Understanding how much your annual salary translates to on an hourly basis is crucial for managing your finances, comparing job offers, and ensuring you’re being compensated fairly. If you’re earning 40K a year, you might wonder how that breaks down on an hourly level, especially when you consider factors like work hours, deductions, and different schedules. This article will guide you through calculating your hourly wage from a $40,000 annual salary, exploring different scenarios, and providing insight into how this wage affects your daily life.

Breaking Down the Annual Salary to an Hourly Wage

The Basic Calculation

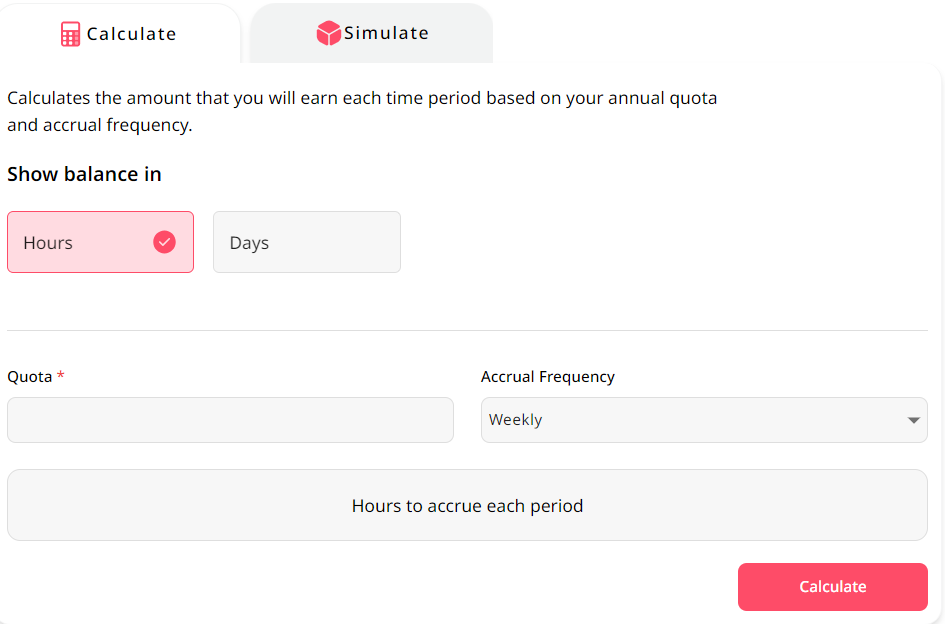

The fundamental formula to calculate your hourly wage from an annual salary is:

Hourly Wage= Annual Salary/Total Number of Hours Worked in a Year

Let’s break down each component:

Annual Salary: This is the amount you earn over an entire year before taxes and other deductions. In this case, it’s 40K.

Total Number of Hours Worked in a Year: This depends on how many hours you work per week and the number of weeks you work per year.

For a standard full time job, most people work:

- 40 hours per week: This is the typical full time work schedule in many industries.

- 52 weeks per year: This assumes you work every week of the year without taking unpaid leave.

Using these numbers:

Total Number of Hours Worked in a Year=40×52=2,080 hours

Now, you can calculate the hourly wage by dividing the annual salary by the total number of hours worked:

40,000/2,080=$19.23 per hour

So, with a $40,000 annual salary and a standard full time schedule, your hourly wage would be approximately $19.23.

What if You Work Part-Time or Have a Different Schedule?

Not everyone follows the typical 40 hour workweek. Some people work part time, have flexible hours, or take extended time off. Let’s explore how different schedules affect your hourly wage.

Part Time Work

If you work fewer hours per week, your hourly wage will increase because you’re earning the same annual salary for fewer hours of work. For example:

30 hours per week: If you work 30 hours a week instead of 40, your total annual work hours would be:

30×52=1,560 hours

Now, divide the $40,000 salary by the total hours worked:

40,000/1,560≈$25.64 per hour

This means your hourly wage increases to $25.64 if you’re working only 30 hours per week.

20 hours per week: If you work 20 hours per week, the calculation changes to:

20×52=1,040 hours

Dividing the annual salary by this number:

40,000/1,040≈$38.46 per hour

With a 20 hour workweek, your hourly wage jumps to $38.46.

