In today’s fast paced and technology driven world, managing employee time off efficiently is critical for maintaining productivity and employee satisfaction. Leave app have emerged as a powerful tool to streamline leave management processes for both HR departments and employees. This article explores the significant benefits of using a leave app and how it enhances the workplace experience.

What is a Leave Apps?

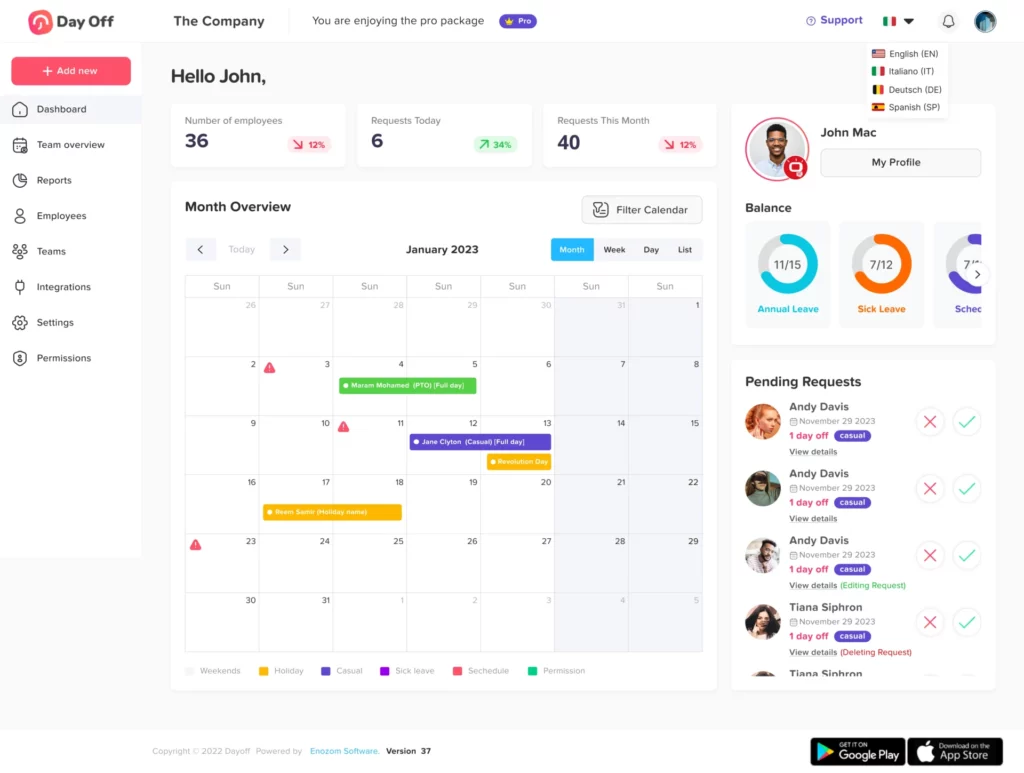

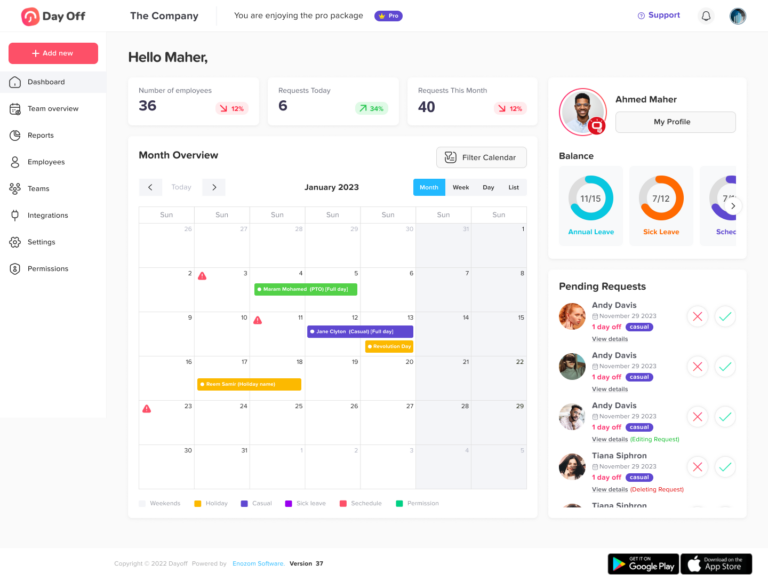

A leave app is a digital platform that automates the process of managing employee leave requests, approvals, and tracking. It provides a centralized system for both HR and employees to access leave information, apply for time off, and ensure compliance with company policies and regulations. Leave apps are typically accessible via desktop or mobile devices, ensuring convenience and accessibility.

