Understanding Paid Time Off (PTO) and New York leave laws is important for both employers and employees. Whether you’re planning your time off or managing a team, knowing your rights and responsibilities can make a big difference. This guide, brought to you by Day Off, breaks down New York Leave Laws, covering key areas like vacation leave, sick leave, and maternity or paternity leave. It also explains how accrual systems work and what protections are in place under federal and state laws. Whether you’re looking to create fair policies or just want to know what you’re entitled to, this guide gives you the essential information you need about PTO and leave in New York.

Paid Time Off (PTO) in New York

Vacation Leave Quota

In New York leave laws, state law does not obligate employers to offer vacation leave, whether paid or unpaid. Private employers have the discretion to establish their own policies regarding vacation leave. While there is no legal requirement, it is common practice for many employers to provide vacation time as part of their benefits package. Typically, employees in the U.S. receive around 10 paid days off annually after completing a year of service, though this amount can vary based on the industry, location, and employee tenure.

If an employer does decide to offer vacation leave, it must align with state regulations, the company’s established policies, and any employment contracts in place.

Accrual

There is no legal mandate in New York requiring employers to use an accrual system for vacation time. However, many companies choose to implement such a system, often tied to the pay period. Employers can design their vacation accrual policies, which may include weekly, biweekly, semimonthly, or monthly increments.

In New York leave laws, the official payroll frequencies are weekly and semimonthly, meaning employers must pay most hourly employees on these schedules. Employers are allowed to set limits on the amount of vacation time an employee can accrue, provided they inform the employees of this policy in advance.

Roll Over (Carry Over, Brought Forward)

Employers in New York are permitted to implement a “Use It or Lose It” policy, which prevents employees from carrying over unused vacation time from one year to the next. This policy is legal as long as employees are informed of it beforehand, leading to the loss of untaken vacation time.

Statutory Provisions Addressing Vacation Pay

When offering paid vacation, employers must adhere to their own policies or the terms outlined in the employment contract.

Payment of Accrued, Unused Vacation on Termination

The rules surrounding the payment of accrued, unused vacation upon termination of employment are governed by the employer’s policy or the employment contract. New York law has not definitively stated whether employers can enforce a policy that causes employees to forfeit accrued vacation time upon termination. Therefore:

- Employers must pay out any accrued vacation if their policy or contract requires it.

- If the policy or contract is silent on this issue, employers are still generally expected to pay out unused vacation time.

- Employers can create policies that deny payment for unused vacation upon termination, but these policies must be clearly communicated to employees in advance.

Sick Leave in New York

Federal Laws – Leave Quota

Under the federal Family and Medical Leave Act (FMLA), employees in New York are entitled to 12 weeks of unpaid, job protected sick leave. To qualify for FMLA benefits, employees must have worked for their employer for at least 12 months (or 1,250 hours over the past year) and be employed at a location with at least 50 employees within a 75-mile radius.

The FMLA covers various situations, including:

- Personal illness or injury.

- Caring for a close family member with a serious health condition.

- Maternity or paternity leave.

Employers may offer more generous sick leave benefits beyond the federal requirements.

New York State Laws

All private employers in New York must provide sick leave, but whether this leave is paid or unpaid depends on the size of the employer and their net income. The specifics are as follows:

- Employers with 0-4 employees and an annual net income of $1 million or less: Up to 40 hours of unpaid sick leave.

- Employers with 0-4 employees and an annual net income over $1 million: Up to 40 hours of paid sick leave.

- Employers with 5-99 employees: Up to 40 hours of paid sick leave.

- Employers with 100+ employees: Up to 56 hours of paid sick leave per calendar year.

Employees accrue sick leave at a rate of 1 hour per 30 hours worked, with accrual beginning immediately upon hire. Employees can roll over unused sick leave from one year to the next.

Sick leave can be used for various reasons, including:

- The employee’s own physical or mental illness, injury, or health issue.

- Care for a sick family member.

- Issues related to domestic violence, family offenses, sexual offenses, stalking, or human trafficking.

Employees must be paid their regular rate for any paid sick leave taken, but employers are not required to pay out unused sick leave upon termination.

Paid Sick Leave in Westchester County

In Westchester County, employers with five or more employees must provide paid sick leave (unpaid if fewer than five employees). All employees working over 80 hours annually in the county are entitled to sick leave. Employees accrue 1 hour for every 30 hours worked, with a maximum accrual and usage of 40 hours per year. Sick leave can be used for the employee’s or a family member’s illness, preventive care, or exposure to communicable diseases.

Maternity, Paternity, FMLA in New York

Federal Law

Under the FMLA, eligible employees can take up to 12 weeks of unpaid, job protected leave per year for family or medical reasons, including maternity or paternity leave. This leave is typically taken continuously unless otherwise agreed upon with the employer.

