Table of Contents

TogglePaid Time Off (PTO) is a vital component of employee benefits packages, offering workers the flexibility to take time away from work without sacrificing their income. Understanding how PTO hours accumulate is crucial for both employers and employees to manage time off effectively. This guide will explain the accumulation of PTO hours, the various systems employers use, and tips for both managing and utilizing these benefits.

Paid Time Off (PTO) consolidates vacation, sick leave, and personal time into a single bank of hours that employees can use at their discretion. This approach contrasts with traditional systems that separate time off into categories. The flexibility of PTO is appealing because it empowers employees to make decisions about how best to use their time off based on their specific needs.

How PTO Hours Accumulate

The accumulation of PTO hours typically follows a policy set by the employer, which can vary widely from one organization to another. Here are the most common methods used to calculate PTO accrual:

1. Yearly Accrual

In a yearly accrual system, employees receive a fixed amount of PTO hours each year. For instance, an employee might be granted 120 hours of PTO each year. This method is straightforward but offers less flexibility for new hires who might need time off before they’ve worked a full year.

2. Accrual per Pay Period

Many employers opt for a pay-period accrual system, where employees earn a certain amount of PTO for each week, bi-week, or month they work. For example, if an employee accrues 4 hours of PTO every bi-weekly pay period, they would accumulate approximately 104 hours of PTO over a year. This method allows PTO to build gradually and can be used as it is accrued.

3. Accrual Based on Hours Worked

Some organizations link PTO accrual to the number of hours an employee works. This can be particularly beneficial for part-time employees, as their PTO grows in direct proportion to the time they’ve worked. For example, an employee might earn one hour of PTO for every 40 hours worked.

4. Frontloading PTO

An alternative to accrual during the year is frontloading, where the entire year’s PTO is available at the start of the year or on the anniversary of the employee’s start date. This method is simple to administer and makes it easy for employees to plan vacations early in the year.

Factors Influencing PTO Accrual

Understanding the factors that influence how Paid Time Off (PTO) accrues is crucial for both employers designing PTO policies and employees managing their benefits. Several variables can affect the rate at which PTO is accumulated, ranging from employment status and length of service to the employee’s specific job role.

1. Employment Status

Full-time employees typically accrue PTO at a faster rate than part-time employees. Companies often pro-rate PTO accrual based on the number of hours worked, especially when using a system that accrues PTO based on hours worked.

2. Length of Service

Many organizations increase the rate at which employees accrue PTO based on their tenure with the company. For example, a new employee might start by accruing two weeks of PTO per year, which could increase to three weeks after five years of service, and four weeks after ten years.

3. Job Position or Level

Sometimes, the accrual rate may also vary by job position or level within the company. Higher-level positions or those requiring more responsibility might accrue more PTO as part of a competitive benefits package.

When Does PTO have to be Paid Out?

The requirements for paying out Paid Time Off (PTO) upon an employee’s departure from a company largely depend on the jurisdiction’s labor laws and the company’s specific policies. Here’s a breakdown of when PTO might be required to be paid out:

1. State and Local Laws

In the United States, the obligation to pay out accrued PTO at termination varies by state. Some states, like California, Illinois, and Massachusetts, require employers to pay out all unused PTO as it is considered earned wages. Other states allow employers to set their own policies regarding whether PTO is paid out at termination, provided these policies are clearly communicated and applied consistently. It’s important to check the specific laws in your state to understand the legal obligations.

2. Company Policy

Outside of legal requirements, whether PTO must be paid out upon termination often depends on the company’s policy. Companies may choose to pay out PTO for various reasons, such as maintaining a competitive benefits package or incentivizing long-term employment. Policies typically specify:

- Whether PTO is paid out at termination.

- Under what conditions PTO may be paid (e.g., resignation vs. termination).

- Any caps or limits on the amount of PTO that can be paid out.

3. Employment Contracts

In some cases, individual employment contracts or union agreements may dictate terms regarding PTO payout. These contracts can override general company policies if they provide specific stipulations about compensating unused time off.

4. Type of Termination

Some companies differentiate between different types of termination when deciding on PTO payout. For example, some policies may state that employees who are terminated for cause might not receive a payout of accrued PTO, while those who leave voluntarily or are laid off might be eligible for full payout.