Benefits of a Leave App for HR

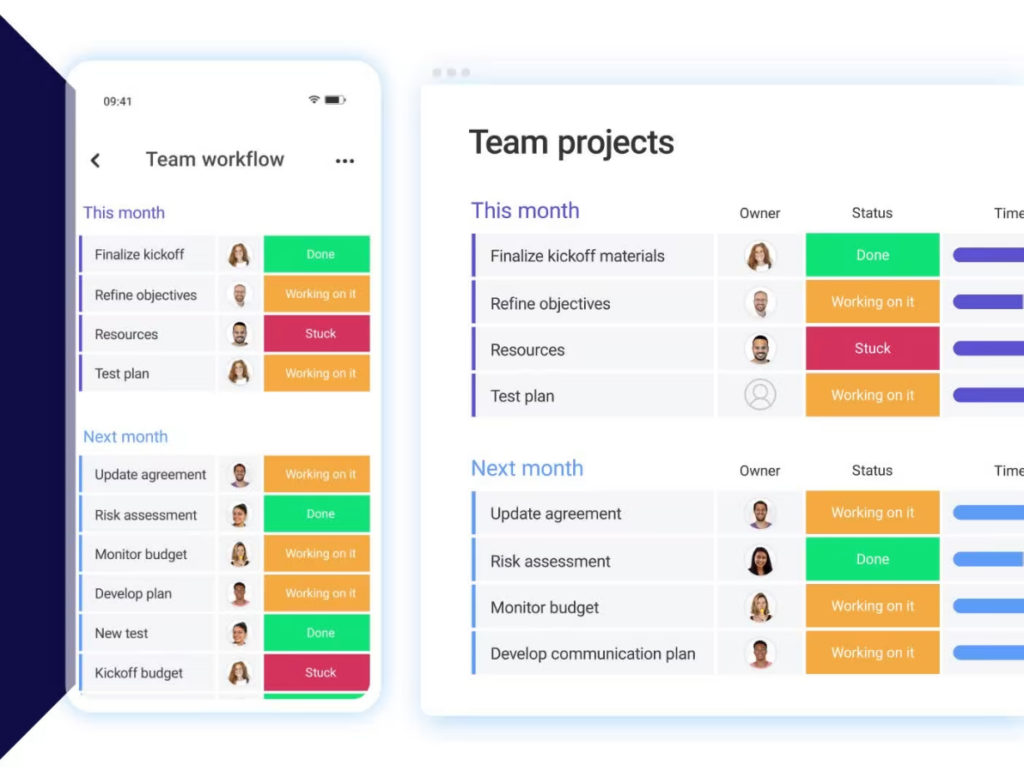

Streamlined Leave Management

Relying on spreadsheets or paper forms to track leave can easily become overwhelming and lead to errors. A leave management app automates the entire process, from submitting a request to calculating balances and processing approvals. This saves HR teams valuable time, reduces the chance of mistakes, and allows managers to review and approve requests quickly in one centralized system.

Improved Compliance with Leave Policies

Manually checking leave requests against company rules and labor laws can be complicated. A leave app simplifies this by automatically flagging requests that go beyond available balances or break policy guidelines. This helps ensure fairness across the workforce, reduces the risk of policy violations, and keeps the company in compliance with legal requirements.

Real Time Reporting and Insights

A leave app gives HR instant access to detailed reports on leave usage, absence trends, and policy adherence. These real time insights support smarter workforce planning and help identify patterns like frequent absenteeism or unbalanced workloads. This data driven approach allows organizations to address issues early and maintain productivity.

Centralized Records

Instead of juggling multiple spreadsheets or paper files, a leave app securely stores all leave records in one place. This centralized system makes it easy to access accurate information when needed, prevents documents from being lost or misplaced, and reduces miscommunication between employees, managers, and HR.