The Pregnancy Discrimination Act (PDA) also protects pregnant employees from discrimination in all aspects of employment.

Additional State Laws in New York

New York’s Paid Family Leave (PFL) law provides partial income replacement and job protection for employees taking leave for certain family or medical reasons. Employees are entitled to 12 weeks of paid leave, receiving 67% of their average weekly wage, up to a cap of 67% of the Statewide Average Weekly Wage. The current maximum weekly benefit is $1,068.36.

PFL benefits are funded through employee salary deductions, with employers having the option to cover these costs voluntarily. Employees are eligible for PFL after 26 weeks of full time employment or 175 days of part time employment. PFL provides job reinstatement and continued health insurance during the leave.

New York also has a Temporary Disability Benefits Law, requiring employers to provide short term disability coverage for employees temporarily unable to work due to pregnancy or childbirth.

Adoptive Parents Leave

Employers who provide parental leave must offer the same leave to adoptive parents, applicable to children under five years old or under 18 if the child has special needs.

Bereavement Leave in New York (Funeral Leave)

New York leave laws does not legally require employers to provide bereavement leave. However, many employers do offer this benefit, typically granting up to three days off for the death of a close family member.

Jury Duty Leave in New York

Employers in New York are required to provide leave for employees serving on jury duty. Employees must present their jury summons to receive the necessary leave. Employers cannot penalize employees for fulfilling their civic duty, but they are not required to pay for this leave unless the employer has 10 or more employees, in which case they must pay at least $40 per day for the first three days of jury service.

Witness Leave and Crime Victim Leave in New York

Employees who are crime victims or witnesses in criminal trials are entitled to unpaid leave to attend court proceedings. Employees must provide notice and certification to their employer to qualify for this leave.

Military Leave in New York

Federal Law

The Uniformed Services Employment and Reemployment Rights Act (USERRA) protects employees called to active duty in the U.S. military, ensuring they can return to their jobs after completing their service. USERRA provides up to five years of unpaid leave, reinstatement rights, protection from discrimination, and the continuation of health benefits for up to 24 months.

New York State Law

New York also provides additional protections for military members, allowing for unpaid leave for service related activities. Upon returning, employees are entitled to reinstatement to their previous job or a similar one, provided they apply within the appropriate timeframe. Employers are prohibited from terminating these employees without cause for 12 months following their return.

New York Military Family Leave (Military Spouse Leave)

This law provides up to 10 days of unpaid leave for employees who are spouses of deployed military service members. The leave can only be taken while the spouse is on leave during their deployment.

Voting Leave in New York

Employees in New York who do not have sufficient time to vote outside their work hours are entitled to up to two hours of paid leave to vote. The employer can specify when this leave is taken, typically at the beginning or end of the workday. Employees must notify their employer at least two days in advance if they intend to take time off to vote.

New York State Holidays for 2026

New York law does not require private employers to provide paid or unpaid holiday leave. Employers may require employees to work on holidays, but many offer paid holidays as part of their benefits package. Employers are not required to pay extra for holiday work unless the employee qualifies for overtime. However, if an employer offers holiday leave, it must follow the terms of its policy or employment contract.

New York officially observes 13 state holidays in 2026.

FAQ

Does New York require employers to provide paid vacation leave?

No. New York law does not require employers to provide paid or unpaid vacation leave. However, if an employer offers vacation benefits, they must comply with their written policy or employment contract regarding accrual, usage, and payout.

Are employers required to pay out unused vacation time when an employee leaves?

Yes. If an employer’s policy or contract states that unused vacation will be paid out at separation, they must honor that agreement. If there is no such policy, employers are not obligated to pay for unused vacation.

Does New York have a paid sick leave law?

Yes. Under the New York State Paid Sick Leave Law, employees earn 1 hour of paid sick leave for every 30 hours worked, with annual accrual limits based on employer size:

Employers with 5–99 employees: up to 40 hours of paid sick leave per year.

Employers with 100+ employees: up to 56 hours of paid sick leave per year.

Can employees in New York City and Westchester earn additional sick leave benefits?

Yes. Both New York City and Westchester County have local sick leave ordinances that provide equal or greater benefits than the state law. Employers must comply with whichever law offers more favorable terms for employees.

Does New York have paid family leave?

Yes. The New York Paid Family Leave (NYPFL) program provides employees with up to 12 weeks of paid time off to bond with a new child, care for a seriously ill family member, or assist loved ones when a family member is deployed on active military duty.

How is Paid Family Leave funded in New York?

New York’s Paid Family Leave is funded entirely through employee payroll deductions. The program is administered through the employer’s disability insurance provider.

Is maternity or paternity leave paid in New York?

