Efficiently managing employee vacations, personal time off (PTO), and sick leaves is critical to maintaining team productivity and harmony. As teams expand, especially with the rise of remote and hybrid work, traditional methods like spreadsheets and manual tracking quickly become inefficient, error-prone, and difficult to scale. This is where the vacation trackers come into play.

Vacation trackers are dedicated tools, either as standalone software or integrated within existing platforms, that help businesses manage, monitor, and streamline time-off requests and approvals. This article will guide you through what a vacation trackers are, why your business needs one, the key features to consider, and some of the best options available today.

What Is a Vacation Tracker?

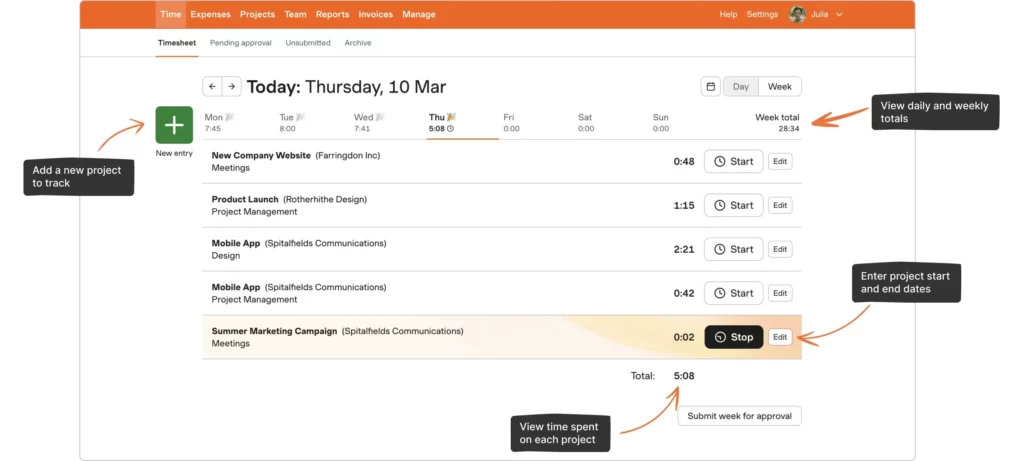

Vacation trackers are digital tools designed to automate and simplify the process of managing employee leave. It centralizes time-off requests, approvals, and leave balances, eliminating the need for clunky spreadsheets, endless email chains, or manual calculations.

Vacation trackers come in various forms, from simple calendar tools to robust software that integrates with HR systems and workplace apps like Slack, Microsoft Teams, or Google Workspace. They provide a transparent, easy-to-use system where employees can request time off, managers can approve or deny requests in real-time, and HR teams can generate reports and ensure policy compliance effortlessly.

Reduces Administrative Workload

Tracking vacation days manually can quickly become a tedious and time-consuming task, especially as the team grows. HR managers and team leads often find themselves buried under piles of leave requests, juggling between spreadsheets, email threads, and calendar invites to ensure everything is properly recorded.

A vacation tracker automates this process, reducing the administrative burden significantly. It eliminates repetitive tasks like updating spreadsheets or manually calculating leave balances, allowing HR teams to focus on more strategic activities like talent development and employee engagement.

Example: Instead of spending hours at the end of each month reconciling time-off data from different sources, HR managers can generate a report with just a few clicks, showing all approved and pending leaves in one place.

Improves Transparency and Communication

One of the biggest challenges in managing employee leave is maintaining clear communication between employees, managers, and HR. Miscommunication can lead to overlapping vacations, understaffed teams, and even workplace tension.

A vacation tracker provides full visibility into who is on leave and when, making it easier to plan projects, allocate resources, and avoid scheduling conflicts. Employees can see their leave balances and team calendars, while managers can approve or decline requests with all the information at their fingertips.

Example: Imagine a situation where two key team members unknowingly plan vacations during the same week, jeopardizing an important project deadline. A vacation tracker with shared calendars helps prevent such conflicts by giving everyone a clear view of team availability.

Ensures Compliance with Leave Policies

Every organization has its own set of leave policies, whether related to vacation accrual, sick days, or statutory holidays. Keeping track of these policies manually can be challenging, especially for global teams dealing with different labor laws and regulations.

Vacation trackers enforce these policies automatically. They can be customized to reflect different leave types, accrual rules, carryover limits, and maximum allowable days off. This ensures consistency across the organization and helps avoid disputes related to leave entitlements.

Example: If your company allows a maximum of 20 vacation days per year with a carryover limit of 5 days, a vacation tracker will automatically apply these rules. Employees will be notified when they reach their limit, and HR won’t have to manually monitor each person’s usage.

