Managing accounts payable software efficiently is crucial for maintaining healthy cash flow and ensuring that vendors and suppliers are paid on time. With the increasing complexity of financial operations, businesses of all sizes need reliable software solutions to automate and streamline their accounts payable processes. From handling invoices and payments to managing multi-currency transactions and vendor relationships, the right accounts payable software, alongside tools like Day Off for time tracking and leave management, can save time, reduce errors, and enhance financial visibility.

In this article, we’ll explore the top 10 accounts payable software options available, highlighting their key features, pros, and cons to help you choose the best solution for your business.

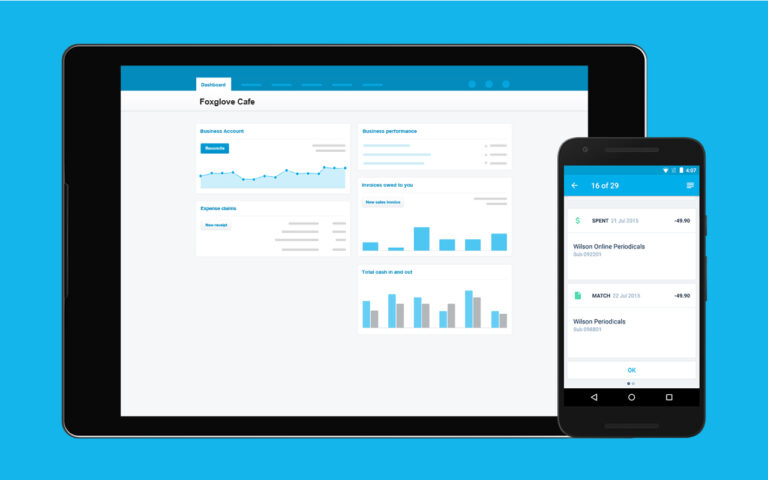

Xero

Key Features

- Cloud-Based Accounting: Accessible from anywhere with internet access, offering real-time updates.

- Bank Reconciliation: Automatically imports and categorizes bank transactions, making reconciliation faster.

- Invoicing: Customizable invoicing templates, with automatic reminders for overdue payments.

- Expense Tracking: Allows easy tracking of business expenses, with the ability to attach receipts to transactions.

- Inventory Management: Helps track stock levels, sales, and purchases in real-time.

- Multi-Currency Support: Automatically calculates exchange rates for international transactions.

- Payroll: Integrated payroll processing with tax calculations and employee management tools.

- Financial Reporting: Provides a wide range of customizable reports including profit and loss, balance sheets, and more.

- Integration with Third-Party Apps: Connects with over 800 apps, including CRM systems, payment gateways, and more.

- Mobile App: Offers a mobile app for on-the-go access to key features like invoicing, expenses, and reports.

Mobile App

Workflow

$13 to $70 per month • Trial: Yes • Free Plan: No.

Pros

User-Friendly Interface: Simple and intuitive dashboard for easy navigation, even for non-accountants.

Scalability: Suitable for both small and medium-sized businesses, with features that grow alongside your business needs.

Automation: Automates many manual tasks like invoicing and reconciliation, saving time.

Collaboration: Multiple users can access the platform simultaneously, making it easy for teams and accountants to collaborate.

Security: Uses strong encryption and multi-factor authentication for secure access.

Multi-Currency Capabilities: Great for businesses dealing with international clients or suppliers.

Regular Updates: Xero frequently updates and improves its platform with new features.

Extensive Integration Options: Seamless integration with numerous third-party applications to enhance functionality.

Cons

Steep Learning Curve for Advanced Features: While the basics are simple, more advanced features might require a learning curve for new users.

Limited Customer Support: No phone support is available, and customer support is primarily through email or online chat, which can be slow at times.

Cost: Can become expensive, especially when using multiple add-ons or premium features.

Payroll Limitations: Payroll is limited to certain countries, requiring additional third-party apps for global payroll management.

No Native Project Management: Lacks built-in project management tools, requiring integration with other apps for this functionality.

Custom Reporting: While the reports are useful, custom reporting features are limited compared to other platforms.

FreshBooks

Key Features

- Invoicing: Create and customize professional invoices, set up recurring invoices, and accept online payments.

- Expense Tracking: Easily track expenses by connecting your bank account or uploading receipts.

- Time Tracking: Built-in time tracking to log billable hours, useful for freelancers and service-based businesses.

- Project Management: Collaborate with team members and clients by sharing files, assigning tasks, and tracking project progress.

- Automated Billing and Reminders: Automates payment reminders, late fees, and recurring invoices.

- Estimates and Proposals: Create estimates and proposals and convert them into invoices once accepted by clients.

- Reports and Financial Statements: Offers various reports like profit and loss, tax summaries, and expense reports.

- Mobile App: Access invoicing, expenses, and time tracking from the mobile app.

- Multi-Currency Support: Handle international clients with automatic currency conversions.

- Integration with Third-Party Apps: Integrates with numerous apps including payment gateways, CRMs, and accounting tools.