Benefits of Leave Apps for Employees

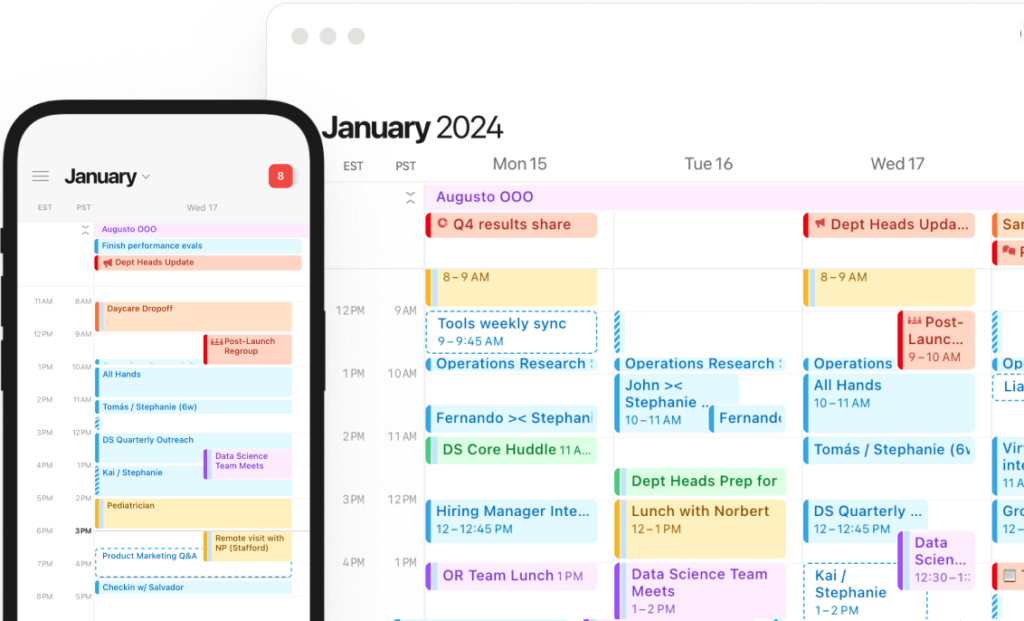

Convenience and Accessibility

A leave app makes requesting time off simple and stress free. Employees can submit leave requests anytime, anywhere, through a mobile app or web portal, without the need to fill out forms or send emails. They can instantly check their available leave balances, monitor the status of pending requests, and view upcoming company holidays all without contacting HR. This self service approach saves time for both employees and HR teams.

Transparency

With a leave management app, the entire process becomes clear and easy to follow. Employees can see exactly how much leave they’ve taken, how much is remaining, and the progress of their requests. This level of transparency reduces confusion, eliminates back and forth inquiries with HR, and builds trust by ensuring everyone is treated fairly according to the same set of rules.

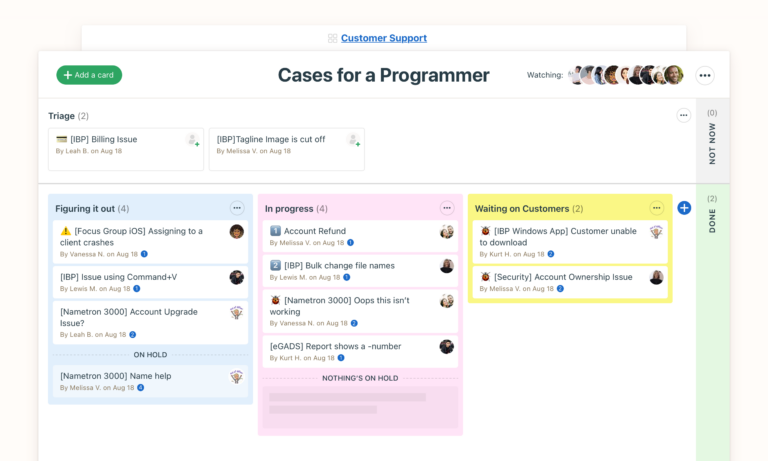

Faster Approvals

Manual approval processes often cause delays and uncertainty. A leave app speeds things up by routing requests directly to the appropriate managers through automated workflows. Managers receive notifications instantly and can approve or decline requests with just a few clicks. This quick turnaround allows employees to plan their time off with confidence and reduces last minute disruptions.

Better Work Life Balance

When leave is easy to request and track, employees feel more comfortable taking the time off they need. A leave app encourages people to use their allocated leave days without worrying about mistakes or delays in approvals. By making the process smooth and reliable, it helps reduce burnout, supports employee well being, and fosters a healthier work life balance.

Error Free Calculations

Tracking leave manually can lead to mistakes in accruals, rollovers, or deductions, which can cause frustration for employees and extra work for HR. A leave management app eliminates these issues by automatically calculating leave balances with accuracy. This ensures that every employee gets the correct entitlements and provides peace of mind that no errors will affect their pay or time off.

Additional Benefits for the Organization

Enhanced Productivity

Leave apps significantly reduce the administrative workload on HR teams by automating time consuming tasks like tracking balances, processing requests, and ensuring policy compliance. This allows HR professionals to focus on more strategic initiatives such as employee development and engagement. At the same time, employees benefit from a clear and reliable system, eliminating the distractions of leave related uncertainties and enabling them to stay focused and productive in their roles.

Improved Employee Satisfaction

A streamlined leave management system sends a strong signal about a company’s commitment to efficiency and employee well being. When staff can easily request leave, track approvals, and trust that their balances are accurate, it improves their overall experience. This convenience not only reduces frustration but also enhances employee satisfaction, morale, and long term loyalty to the organization.