Yes. New parents can use Paid Family Leave to receive partial wage replacement for up to 12 weeks. Employees may also qualify for additional unpaid, job protected leave under the federal Family and Medical Leave Act (FMLA).

Are employers required to provide bereavement leave in New York?

No. Bereavement leave is not required under state law. Employers who offer it must follow their own written policy or collective bargaining agreement.

Are employees entitled to jury duty leave in New York?

Yes. Employers must provide employees with time off for jury duty. Employees cannot be fired or penalized for serving. Employers with 10 or more employees must pay the first $40 of wages for the first three days of jury service.

Are employees entitled to voting leave in New York?

Yes. Employees who do not have at least four consecutive non working hours while polls are open are entitled to up to two hours of paid time off to vote. Employees must notify their employer at least two days before the election.

Are private employers required to provide paid holidays in New York?

No. Private employers are not required to provide paid or unpaid holiday leave. Many businesses, however, offer paid holidays as part of their employee benefits.

What public holidays are recognized in New York?

New York observes the following state and federal holidays:

New Year’s Day

Martin Luther King Jr. Day

Presidents’ Day

Memorial Day

Juneteenth National Independence Day

Independence Day

Labor Day

Columbus Day

Veterans Day

Thanksgiving Day

Christmas Day

Does New York have any unique state holidays?

Yes. Lincoln’s Birthday (February 12) is observed as a state holiday for government offices, though not all private employers observe it.

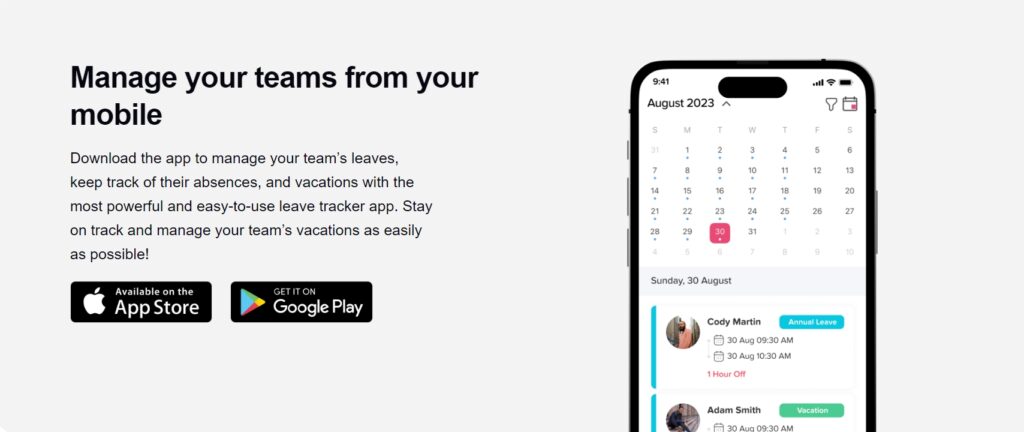

How can the Day Off app help New York businesses manage leave and holidays?

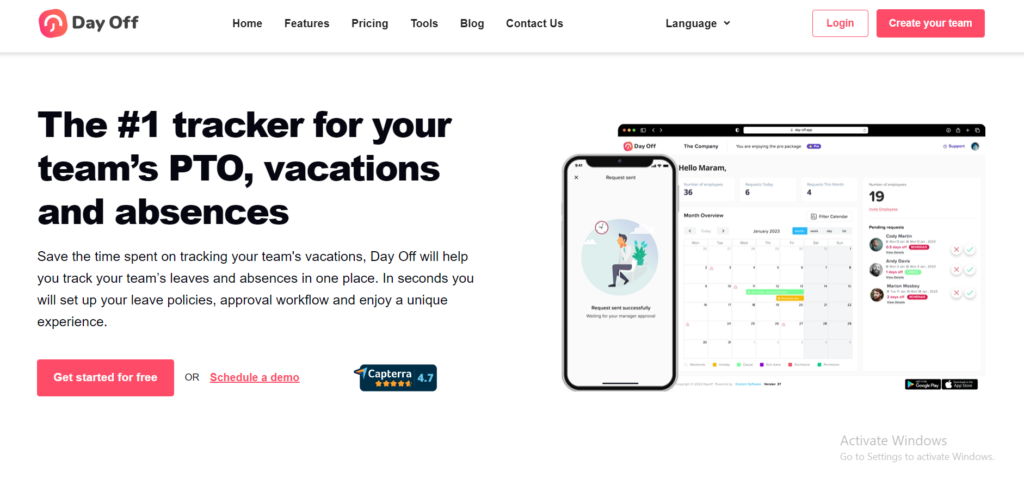

The Day Off app helps New York employers track paid sick leave, vacation time, and holidays automatically. It ensures compliance with state and city laws, simplifies leave approvals, and integrates with tools like Google Calendar for better team planning.