Mobile App

Reports

Integrations

$17 to $55 per month • Trial: Yes • Free Plan: No.

Pros

User-Friendly Interface: Simple and intuitive design, especially great for freelancers and non-accountants.

Comprehensive Invoicing Features: Extensive invoicing capabilities with customization, automation, and payment options.

Time Tracking and Billing: Helps service businesses track billable hours and easily invoice clients for time worked.

Client Collaboration: Great tools for working with clients on projects, proposals, and sharing files.

Expense Management: Automated expense tracking by linking bank accounts and credit cards.

Mobile App: Offers flexibility with a powerful mobile app for invoicing, expense tracking, and time logging.

Strong Customer Support: Well-known for excellent customer service through phone, email, and live chat.

Customizable Reports: Provides a variety of reports that can be customized for financial insights.

Recurring Payments: Automates payments for subscriptions or ongoing services.

Cons

Limited Scalability for Large Businesses: Better suited for freelancers and small businesses rather than larger enterprises with complex accounting needs.

No Inventory Management: Lacks built-in inventory tracking, which may be a drawback for product-based businesses.

Limited Integration with Payroll: FreshBooks doesn’t have its own payroll processing, requiring third-party integration for this feature.

Higher Cost for Multiple Users: The price increases significantly as you add more users, which can be expensive for small teams.

Limited Customization for Reports: While reports are useful, they might not be as customizable or detailed as other accounting platforms.

No Double-Entry Accounting: Lacks traditional double-entry accounting features, making it less suitable for businesses requiring more complex financial reporting.

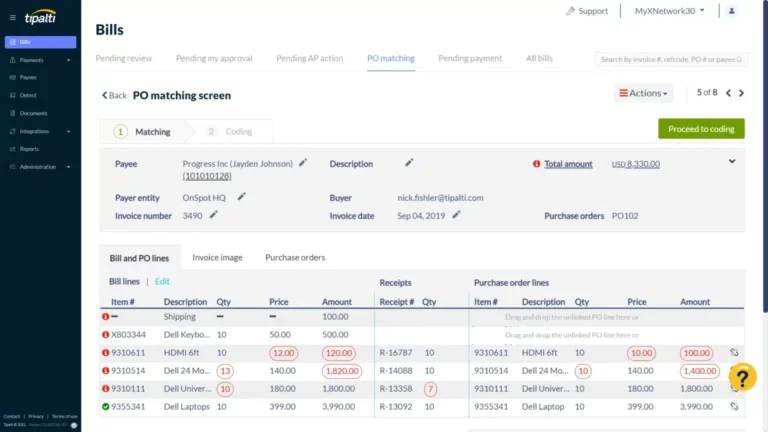

Tipalti

Key Features

- Global Payments Automation: Supports payments in multiple currencies and payment methods, such as wire transfers, PayPal, ACH, and prepaid debit cards.

- Supplier Management: Centralized platform for onboarding, managing, and paying suppliers, with automated tax form collection (W-8, W-9).

- AP Automation: Automates the entire accounts payable workflow from invoice capture to approval and payment.

- Multi-Entity Support: Consolidates financial operations for multiple subsidiaries and business entities.

- Tax Compliance: Ensures compliance with international tax regulations and automatically collects, validates, and generates tax reports.

- Self-Billing and Invoice Management: Automates invoice creation, approval workflows, and payment scheduling, reducing manual entry.

- Payment Reconciliation: Automatic reconciliation of payments with ERP systems like NetSuite, QuickBooks, and others.

- Real-Time Currency Conversion: Offers automated currency conversion with competitive rates and real-time foreign exchange data.

- Fraud Detection and Risk Management: Built-in fraud prevention mechanisms, including payment validation and screening.

- Regulatory Compliance: Adheres to global compliance standards like OFAC, AML, and KYC requirements.

Workflow

Self-Service

Automation

$299 per month • Trial: No • Free Plan: No.

Pros

End-to-End Payment Automation: Automates the entire AP process, from supplier onboarding to payment and reconciliation, saving time and reducing errors.

Global Payments: Supports over 190 countries and 120 currencies, making it highly suited for global operations.

Scalability: Tipalti is designed to scale with growing businesses, managing multi-entity accounting and high transaction volumes.

Compliance and Risk Management: Ensures tax and regulatory compliance across different countries, reducing the risk of penalties and errors.

Supplier Portal: Suppliers can update their payment details and view payment status, reducing the burden on internal teams.

ERP Integration: Seamlessly integrates with leading ERP systems like NetSuite, QuickBooks, and others for streamlined financial processes.

Fraud Prevention: Robust fraud detection and risk management tools help safeguard financial transactions.

Improved Efficiency: By automating repetitive tasks, Tipalti reduces manual labor, minimizes errors, and speeds up payment cycles.

Cons

High Cost for Small Businesses: Tipalti is primarily designed for mid-sized and large businesses, making it potentially costly for smaller companies with limited transactions.

Complex Setup: Initial implementation can be time-consuming and may require dedicated IT resources or support to configure.

