Paid Time Off (PTO) is one of the most valuable benefits employees receive from their employers, allowing them to step away from work while still earning their salary. However, some companies provide an alternative option: cashing out unused PTO. This means that instead of taking time off, employees can receive a payout for their accrued but unused vacation or personal days.

This creates an important decision: Should you take your PTO and enjoy a break, or is it financially smarter to cash it out instead?

The answer depends on various factors, such as your financial situation, workload, company policies, and long-term career goals. While some employees see PTO as a much-needed opportunity to rest and recharge, others may prefer to cash out their time off to boost their income. In this in-depth guide, we’ll explore the pros and cons of both options and help you decide which is the best choice for you.

Understanding PTO Policies

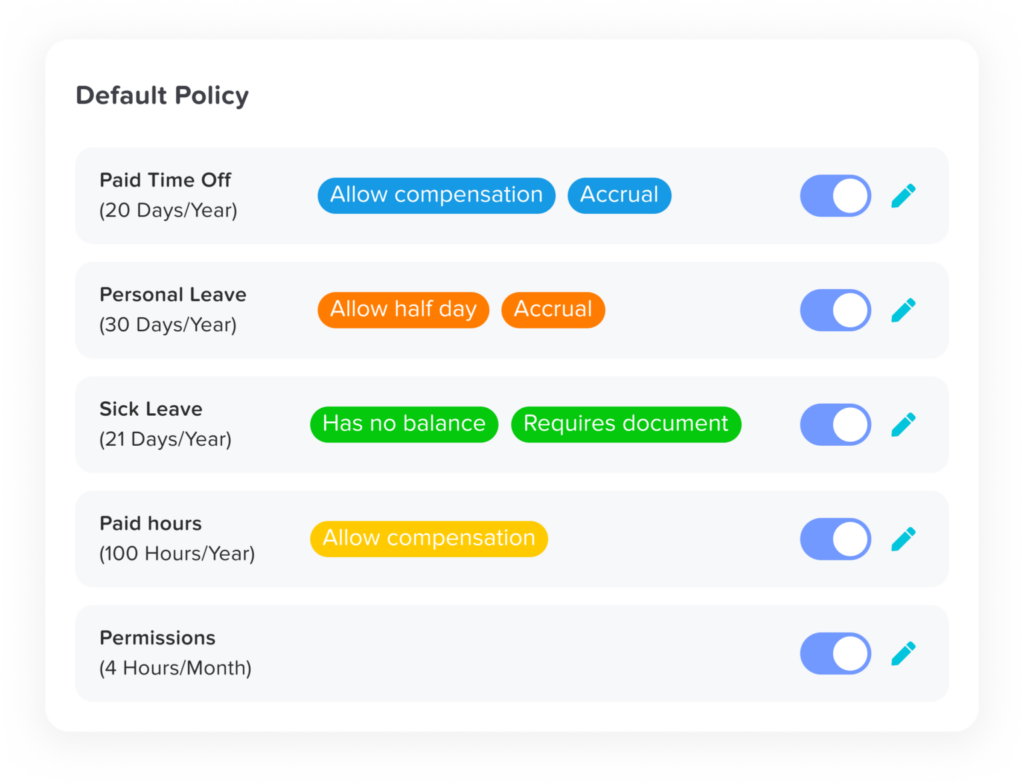

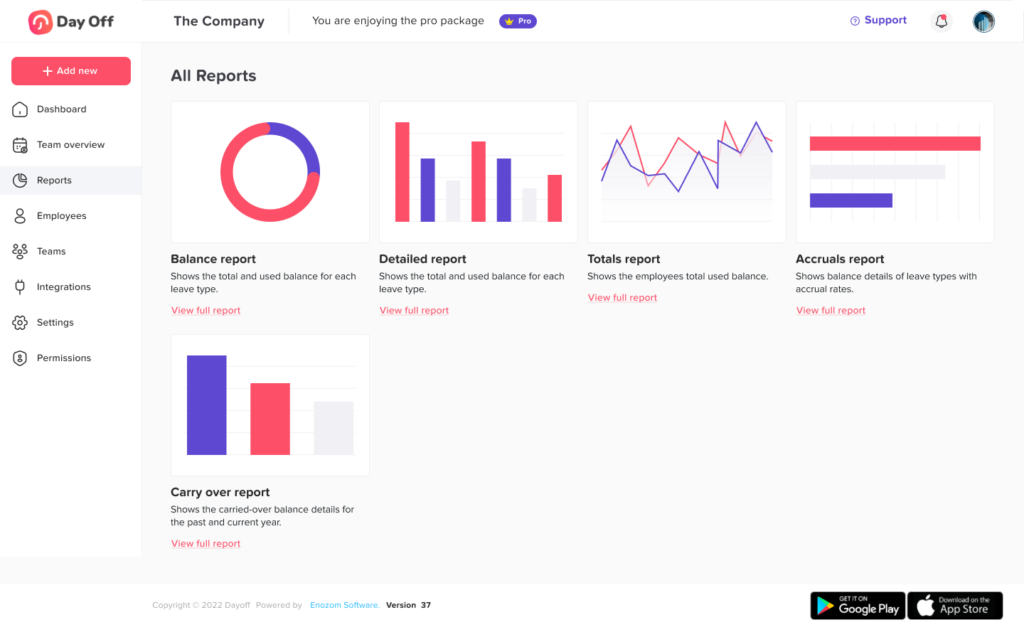

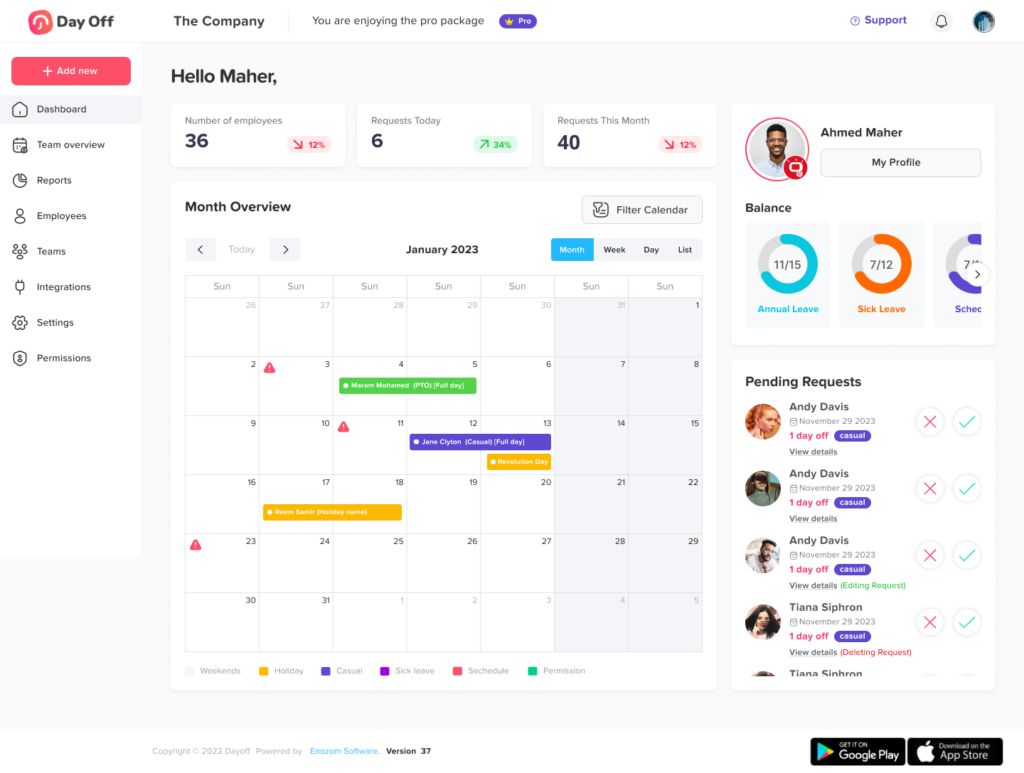

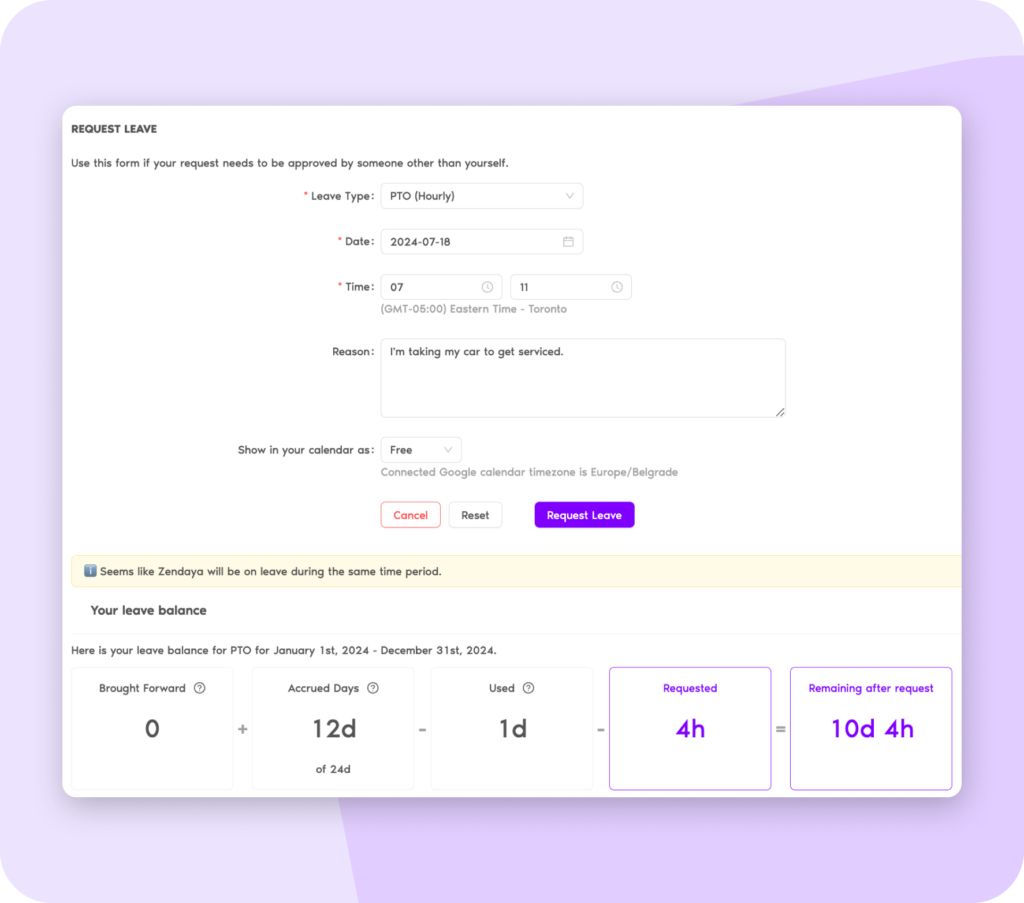

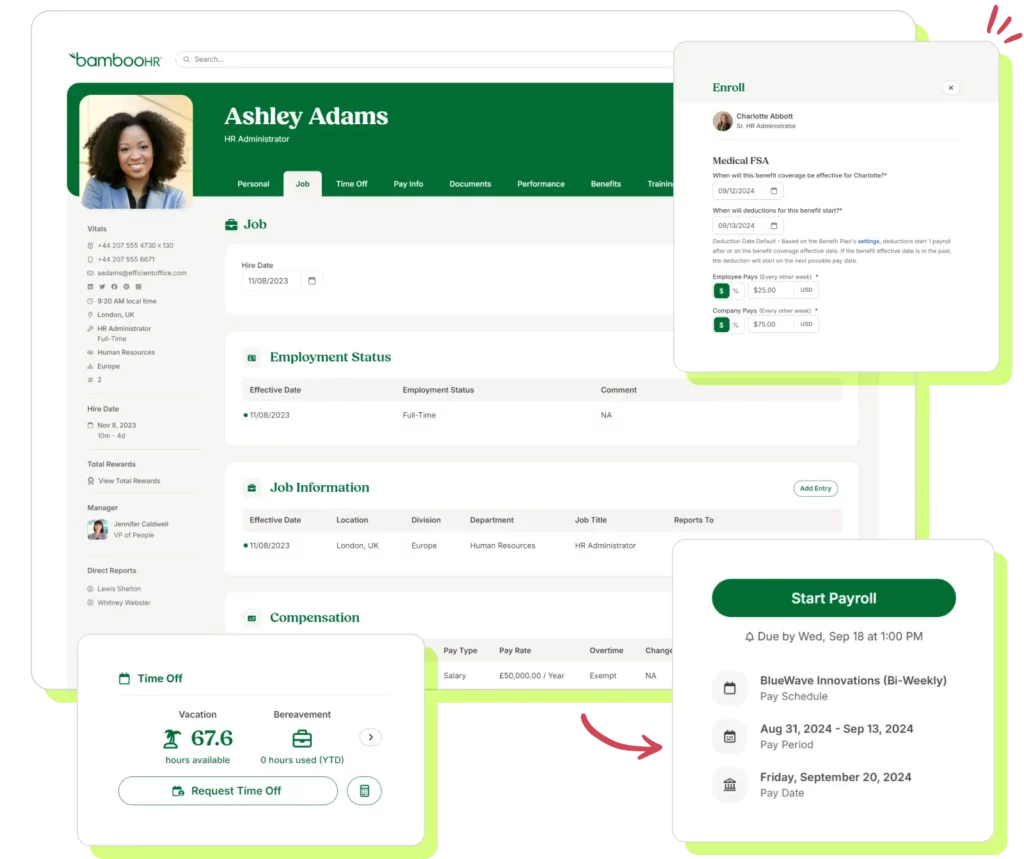

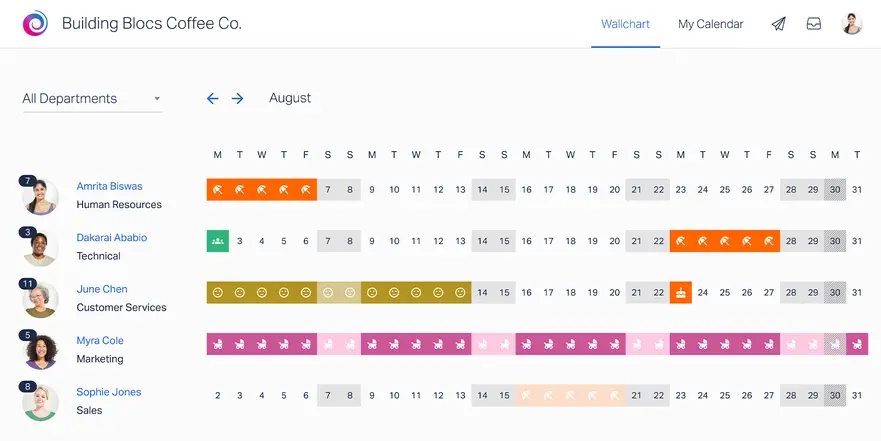

