Employee burnout has emerged as a significant challenge for organizations worldwide. It’s a state of physical, emotional, or mental exhaustion combined with doubts about one’s competence and the value of work. Left unchecked, burnout can lead to diminished productivity, higher turnover rates, and a negative impact on workplace morale. This article delves into effective strategies for managing and preventing employee burnout, offering insights that can help foster a more resilient and vibrant work culture.

Understanding the Signs of Burnout

Emotional Exhaustion, Cynicism, and Reduced Professional Efficacy are key components of employee burnout, a complex syndrome evolving from chronic workplace stress that has not been successfully managed. Here’s a deeper look into each aspect:

Emotional Exhaustion

Emotional exhaustion is the feeling of being overwhelmed and drained by one’s work to the extent that it becomes challenging to muster the energy for tasks that one typically handles easily. This can result from constant high demands, tight deadlines, or a lack of support within the workplace. Employees might experience symptoms such as fatigue, irritability, and a sense of dread about going to work. Over time, this exhaustion can affect personal life, leading to detachment and a decrease in overall life satisfaction.

Cynicism

Cynicism in the context of burnout refers to a growing sense of detachment from one’s job and a negative or overly critical view towards the work environment, colleagues, and the organization itself. This attitude often develops as a protective measure against the disappointment and disillusionment employees feel when their efforts seem unrewarded or when the work environment is perceived as unsupportive or overly demanding. Cynical employees are more likely to be disengaged, less cooperative, and may contribute to a toxic work culture, further exacerbating the problem of burnout across the team.

Reduced Professional Efficacy

Reduced professional efficacy describes a decline in one’s feelings of competence and successful achievement in one’s job role. Employees may start to doubt their skills or the quality of their work, leading to decreased productivity and engagement. This reduction in efficacy can create a vicious cycle where the employee’s lack of confidence leads to lower performance, which in turn, further diminishes their sense of competence and accomplishment. This aspect of burnout not only affects the individual’s career satisfaction and progression but can also impact the overall performance and morale of the team or organization.

Addressing the Components of Burnout

Understanding these components of burnout is crucial for organizations aiming to create a healthy work environment. Interventions might include implementing work-life balance policies, fostering a supportive and inclusive workplace culture, providing recognition and rewards, ensuring workload management, and offering professional development opportunities. Additionally, promoting open communication and providing resources for mental health support can empower employees to address their stressors effectively, thereby mitigating the risk of burnout.

Studies and Surveys for Employee Burnout

various studies and surveys have highlighted the prevalence and impact of employee burnout across industries. Here are some statistics that shed light on the severity and commonality of burnout:

- Gallup’s 2021 State of the Global Workplace Report found that 41% of employees worldwide reported feeling stressed a lot of the day prior, indicating a high level of emotional strain that can contribute to burnout.

- According to the World Health Organization (WHO), which recognized burnout as an occupational phenomenon in 2019, burnout results from chronic workplace stress that has not been successfully managed.

- A 2020 survey by FlexJobs and Mental Health America found that 75% of people have experienced burnout at work, with 40% saying they’ve experienced burnout during the pandemic specifically. This highlights the significant impact of remote work and the COVID-19 pandemic on employee well-being.

- The 2021 Work Trend Index by Microsoft surveyed over 30,000 people in 31 countries and found that 54% of workers felt overworked, while 39% felt exhausted, underscoring the widespread issue of work-related stress and its contribution to feelings of burnout.

- Harvard Business Review reported that the estimated cost of workplace stress to U.S. employers is as high as $190 billion in healthcare expenses annually, indicating the financial impact of not addressing employee well-being.

- These statistics underscore the critical need for organizations to prioritize employee mental health and implement strategies to prevent burnout. By fostering a supportive work environment, recognizing the signs of burnout, and taking proactive steps to address it, companies can help safeguard their employees’ well-being and productivity.

Causes of Burnout

To effectively manage and prevent burnout, it’s crucial to understand its root causes, which often include:

- Overwhelming Workloads: Consistently high workloads can lead to stress and eventual burnout.

- Lack of Control: Feeling unable to influence decisions that affect one’s job, such as schedules, assignments, or workload, can contribute to burnout.

- Insufficient Rewards: Lack of recognition or reward for good work can diminish motivation.

- Lack of Community: A workplace that lacks support and camaraderie can exacerbate feelings of isolation.