Limited Customization: Some users may find the platform’s customization options for workflows and reporting limited compared to other solutions.

Learning Curve: The platform offers many advanced features, which can take time to master, particularly for teams new to payment automation.

Supplier Fees: Some payment methods (e.g., PayPal) incur fees for suppliers, which may create friction in payment preferences.

Customer Support: While generally good, some users report longer response times or challenges with support for complex issues.

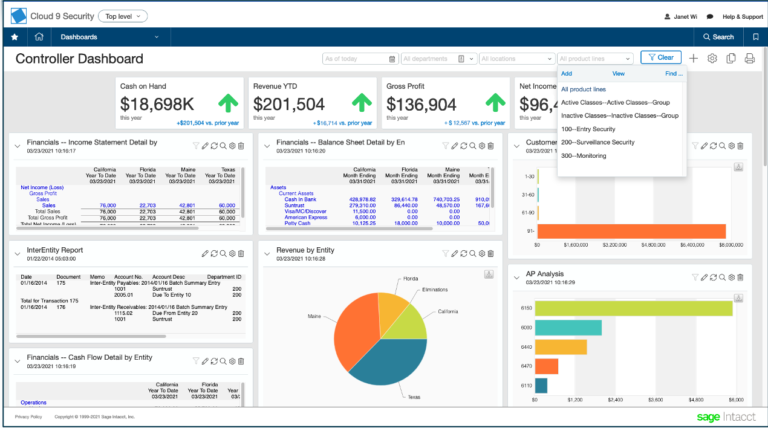

Sage Intacct

Key Features

- Core Financials: Includes general ledger, accounts payable, accounts receivable, order management, and cash management.

- Multi-Entity and Global Consolidations: Enables consolidation across multiple entities, currencies, and geographies in real time.

- Financial Reporting: Advanced reporting capabilities with customizable financial reports and dashboards, including real-time visibility.

- Automation: Automates processes like billing, revenue recognition, accounts payable, and invoicing to improve efficiency.

- Project Accounting: Offers project management features for tracking project costs, profitability, and time tracking.

- Dimensional Accounting: Allows for detailed financial tracking using dimensions like department, location, and customer for enhanced reporting.

- ERP Integration: Seamless integration with a wide range of ERP solutions and other third-party apps, including Salesforce and ADP.

- Budgeting and Forecasting: Advanced tools for managing budgets, forecasts, and financial planning.

- Compliance Management: Ensures adherence to accounting standards like GAAP, IFRS, and SOX compliance.

- Cloud-Based Platform: Accessible anywhere with internet access, offering a real-time, scalable solution.

Workflow

Automation

Reports

$1,250 to $2,500 per month • Trial: No • Free Plan: No.

Pros

Scalable for Growing Businesses: Ideal for mid-sized businesses that need to scale up financial processes as they grow.

Comprehensive Financial Management: Offers a wide array of financial tools, from core accounting to advanced features like multi-entity management.

Automation of Complex Processes: Helps reduce manual effort by automating complex financial processes like revenue recognition and consolidations.

Real-Time Visibility: Provides real-time data and dashboards, allowing businesses to make data-driven decisions quickly.

Customizable Reports: Offers powerful and customizable financial reporting to fit specific business needs.

Multi-Entity and Multi-Currency: Excellent for businesses operating in multiple countries or with multiple subsidiaries.

Integration Capabilities: Easily integrates with other software like CRM, payroll, and ERP systems.

Cloud-Based: Provides flexibility to work from anywhere, and the cloud-based nature ensures automatic updates and maintenance.

Strong Security Features: Adheres to top-level data security standards, including encryption, backup, and user authentication.

Cons

Expensive for Small Businesses: Sage Intacct is designed for mid-sized to large businesses, so the pricing may be steep for smaller organizations.

Complex Setup and Implementation: Requires a significant amount of time and resources for setup and integration, particularly for complex needs.

Steep Learning Curve: Some users may find the advanced features and reporting difficult to master initially.

Limited Customization in User Interface: While reports are highly customizable, the user interface itself offers limited customization.

Additional Costs for Add-Ons: Many key features, such as advanced modules (like project accounting or budgeting), may come at an extra cost.

Customer Support: Some users have reported slower customer support response times, particularly for more complex queries.

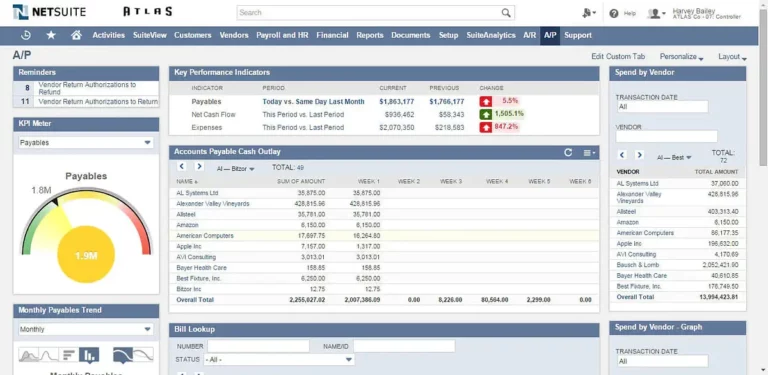

Oracle NetSuite

Key Features

- Comprehensive ERP Solution: Integrates financial management, CRM, inventory, and e-commerce in a single cloud-based platform.