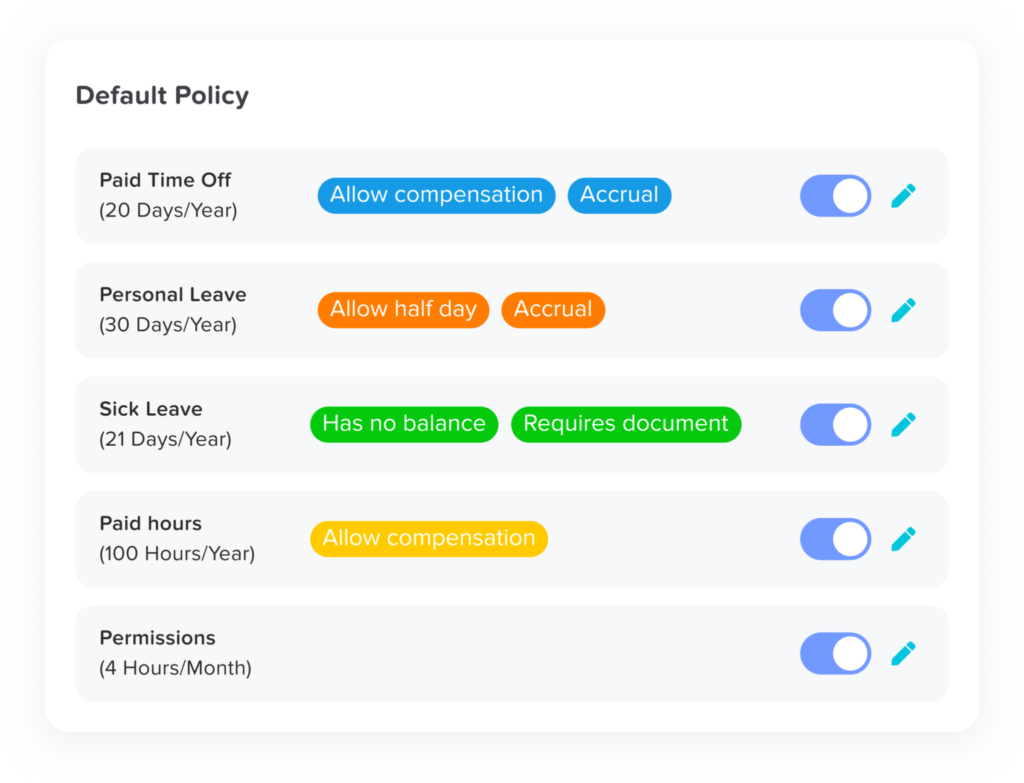

PTO policies vary significantly between companies. Some organizations provide a fixed number of vacation, sick, and personal days, while others offer a flexible or unlimited PTO system. The way PTO is accrued also differs, some employers allow employees to accumulate PTO over time, while others grant it in a lump sum at the start of the year.

Many employers encourage their staff to use their PTO to maintain a healthy work-life balance. However, certain workplaces allow employees to cash out their unused PTO instead, meaning they receive financial compensation instead of taking days off.

Before making a decision, it’s essential to check your employer’s PTO policy.

Some key questions to ask include:

Does your company allow PTO cash-outs?

Is there a limit on the number of PTO hours that can be cashed out?

Do unused PTO days expire if not used within a specific time frame?

Is unused PTO automatically paid out upon separation from the company?

Are there any tax implications associated with cashing out PTO?

Understanding your employer’s PTO policies will help you make an informed decision about whether to take time off or opt for a payout.