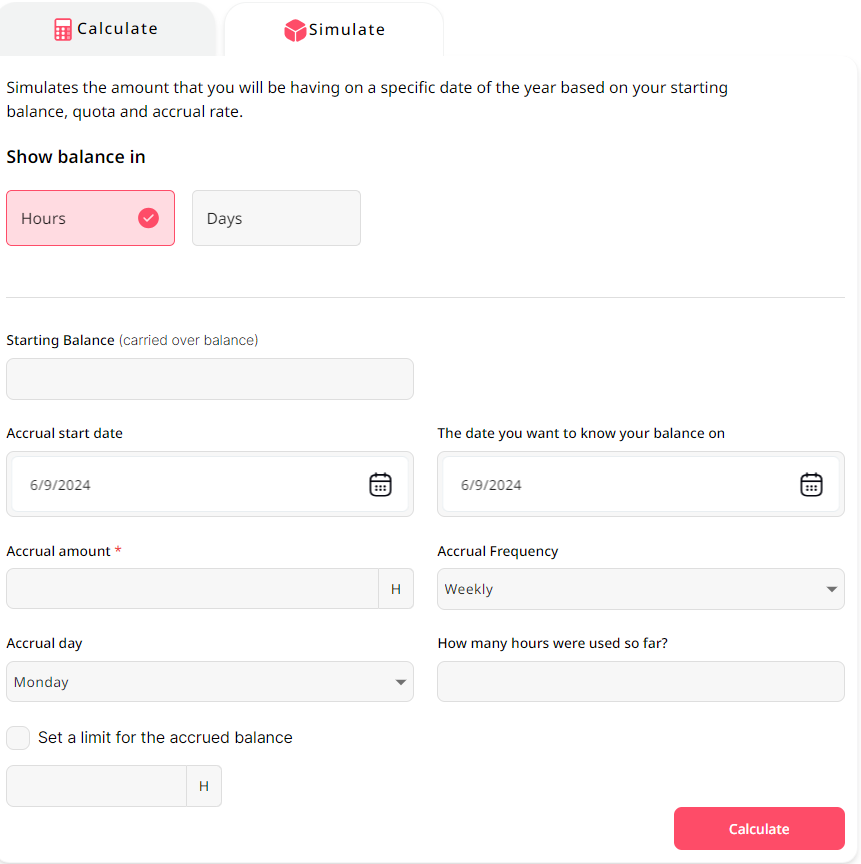

Accounting for Unpaid Time Off

If you take time off without pay, this reduces the total number of hours you work in a year, which in turn affects your hourly wage. For instance, if you take two weeks off without pay:

50 weeks of work per year: Instead of working 52 weeks, you only work 50 weeks.

40×50=2,000 hours

Your new hourly wage would be:

40,000/2,000=$20.00 per hour

This slight increase in your hourly wage reflects the reduced number of hours worked over the year.

The Impact of Deductions: Gross vs. Net Pay

Understanding your gross hourly wage is only part of the equation. What you actually take home your net pay can be significantly lower after deductions. These deductions typically include:

- Federal and State Taxes: The amount withheld for income taxes can vary depending on your tax bracket and state of residence.

- Social Security and Medicare Contributions: These are standard payroll deductions that fund Social Security and Medicare.

- Health Insurance Premiums: If your employer provides health insurance, your share of the premiums will be deducted from your paycheck.

- Retirement Contributions: Contributions to a 401(k) or other retirement plans also come out of your paycheck.

Let’s say your deductions amount to 25% of your gross income. Your gross hourly wage of $19.23 would then be reduced by 25%:

$19.23×(1−0.25)=$14.42 per hour

Thus, your net hourly wage the amount you actually receive after deductions would be around $14.42.

Comparing Cost of Living and Other Financial Considerations

Knowing your hourly wage is critical for budgeting and financial planning, but its true value depends heavily on where you live and your lifestyle. Here’s why:

Cost of Living

The cost of living varies widely across the United States. A 40K salary might be sufficient in a small town but could be challenging in a major metropolitan area. Essential expenses such as housing, food, transportation, and healthcare tend to be higher in cities with a higher cost of living.

Housing Costs: Rent or mortgage payments can take a significant portion of your income. If you’re spending 30% or more of your income on housing, it may be difficult to cover other expenses.

Utilities and Transportation: Utility bills and transportation costs (car payments, gas, insurance, public transit) can also eat into your budget.

Food and Healthcare: These are other essential expenses that can vary greatly depending on your location.

If you live in an area with a high cost of living, you may find that $19.23 an hour (before taxes) doesn’t go as far as you’d like. Understanding your hourly wage can help you adjust your budget or reconsider living in a more affordable area.

Industry Standards and Career Progression

It’s also important to compare your hourly wage to industry standards. In some fields, $19.23 an hour might be the starting point, with opportunities for significant raises or bonuses as you gain experience or take on more responsibilities. In other fields, it might be closer to the average wage, with less room for upward movement.

Entry Level vs. Experienced Roles: Entry level positions typically offer lower hourly wages, but as you gain experience, you should expect to see your wage increase. It’s important to regularly assess your wage in the context of your skills and experience.

Job Benefits: Consider the value of other benefits, such as health insurance, retirement contributions, and paid time off. These can add significant value to your total compensation package, even if the hourly wage seems low.