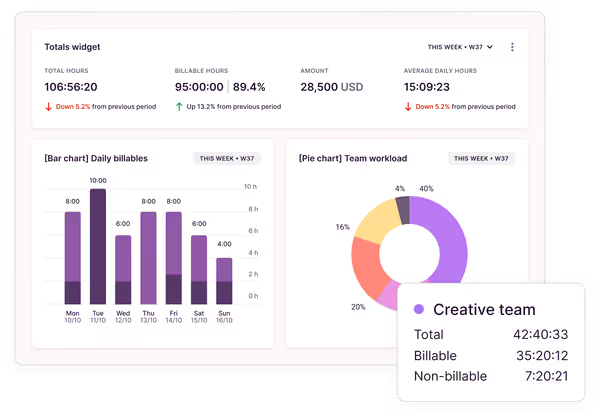

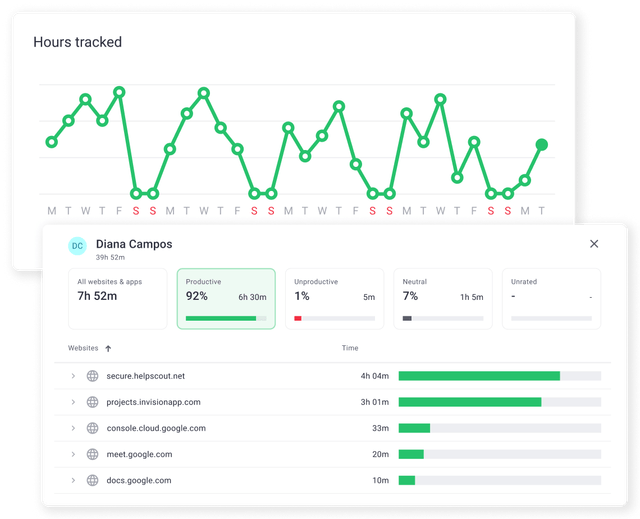

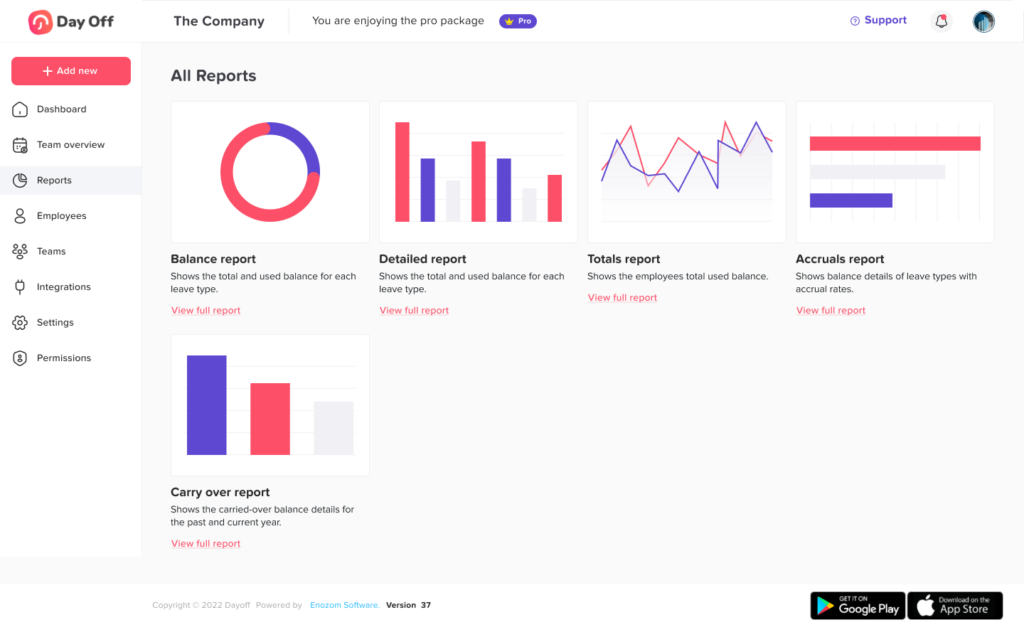

Provides Data and Insights

Vacation trackers aren’t just about managing requests; they also provide valuable insights into employee leave patterns. Through comprehensive reporting and analytics, managers can identify trends such as frequent absenteeism, seasonal spikes in vacation requests, or potential burnout risks.

This data helps leaders make informed decisions about workload distribution, hiring needs, and even employee wellness initiatives.