- Mismatched Values: A disconnect between an employee’s personal values and the organizations can lead to dissatisfaction and burnout.

Strategies for Managing and Preventing Burnout

Promote Work-Life Balance

Encourage employees to maintain a healthy work-life balance by setting clear boundaries between work and personal time. Implement flexible work schedules, encourage taking full lunch breaks, and respect employees’ time off by not sending after-hours communications unless absolutely necessary.

Foster a Supportive Work Environment

Create a culture of support where employees feel valued and appreciated. Regular check-ins, team-building activities, and open communication channels can help build a sense of community and belonging.

Empower Employees with Control

Offer employees more control over their work processes, schedules, and environments. Autonomy can significantly reduce stress levels and prevent feelings of helplessness that contribute to burnout.

Acknowledge and Reward Contributions

Recognition doesn’t always need to be monetary. Public acknowledgment, awards, and simple thank-yous can go a long way in making employees feel appreciated. Regularly review compensation and benefits to ensure they match or exceed industry standards.

Provide Professional Development Opportunities

Employees who feel stuck or unchallenged are at risk of burnout. Offering opportunities for growth and learning can reignite their passion and commitment to their roles and the organization.

Implement Regular Wellness Checks

Incorporate wellness checks into regular one-on-one meetings. Use these sessions to discuss workload, challenges, and feelings, allowing for early identification and intervention of burnout symptoms.

Encourage Physical Wellness

Promote a healthy lifestyle by offering gym memberships, organizing wellness challenges, or providing healthy snacks at work. Physical well-being is closely linked to mental and emotional health.

Lead by Example

Leadership plays a crucial role in setting the tone for the organization. Demonstrate a commitment to work-life balance, wellness, and personal growth. Leaders who prioritize their well-being inspire their teams to do the same.

Real-World Example:

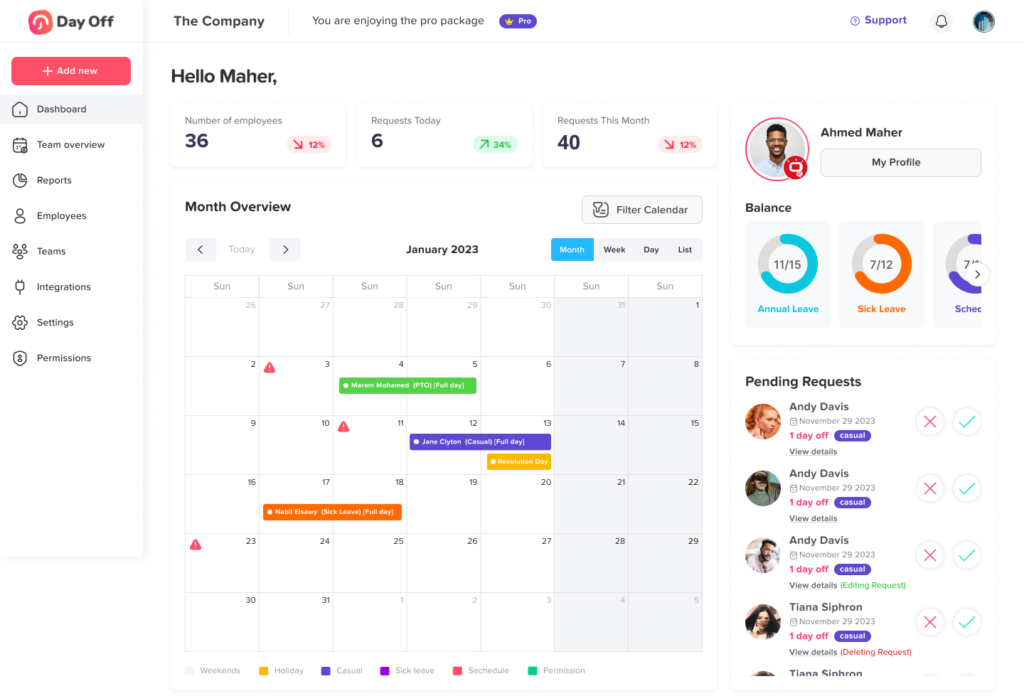

Google is a real-world example of a company that has implemented comprehensive strategies to combat employee burnout and promote workplace wellness. Known for its innovative approach to employee satisfaction and organizational culture, Google offers a wide range of programs and benefits aimed at supporting its workforce.