How is PTO payout calculated

PTO payout calculations can vary significantly depending on the company’s policy, local laws, and the terms of employment contracts. Generally, PTO (Paid Time Off) payout occurs when an employee leaves the company, either through resignation, termination, or retirement, and they have unused accrued PTO. Here is a general overview of how PTO payout is typically calculated:

Understanding Company Policy

The first step in determining how PTO payout is calculated is to refer to the company’s specific PTO policy. This policy should outline whether PTO is payable upon termination and under what conditions. Not all companies pay out unused PTO, and some may only pay out a portion based on tenure or other factors.

Common Methods of PTO Payout Calculation

1. Standard Accrual Rate

If a company pays out unused PTO, the calculation is often straightforward. It is typically based on the accrued PTO balance at the employee’s standard hourly rate. For example:

- Accrued PTO Hours: 80 hours

- Hourly Rate: $25

- PTO Payout: 80 hours x $25/hour = $2,000

2. Pro-Rata Basis

For employees who leave partway through the year, some companies calculate the payout on a pro-rata basis. This means the payout is based on the amount of PTO accrued during the period worked in the final year of employment. For instance, if an employee earns 10 days per year and leaves halfway through the year, they would be eligible for 5 days’ worth of PTO payout if they haven’t used those days.

3. Cap on Payout

Some companies set a cap on how much PTO can be paid out. This cap may be a certain number of days or hours, beyond which PTO will not be compensated. This cap often exists to encourage employees to take time off during their employment rather than accumulating it.

4. Conditioned Payouts

Certain conditions might affect whether and how PTO is paid out. For instance, some policies require employees to provide a minimum notice period (e.g., two weeks) to qualify for a PTO payout. Failing to provide such notice may result in forfeiting some or all of the accrued PTO payout.

Legal Considerations

It’s important to note that legal requirements for PTO payout vary by region. Some states or countries require employers to pay out all unused PTO, while others do not. Employers must comply with local labor laws to avoid legal penalties.

Example Calculation

Let’s consider an example where an employee has accrued 120 hours of PTO and earns $30 per hour. Assuming the company’s policy and local laws stipulate full payout of accrued PTO:

- Accrued PTO Hours: 120 hours

- Hourly Rate: $30

- PTO Payout: 120 hours x $30/hour = $3,600

Calculating PTO payout requires a clear understanding of company policies and local labor laws. Employees should familiarize themselves with the specific terms and conditions laid out in their employment agreements or employee handbooks regarding PTO. Both employers and employees benefit from transparent and fair policies that clearly define how PTO is accrued, used, and paid out upon termination of employment.

Which States Require PTO to be Paid Out?

In the United States, the rules around whether employers must pay out accrued but unused Paid Time Off (PTO) at the end of employment depend on state laws. There is no federal law mandating PTO payout, so it varies significantly from state to state. Below is an overview of some states that require employers to pay out unused PTO, under specific conditions:

States That Require PTO Payout

1. California

California law treats accrued vacation time as earned wages, which must be paid out upon termination of employment at the employee’s final rate of pay. This applies to all unused vacation time or PTO that is provided in lieu of vacation.

2. Illinois

In Illinois, employers are not required to provide vacation benefits, but if an employer chooses to do so, they must pay out accrued vacation upon termination as per the Illinois Wage Payment and Collection Act, provided there is no valid, enforceable employment policy to the contrary.

3. Massachusetts

Massachusetts requires employers to pay out all accrued, unused vacation time at the end of employment, as it is considered wages.

4. Montana

Montana, unlike most states, is not an “at-will” state. Upon termination, employers must pay out accrued PTO unless the employer has a policy that limits the compensation of accrued PTO to certain types of termination such as layoffs or resignations, but not firings.

States With Specific Conditions or Exceptions

Several states allow companies to establish their own policies regarding whether accrued vacation must be paid out upon termination, provided these policies are clearly communicated to the employees and applied consistently. For example:

- New York and Texas do not have specific statutes requiring the payout of unused vacation time. Employers in these states can establish their own policies, which must be adhered to as per the terms of the employment contract or company policy.

- Ohio and Florida also allow employers to set their own policies regarding vacation payout and do not have specific requirements mandating the payout of unused PTO.

Best Practices

Employers should clearly state their PTO and vacation policies, including whether PTO is paid out upon termination, in an employee handbook or a written contract. This practice not only ensures compliance with state laws but also provides clear expectations for employees regarding their benefits.

If you are an employee or an employer unsure about the specific laws in your state, it may be beneficial to consult with a legal expert specializing in employment law to ensure compliance and understand your rights or obligations.

