In an era where digital communication dominates, managing your email interactions efficiently is crucial. One tool that often goes unnoticed but offers significant utility is the fake email generator. While it might sound deceptive, these tools serve legitimate and practical purposes. This article explores what fake email generators are, their benefits, practical applications, and provides examples of their usage.

What is a Fake Email Generator?

A fake email generator creates temporary, disposable email addresses that can be used for a variety of purposes without exposing your real email address. These addresses are usually valid for a short period, allowing you to receive emails and respond, if necessary, after which they expire. Email generators are particularly useful in situations where privacy, security, and convenience are prioritized.

Benefits of Using Fake Email Generators

Privacy Protection

Using a fake email helps protect your primary email address from being exposed to spam or unwanted contacts. When signing up for a service or website that requires an email but might not have the best data security practices, a fake email ensures your real address stays private. This can be particularly beneficial in avoiding phishing scams or data breaches that might target your personal information.

Avoiding Spam

One of the most practical uses of fake emails is to avoid cluttering your main inbox with promotional emails. When you want to sign up for newsletters, promotions, or trials, a fake email can collect these communications without filling up your primary inbox. This separation helps maintain a clean and organized email environment, where important messages are not lost among marketing emails.

Testing and Development

Developers and testers can greatly benefit from fake email generators during the software and application development process. These tools allow for testing email functionalities such as registration, password recovery, and notifications without using real email addresses. This not only preserves privacy but also makes it easier to manage and reset test data during different phases of development.

Anonymity

Maintaining anonymity online is increasingly important for privacy and security. Fake email generators allow you to participate in online forums, surveys, or interact with unknown entities without revealing your real email address. This can be particularly useful in environments where you want to avoid potential harassment or simply keep your personal information private.

Managing Multiple Accounts

For those who need to manage multiple accounts on a single platform, fake email addresses provide a simple solution. Whether for testing purposes or to separate personal and professional activities, these generators enable you to create multiple accounts without the hassle of managing numerous real email addresses. This flexibility is invaluable for both personal use and business scenarios.

Practical Applications of Fake Email Generators

Software and App Testing

In the development and testing of software and apps, fake emails are indispensable. Developers can use them to simulate user interactions, test email notifications, and verify functionality. This helps ensure that features like user registration, password resets, and promotional communications work correctly before the product is released to real users.

Signing Up for Services

When exploring new services or platforms, using a fake email can prevent your primary inbox from being overwhelmed by potential spam. This is especially useful for trial periods or one-time usage scenarios where long-term communication is not necessary. It allows you to evaluate the service without committing your real contact information.

Short-term Projects

For temporary projects or collaborations, fake emails provide a convenient way to manage communications. Whether for a short-term business project, event planning, or any other temporary activity, using a disposable email address ensures that once the project is over, you won’t continue to receive related communications.

Online Shopping

Online shoppers can use fake emails to receive order confirmations and updates without sharing their real email with retailers. This helps maintain privacy and keeps your primary inbox free from marketing emails. Additionally, it reduces the risk of your email address being sold to third-party marketers, which is common with some online retailers.

Examples of Fake Email Generator

Mailinator

Mailinator provides disposable email addresses for public use. Just enter any address @mailinator.com, and you can check the inbox without needing to register. It’s particularly useful for quick, anonymous sign-ups and receiving short-term emails without any fuss. Mailinator’s simplicity and accessibility make it a popular choice for many users.

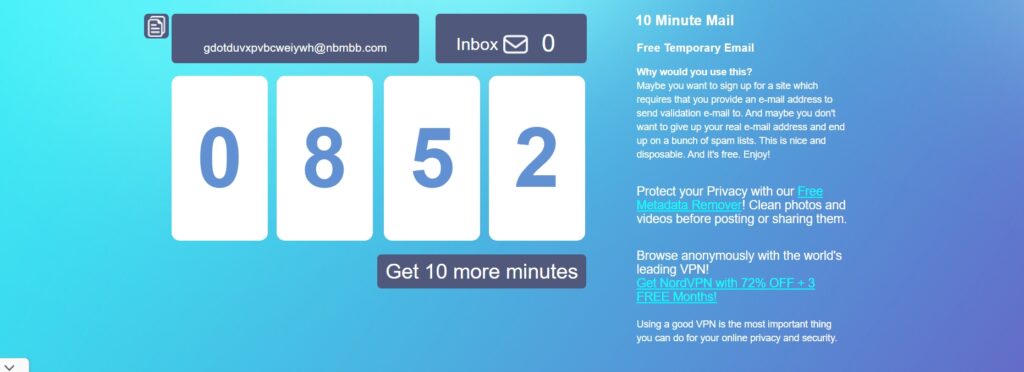

10MinuteMail

10MinuteMail offers temporary email addresses that expire after 10 minutes, although you can extend the time if needed. This service is ideal for scenarios where you need an email address for a very short period, ensuring maximum privacy and minimal spam. The automatic expiration feature means you don’t have to remember to delete the email address later.