- Financial Management: Includes general ledger, accounts receivable, accounts payable, and tax management, along with automated revenue recognition.

- Real-Time Dashboards and Reporting: Provides real-time, customizable reports and dashboards for deeper insights into business performance.

- Global Business Management: Supports multi-currency, multi-language, and multi-subsidiary operations, making it ideal for global businesses.

- Order and Inventory Management: Streamlines order processing and inventory management across various channels with real-time tracking.

- CRM and Sales Automation: Built-in CRM helps manage customer relationships, track sales opportunities, and automate marketing efforts.

- Supply Chain Management: Provides real-time visibility into the supply chain, including inventory levels, demand planning, and vendor management.

- E-commerce Integration: Offers native integration with e-commerce platforms, unifying online and offline operations.

- Customization and Scalability: Highly customizable platform with the ability to scale as the business grows, offering a wide range of modules and add-ons.

- Compliance Management: Helps ensure compliance with global financial regulations and standards like GAAP, IFRS, and SOX.

Integrations

Reports

Self-Service

$999 per month • Trial: No • Free Plan: No.

Pros

All-in-One Solution: Combines ERP, CRM, financials, and e-commerce into one unified platform, reducing the need for multiple systems.

Scalability: Suitable for small businesses, mid-sized companies, and enterprises with the ability to scale operations as the company grows.

Real-Time Visibility: Provides real-time data and insights across the business, which improves decision-making and operational efficiency.

Global Capabilities: Ideal for international companies with multi-currency, multi-language, and multi-entity support.

Extensive Customization: Highly customizable platform with numerous options for custom workflows, reporting, and third-party integrations.

Automation of Key Processes: Automates many business processes, including financial reporting, inventory management, and order processing.

Advanced Reporting: Provides detailed, customizable financial reports and dashboards for improved financial performance tracking.

Cloud-Based: Being cloud-native, it offers easy access from anywhere, automatic updates, and lower maintenance costs.

E-commerce Integration: Streamlines omnichannel sales with built-in e-commerce functionality and support for retail operations.

Strong Ecosystem: Extensive marketplace for third-party applications and integrations, extending its capabilities further.

Cons

High Cost: NetSuite is one of the more expensive ERP solutions, making it less accessible for smaller businesses or startups.

Complex Implementation: Implementation can be time-consuming and complex, often requiring dedicated IT support or external consultants.

Steep Learning Curve: Due to its vast feature set, new users may find it overwhelming and require significant training to master the system.

Customization Costs: While highly customizable, advanced customizations can increase costs and complexity, especially if professional services are required.

Customer Support: Some users report that the quality of customer support can be inconsistent, especially for more technical issues.

Overkill for Small Businesses: Smaller businesses with simpler needs may find NetSuite’s comprehensive feature set to be excessive.

Integration Challenges: Integrating with non-native third-party systems can sometimes be challenging and may require technical expertise.

Upgrade Process: Regular updates are automatic, but some users report challenges when dealing with these upgrades, particularly if customizations are involved.

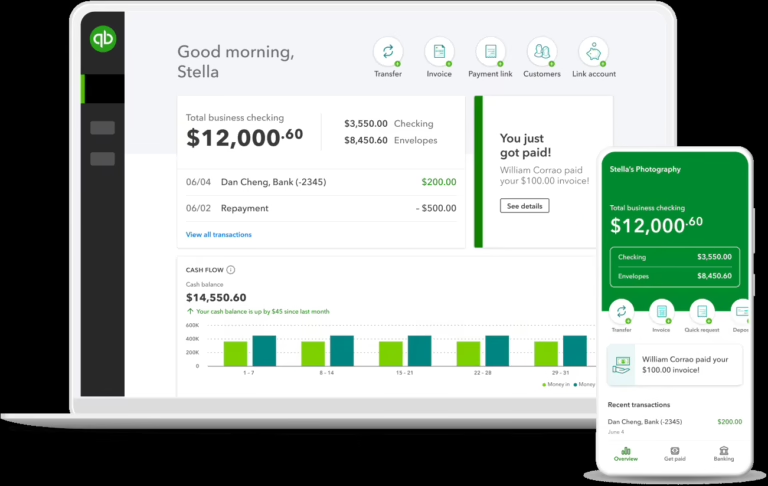

QuickBooks Online

Key Features

- Cloud-Based Accounting: Allows businesses to manage finances from anywhere with an internet connection, offering real-time data access.

- Invoicing and Payments: Create and send customizable invoices, track payments, and set up automated reminders for overdue invoices.

- Expense Tracking: Automatically track and categorize expenses by connecting bank accounts and credit cards.