Example: If reports show that employees are not using their vacation days, it might indicate an overworked team culture, prompting management to encourage better work-life balance. Conversely, spotting patterns of frequent short-term absences could highlight underlying issues like job dissatisfaction or health problems.

Key Features to Look for in a Vacation Tracker

Choosing the right vacation tracker isn’t just about picking the most popular tool on the market—it’s about finding the solution that aligns with your organization’s specific needs, culture, and workflow. Here are some critical features to consider when selecting a vacation tracker:

User-Friendly Interface

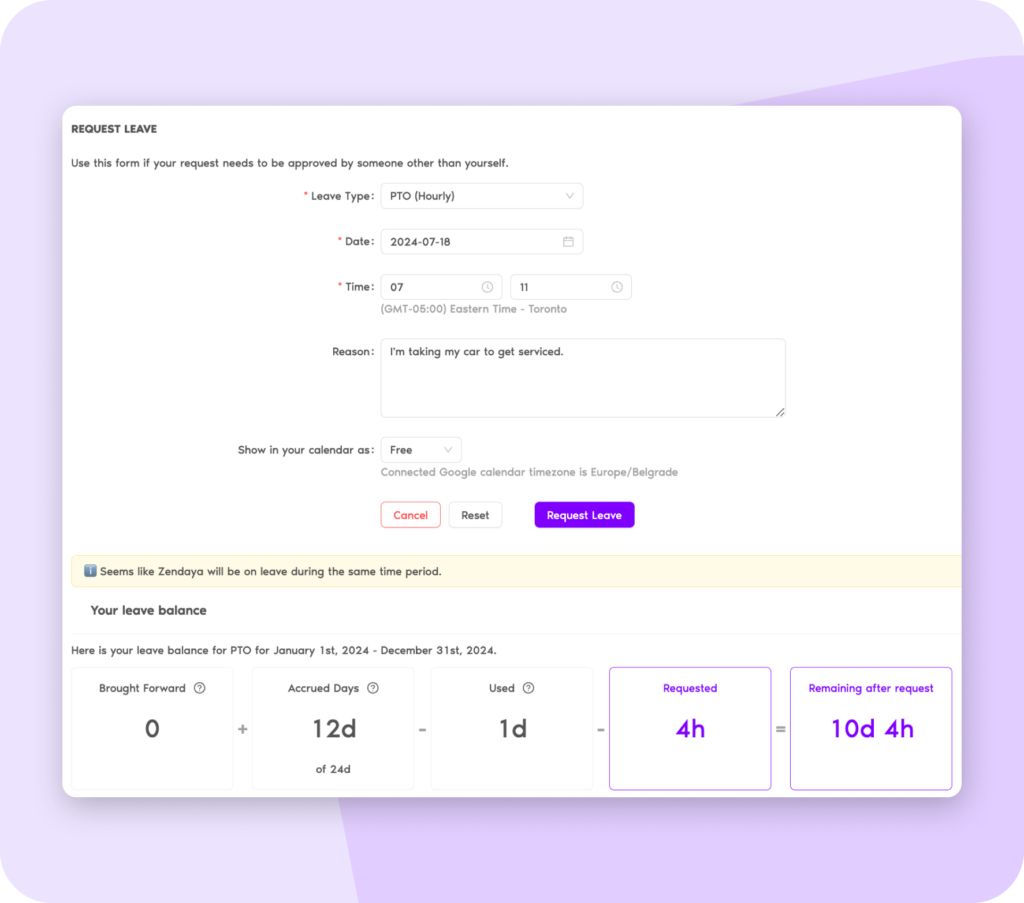

A vacation tracker should simplify processes, not complicate them. An intuitive, easy-to-use interface is crucial for ensuring that both employees and managers adopt the tool quickly and use it effectively.

Look for software with a clean, simple dashboard that makes it easy to submit and approve requests, view leave balances, and generate reports. A steep learning curve can lead to resistance from staff, defeating the purpose of introducing the tool in the first place.

Example: A well-designed vacation tracker allows employees to submit a leave request in just a few clicks, while managers can approve or decline requests with a simple tap on their phone or desktop.

Integration with Existing Tools

To maximize efficiency, your vacation tracker should integrate seamlessly with the tools your team already uses. Whether it’s Slack, Microsoft Teams, Google Workspace, or project management tools like Asana or Trello, integration helps create a streamlined workflow without the need to switch between multiple platforms.

Integrations also allow for automatic calendar updates, so team schedules are always up-to-date, and no one misses important deadlines due to unplanned absences.

