The traditional 9-to-5 model is rapidly evolving. As technology enables remote work and businesses strive to support diverse employee needs, organizations are rethinking how work is structured. Employers and employees alike are exploring various types of work schedules to enhance flexibility, increase productivity, and promote better work-life balance.

Choosing the right work schedule is more than an operational decision, it’s a strategic factor that affects performance, morale, and retention. Below, we explore the most common types of work schedules, their advantages and challenges, and insights into how organizations can implement them effectively.

Standard Work Schedule

Often known as the “9-to-5,” this schedule is the cornerstone of traditional employment. Employees typically work from 9 a.m. to 5 p.m., Monday through Friday, accumulating around 40 hours per week. This format remains common in corporate environments, government offices, and other sectors where collaboration during consistent business hours is critical.

The predictability of a standard schedule allows employees to plan personal activities, childcare, or education around fixed work hours. It also facilitates coordination since most colleagues, clients, and partners operate on the same timetable.

However, the rigidity of this structure can be a drawback in today’s world of personalized working styles. It may limit flexibility for employees who prefer different hours due to family responsibilities, long commutes, or peak productivity times. For creative or project-based roles, the monotony of a fixed routine can also hinder innovation.

Organizations that maintain this schedule can enhance engagement by offering occasional flexible days or remote options to counterbalance its rigidity.

Fixed Schedule

A fixed schedule involves consistent, pre-set hours that might differ from the typical Monday-to-Friday pattern. For example, an employee may work Tuesday through Saturday, or Sunday through Thursday, depending on operational needs. Fixed schedules are common in industries like retail, logistics, and customer support, where business demands extend beyond standard business days.

The strength of this schedule lies in stability and predictability. Employees know their routine well in advance, making it easier to plan family activities, classes, or personal commitments. Employers, meanwhile, can efficiently organize staffing levels and manage coverage.

However, this setup can occasionally lead to social drawbacks, particularly if the employee’s days off don’t align with those of friends or family. It may also feel restrictive for those seeking variety in their workweek. To make this schedule more appealing, employers can allow occasional shift swaps or provide incentives for weekend or evening work.

Full-Time Schedule

Full-time employment typically entails 35 to 40 hours per week and often follows a fixed daily pattern. It may take the form of five 8-hour days or a compressed schedule such as four 10-hour shifts.

Full-time positions are highly valued because they usually offer financial stability, health benefits, and job security. For many, this schedule establishes a sense of routine and commitment to the organization. It also strengthens team cohesion since most full-time employees work overlapping hours, making collaboration seamless.

The trade-off, however, is reduced flexibility. Long, fixed hours can lead to fatigue, stress, and work-life imbalance if boundaries aren’t respected. Organizations can mitigate this by introducing flexible start times, wellness initiatives, or occasional remote days.

In a post-pandemic world, redefining full-time work to include flexibility, rather than fixed physical presence, is increasingly becoming the standard.

Part-Time Schedule

Part-time work involves fewer hours than a full-time role, generally under 35 hours per week. Schedules can vary widely, from a few hours each day to certain days of the week, depending on business needs and employee availability.

This arrangement is popular among students, parents, retirees, and those pursuing other personal or professional interests. It provides the freedom to earn income while maintaining time for education, caregiving, or hobbies.

However, part-time work often comes with reduced pay, limited benefits, and fewer opportunities for career advancement. Employees may also struggle with inconsistent schedules if shifts change week to week.

Employers who rely on part-time workers can improve satisfaction by offering predictable scheduling, fair pay, and opportunities for professional growth. Consistency helps part-time employees feel more connected and motivated, improving retention and service quality.

Shift Work

Shift work divides the 24-hour day into multiple working periods, such as morning, evening, and night shifts. It’s essential for industries that operate around the clock, healthcare, security, manufacturing, transportation, and hospitality, among others.

Shift work offers flexibility for employees who prefer nontraditional hours or need to accommodate personal obligations during the day. Some enjoy the quiet focus of night shifts, while others appreciate shift differentials (extra pay for evening or overnight work).