- Bank Reconciliation: Automatically import and reconcile bank transactions, simplifying bookkeeping.

- Payroll Integration: Offers payroll processing with tax calculations and filing, seamlessly integrated into the platform (available as an add-on).

- Financial Reporting: Provides a wide range of standard and customizable financial reports, such as profit & loss, balance sheet, and cash flow.

- Multi-Currency Support: Handles transactions in different currencies, useful for businesses with international clients or suppliers.

- Tax Management: Tracks sales tax and automates tax calculations, including preparing and filing taxes.

- Inventory Management: Helps manage and track inventory levels, with alerts for stock reordering.

- Integration with Third-Party Apps: Supports integration with various third-party tools, including payment gateways, CRMs, and e-commerce platforms.

Reports

Integrations

$30 to $200 Per month • Trial: Yes • Free Plan: No.

Pros

Ease of Use: User-friendly interface that is easy to navigate, even for non-accountants, with helpful tutorials and support.

Accessibility: Being cloud-based, it offers flexibility with access from any device, anytime.

Automation: Automates many tasks like invoicing, recurring payments, and bank reconciliation, saving time and effort.

Scalability: Offers different pricing tiers to suit businesses of varying sizes, making it flexible for growth.

Customizable Reports: Provides useful financial insights through standard and customizable reporting tools.

Wide Range of Integrations: Connects with hundreds of third-party applications, such as PayPal, Shopify, and Stripe, to extend functionality.

Mobile App: Offers a mobile app that allows users to manage key features like invoicing, expenses, and bank reconciliation on the go.

Real-Time Collaboration: Allows multiple users to access the system simultaneously, improving collaboration between business owners and accountants.

Cons

Limited Features for Advanced Accounting: While great for small to mid-sized businesses, it may lack the advanced features needed by larger enterprises.

Costly Add-Ons: Adding features like payroll, advanced reporting, or third-party app integrations can increase the overall cost.

Customer Support: Some users report inconsistent or slow customer service response times, especially for complex issues.

Transaction Limits: For larger businesses with high transaction volumes, QuickBooks may run into limitations with data processing or performance.

Learning Curve for Advanced Features: While basic tasks are simple, some advanced accounting features may have a steeper learning curve.

Mobile App Limitations: The mobile app, while convenient, has limited functionality compared to the desktop version.

Occasional Syncing Issues: Users have reported occasional syncing issues with bank accounts and third-party integrations, requiring manual corrections.

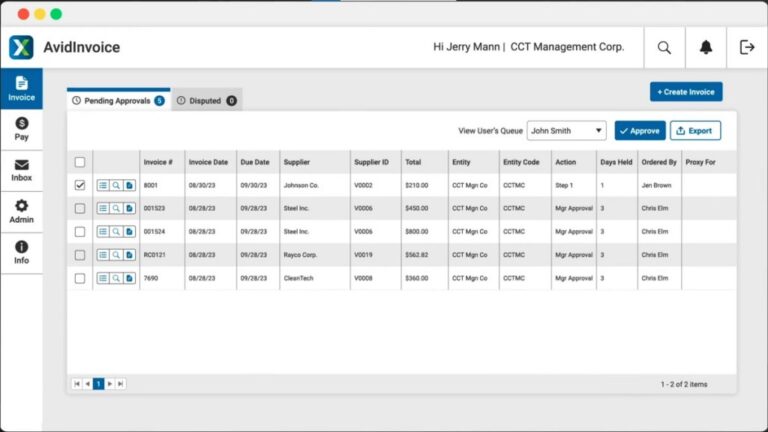

AvidXchange

Key Features

- Automated Invoice Processing: Streamlines the entire invoice lifecycle by automating invoice capture, approval workflows, and payments.

- Accounts Payable Automation: Automates accounts payable (AP) processes, reducing manual data entry and improving accuracy.

- Payment Automation: Offers a full-service payment solution to process vendor payments through checks, ACH, and virtual cards.

- Vendor Management: Provides a centralized platform for onboarding and managing vendor information and payment preferences.

- Approval Workflows: Customizable approval workflows allow routing of invoices to the appropriate departments or personnel for review.

- ERP Integration: Integrates seamlessly with leading ERP systems, including NetSuite, Microsoft Dynamics, QuickBooks, and others.

- Real-Time Reporting and Analytics: Offers insights into financial performance with real-time reporting tools and customizable dashboards.

- Compliance and Security: Ensures payment compliance, manages tax forms, and adheres to industry regulations for secure transactions.

- Multi-Entity Support: Manages multiple business entities or subsidiaries, consolidating payments and reporting across them.

- Mobile Access: Allows users to approve invoices and manage payments from any device through its mobile-friendly platform.

Mobile App

Integrations

Automation

$1,500 to $2,500 per month • Trial: No • Free Plan: No.

Pros

Time Savings: Automates many manual tasks, significantly reducing the time spent on invoice processing, data entry, and payment approvals.

Improved Accuracy: Minimizes human error through automation, leading to more accurate AP processes and vendor payments.