Example: With Slack integration, employees can request time off directly within the chat app, and managers can approve it without leaving their Slack workspace. The approved leave is then automatically added to the team calendar.

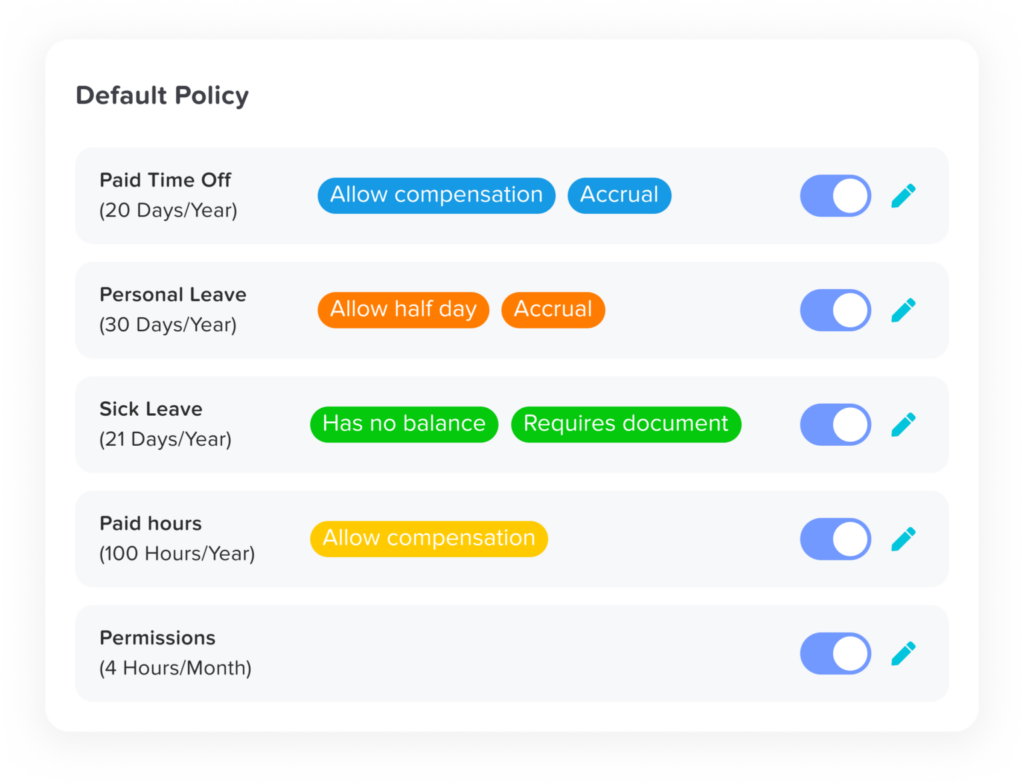

Customizable Leave Types and Policies

Every organization has unique leave policies, and your vacation tracker should be flexible enough to accommodate them. Look for tools that allow you to create custom leave types (e.g., vacation, sick leave, parental leave, unpaid leave) and set rules for accrual, rollover, and approval processes.

This customization ensures that the system aligns perfectly with your company’s policies and makes it easier to manage complex leave scenarios, such as part-time employees or international teams with different holiday schedules.

Example: If your company offers a special “wellness day” or “volunteer leave,” you can add these as unique leave types with specific rules and approval workflows.

Automated Notifications and Reminders

A good vacation tracker keeps everyone informed without constant manual follow-ups. Automated notifications for pending approvals, upcoming vacations, or changes to leave policies ensure that no request goes unnoticed and that employees stay aware of their remaining leave balances.

This feature not only saves time but also minimizes the risk of forgotten requests or overlooked approvals.

Example: If a manager forgets to approve a pending leave request, the system will automatically send a reminder. Similarly, employees receive alerts when their leave requests are approved, denied, or nearing their leave limit.