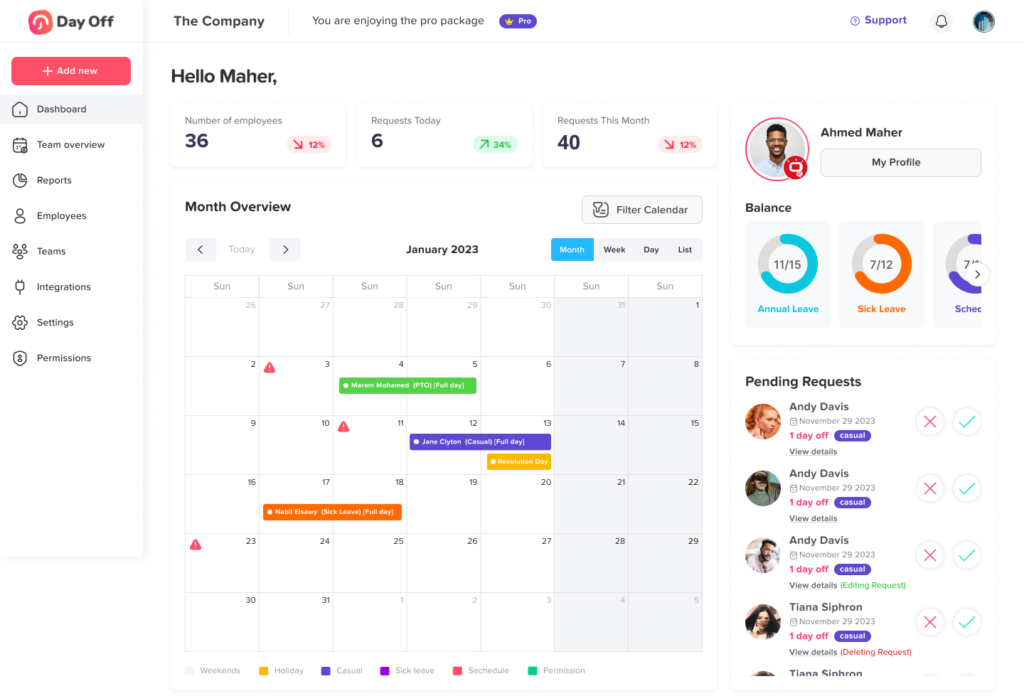

Day Off Vacation Tracking Software designed to assist both employers and employees in managing Paid Time Off (PTO) effectively. Here’s how you can use this platform to streamline the process of handling PTO:

For Employers:

1. Setting Up Company PTO Policies

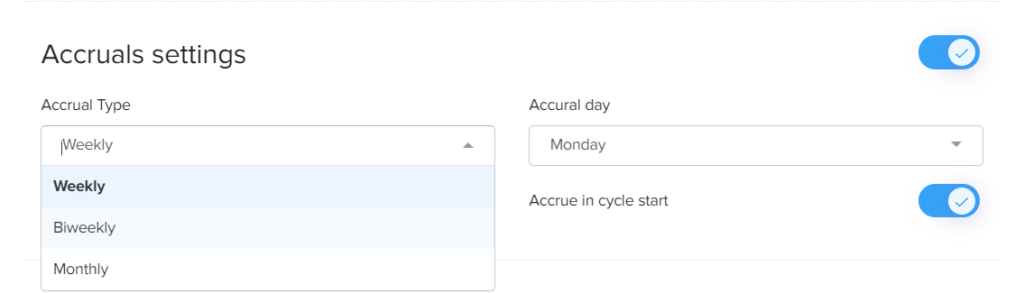

- Configure Policies: Begin by setting up your company’s specific PTO policies within the platform. This includes defining accrual rates, carryover limits, and types of leave available (such as vacation, sick leave, and personal days).

- Customize Settings: Adjust settings to match specific employment types or departments, accommodating various accrual methods or eligibility criteria.

2. Employee Management

- Add Employees: Input details about your employees, including their start dates, employment status (full/part-time), and any other relevant information that affects PTO accrual.

- Track Employee PTO: Monitor accruals, usage, and remaining balances in real-time, ensuring transparency and helping to prevent disputes or misunderstandings.

3. Approval Workflow

- Review Requests: Implement an approval workflow where employees can submit PTO requests through the platform. Managers can review, approve, or deny these requests based on team availability and individual PTO balances.

