in one dashboard.

✔ Customer Segmentation: Identify high-value customers and analyze trends in subscriber behavior.

✔ Churn Prediction & Recovery: Detect and reduce revenue loss with proactive retention strategies.

💰 Pricing: Starts at $129 per month, making it a better fit for growing businesses with higher budgets.

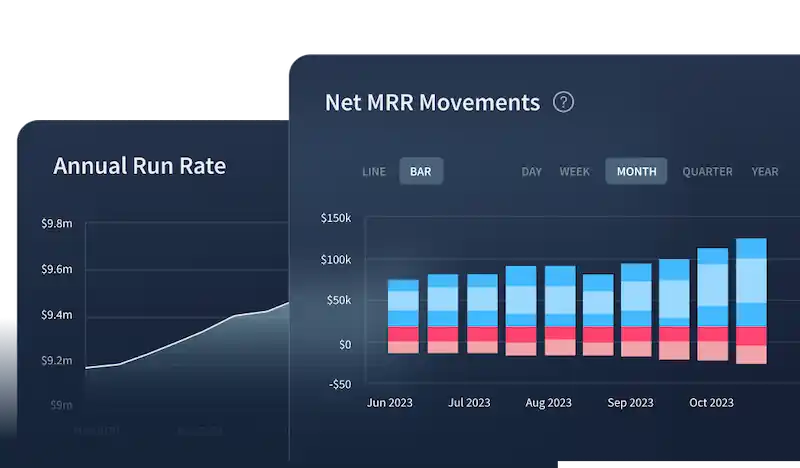

3. ChartMogul

Best for: Businesses that require detailed financial reporting and subscription metrics.

ChartMogul is built for data-driven businesses that need advanced analytics to track customer retention, revenue growth, and subscription trends. It integrates with multiple payment processors, including Stripe, PayPal, and Chargebee, making it a flexible choice for growing businesses.

🔹 Key Features:

✔ Cohort Analysis: Track customer retention over time and identify patterns in churn.

✔ Automated Revenue Reporting: Monitor MRR, ARR, and other key metrics without manual calculations.

✔ Multi-Source Data Import: Consolidate data from different payment processors for a complete financial picture.

💰 Pricing: Starts at $100 per month, making it ideal for mid-sized businesses focused on data analysis.

4. ProfitWell

Best for: Startups and small businesses looking for a free analytics tool with optional paid features.

ProfitWell offers free subscription analytics, making it one of the most accessible options for early-stage businesses. It provides insights into revenue trends and customer behavior, with additional paid features for churn reduction and revenue recovery.

🔹 Key Features:

✔ Free Subscription Analytics: Get essential revenue tracking without paying for a subscription.

✔ Churn Reduction Tools: Recover lost customers with automated outreach and engagement strategies.

✔ Industry Benchmarking: Compare your performance with similar companies to optimize pricing and retention.

💰 Pricing: Core analytics are free, with paid features available for businesses looking to reduce churn and optimize revenue.

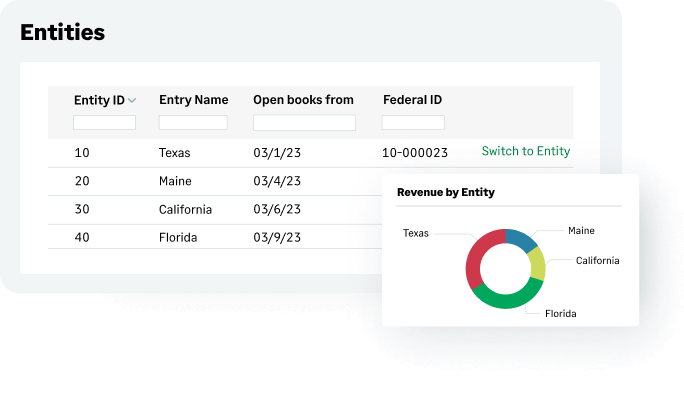

5. Sage Intacct

Best for: Mid-sized to large businesses needing financial automation and advanced accounting features.

Sage Intacct is more than just a subscription analytics tool—it’s a full-fledged financial management system. It’s best suited for businesses that require automated revenue recognition, real-time financial reporting, and compliance tracking for complex accounting needs.

🔹 Key Features:

✔ Automated Accounting & Revenue Recognition: Ensures compliance with financial regulations.

✔ Customizable Financial Dashboards: Get real-time insights tailored to your business needs.

✔ Scalability for Enterprise-Level Businesses: Designed for companies managing multiple revenue streams.

💰 Pricing: Custom pricing based on business needs; requires a consultation for a quote.