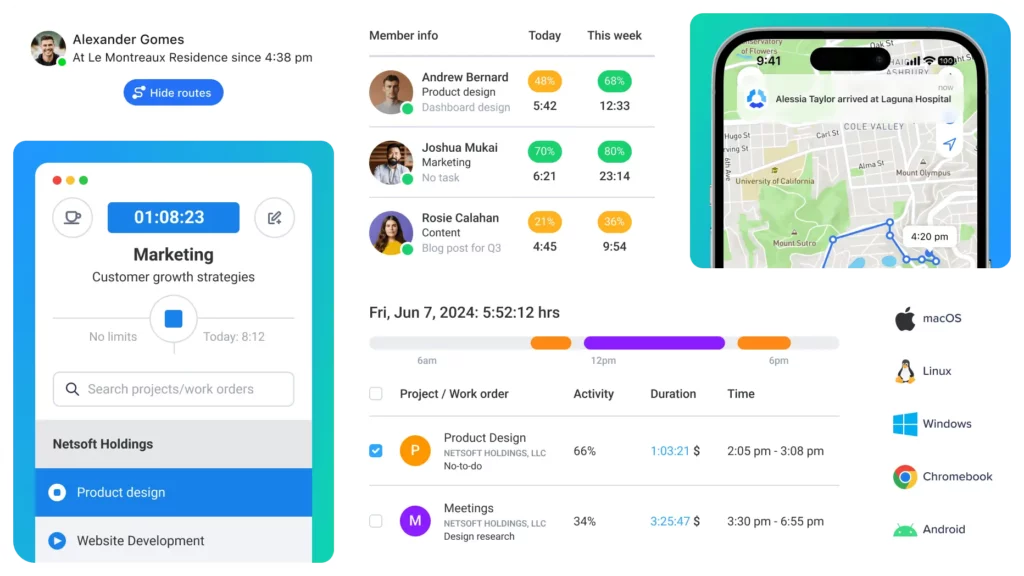

Mobile Access

In today’s mobile-first world, having access to your vacation tracker on the go is crucial. A mobile-friendly interface or dedicated app allows employees and managers to handle time-off requests from anywhere, whether they’re at home, commuting, or traveling.

This flexibility is particularly important for remote teams or companies with field employees who may not have regular access to a desktop.

Example: An employee can quickly submit a sick leave request from their smartphone while at home, and their manager can approve it instantly, even while attending an off-site meeting.

Reporting and Analytics

Detailed reports on leave usage help HR and management teams make data-driven decisions. Whether it’s identifying trends in absenteeism, planning for peak vacation seasons, or ensuring compliance with labor regulations, robust reporting features are essential.

Look for vacation trackers that offer customizable, exportable reports and visual dashboards for quick insights.

Example: HR can generate monthly reports to see which departments are taking the most time off, helping them identify if certain teams are overworked or if there’s a need for additional hiring.

Security and Privacy

Since vacation trackers handle sensitive employee data, security is non-negotiable. Choose a tool that prioritizes data protection, offers encryption, and complies with privacy regulations like GDPR.

Ensure that the tool provides role-based access, so only authorized personnel can view or modify sensitive information.

Example: Managers should only have access to the leave data for their team members, while HR administrators can view and manage company-wide records.

Top Vacation Tracker Tools For Your Team

Here are some of the best vacation tracker tools available today, each catering to different organizational needs. Whether you’re looking for a simple solution for a small team or a comprehensive system for a large enterprise, there’s an option for you.