The Benefits of Taking PTO: Why Time Off Is Important

Many employees hesitate to take time off, often due to fear of falling behind at work or concerns about how it might affect their job performance. However, using PTO strategically can lead to significant benefits for both employees and employers.

Improves Mental and Physical Health

Taking PTO allows employees to rest, recharge, and reduce stress, all of which contribute to better mental and physical health. Numerous studies have shown that employees who take vacations experience lower levels of anxiety, depression, and burnout.

Chronic stress and overwork can lead to serious health issues, including high blood pressure, heart disease, and weakened immune function. By stepping away from work and engaging in relaxing activities, employees can improve their overall well-being, making them more resilient and focused when they return.

Boosts Productivity and Job Performance

Taking time off isn’t just beneficial for personal well-being; it can also enhance workplace performance. Research shows that well-rested employees tend to be more focused, creative, and efficient than those who are constantly working without breaks.

By allowing your brain time to relax and reset, you can return to work with a fresh perspective and improved problem-solving skills. Many professionals find that after a vacation, they are more motivated and able to tackle complex tasks with renewed energy.

Strengthens Work-Life Balance and Personal Relationships

A healthy work-life balance is essential for long-term career satisfaction. PTO provides an opportunity to spend quality time with family and friends, travel, pursue hobbies, or simply relax at home. Taking time off helps maintain strong personal relationships, which can lead to increased happiness and overall job satisfaction.

Prevents PTO Expiration and Policy Limitations

Many companies have “use-it-or-lose-it” policies, meaning that if employees don’t use their PTO within a certain period, they forfeit it. Even if your employer allows PTO to roll over, there may be limits on how much can be carried into the next year.

Using your PTO ensures that you fully utilize the benefits your employer provides. Otherwise, you might be leaving valuable time (and money) on the table.

Reduces Burnout and Increases Job Satisfaction

Burnout is a significant issue in today’s workforce. Employees who work for long periods without taking breaks often experience exhaustion, decreased motivation, and lower job satisfaction. Taking PTO helps prevent burnout, ensuring that employees remain engaged and productive in their roles.

Companies that encourage employees to take time off often see higher retention rates, as employees who feel supported in their work-life balance are more likely to stay with the organization long term.

The Downsides of Taking PTO: What to Consider

While taking Paid Time Off (PTO) offers significant benefits for employee well-being and productivity, it’s important to be aware of potential challenges and plan accordingly to minimize their impact.

Workload Buildup and Job Responsibilities

A common concern among employees is returning from vacation to a backlog of unfinished work. Without proper preparation, tasks can accumulate, leading to stress and decreased productivity upon return.

How to avoid this:

Plan ahead by completing high-priority assignments before your PTO.

Delegate responsibilities to colleagues to ensure ongoing progress in your absence.

Communicate early with your manager and team about your time-off dates and workload coverage.