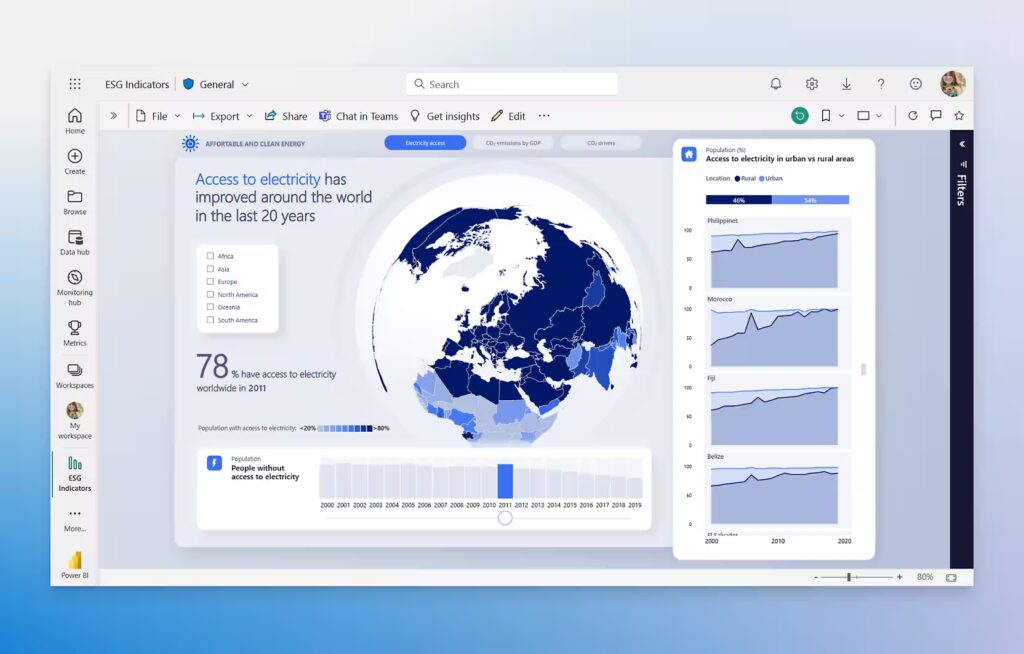

6. Microsoft Power BI

Best for: Businesses looking for customizable business intelligence and data visualization.

While not a dedicated subscription analytics platform, Microsoft Power BI is a powerful business intelligence tool that can be integrated with billing systems to provide custom reports and deep financial insights. It’s ideal for companies that need fully customizable data dashboards rather than pre-built analytics.

🔹 Key Features:

✔ Custom Report Creation: Drag-and-drop functionality for interactive dashboards.

✔ AI-Powered Analytics: Helps identify trends and make data-driven decisions.

✔ Integration with Various Data Sources: Works with Excel, SQL, Stripe, and third-party apps.

💰 Pricing: Starts at $10 per user per month, making it an affordable choice for businesses focused on reporting.

FAQ: Subscription Analytics Tools

1. What is a subscription analytics tool?

A subscription analytics tool is a platform that helps businesses monitor key financial metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rate, and customer lifetime value (LTV). These tools provide insights into business performance, customer retention, and revenue trends.

2. How do subscription analytics tools help reduce churn?

These tools help reduce churn by:

- Identifying at-risk customers through engagement tracking and payment history.

- Automating revenue recovery by retrying failed payments.

- Providing insights into churn patterns so businesses can adjust pricing, communication, or product offerings.

- Sending automated reminders for upcoming payments or expiring subscriptions.

3. Are subscription analytics tools only for SaaS businesses?

No! While they are most commonly used by Software-as-a-Service (SaaS) companies, any business with a recurring revenue model (e.g., streaming services, subscription boxes, membership programs) can benefit from these tools.