Scalability

As businesses grow, manual systems often struggle to keep up with increasing demands. A leave app is designed to scale effortlessly, accommodating a growing workforce without adding complexity. Whether a company has 50 employees or 5,000, the system remains efficient and reliable, ensuring smooth leave management regardless of size. This makes it an ideal long term solution for organizations planning for expansion.

Key Features to Look for in a Leave App

User Friendly Interface

The app should be easy to navigate for both employees and HR professionals. A simple, intuitive design reduces training time, minimizes errors, and ensures that everyone can manage leave without confusion.

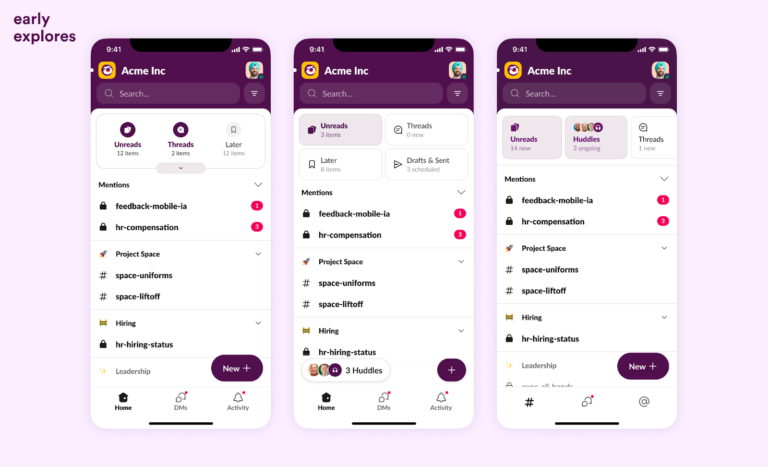

Mobile Access

With mobile compatibility, employees and managers can handle leave requests anytime, anywhere. This flexibility is especially important for remote teams or employees who are frequently on the move.

Policy Customization

Every organization has its own set of leave rules and entitlements. A good leave app should allow customization to reflect your company’s specific policies, including accrual rates, carryover limits, and holiday calendars.

Notifications and Reminders

Automated alerts help keep the process smooth and transparent. Employees get reminders about pending approvals, while managers receive notifications for new requests, ensuring nothing slips through the cracks.

Frequently Asked Questions (FAQ)

What is a leave management app?

A leave management app is a digital tool that streamlines the process of requesting, approving, and tracking employee leave. It replaces outdated methods like spreadsheets and paper forms, offering a faster, more accurate, and more transparent way to manage time off.

How does a leave app benefit HR teams?

By automating leave tracking and approvals, HR teams save hours of manual work. The app also ensures compliance with policies and labor laws while providing detailed reports for workforce planning. This allows HR professionals to focus more on strategy and employee engagement instead of administrative tasks.

Can employees access the app outside of the office?

Yes. Most leave apps are designed for convenience and offer mobile or web access, allowing employees to request leave, check balances, and track approvals anytime and anywhere.

How does a leave app improve accuracy?

The system automatically calculates leave accruals, rollovers, and deductions, removing the risk of human error. This ensures employees always see the correct balance, while HR and payroll teams benefit from accurate, real time data.

Will it help with compliance to labor laws and company policies?

Definitely. A leave app applies company rules and labor regulations to every request, automatically flagging violations or overages. This minimizes the risk of disputes, protects the business from penalties, and ensures consistent fairness across the workforce.

Is a leave app suitable for small businesses as well as large organizations?

Yes. Leave management apps are highly scalable, making them just as effective for small businesses as they are for large enterprises. As the workforce grows, the system easily adapts without adding complexity.

Can the system integrate with other HR or payroll software?

Many leave apps integrate seamlessly with payroll systems, HR platforms, and attendance tools. This reduces duplicate data entry, streamlines payroll processing, and ensures all employee records remain consistent and up to date.

How does it affect employee satisfaction?

A transparent and hassle free leave system gives employees confidence that their requests are handled fairly and accurately. This not only reduces stress but also supports better work life balance, boosting overall satisfaction and loyalty.

Is employee data secure in a leave app?

Trusted leave management apps use advanced security measures such as encryption, secure cloud storage, and role based access controls. These features keep sensitive employee information protected at all times.

What should I look for when choosing a leave management app?

The best apps combine ease of use with powerful functionality. Look for features such as a user friendly interface, mobile accessibility, policy customization, and automated notifications. Integration with payroll, robust reporting tools, and strong data security are also key considerations.

Conclusion

The adoption of a leave app benefits both HR and employees by simplifying processes, enhancing transparency, and fostering a positive work environment. For HR, it reduces administrative workload and ensures compliance, while for employees, it provides convenience and clarity. By investing in a reliable leave app, organizations can create a more efficient and employee friendly workplace.