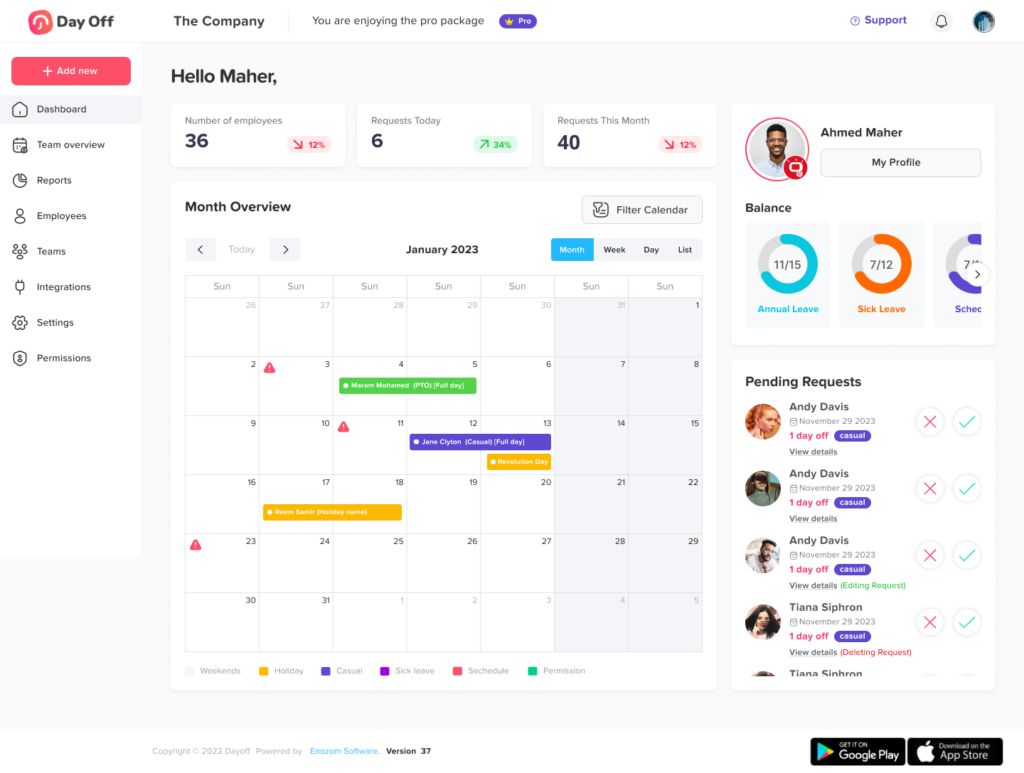

Day Off Vacation Tracker

Day Off is a simple yet powerful vacation and leave tracker built to make time off management effortless for teams of all sizes. With its intuitive, mobile-first interface, employees can submit time-off requests in just seconds, while managers can review, approve, or decline them instantly, from anywhere.

Designed to simplify communication and coordination, Day Off integrates seamlessly with tools your team already uses, like Google Calendar and Slack, ensuring everyone stays informed and team schedules remain synchronized in real time.

Whether you’re a small startup or a growing enterprise, Day Off provides a hassle-free way to manage Paid Time Off (PTO), vacations, sick leave, and remote work days, without the complexity of larger HR systems.

Key Features

Modern, Mobile-First Interface

Manage and track time-off requests with a clean, intuitive design that works flawlessly on both desktop and mobile devices.Customizable Leave Types & Policies

Define your own leave categories, such as vacation, sick leave, or work-from-home, and tailor approval workflows to match your company’s policy.Work Schedules & Calendar Sync

View employee work schedules and upcoming absences in one place. Integrate directly with Google Calendar to keep your team’s availability always up to date.Multiple Approvers & Smart Approval Flows

Set up flexible approval hierarchies with multi-level approvers (e.g., team leads, department heads, HR) to ensure every request follows the right chain of approval.Seamless Integrations

Connect with Slack for real-time notifications, reminders, and time-off summaries, keeping everyone informed without extra emails or spreadsheets.Single Sign-On (SSO)

Enable secure, one-click access with SSO integration through popular providers like Google Workspace, Microsoft Azure AD, and Okta.Automated Notifications & Reminders

Stay informed with instant updates when requests are submitted, approved, or approaching. No more missed messages or unplanned absences.Comprehensive Reporting & Insights

Generate detailed reports on PTO usage, department trends, and employee availability to make data-driven workforce decisions.

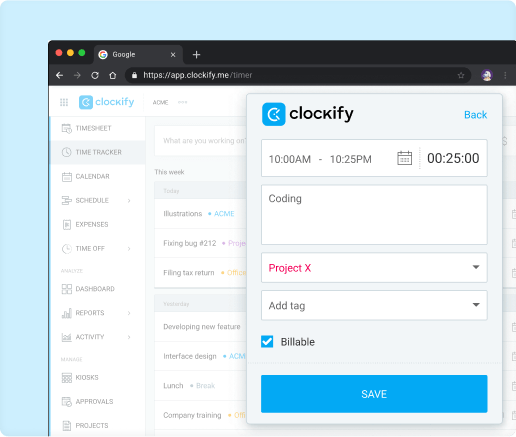

Vacation Tracker

Vacation Tracker is a robust leave management solution that integrates directly into Slack, Microsoft Teams, and Google Workspace. It allows teams to request and approve time off without leaving their favorite collaboration tools.

Vacation Tracker’s customizable settings, detailed reports, and automated reminders make it a top choice for remote and hybrid teams looking to simplify their leave management processes.

Key Features:

Deep integration with Slack, Teams, and Google Workspace

Customizable leave types and accrual policies

Daily and weekly absence summaries

Automated reminders for managers and employees

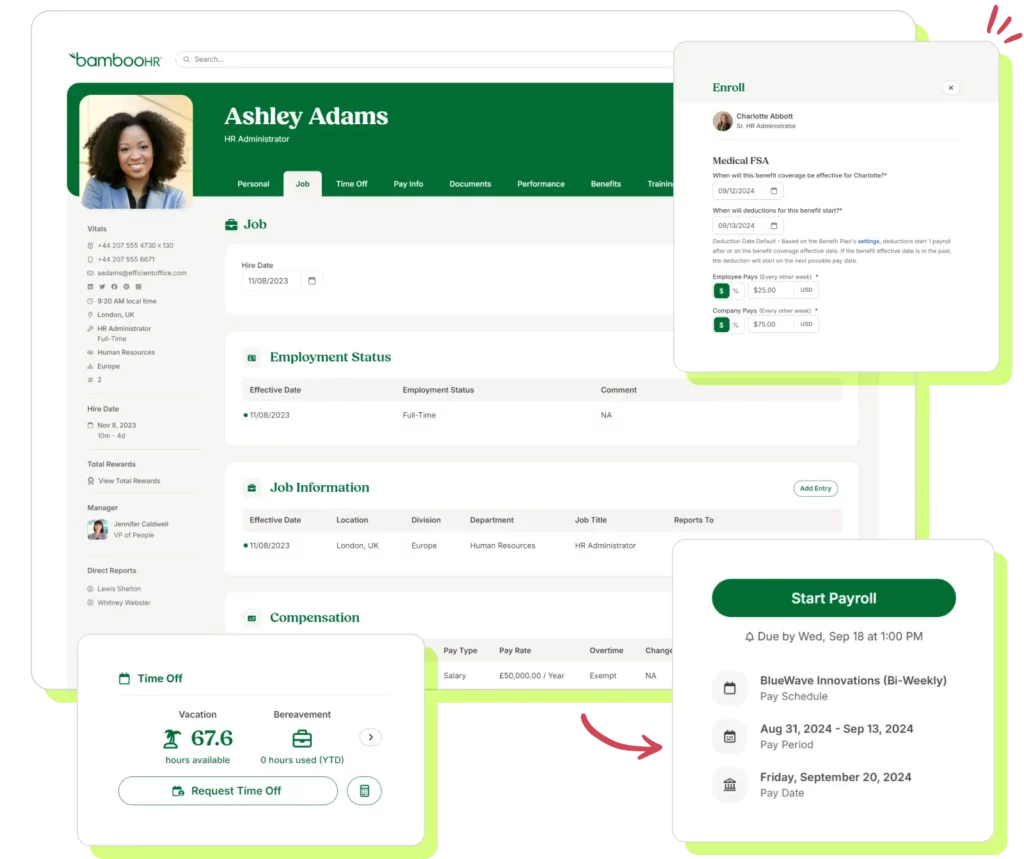

BambooHR

BambooHR is more than just an HR management system, it also offers a powerful vacation tracking feature tailored for small to mid-sized businesses. It simplifies PTO tracking by automating accruals and approvals, while seamlessly integrating with payroll and other HR functions. With an intuitive interface and mobile access, it makes leave management efficient for both employees and managers.

Key Features:

PTO tracking with automated accruals and approvals

Easy-to-use employee self-service portal for leave requests

Integration with payroll and other HR tools

Mobile app for managing time-off on the go

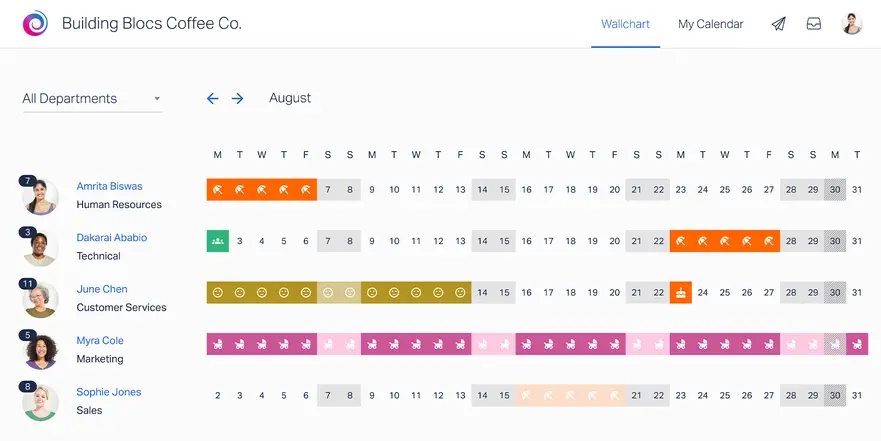

Timetastic

Timetastic is a straightforward, no-frills vacation tracker designed for small businesses that value simplicity and efficiency. It offers an affordable solution for managing employee time off, focusing on ease of use without overwhelming features. With a clean calendar view and seamless integrations, it makes tracking absences hassle-free.

Key Features:

Clear, easy-to-use calendar view of team absences

Integration with Google Calendar and Outlook for seamless scheduling

Automated email notifications for upcoming leaves

Mobile app for quick and convenient access on the go

Frequently Asked Questions (FAQ)

What is a vacation tracker, and how does it work?