However, this schedule poses health and social challenges. Disrupted sleep patterns, limited exposure to daylight, and difficulties attending family or social events can take a toll on well-being. Employers can reduce these effects by rotating shifts forward (morning → evening → night), offering adequate rest periods, and promoting wellness programs focused on sleep and nutrition.

Freelance Schedule

Freelancers, also known as independent contractors, work for themselves and often serve multiple clients at once. They enjoy nearly complete autonomy over when, where, and how they work, focusing on projects rather than fixed hours.

The freelance schedule’s greatest strength is flexibility. Freelancers can work during their peak productivity hours, take breaks as needed, and balance personal responsibilities more easily. This control over time and workload can lead to high satisfaction and creativity.

However, freelancing comes with uncertainty. Income can fluctuate, clients may have conflicting deadlines, and benefits like health insurance, paid time off, or retirement plans are typically self-managed.

To succeed, freelancers must cultivate strong discipline and business skills, managing contracts, deadlines, and finances independently. For many professionals, though, the freedom and autonomy outweigh the challenges, making freelancing an increasingly attractive career choice.

Seasonal Schedule

Seasonal employment is tied to specific periods of high demand, such as holidays, summer months, or harvest seasons. Industries like tourism, agriculture, and retail depend heavily on seasonal workers to handle surges in workload.

Seasonal roles offer flexibility for those seeking temporary or supplementary income. Students often use seasonal jobs to gain experience during school breaks, while others may leverage them to fill employment gaps or explore different industries.

On the downside, these positions typically lack year-round stability, benefits, and guaranteed hours. However, they can serve as stepping stones to permanent roles, especially for standout performers.

Employers benefit from a flexible workforce that scales with demand, but to attract reliable seasonal talent, they should provide clear contracts, training, and opportunities for returning employment each year.

Flexible Schedule

Flexible schedules allow employees to choose when they start and end their workday, as long as they complete the required hours or meet performance goals. This approach recognizes that productivity peaks differ for everyone, some people excel early in the morning, others late at night.

Flexibility has become a top priority for the modern workforce. It empowers employees to integrate work and life seamlessly, reducing stress and improving engagement. Parents can attend school events, caregivers can manage responsibilities, and all employees can adapt work around personal commitments.

The challenge lies in maintaining coordination and accountability. If not managed carefully, flexibility can blur boundaries, leading to overwork or communication gaps. Organizations that implement flexible schedules should use shared calendars, set core collaboration hours, and focus on output rather than clock time.

When done right, flexible scheduling boosts morale, loyalty, and productivity, a true win-win for both employers and employees.

Alternative Schedule

An alternative schedule refers to customized working hours that differ from the organization’s standard pattern. It’s often a temporary arrangement designed to accommodate personal circumstances such as medical needs, education, or family obligations.

This type of schedule allows employees to remain engaged and productive while managing personal challenges, reducing absenteeism and turnover. For example, someone recovering from surgery might work half-days temporarily, or a parent may shift hours to care for a child.

While highly supportive, alternative schedules can sometimes lead to feelings of isolation if the employee’s hours don’t overlap with their team’s. Employers should ensure that these employees remain included in communications, meetings, and recognition programs.

Such accommodations reflect an organization’s commitment to employee well-being, often improving trust and loyalty long after the temporary period ends.

Compressd Schedule

A compressed work schedule condenses the standard workweek into fewer but longer days. A common version is the “4/10” schedule, four 10-hour days followed by a three-day weekend.

This format appeals to employees who value longer rest periods and fewer commutes. The extended breaks provide time for travel, hobbies, or family activities, enhancing work-life balance. Many also find that longer days increase focus, as tasks aren’t fragmented across multiple short shifts.

The downside is that 10- or 12-hour workdays can lead to fatigue, reduced concentration, and less time for evening commitments. Employers must ensure workloads are realistic and that longer hours don’t compromise quality or safety.

When implemented thoughtfully, compressed schedules can elevate morale, reduce absenteeism, and even lower facility costs due to fewer operational days.

Split Schedule

A split schedule divides the workday into two or more separate segments, with a substantial break in between. For example, an employee might work from 7 a.m. to 11 a.m. and then again from 4 p.m. to 8 p.m. This model is common in fields like transportation, education, and customer service, where demand peaks at certain times of day.