Enhanced Vendor Relationships: Provides timely and accurate payments, improving relationships with vendors and reducing payment disputes.

Scalability: Can easily scale to accommodate growing businesses and manage high transaction volumes.

Customizable Workflows: Tailored approval workflows and payment processes can adapt to the specific needs of an organization.

Secure Payments: Ensures payment security and regulatory compliance, protecting businesses from fraud and maintaining data privacy.

ERP Integration: Easily integrates with popular ERP systems, simplifying financial operations by syncing data between platforms.

Real-Time Reporting: Provides actionable insights through detailed reporting and analytics, helping businesses make data-driven decisions.

Mobile-Friendly: Approve invoices and payments on the go with a mobile app, offering convenience for busy managers.

Supports Various Payment Methods: Handles multiple payment types, including ACH, checks, and virtual cards, providing flexibility for vendors.

Cons

Costly for Small Businesses: The pricing structure may be expensive for smaller businesses or those with fewer transactions.

Implementation Complexity: Setup and implementation can be complex and may require dedicated IT support or a lengthy onboarding process.

Learning Curve: Some users report a learning curve when getting familiar with the platform’s features, especially for teams new to AP automation.

Customer Support: There are mixed reviews about the responsiveness and quality of customer support, especially for more technical issues.

Vendor Fees: Some vendors may incur fees when receiving payments through certain methods like virtual cards, which could lead to resistance.

Customization Limitations: While it offers customizable workflows, some users report limited flexibility in certain aspects of customization.

Occasional Integration Challenges: Depending on the ERP system used, some users may experience challenges or delays with integration.

Not Ideal for Complex Accounting Needs: AvidXchange is primarily focused on AP automation and might not be suitable for businesses requiring advanced accounting or financial management features.

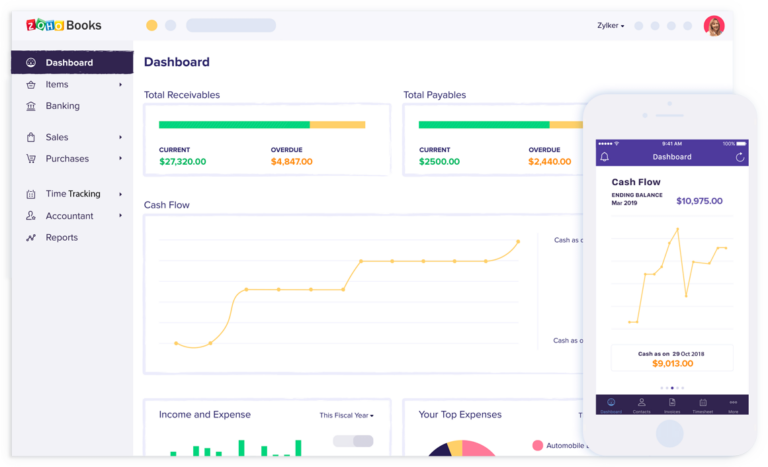

Zoho Books

Key Features

- Invoicing: Create professional, customizable invoices with options for recurring invoices, automated payment reminders, and multiple currencies.

- Expense Tracking: Track and categorize expenses with receipt uploads, and connect your bank accounts for automated transaction importing.

- Bank Reconciliation: Automatically import bank transactions and reconcile them with your accounts, making bookkeeping simpler.

- Project Management: Manage projects and track time spent on tasks, with the ability to bill clients for hours worked.

- Multi-Currency Support: Easily handle transactions in multiple currencies, with automatic exchange rate calculations.

- Inventory Management: Track inventory levels, manage stock, and set reorder points for efficient inventory management.

- GST and VAT Compliance: Built-in tax management for businesses in regions with GST, VAT, and other tax structures, with easy tax filing options.

- Financial Reporting: Generates detailed reports such as profit & loss, balance sheets, cash flow statements, and more.

- Client Portal: Offers a portal where clients can view, accept, or comment on estimates and pay invoices.

- Mobile App: Provides access to invoicing, expense tracking, and reports on the go via its mobile app for both iOS and Android.

- Workflow Automation: Automates repetitive accounting tasks, including invoicing, payment reminders, and approval workflows.

- Third-Party Integrations: Integrates with a wide range of Zoho applications and third-party apps like PayPal, Stripe, and G Suite.

Mobile App

Reports

Automation

$20 to $70 per month • Trial: Yes • Free Plan: Yes.

Pros

Affordable Pricing: Offers competitive pricing with a range of features, making it ideal for small to medium-sized businesses.

User-Friendly Interface: Clean, intuitive interface that’s easy to navigate, even for users without an accounting background.

GST/VAT Compliance: Excellent for businesses in regions where GST or VAT is applicable, with built-in compliance and tax filing features.

Scalability: Can scale with your business, with features that support growing companies, such as inventory tracking and multi-currency support.

Automation: Reduces manual work by automating tasks like invoicing, payment reminders, and expense tracking.

Integration with Zoho Ecosystem: Works seamlessly with other Zoho apps, such as Zoho CRM, Zoho Inventory, and Zoho Projects.