- Notifications: Set up notifications to alert managers of new requests.

4. Reporting and Analytics

- Generate Reports: Use the platform’s reporting tools to generate insights into PTO usage patterns, identify trends, or prepare for peak vacation times.

- Compliance Monitoring: Ensure compliance with local labor laws by using analytics to monitor adherence to regulations concerning PTO.

For Employees:

1. Submitting PTO Requests

- Submit Requests: Easily submit PTO requests by selecting dates and the type of PTO you are requesting. You can view your accrued PTO balance to make informed decisions about your time off.

2. Managing PTO

- View PTO Balance: Check your current PTO balance anytime to see how much time you have available for use.

- Track Status of Requests: Follow the progress of your PTO requests, from submission to approval or denial, and plan accordingly.

3. Notifications

- Stay Informed: Receive notifications regarding the approval status of your PTO requests, and upcoming scheduled PTO.

Integration and Accessibility

- Mobile Access: Day Off offers a mobile version, employees can manage their PTO requests and view balances on the go, while managers can approve requests, ensuring flexibility and responsiveness.

- Integration: The platform offers integration with calendars like Google Calendar and Outlook, as well as Slack and Microsoft Teams, syncing PTO schedules across platforms for better resource planning.

Frequently Asked Questions (FAQ) about PTO Accrual and Payout

Q1: How is PTO typically accrued in most companies?

A1: PTO usually accrues based on the number of hours worked, the number of pay periods completed, or on a yearly basis. Many companies use a pay-period accrual system where employees earn a fixed amount of PTO hours each pay period, such as every week or month.

Q2: Can an employer refuse to pay out accrued PTO upon termination?

A2: The ability of an employer to refuse payout of accrued PTO depends largely on state laws and the company’s own PTO policy. In some states like California, accrued PTO must be paid out upon termination, while in others, it depends on the company’s policy as long as it is clearly communicated and consistently applied.

Q3: Does PTO accrual carry over from year to year?

A3: Whether PTO carries over from one year to the next depends on the employer’s policy. Some companies have a “use it or lose it” policy, where employees must use their PTO within a given year, while others allow a certain number of hours to carry over into the next year. State laws may also impact carryover policies.

Q4: Are part-time employees eligible for PTO?

A4: Part-time employees are often eligible for PTO, but the rate at which they accrue PTO may be lower than that of full-time employees, typically calculated on a pro-rated basis depending on the number of hours worked.

Q5: How can employees track their PTO accrual?

A5: Employees can track their PTO accrual through their company’s HR or payroll system where PTO balances are usually updated each pay period. Employers are encouraged to maintain transparent records accessible to employees at any time.

Q6: What happens to unused PTO if I quit or am terminated?

A6: The handling of unused PTO upon resignation or termination varies. Some companies pay out all unused PTO, while others base their decision on state laws or specific company policies. Always check your employee handbook or contract for the specific rules applicable to your situation.

Q7: How do I calculate my PTO payout?

A7: To calculate your PTO payout, multiply your accrued, unused PTO hours by your hourly wage rate. For example, if you have 40 hours of unused PTO and your hourly rate is $25, your payout would be 40 hours x $25/hour = $1,000.

Q8: Are employers required to provide PTO?

A8: No federal law requires employers to provide PTO, but many offer it as part of a competitive benefits package. The specifics can vary widely depending on the employer’s policy and the local laws.

Q9: Can my employer change the PTO policy after I’ve accrued time off?

A9: Employers can change their PTO policies, but typically changes will only affect PTO accrued after the policy change. Most jurisdictions require employers to notify employees of such changes in advance. Existing accrued PTO is usually protected under the terms in place at the time it was accrued.

Q10: What should I do if I believe my PTO payout is incorrect?

A10: If you believe there has been an error with your PTO payout, you should first review your company’s PTO policy and any relevant state laws. Then, discuss the issue with your HR department. If the issue is not resolved, you may need to seek legal advice.

Conclusion

In conclusion, understanding and managing Paid Time Off (PTO) effectively is crucial for both employers and employees. Employers need to develop clear, compliant PTO policies that align with state laws and meet the needs of their workforce, while employees must be proactive in understanding and managing their PTO to maximize its benefits. Utilizing tools like the Day Off can significantly streamline this process, providing a robust platform for tracking accruals, submitting requests, and ensuring that all parties are informed and compliant with regulations.