Lifestyle Choices

Finally, your personal lifestyle choices will play a big role in how far $40,000 a year will go. If you prioritize saving, live in a lower cost area, or have minimal debt, this salary could be sufficient. On the other hand, if you have high expenses or want to live a more lavish lifestyle, you may find that this income requires careful budgeting or additional income sources.

FAQ: Additional Questions About 40K a Year and Hourly Wages

How does overtime affect my hourly wage if I earn $40,000 a year?

If you earn 40K annually and are eligible for overtime pay, your hourly wage for overtime would typically be 1.5 times your regular hourly rate. Based on the standard calculation, your regular hourly wage is approximately $19.23. Therefore, your overtime pay rate would be:

$19.23×1.5=$28.85 per hour for overtime work

However, whether you’re eligible for overtime depends on your job classification under the Fair Labor Standards Act (FLSA). Salaried employees who meet certain criteria may be exempt from overtime pay.

How do bonuses and commissions factor into the $40,000 salary?

Bonuses and commissions can significantly affect your total earnings. If you receive additional compensation on top of your base 40K salary, you should factor these into your overall income. For example, if you earn a $5,000 bonus during the year, your total earnings would be $45,000, which would slightly increase your effective hourly rate.

You can calculate the new hourly rate by adding your bonus to your base salary and then dividing by the total hours worked:

45,000/2,080≈$21.63 per hour

Is $40,000 a year considered a good salary?

Whether 40K a year is a good salary depends on several factors, including your location, industry, and personal financial goals. In some areas with a low cost of living, $40,000 can provide a comfortable lifestyle. However, in cities with higher costs, such as New York or San Francisco, $40,000 may be considered lower income. It’s important to assess your personal expenses and lifestyle needs when determining if this salary is sufficient.

How do benefits like health insurance and retirement plans affect the value of a $40,000 salary?

Benefits such as health insurance, retirement contributions, and paid time off add significant value to your overall compensation package. While these benefits don’t directly increase your hourly wage, they reduce your out of pocket expenses and provide financial security. For example, employer provided health insurance might save you several thousand dollars annually, effectively boosting the value of your $40,000 salary.

How can I increase my hourly wage if I earn $40,000 a year?

There are several ways to increase your hourly wage:

- Negotiate a Raise: If you feel you’re underpaid, consider negotiating with your employer for a higher salary.

- Gain Additional Skills: Acquiring new skills or certifications can make you more valuable to your employer, potentially leading to a promotion or raise.

- Seek Higher Paying Positions: If your current job offers limited advancement opportunities, you might explore other positions or industries that pay more for similar work.

- Work Overtime: If you’re eligible for overtime, working extra hours at an increased pay rate can boost your overall earnings.

What if I’m paid biweekly? How does that affect my understanding of the 40K salary?

If you’re paid biweekly, you receive a paycheck every two weeks. Since there are 26 pay periods in a year, your biweekly gross pay would be:

40,000/26≈$1,538.46 per pay

Understanding your biweekly pay can help with budgeting, as it gives you a more immediate sense of how much you’ll receive regularly.

How does inflation impact the value of a 40K salary?

Inflation erodes the purchasing power of your salary over time. This means that as the cost of goods and services rises, your $40,000 salary may not go as far in covering your expenses. To maintain your standard of living, you may need to seek periodic raises or additional income sources that keep pace with inflation.

If I live in a state with no income tax, how does that affect my take home pay?

Living in a state without income tax (like Texas or Florida) means that you won’t have state income tax deducted from your paycheck. This can increase your take home pay compared to someone earning the same salary in a state with high income tax. However, other factors, like property taxes or the cost of living, should also be considered when evaluating the overall financial benefit.

How does 40K a year compare to the federal minimum wage?

The federal minimum wage is $7.25 per hour. If you work full-time at this rate, your annual earnings would be:

7.25×40×52=$15,080 per year

A $40,000 salary is significantly higher than the federal minimum wage, providing a greater level of financial security and more disposable income for savings, investments, or discretionary spending.

How does working fewer than 40 hours a week but more weeks per year affect the hourly wage calculation?

If you work fewer hours per week but work more weeks per year, you would need to adjust the calculation of total hours worked annually. For example, if you work 30 hours a week but for 52 weeks without any unpaid time off:

30×52=1,560 hours

Your hourly wage would then be:

40,000/1,560≈$25.64 per hour

This scenario might be common in part time or flexible job arrangements where employees work fewer hours per week but do not take extended breaks or unpaid time off.

Conclusion

Earning $40,000 a year translates to approximately $19.23 per hour if you’re working a standard 40 hour workweek. This hourly wage can vary depending on factors like part time work, unpaid time off, bonuses, and deductions. Understanding your hourly wage is crucial for effective budgeting, financial planning, and comparing job offers. It allows you to assess whether your salary meets your financial needs and helps you make informed decisions about your career and lifestyle. By breaking down your salary in this way, you gain a clearer picture of your true earnings and how they fit into your overall financial goals.