Guerrilla Mail

Guerrilla Mail provides disposable email addresses that you can use for temporary purposes. It includes features like a spam filter and email attachments, making it suitable for a wide range of applications. Guerrilla Mail also offers the option to use a custom email address, adding flexibility for users who need a specific alias.

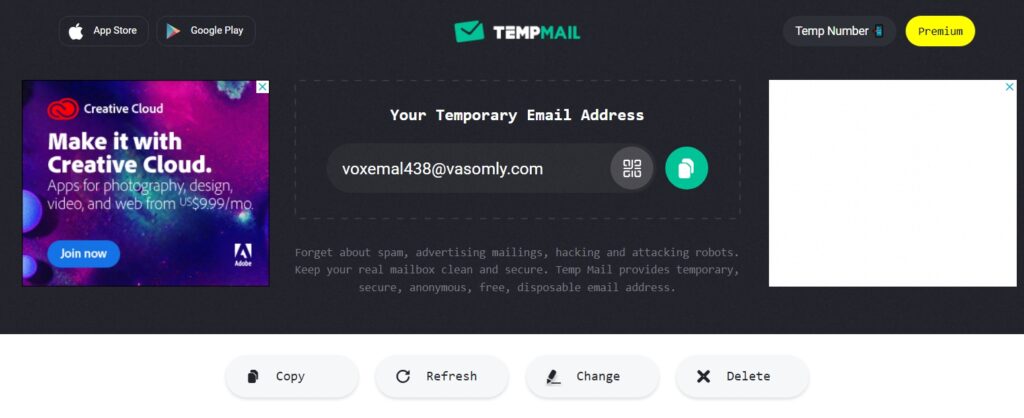

TempMail

TempMail offers temporary, anonymous email addresses with the ability to receive emails. It’s user-friendly and requires no registration, making it quick and easy to use. TempMail is especially useful for signing up for services and receiving verification emails without exposing your real email address.

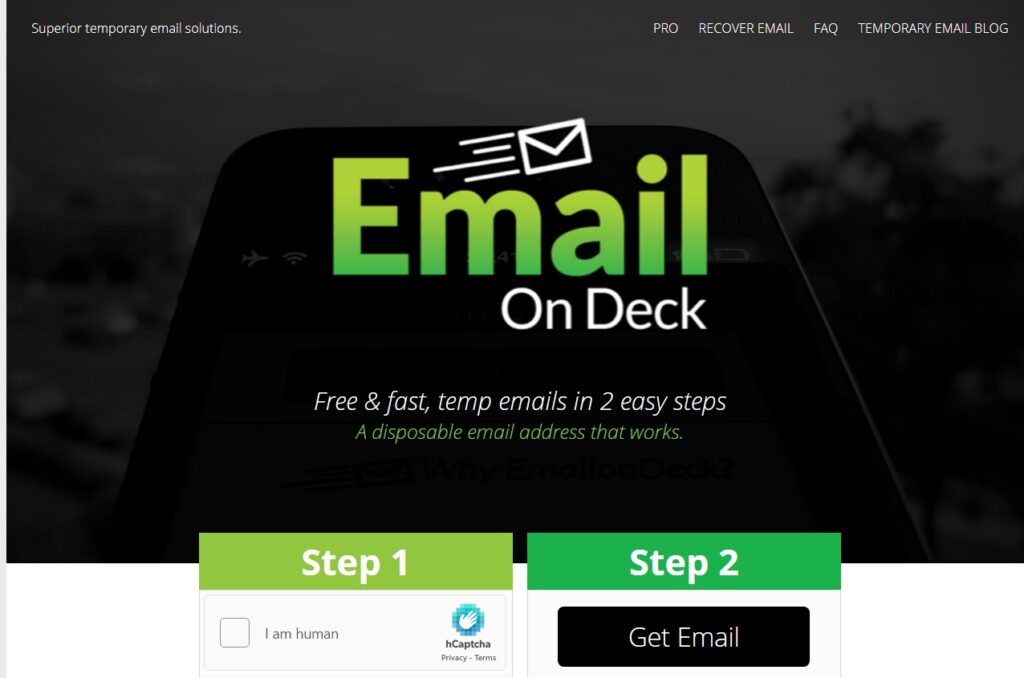

EmailOnDeck

EmailOnDeck provides disposable email addresses for short-term use. It’s designed to be fast and easy, making it a great choice for situations where you need a temporary email address quickly. EmailOnDeck’s focus on speed and simplicity makes it a favorite among users who need a temporary email solution without any hassle.

