Effective leave management is one of the most vital HR functions in any organization. When handled correctly, it helps maintain a balanced and productive workforce while supporting employees’ physical and mental well-being. When neglected, it can lead to burnout, miscommunication, payroll errors, and operational disruption.

In today’s hybrid and flexible work environments, organizations can no longer rely on manual spreadsheets or email chains to handle leave requests. Instead, they need a comprehensive leave management system, a digital solution that automates time-off requests, approvals, tracking, and reporting.

Day Off is a powerful, intuitive platform built for modern HR teams. It helps companies of all sizes manage employee absences efficiently while promoting a culture of transparency and trust. Below, we explore the core features of Day Off, their strategic benefits, and how they contribute to a more efficient and people-focused workplace.

Key Features of a Day Off Tracking System

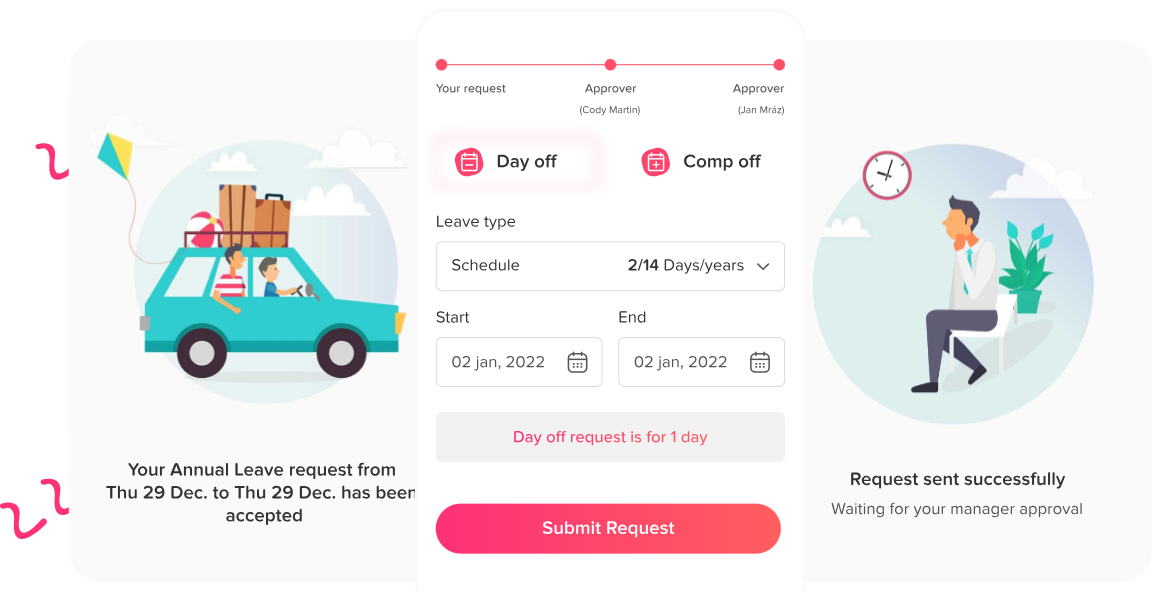

Automated Leave Request and Approval Workflow

One of the most transformative features of a leave management system is automation. Instead of using outdated paper forms or endless email chains, employees can submit their leave requests digitally. The system automatically routes each request to the appropriate supervisor or HR manager based on predefined approval hierarchies.

This process ensures:

-

Speed and accuracy: Requests and approvals happen in seconds, not days.

-

Transparency: Every action is documented, leaving a clear digital trail.

-

Fairness: Standardized workflows prevent favoritism or inconsistent decisions.

-

Reduced workload: HR teams spend less time manually processing leave forms.

For example, an employee might request five vacation days through the Day Off mobile app. The system immediately notifies their manager, who reviews it in the dashboard, checks team availability, and approves it with one click. The employee then receives an automatic confirmation email and calendar update.

This seamless automation not only saves administrative time but also builds confidence in the HR process, employees know their requests are being handled efficiently and fairly.

Real-Time Leave Balance Tracking

Keeping track of how many vacation or sick days employees have left can quickly become chaotic if done manually. Real-time tracking solves this problem by giving both employees and managers instant visibility into current balances and usage.

With Day Off:

-

Employees always know how much leave they have left.

-

Managers can make informed scheduling decisions before approving requests.

-

HR can easily monitor trends and ensure policy compliance.

This transparency prevents confusion and disputes about entitlements. For instance, if an employee’s annual PTO balance is 20 days and they’ve already used 10, the system automatically updates their remaining balance to 10 days, visible to both the employee and HR in real time.