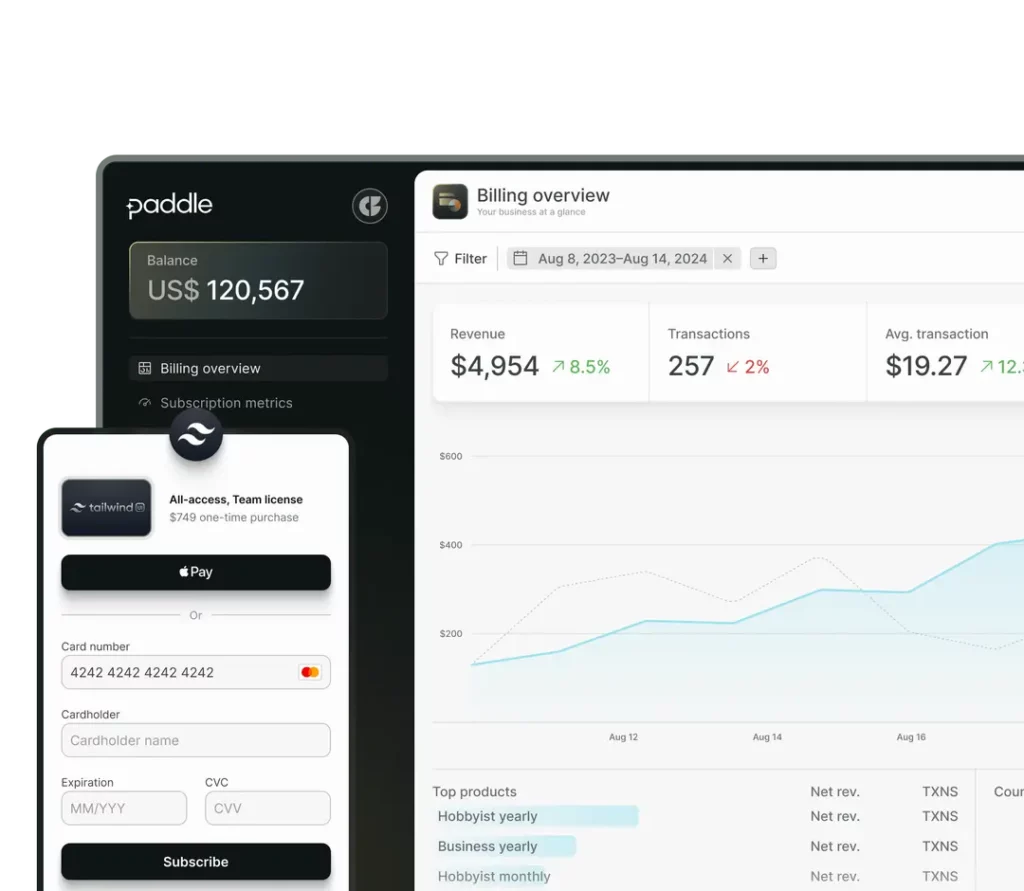

4. What’s the difference between a subscription analytics tool and a billing platform?

- Subscription analytics tools provide data-driven insights on revenue, churn, and customer behavior.

- Billing platforms (like Stripe, Chargebee, or Recurly) handle payment processing, invoicing, and subscription management.

- Some tools, like Baremetrics, integrate directly with billing platforms to offer both functions.

5. Can I use a subscription analytics tool without Stripe or PayPal?

Yes! Many platforms support multiple integrations, including custom payment gateways, bank transfers, and invoicing systems. Tools like ChartMogul and ProfitWell allow you to import data manually or through API integrations.

6. Are there free subscription analytics tools available?

Yes! ProfitWell offers free core analytics, while other platforms may provide limited free plans or trial versions. However, advanced features (like churn reduction and revenue recovery) usually require paid subscriptions.

7. How do I choose the best subscription analytics tool for my business?

Consider the following factors:

- Business Size & Budget: Startups may prefer budget-friendly options like ProfitKit, while larger companies may need advanced tools like Baremetrics or ChartMogul.

- Features Needed: Do you need just basic revenue tracking, or do you also require churn prediction, customer segmentation, and integrations?

- Integration Support: Ensure the tool works with your existing billing platform (Stripe, PayPal, Chargebee, etc.)

- Scalability: If you plan to grow, choose a tool that supports higher data volumes and team collaboration.

8. Do these tools require technical expertise to set up?

Not necessarily. Most subscription analytics tools are designed for non-technical users and offer plug-and-play integrations with billing systems. However, advanced customization (like API integration) may require developer support.

9. Can subscription analytics tools help with pricing strategy?

Yes! These tools provide customer insights, competitor benchmarks, and retention analysis, helping businesses adjust pricing models for maximum revenue and customer satisfaction.

10. What’s the best alternative if I don’t want to pay for a subscription analytics tool?

If you’re looking for free options, consider:

- ProfitWell for free core analytics.

- Google Sheets or Microsoft Excel with automated reports and formulas for basic revenue tracking.

- Google Analytics for website visitor tracking, which can be useful for understanding customer engagement.

Conclusion

ProfitKit is a powerful and affordable subscription analytics tool, making it a great choice for startups and small businesses. Its cash flow calendar, automated communications, and revenue recovery tools help businesses stay on top of their finances with ease.

However, if your business requires more advanced analytics, deeper financial insights, or different pricing structures, alternatives like Baremetrics, ProfitWell, and ChartMogul may be worth considering.

The best platform depends on your business needs—whether you’re focused on affordability, advanced analytics, or churn reduction. Take the time to explore these options and choose the one that fits your business best! 🚀