Set up an out-of-office email reply to inform clients or stakeholders of your return date and alternative points of contact.

Fear of Falling Behind or Missing Opportunities

Some employees worry that taking time off could make them appear less committed, potentially affecting promotions or important project opportunities. In reality, most organizations value well-rested employees who return focused and motivated. Regularly using PTO demonstrates good self-management and contributes to sustained performance over time.

Financial Trade-Off: Missing Out on Extra Income

Although PTO provides essential rest and recovery, some employees may prefer the option to cash out unused days for extra income. For those facing financial challenges, this can be a difficult decision. To make the best choice, employees should evaluate their financial needs alongside their personal well-being, keeping in mind that rest often yields greater long-term productivity and job satisfaction.

The Financial Benefits of Cashing Out PTO

For employees focused on financial stability or short-term monetary goals, cashing out Paid Time Off (PTO) can be an appealing option. Instead of taking time away from work, employees receive a payout for unused leave, providing immediate access to extra income when it’s needed most. While rest and recovery are invaluable, there are situations where cashing out PTO can be a smart financial decision.

Immediate Access to Extra Income

Cashing out unused PTO offers an instant financial boost that can help address urgent expenses or support important financial objectives. Employees often use their PTO payouts for purposes such as:

Paying off debt: Applying a PTO payout toward high-interest debt, such as credit cards or student loans, can reduce long-term interest costs and improve financial stability.

Building an emergency fund: Life is unpredictable, and unexpected expenses like medical bills or car repairs can arise suddenly. A PTO payout can strengthen your financial safety net.

Funding major purchases or investments: Whether saving for a home down payment, starting a side business, or covering a significant purchase, cashing out PTO can help accelerate your financial goals.

If extra income would meaningfully reduce financial stress or enhance your financial well-being, a PTO cash-out may be a practical short-term solution.

Helps Maintain Work Continuity

In some industries or high-demand roles, taking extended time off can be challenging due to ongoing projects, strict deadlines, or limited coverage. Employees who face such constraints may find that cashing out PTO allows them to maintain productivity without the disruption of time away.

By cashing out PTO instead of taking leave, employees can:

Stay on top of responsibilities without returning to an excessive workload.

Avoid missing critical deadlines that could affect team or organizational performance.

Demonstrate reliability and commitment in positions where consistent availability is essential.

For professionals in fast-paced environments, PTO cash-out can offer a balance between financial reward and job continuity.

Maximizes Earnings When Leaving a Job

For employees preparing to resign, retire, or transition to a new position, cashing out unused PTO can significantly enhance their final paycheck.

Some employers automatically pay out unused PTO upon departure, while others require a formal request before the final pay period.

The additional income can help cover relocation expenses, job-hunting costs, or provide a financial buffer during the transition between roles.

If you plan to leave your current position, review your company’s PTO payout policy carefully to ensure you receive full compensation for your earned time off. In cases where PTO cannot be paid out, using your remaining leave before departure may be the best alternative.

(FAQ) About PTO and Cashing Out

Can employers deny a PTO cash-out request?

Yes. Employers have the right to limit or deny PTO cash-out requests based on company policy. Some organizations only allow PTO cash-outs under specific conditions, such as when an employee leaves the company or at the end of the fiscal year. It’s important to review your organization’s PTO policy or employee handbook to understand when cash-outs are permitted.

What happens to unused PTO if I change jobs?

This depends on state laws and company policies:

Some states require employers to pay out unused PTO when an employee leaves.

Others follow a “use-it-or-lose-it” policy, where unused PTO expires upon departure.

Some businesses allow PTO to roll over or transfer if you move to another position within the same organization.

If you plan to leave your job, check your employer’s payout policy to ensure you maximize any earned time before resigning.

Is PTO cash-out taxed differently than regular pay?

Yes. PTO cash-outs are classified as supplemental income and are usually taxed at a higher withholding rate than regular wages. Employers typically deduct federal and state income taxes, along with Social Security and Medicare contributions.

The federal tax withholding rate on PTO payouts is generally 22% for amounts under $1 million (per IRS guidelines). If your employer includes the payout with your regular paycheck, it may be taxed at your normal income rate. For personalized advice, consult a tax professional or financial advisor before cashing out PTO.

How does unlimited PTO affect cash-out policies?