Such clarity builds trust and promotes proactive leave planning, reducing last-minute absences and improving workload distribution.

Integration with Popular Workplace Tools

Modern workplaces rely on interconnected systems. A great leave management platform shouldn’t exist in isolation, it should integrate smoothly with the tools teams use every day.

Day Off connects with Google Calendar, Outlook Calendar, Microsoft Teams and Slack, among others. This means:

-

Approved leaves automatically appear in shared calendars.

-

Slack notifications alert teams to who’s out of the office.

-

Managers get quick reminders of pending approvals.

For instance, when an employee’s vacation request is approved, their absence automatically appears in the team calendar, so everyone knows who’s unavailable. This level of integration eliminates confusion, ensures better project planning, and keeps the entire team aligned.

By blending with communication and scheduling tools, Day Off becomes a natural part of the organization’s daily workflow rather than an extra HR burden.

Blockout Dates for Scheduling Control

Every business has certain periods when it’s “all hands on deck.” These could include the end of a fiscal year, seasonal sales spikes, or major project deadlines. To maintain operational stability, HR needs the ability to restrict leave requests during these critical windows.

Day Off’s blockout date feature allows HR managers to:

-

Prevent leave submissions during high-demand periods.

-

Limit the number of employees off at the same time.

-

Maintain balanced staffing across departments.

For example, a retail business might block out the last two weeks of December to ensure full staffing during holiday sales. Employees can see these restrictions directly in their dashboard, avoiding misunderstandings or conflicts.

This feature ensures operational continuity without compromising fairness, as the system applies restrictions transparently to everyone.

Customizable Leave Policies

Every company’s leave policy is unique. Some organizations grant PTO monthly, others annually; some allow carryover, others don’t. Day Off supports full customization to align with your organization’s specific rules, legal obligations, and culture.

You can tailor policies by:

-

Leave type: Configure vacation, sick, parental, bereavement, or unpaid leave.

-

Accrual method: Choose between annual, monthly, or real-time accruals.

-

Carryover settings: Decide whether unused leave rolls over to the next year.

-

Approval hierarchy: Assign multiple approvers or department-specific workflows.

For instance, an employee in the finance department might accrue 1.5 vacation days per month, while a senior executive accrues 2.5. The system automatically applies the correct rules without manual intervention.

This level of flexibility ensures compliance, fairness, and alignment with company culture while reducing administrative complexity.

Mobile Accessibility for On-the-Go Management

In today’s fast-paced, hybrid work environment, accessibility is key. Day Off’s mobile application, available for both iOS and Android, ensures that leave management is always at your fingertips.

With the mobile app, employees can:

-

Submit requests and track approval status anywhere.

-

View current balances instantly.

-

Receive real-time push notifications about updates.

Meanwhile, managers can review and approve requests during travel or meetings, keeping operations running smoothly even when they’re away from their desks.

Mobile access also supports inclusivity by allowing field workers, remote employees, or global teams to participate equally in HR processes. It eliminates bottlenecks, making leave management more agile and accessible.

Reporting and Analytics for Data-Driven HR Decisions

Data is one of HR’s most valuable tools. With Day Off’s reporting and analytics, HR teams gain deep insights into employee attendance, leave patterns, and workforce trends.

Analytics help organizations to:

-

Identify peak leave seasons to plan ahead.

-

Spot absenteeism patterns that may signal burnout or dissatisfaction.

-

Evaluate team workloads and productivity levels.

-

Generate compliance reports for audits and management reviews.

For instance, analytics might reveal that a certain department consistently takes more sick days during specific months. This could signal underlying stress, prompting management to investigate workload distribution or team morale.

By turning leave data into actionable insights, HR can make strategic decisions that support both business performance and employee well-being.

Employee Self-Service Portal

Empowering employees is at the heart of modern HR practices. Day Off’s self-service portal allows employees to manage their leave independently—reducing administrative burden and improving transparency.

Employees can:

-

Submit and track leave requests.

-

View balances and historical records.

-

Access official leave policies.

-

Communicate directly with HR about leave-related queries.

This independence promotes trust and engagement. Instead of waiting for HR to manually check balances or respond to emails, employees can handle their time-off needs autonomously, saving everyone time and effort.

A self-service system also ensures consistency and reduces HR workload by automating routine inquiries and actions.

Benefits of Implementing a Leave Management System

A robust leave management system like Day Off provides tangible benefits across all organizational levels:

-

Operational efficiency: Automation eliminates manual errors and administrative overload.

-

Compliance assurance: Built-in policy and legal rule enforcement reduces risk.