Mobile Access: Provides full functionality via its mobile app, allowing users to manage their finances from anywhere.

Multi-User Access: Offers multiple user roles and permissions, allowing businesses to collaborate more effectively on accounting tasks.

Customizable Reports: Offers a range of customizable financial reports that provide insights into business performance.

Cons

Limited Payroll Features: Lacks built-in payroll management in many countries, requiring third-party integrations or manual workarounds.

Complexity in Advanced Features: While easy for basic tasks, some advanced features (e.g., multi-currency, project management) may have a learning curve.

Limited Integration Outside Zoho Ecosystem: While it integrates well with other Zoho apps, it has fewer third-party integrations compared to competitors like QuickBooks.

No Offline Access: Being a cloud-based platform, Zoho Books requires an internet connection, with no offline access available.

Support for Larger Businesses: While ideal for small to mid-sized businesses, it may lack the advanced features needed for larger enterprises or those with highly complex financial needs.

Limited Automation Compared to Competitors: While automation features are useful, they may not be as robust as some competitors’ offerings in terms of complex workflows.

Limited Customization for Invoices: Although invoices can be customized, some users report wanting more advanced design flexibility.

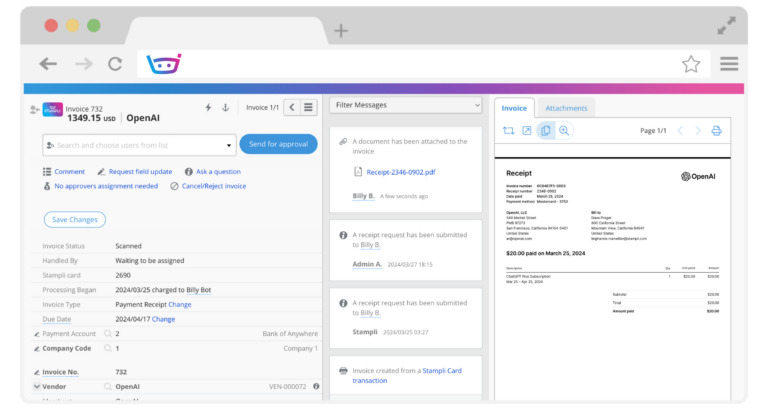

Stampli

Key Features

- AP Automation: Automates the entire accounts payable (AP) process, including invoice capture, approval workflows, and payment processing.

- Collaborative Invoice Management: Offers a collaborative platform where AP teams, approvers, and vendors can communicate directly on each invoice.

- AI-Powered Assistant (Billy): Uses AI to capture and code invoices, learn approval patterns, and make recommendations to streamline AP processes.

- Custom Approval Workflows: Tailored workflows for routing invoices to the appropriate team members for approval based on specific rules and requirements.

- Two-Way Matching: Matches invoices with purchase orders (POs) and receipts to ensure accuracy before processing payments.

- Integration with ERP Systems: Seamlessly integrates with popular ERP systems like NetSuite, SAP, QuickBooks, and Oracle for synchronized financial management.

- Vendor Management: Manages vendor details, payment preferences, and communication, and provides a vendor portal for self-service.

- Payment Processing: Supports various payment methods, including ACH, checks, and credit cards, with complete control over payment timing.

- Real-Time Visibility and Reporting: Offers real-time insights into AP processes, including invoice status, payment details, and approval progress.

- Mobile Access: Enables invoice approvals and management on the go through a mobile app for iOS and Android.

Mobile App

Integartion

Reports

Automation

$2,500 per month • Trial: No • Free Plan: No.

Pros

Streamlines AP Process: Automates repetitive tasks, reducing manual data entry, and helps ensure accuracy in invoice processing.

AI-Powered Efficiency: The AI assistant (Billy) improves efficiency by learning from user behavior, making recommendations, and speeding up approval processes.

Collaborative Platform: Allows for direct communication between AP teams, approvers, and vendors on the invoice itself, reducing delays and confusion.

Customizable Workflows: Flexibility in setting up workflows based on business needs, allowing for a more tailored AP process.

ERP Integration: Easily integrates with popular ERP and accounting systems, eliminating duplicate data entry and ensuring real-time updates.

Improved Control and Visibility: Offers enhanced control over invoice approvals and payments, with real-time tracking and reporting for better decision-making.

Mobile Access: Allows users to approve invoices and manage the AP process from anywhere, increasing convenience and efficiency.

Two-Way Matching: Ensures accuracy by matching invoices with purchase orders and receipts before payment processing.

Secure Payments: Offers a secure payment process, reducing the risk of fraud, with control over the timing and method of payments.

Reduces Approval Cycle Time: Streamlines invoice approvals, resulting in faster payments and stronger vendor relationships.

Cons

Higher Cost for Small Businesses: Stampli’s pricing is generally designed for mid-sized to large businesses, which might make it expensive for smaller companies.

Limited Advanced Features for Global Operations: While Stampli is excellent for automating AP processes, it may lack some advanced features needed by global enterprises, such as multi-currency or complex tax compliance.