In most cases, unlimited PTO cannot be cashed out because employees do not accrue a fixed balance of hours or days. Unlimited PTO is designed to encourage employees to take time off as needed rather than accumulate unused days. However, some employers offer severance packages or other benefits that may compensate for unused time when an employee leaves the company.

Can I negotiate a PTO payout when accepting a new job offer?

Yes, in some cases. While PTO negotiations are less common than salary discussions, they can still be part of the hiring process. You might:

Request a higher PTO accrual rate.

Ask for a sign-on bonus to offset unused PTO from your previous employer.

Negotiate carry-over PTO if the company limits annual leave.

If PTO is an important aspect of your compensation, bring it up early in the negotiation process.

Can I cash out PTO while still employed, or only when leaving a company?

This depends on your employer’s policy. Some organizations allow active employees to cash out PTO at specific times, such as at the end of the calendar year, while others only issue payouts when employment ends. Check with your HR department to confirm eligibility and procedures.

Does taking PTO affect my chances of promotion?

Many employees worry that taking time off may appear as a lack of dedication, but most employers recognize the importance of rest and work-life balance. Well-rested employees are typically more productive and engaged.

To ensure that using PTO doesn’t affect your career growth:

Plan time off strategically, avoiding key deadlines or review periods.

Communicate your plans with your manager and ensure proper workload coverage.

Maintain strong performance throughout the year to reinforce reliability.

Encourage a healthy PTO culture by setting a positive example for others.

Promotions are based on results, leadership, and contributions, not on how much PTO you take.

How does PTO cash-out differ for hourly and salaried employees?

PTO cash-out calculations depend on how employees are compensated:

Hourly employees typically receive cash-outs based on their hourly wage at the time of payout. Some companies allow year-end or departure-based cash-outs.

Salaried employees usually have their payout calculated using their annual salary divided by total work hours. Cash-out availability may be more limited for salaried roles.

Always confirm your organization’s formula for PTO payout calculations.

Are there legal protections for PTO cash-outs?

PTO cash-outs are governed by state labor laws, not federal law.

Regulations vary by location:

Some states, such as California, Illinois, and Massachusetts, require employers to pay out unused PTO upon termination or resignation.

Others allow “use-it-or-lose-it” policies, where employers are not obligated to pay unused time.

Some companies voluntarily offer more generous payout terms than legally required.

Employees should review their contracts and local labor laws to understand their rights before making any PTO decisions.

What happens to PTO if my company closes or lays off employees?

If a company closes or conducts layoffs, PTO payout eligibility depends on:

State laws: Some states require employers to pay out unused PTO even during closures or layoffs.

Company policy: Internal rules may dictate payout terms for downsizing or closures.

Union agreements: Collective bargaining contracts may include specific PTO payout provisions.

If your organization is undergoing restructuring, clarify your entitlements with HR.

Should I cash out PTO or save it for future use?

The right decision depends on your financial and personal circumstances.

Cash out PTO if:

You need immediate income for essential expenses or debt repayment.

You are leaving your job soon and want to maximize your final paycheck.

Your employer has a “use-it-or-lose-it” policy and you cannot take time off.

Save PTO and take time off if:

You feel fatigued or burned out and need recovery time.

You still have time to use your PTO before it expires.

You value rest and work-life balance more than short-term income.

The best approach is to strike a balance, use PTO to maintain health and morale, while cashing out strategically when financial needs arise.

How can I make the most of my PTO benefits?

To fully maximize your PTO:

Plan vacations and time off well in advance to avoid scheduling conflicts.

Use PTO for mental health, personal growth, or relaxation, not just vacations.

Regularly track your PTO balance and expiration dates to avoid losing earned time.

Discuss potential policy improvements or accrual increases with HR if your current plan is restrictive.

A proactive approach to PTO ensures that you enjoy the full value of your benefits while maintaining financial and professional balance.

Conclusion

While taking time off remains essential for maintaining mental, physical, and emotional well-being, cashing out Paid Time Off (PTO) can offer meaningful financial advantages in the right circumstances. For employees facing immediate financial needs, such as covering essential expenses, paying down debt, or navigating a career transition, a PTO payout can serve as a practical and strategic option.

The key is finding balance. Employees should weigh the long-term benefits of rest and recovery against short-term financial priorities. When managed thoughtfully, PTO, whether used for time away or cashed out for income, can support both personal well-being and financial stability, empowering individuals to make choices that best align with their goals.