-

Employee empowerment: Self-service tools foster transparency and accountability.

-

Strategic workforce planning: Analytics help anticipate staffing needs.

-

Improved morale: Fair and efficient leave management contributes to job satisfaction.

-

Work-life balance: Employees feel supported in maintaining personal and professional well-being.

In essence, effective leave management enhances both employee happiness and organizational success.

How to Choose the Right Leave Management System

Selecting a system that aligns with your company’s goals is key to maximizing value. Consider:

-

User experience: Is it intuitive for both employees and HR staff?

-

Customization: Can it adapt to your policies and regulations?

-

Integrations: Does it connect with calendars, payroll, and communication tools?

-

Scalability: Will it grow with your business?

-

Security: Are employee data and privacy protected?

-

Support: Does the vendor offer reliable customer assistance?

Day Off excels in all these areas, offering a balance of usability, flexibility, and data security designed for today’s dynamic workplaces.

Implementation Tips for HR Teams

To ensure a smooth transition to a digital leave management system:

-

Communicate clearly: Explain the benefits and new processes to all staff.

-

Provide training: Offer demos or quick-start guides.

-

Customize early: Configure policies before onboarding users.

-

Test thoroughly: Run pilot programs in select departments.

-

Gather feedback: Adjust workflows based on real user input.

Proper implementation sets the foundation for long-term adoption and success.

Frequently Asked Questions (FAQ)

What is a leave management system?

A leave management system is a digital solution that automates how organizations handle employee absences, from submitting and approving requests to tracking balances and generating reports. Instead of relying on paper forms or manual spreadsheets, a digital system centralizes all data in one place, ensuring accuracy and efficiency.

It gives HR teams better control over compliance and workforce planning, while employees enjoy an easier, more transparent process for managing their time off. In essence, a leave management system streamlines communication, eliminates confusion, and creates a fair, well-documented process that benefits everyone involved.

How does automation improve HR efficiency?

Automation removes the manual, repetitive tasks that often slow down HR operations. Instead of sorting through emails or updating Excel sheets, automated workflows handle leave requests, approvals, and notifications in real time.

For example, when an employee submits a vacation request, the system immediately notifies the appropriate manager, updates calendars automatically, and adjusts the employee’s leave balance once approved. This eliminates bottlenecks and reduces the risk of human error.

By saving hours of administrative time, automation allows HR professionals to focus on more strategic initiatives such as employee engagement, retention, and development, areas that truly drive organizational success.

Can employees see their leave balance in real time?

Yes. Real-time visibility is one of the biggest advantages of a modern leave management system like Day Off. Employees can log in anytime, whether from their computers or mobile devices, to view exactly how much leave they’ve accrued, how many days they’ve used, and what remains available.

This transparency prevents misunderstandings and helps employees plan their vacations or personal days responsibly. It also builds trust by giving them control and clarity over their own data, instead of relying on HR for every small inquiry.

What makes integration important in leave management?

Integration ensures that your leave management system works seamlessly with other workplace tools, such as Google Calendar, Outlook, Teams, Slack, or your HR software. This connectivity eliminates redundancy and makes communication effortless.

For instance, when a leave request is approved, it automatically appears on shared calendars so everyone knows who’s out. Slack notifications can instantly alert managers to pending requests, while Outlook sync keeps meeting scheduling conflict-free.

Integrations not only enhance productivity but also ensure that teams stay informed and operations remain uninterrupted, even during employee absences.

Why should HR use analytics for leave tracking?

Analytics transform your leave data into actionable business insights. Instead of just tracking absences, HR can analyze trends to identify patterns that affect productivity, engagement, and workforce well-being.

For example, if a department consistently has high sick leave rates in specific months, it could indicate burnout or workload imbalance. With this insight, HR can take proactive steps such as adjusting staffing levels or launching wellness programs.

Data-driven decisions like these help optimize scheduling, improve employee satisfaction, and ensure a healthier, more balanced workplace overall.

Is mobile access secure?

Yes. Modern leave management platforms like Day Off prioritize data privacy and security. They use encryption protocols, secure authentication, and role-based access control to ensure that sensitive employee information stays protected, even when accessed remotely.

Employees and managers can safely request or approve leave from their mobile devices without worrying about data breaches. Security updates and cloud backups also ensure business continuity and compliance with data protection regulations such as GDPR.

In short, mobile access gives flexibility without sacrificing safety.

How do blockout dates help businesses?

Blockout dates are essential for maintaining operational stability during high-demand periods. They allow HR to restrict leave requests when the company needs all hands on deck, such as during product launches, audits, or holiday rushes.