A vacation tracker is a digital tool that automates and simplifies the process of managing employee leave. It allows employees to submit time-off requests, managers to review and approve them, and HR teams to maintain accurate records, all within a centralized system. Most vacation trackers integrate with tools like Google Workspace, Slack, or Microsoft Teams, providing real-time updates and visibility across the organization.

Why should my company invest in a vacation tracker?

Manual tracking methods like spreadsheets and emails are inefficient and prone to error. A vacation tracker eliminates these issues by automating the leave management process. It reduces administrative workload, improves visibility, ensures compliance with company policies, and provides valuable data insights for workforce planning and employee well-being.

Can vacation trackers integrate with the tools we already use?

Yes. Most modern vacation trackers integrate seamlessly with your existing platforms, including Slack, Microsoft Teams, Google Workspace, Outlook, Trello, and Asana. These integrations enable automatic calendar updates and streamline communication, ensuring that all team members stay informed without switching between multiple tools.

Are vacation trackers suitable for remote or hybrid teams?

Absolutely. Vacation trackers are particularly beneficial for remote and hybrid teams where employees may work across different locations and time zones. With cloud-based access and mobile apps, team members can submit requests and view their leave balances from anywhere, while managers can approve and monitor absences in real time.

Can we customize leave types and policies?

Yes. Most vacation trackers offer extensive customization options. You can create different leave types such as vacation, sick leave, parental leave, volunteer days, or unpaid time off, and set specific rules for accrual, carryover, and approval workflows. This flexibility ensures that the system aligns perfectly with your organization’s unique policies and legal requirements.

How do automated notifications and reminders help?

Automated notifications ensure that no request is missed or forgotten. Employees receive reminders when they approach their leave limits, while managers are alerted to pending approvals or upcoming absences. These reminders improve communication, prevent scheduling conflicts, and reduce manual follow-ups.

How does a vacation tracker improve transparency and communication?

Vacation trackers provide a shared calendar view that shows who is on leave and when. This visibility helps teams plan projects effectively, avoid overlapping vacations, and allocate resources efficiently. Employees, managers, and HR all have access to accurate, real-time information, which promotes clarity and accountability.

Are vacation trackers secure?

Yes. Leading vacation trackers adhere to strict data protection standards, such as GDPR compliance. They use encryption, secure cloud storage, and role-based access control to safeguard sensitive employee information. Only authorized users can view or modify data, ensuring privacy and security at all times.

How can vacation trackers help with compliance and reporting?

Vacation trackers automatically enforce company leave policies, including accrual rates, carryover limits, and maximum leave allowances. They also generate detailed reports and analytics that help HR monitor compliance, identify trends, and make data-driven decisions about staffing, scheduling, and employee engagement.

What should I look for when choosing a vacation tracker?

When selecting a vacation tracker, prioritize features that align with your organization’s needs, such as:

User-friendly interface

Seamless integration with existing tools

Customizable leave policies

Automated notifications and approvals

Mobile accessibility

Robust reporting and analytics

Strong security and compliance standards

Choosing the right tool ensures your leave management process is efficient, accurate, and scalable.

How much do vacation trackers typically cost?

Pricing varies depending on the platform and features. Some solutions, like Timetastic or Day Off, offer affordable plans for smaller teams, while comprehensive HR suites like BambooHR include vacation tracking as part of a broader package. Many providers offer free trials so you can evaluate functionality before committing.

How do vacation trackers benefit employees?

For employees, vacation trackers simplify the process of requesting and managing time off. They can easily view their remaining leave balances, upcoming holidays, and request statuses. This transparency empowers employees to plan their time confidently and supports a healthier work-life balance.

How do vacation trackers support HR and management teams?

Vacation trackers save HR teams time by automating repetitive tasks and maintaining accurate, centralized records. Managers gain visibility into team availability, helping them plan workloads and avoid resource shortages. The insights provided by reporting tools also support better decision-making around staffing, scheduling, and wellness initiatives.

Conclusion

A reliable vacation tracker is more than just a convenience; it’s a necessity for modern businesses striving for efficiency, transparency, and compliance. By automating the time-off management process, companies can reduce administrative workloads, improve team communication, and ensure that leave policies are applied consistently and fairly.

Whether you’re a small startup or a large enterprise, choosing the right vacation tracker like Day Off can significantly enhance your team’s productivity and satisfaction. Take the time to evaluate your organization’s unique needs, explore the features of various tools, and implement a solution that will help your business thrive in today’s fast-paced work environment.