FAQ Section for Fake Email Generators

Are Fake Email Generators Legal?

Yes, fake email generators are legal to use in most jurisdictions. They are primarily intended for privacy protection and testing purposes. However, using them for fraudulent or malicious activities is illegal and can have serious consequences.

Can I Send Emails from a Fake Email Address?

Most fake email generators are designed to receive emails, not send them. However, some services might allow you to send responses. It’s important to check the specific features of the fake email generator you are using.

How Long Do Temporary Email Addresses Last?

The lifespan of a temporary email address depends on the service provider. Some expire after a few minutes, while others may last for a few hours or even days. Always check the expiration policy of the service you choose.

Can I Recover Emails After the Temporary Address Expires?

Typically, once a temporary email address expires, all associated emails are permanently deleted and cannot be recovered. If you need to keep certain emails, make sure to save or forward them to a permanent email address before the expiration.

Is There a Limit to How Many Fake Emails I Can Generate?

Most fake email generators do not impose strict limits on the number of email addresses you can create. However, some services may have usage policies or rate limits to prevent abuse. Refer to the terms of service for each provider.

Can I Use Fake Email Generators for Email Marketing?

Using fake email addresses for email marketing is not recommended and could lead to issues with deliverability and compliance. Email marketing should be done using legitimate email addresses that have opted in to receive communications from you.

Are Fake Email Generators Safe to Use?

Fake email generators are generally safe to use for their intended purposes. However, ensure you are using reputable services to avoid potential security risks. Do not use these tools for sensitive communications that require high levels of security.

Will Using a Fake Email Address Affect My Online Accounts?

Using a fake email address for non-critical accounts or temporary purposes typically does not have negative consequences. However, for accounts that require long-term access or where you might need to recover your password, use a valid and permanent email address.

How Do Fake Email Generators Handle Personal Data?

Reputable fake email generators do not store your personal data beyond the temporary email addresses and received emails. Always read the privacy policy of the service to understand how your data is handled and ensure it meets your privacy standards.

Can I Customize the Fake Email Address?

Some fake email generators allow you to create custom email addresses or select from a list of available domains. This can be useful if you need a specific alias or want the address to appear more legitimate.

Are There Any Alternatives to Fake Email Generators?

Alternatives include using alias email addresses provided by your primary email service (e.g., Gmail’s “+” addressing) or creating additional email accounts for specific purposes. These methods provide more control but might require more management effort.

Can Fake Email Generators be Traced Back to Me?

Generally, fake email generators are designed to protect your identity and do not link back to your real email address. However, using them for illegal activities can lead to investigations that may uncover your true identity through other means.

How Do I Choose the Best Fake Email Generator?

Consider factors such as the lifespan of the temporary email addresses, ease of use, available features (e.g., ability to send emails, custom domains), and user reviews. Selecting a reputable provider with positive feedback ensures a reliable experience.

Can I Use Fake Email Generators for Account Verification?

Fake email generators can be used for account verification during sign-ups or trials. However, for accounts that you plan to use long-term or that involve sensitive information, it’s better to use a real email address to avoid issues with access and recovery.

What Should I Do If I Receive Spam on a Fake Email Address?

If you receive spam at a fake email address, simply stop using that address. Since it is temporary, any spam received will not affect your primary email inbox. Some services also include spam filters to minimize unwanted emails.

Conclusion

Fake email generators are valuable tools that offer a range of benefits, from protecting your privacy to aiding in software development and testing. By creating temporary, disposable email addresses, these tools help manage spam, maintain anonymity, and streamline various digital interactions without exposing your real email address. They are particularly useful for signing up for services, engaging in short-term projects, and testing email functionalities without cluttering your primary inbox.

While email generators are generally safe and legal for legitimate purposes, it’s essential to use them responsibly. Avoid using them for fraudulent activities or long-term communications that may require future access. Selecting a reputable fake email generator with features that align with your needs will ensure a smooth and effective experience.