This ensures that critical business functions aren’t disrupted by overlapping absences. Employees appreciate knowing these blackout periods in advance, as it sets clear expectations and prevents frustration.

By using blockout dates strategically, companies maintain productivity while still being fair and transparent about scheduling rules.

Can Day Off handle multiple types of leave policies?

Absolutely. Day Off is built to accommodate diverse leave structures, whether you’re managing standard vacation time, sick days, parental leave, bereavement, or unpaid time off.

It supports full customization for accrual methods (monthly, yearly, or real-time), carryover policies, and even department-specific approval workflows. For example, a healthcare team might need stricter limits on simultaneous absences than a marketing team, and Day Off can enforce those automatically.

This flexibility ensures compliance with local labor laws while aligning with your organization’s internal culture and structure.

How does a leave management system improve employee morale?

Transparency, fairness, and responsiveness are key to strong employee morale, and a good leave management system promotes all three. When employees can easily request time off, see their balances, and get quick approvals, they feel respected and valued.

A digital system also eliminates favoritism or inconsistency in approvals, reinforcing fairness. Moreover, by giving employees autonomy to manage their time off, organizations show trust in their workforce.

The result? Higher engagement, improved job satisfaction, and a stronger sense of work-life balance, all of which contribute to long-term loyalty and reduced turnover.

How long does it take to set up a system like Day Off?

Implementation is quick and hassle-free. Most organizations can get Day Off fully set up and customized within just a few hours. The system is designed with simplicity in mind, no complex installations or lengthy training required.

HR teams can define leave types, accrual rules, and approval hierarchies in minutes. Once configured, employees can be invited to join instantly, with guided onboarding and self-explanatory dashboards.

This speed of setup means you can start reaping the benefits of automation, transparency, and efficiency almost immediately.

Can small and medium-sized businesses benefit too?

Definitely. In fact, smaller businesses often benefit the most from implementing a leave management system early on. With limited HR staff, automation reduces administrative overhead and ensures professionalism in managing absences.

A platform like Day Off scales perfectly, offering affordable pricing and features that adapt as your company grows. For small teams, it saves time; for larger ones, it ensures consistency and compliance across departments.

Either way, it creates a structured, transparent process that promotes fairness and efficiency regardless of company size.

What challenges arise without a leave management system?

Without a centralized system, organizations often struggle with several issues: inconsistent leave approvals, miscommunication between departments, inaccurate tracking, and compliance risks.

Employees might take overlapping vacations, leaving teams understaffed. HR might lose time manually updating spreadsheets or resolving disputes about balances. These inefficiencies don’t just hurt productivity, they also damage employee trust.

A leave management system eliminates these problems by providing clarity, automation, and accountability in one easy-to-use platform.

How often should leave policies be reviewed?

Ideally, HR should review leave policies at least once a year, or sooner if there are changes in labor laws, company structure, or employee feedback.

Regular reviews ensure that your policies stay relevant, fair, and compliant. For example, if your company introduces remote work or flexible schedules, you might need to update how leave accrual and tracking are handled.

Soliciting employee feedback during reviews also helps refine policies to meet evolving needs, ensuring they remain both employee-friendly and business-efficient.

How does leave tracking contribute to work-life balance?

Accurate and transparent leave tracking encourages employees to take the time off they’ve earned, which is vital for rest, mental health, and overall well-being. When people know their requests will be handled fairly and efficiently, they’re more likely to take breaks that prevent burnout.

By supporting rest and recovery, companies promote higher productivity, creativity, and engagement. In this way, effective leave tracking becomes more than an HR function, it’s an investment in long-term employee health and performance.

Can leave management data support diversity and inclusion goals?

Yes. When analyzed thoughtfully, leave data can highlight patterns that support diversity, equity, and inclusion (DEI). For instance, tracking parental leave usage can help ensure equal access for all genders, while monitoring time-off trends can identify groups who might be underusing benefits due to workload or cultural barriers.

HR can then implement targeted initiatives, such as flexible scheduling or education on available benefits, to make the workplace more inclusive and equitable.

Thus, a well-implemented system like Day Off contributes not just to efficiency, but to building a fairer, more supportive company culture.

Conclusion

In the evolving world of work, leave management is not just an HR formality, it’s a strategic pillar of employee well-being and productivity. A modern, automated system like Day Off helps organizations manage leave efficiently, maintain transparency, and support flexibility.

By combining automation, data insights, and mobile accessibility, Day Off empowers HR teams to focus on people, not paperwork. The result? Happier employees, smoother operations, and a healthier workplace culture.