Learning Curve: The AI assistant and some advanced features may have a learning curve for users unfamiliar with AP automation platforms.

Customization Limitations: While workflows are customizable, some users may find limitations in terms of deeper customization or specific integrations.

No Built-In Payment Processing: While Stampli automates invoice approvals, payments are usually processed through third-party integrations, which may add complexity.

Vendor Onboarding: Some vendors may face challenges when interacting with the platform initially, as they need to adapt to using the portal or processes.

Customer Support: Some users have reported inconsistent customer support, especially when dealing with more complex issues or integrations.

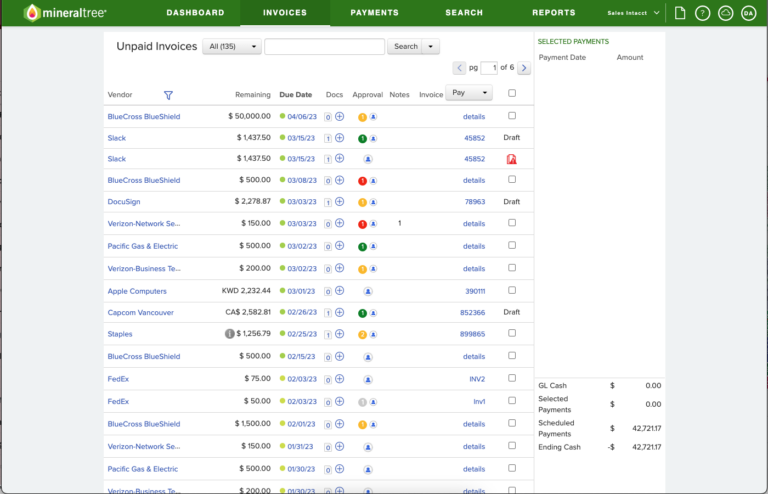

MineralTree

Key Features

- AP Automation: Streamlines the entire accounts payable process, from invoice capture to approval workflows and payment processing.

- Invoice Capture and Processing: Uses OCR (optical character recognition) to digitize invoices and automatically extract data, reducing manual data entry.

- Custom Approval Workflows: Allows for customizable approval workflows to ensure that invoices are reviewed and approved by the correct personnel.

- Payment Automation: Automates payments through multiple methods, including ACH, virtual credit cards, and checks.

- Two-Way and Three-Way Matching: Matches invoices with purchase orders and receipts to ensure accuracy and prevent fraud.

- ERP Integration: Seamlessly integrates with major ERP systems such as QuickBooks, NetSuite, Microsoft Dynamics, Sage, and others for efficient data syncing.

- Fraud Detection and Security: Built-in fraud prevention tools that validate payments and flag potential security issues.

- Mobile Access: Provides a mobile app for invoice approvals and payment management, allowing users to work on the go.

- Real-Time Reporting and Analytics: Offers detailed financial insights with customizable dashboards and real-time reporting of AP metrics and performance.

- Vendor Management: Simplifies vendor onboarding and management, offering tools for vendor payments and communications.

Mobile App

Automation

Analytics

$495 per month • Trial: No • Free Plan: No.

Pros

Comprehensive AP Automation: Provides a complete end-to-end solution for automating accounts payable, from invoice capture to payment processing.

Improves Accuracy and Reduces Manual Work: Automates data extraction and invoice processing, reducing the risk of human error and improving efficiency.

Customizable Workflows: Approval workflows are highly customizable to meet the specific needs and structure of a business.

Fraud Prevention: Incorporates security measures, such as two-way and three-way matching and payment validation, to reduce the risk of fraud.

ERP Integration: Easily integrates with leading ERP and accounting systems, ensuring data flows seamlessly between systems.

Multiple Payment Options: Supports a variety of payment methods, including ACH, virtual cards, and checks, offering flexibility to vendors.

Real-Time Insights: Provides valuable, real-time reporting and analytics to help businesses make data-driven decisions regarding their AP processes.

Mobile-Friendly: Enables invoice approvals and payment management through a mobile app, offering flexibility for busy teams and executives.

Reduces AP Cycle Time: By automating tasks and streamlining approvals, MineralTree significantly speeds up the AP cycle, improving cash flow management.

Cons

High Cost for Small Businesses: MineralTree is designed for mid-sized and larger businesses, so it may be too expensive or complex for smaller organizations.

Implementation Complexity: Setting up MineralTree, especially with complex workflows and ERP integrations, may require significant time and resources.

Limited Vendor Self-Service Options: While it helps manage vendors, MineralTree offers limited self-service features for vendors compared to other AP platforms.

Learning Curve: Some users may experience a learning curve when getting familiar with all of the features and capabilities of the platform.

Customer Support: Some users have reported delays or challenges in resolving complex technical issues with customer support.

Customization Limitations: While workflows are customizable, other aspects of the platform may have limited flexibility in terms of specific business needs.

Mobile App Limitations: The mobile app, while useful, may have limited functionality compared to the desktop version.