Some of the key initiatives Google has introduced include:

-

- Flexibility in Work: Google supports flexible work hours and telecommuting options, allowing employees to balance their work and personal lives more effectively. This flexibility is crucial for preventing burnout by reducing stress related to commuting and rigid work schedules.

- Wellness Programs: Google offers extensive wellness programs, including on-site fitness centers, wellness classes, and access to mental health professionals. These resources help employees maintain physical and mental health, reducing the risk of burnout.

- Employee Development Programs: Google invests in the professional development of its employees through various learning opportunities, workshops, and courses. This commitment to growth helps keep employees engaged and motivated, preventing feelings of stagnation that can lead to burnout.

- Recognition and Rewards: Google has a strong culture of recognition, celebrating employee achievements through awards and bonuses. This recognition reinforces the value of employees’ work, boosting morale and satisfaction.

- Team Building and Social Activities: The company organizes regular team-building events, offsites, and social activities to foster a sense of community and support among employees. These events can alleviate stress and build stronger, more supportive team dynamics.

- By focusing on flexibility, wellness, personal growth, recognition, and community, Google addresses many of the root causes of burnout, creating a work environment that promotes well-being and job satisfaction. These efforts have not only contributed to Google’s reputation as a great place to work but have also demonstrated the business value of investing in employee wellness.

Frequently Asked Questions (FAQ) on Employee Burnout

What exactly is employee burnout, and how is it different from regular stress?

Answer:

Employee burnout is a chronic state of physical, emotional, and mental exhaustion caused by prolonged and unmanaged workplace stress. While stress can be a temporary response to a challenging situation, burnout is characterized by deeper, persistent feelings of depletion, cynicism, and reduced professional efficacy. Unlike everyday stress, which might motivate problem-solving or heightened focus, burnout often leads to disengagement, decreased productivity, and emotional detachment from work.

What are the most common signs that an employee is experiencing burnout?

Answer:

Common signs include emotional exhaustion (feeling drained and overwhelmed), cynicism or negativity toward one’s job or colleagues, and a reduced sense of accomplishment or professional efficacy. Other indicators may include frequent irritability, decreased motivation, physical symptoms like headaches or fatigue, and withdrawal from social interactions at work. Recognizing these early signs can help employers intervene before burnout worsens.

How does burnout impact employee productivity and company performance?

Answer:

Burnout significantly reduces productivity as employees may struggle to concentrate, meet deadlines, or maintain quality standards. It also leads to higher absenteeism and turnover rates, which increase recruitment and training costs. Additionally, burnout can negatively affect team dynamics and morale, fostering a toxic work environment. Ultimately, the organization may suffer from decreased innovation, customer satisfaction, and financial performance.

Are certain industries or job roles more prone to burnout?

Answer:

Yes, burnout is more prevalent in high-pressure industries such as healthcare, education, social services, finance, and technology. Roles with high workloads, tight deadlines, emotional labor, or limited control over work tend to experience higher burnout rates. However, burnout can affect any industry or job where chronic stressors are unmanaged and support systems are lacking.

Can remote or hybrid work arrangements increase or decrease burnout risk?

Answer:

Both. Remote and hybrid work can reduce burnout by offering flexibility, eliminating commuting stress, and enabling better work-life balance. However, these arrangements can also increase burnout risk if employees experience isolation, blurred work-home boundaries, longer working hours, or lack of adequate support and communication from management. It’s essential to provide structure, clear expectations, and social connection opportunities regardless of work location.

How can organizations effectively identify burnout before it escalates?

Answer:

Organizations can proactively identify burnout by encouraging open communication, conducting regular wellness check-ins, and using anonymous employee surveys focused on stress, workload, and job satisfaction. Training managers to recognize behavioral and performance changes, and promoting a culture where employees feel safe discussing mental health, also helps early detection.

What role does leadership play in preventing burnout?

Answer:

Leadership sets the tone for workplace culture and can significantly influence burnout prevention. Leaders who model healthy work-life balance, communicate transparently, provide resources and support, and recognize employee efforts create an environment that mitigates burnout risks. Conversely, poor leadership practices like unrealistic expectations or lack of empathy exacerbate stress and disengagement.

How important is work-life balance in combating burnout?

Answer:

Work-life balance is crucial. When employees can effectively separate work responsibilities from personal time, they are better able to recharge mentally and physically. Organizations that respect boundaries by limiting after-hours work communications, encouraging time off, and offering flexible scheduling empower employees to maintain this balance and reduce burnout.

What strategies can employees personally use to manage or prevent burnout?

Answer:

Employees can practice self-care techniques such as regular physical activity, mindfulness or meditation, maintaining healthy sleep habits, and seeking social support. Setting clear work boundaries, prioritizing tasks, and communicating workload concerns to managers also help. Importantly, employees should feel encouraged to use available mental health resources and seek professional help when needed.

How can companies support employees returning from burnout?

Answer:

Supporting employees post-burnout involves creating a phased return-to-work plan, possibly with reduced hours or adjusted responsibilities. Ongoing check-ins, counseling access, and a flexible work environment can help ease their transition. Employers should foster an understanding culture that reduces stigma and encourages open dialogue to prevent relapse.

Are mental health benefits effective in preventing burnout?

Answer:

Yes. Providing access to mental health resources, such as Employee Assistance Programs (EAPs), counseling services, and wellness programs, demonstrates organizational commitment to employee well-being. When paired with workplace policies that reduce stress and increase support, mental health benefits are effective tools in preventing burnout.

How do recognition and rewards influence employee burnout?

Answer:

Recognition and rewards reinforce employees’ sense of value and accomplishment, which counteracts feelings of cynicism and inefficacy. Whether monetary or non-monetary, timely and meaningful acknowledgment motivates employees, boosts morale, and can significantly decrease burnout risk by fostering a positive and appreciative workplace culture.

Can burnout be completely eliminated in the workplace?

Answer:

While it may not be possible to completely eliminate burnout due to varying individual stress responses and external factors, it can be significantly reduced and managed through proactive organizational strategies. By prioritizing mental health, fostering supportive environments, and addressing root causes, companies can create workplaces where burnout is rare and quickly addressed when it arises.

How does burnout affect teamwork and collaboration?

Answer:

Burnout often leads to withdrawal, irritability, and reduced engagement, which negatively impact teamwork and collaboration. Cynical or disengaged employees may resist cooperation or communication, creating friction within teams. Conversely, healthy work environments that prevent burnout promote stronger relationships, trust, and shared purpose among colleagues.

What are some examples of successful burnout prevention programs?

Answer:

Companies like Google, Salesforce, and SAS Institute have implemented comprehensive wellness programs that include flexible working arrangements, mental health support, professional development, and recognition initiatives. These organizations also promote open communication, provide physical wellness resources, and foster inclusive cultures, resulting in higher employee satisfaction and lower burnout rates.

How can technology aid in managing and preventing burnout?

Answer:

Technology can support burnout prevention by enabling flexible work schedules, facilitating virtual social connections, and providing access to wellness and mental health apps. Tools that monitor workload and stress indicators can alert managers to early signs of burnout. However, it’s essential to balance technology use to avoid digital overload, which can itself contribute to stress.

What steps should an organization take to develop a burnout prevention strategy?

Answer:

An effective burnout prevention strategy starts with assessing current workplace stressors through surveys and feedback. Next, develop clear policies promoting work-life balance, provide resources for mental health, train leaders on empathetic management, and create channels for employee support and recognition. Regularly review and adapt these strategies based on evolving workforce needs.

How does burnout impact employee retention?

Answer:

Burnout is a major driver of employee turnover as exhausted and disengaged employees seek relief by leaving their jobs. High turnover disrupts operations and increases hiring costs. By addressing burnout proactively, organizations can improve retention, preserve institutional knowledge, and sustain a stable, experienced workforce.

Are younger employees more susceptible to burnout?

Answer:

Younger employees, particularly Millennials and Gen Z, may be more vocal about burnout due to higher expectations for work-life balance and mental health support. However, burnout affects all age groups. Generational differences primarily influence how burnout is perceived and discussed, not necessarily who is more vulnerable.

Can burnout symptoms be mistaken for other conditions?

Answer:

Yes. Burnout symptoms overlap with depression, anxiety, and chronic fatigue, making it important to differentiate through professional evaluation. While burnout is specifically work-related, mental health conditions may require broader treatment. Encouraging employees to seek professional help ensures accurate diagnosis and appropriate care.

Conclusion

Managing and preventing employee burnout requires a proactive and holistic approach that addresses the root causes of stress and disengagement in the workplace. By implementing strategies that promote work-life balance, recognize contributions, and foster a supportive culture, organizations can mitigate the risks associated with burnout. In doing so, they not only enhance the well-being of their employees but also secure a more productive, engaged, and resilient workforce.