This arrangement can be beneficial for those who prefer midday flexibility, allowing time for personal appointments, family care, or rest between shifts. It can also align with personal energy levels, letting employees perform at their best during high-focus hours.

However, split shifts can disrupt personal routines and extend the perceived length of the workday. They can make it harder to maintain social plans or family meals, and commuting twice a day can be tiring. Employers who use split schedules should provide adequate rest periods and support employees in managing time effectively.

Rotating Schedule

A rotating schedule cycles employees through different shifts, for instance, switching from mornings one week to nights the next. It’s commonly used in healthcare, emergency services, manufacturing, and law enforcement, where continuous coverage is required.

Rotating schedules can be exciting and varied, preventing monotony and allowing employees to experience different teams or roles. For some, it also offers flexibility to attend daytime or nighttime activities depending on the rotation.

However, the shifting hours can disrupt sleep patterns, affect family routines, and make it difficult to establish a consistent lifestyle. Organizations can mitigate these downsides by rotating shifts gradually, providing sufficient rest between transitions, and offering wellness support for affected employees.

When managed carefully, rotation builds versatility and teamwork, critical qualities in 24/7 operations.

Legal and Compliance Considerations for Work Schedules

When implementing various work schedules, organizations must navigate a complex landscape of legal requirements to ensure compliance. This section outlines crucial legal aspects related to scheduling that affect both employers and employees, focusing on overtime regulations, minimum wage impacts, and the differences in legal rights between part-time and full-time employees.

Overtime Regulations

Overtime laws are critical for employers to understand and adhere to in order to avoid legal repercussions and to ensure fair treatment of employees. In the United States, the Fair Labor Standards Act (FLSA) mandates that employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. It’s important for employers to correctly classify employees as either exempt or non-exempt from these overtime provisions based on their job duties, salary, and the standards set by the FLSA.

Key Considerations:

- Exempt vs. Non-exempt: Misclassification can lead to significant legal and financial consequences.

- State Laws: Some states have stricter overtime laws, requiring overtime pay for over 8 hours a day or double time for over 12 hours a day.

Minimum Wage Impacts

Minimum wage laws set the lowest hourly rate an employer can legally pay an employee. These rates can vary significantly between different states and cities. Employers must comply with both federal and local wage laws, adhering to the higher wage if there are discrepancies between the two.

Key Considerations:

- Updates to Wage Laws: Regular updates to minimum wage laws require employers to stay informed to remain compliant.

- Impact on Scheduling: Adjustments in wage rates might affect staffing decisions, particularly in industries relying on part-time or shift work.

Legal Rights of Part-Time vs. Full-Time Employees

The distinction between part-time and full-time employees can affect eligibility for benefits and other employment rights. Generally, full-time employees are those working 40 hours per week, although employers may define full-time status differently. Part-time employees typically work fewer hours and may not be eligible for the same level of benefits.

Key Considerations:

- Benefits Eligibility: Including health insurance, retirement plans, and paid time off. Employers should clearly communicate eligibility criteria.

- Discrimination Laws: Both part-time and full-time employees are protected under employment discrimination laws. Employers must ensure equitable treatment in terms of scheduling, pay, and work conditions.

Frequently Asked Questions (FAQ) About Work Schedules

What are the main differences between full-time and part-time employment?

Answer: Full-time employees typically work a standard work week, usually 35-40 hours, and are eligible for benefits such as health insurance, paid leave, and retirement plans. Part-time employees work fewer hours, often less than 35 hours per week, and may have limited access to benefits. The specific threshold for full-time and part-time hours can vary by company and jurisdiction.

How is overtime pay calculated?

Answer: Overtime pay is typically calculated at a rate of 1.5 times the regular hourly rate for any hours worked beyond the standard 40-hour workweek. Some states and local laws may require overtime pay for working more than a certain number of hours in a single day, and the rates can vary.

Can an employer change my work schedule without notice?

Answer: The rules around changing work schedules without notice vary widely depending on local labor laws. Generally, employers are allowed to change an employee’s work schedule without notice unless a contract or collective bargaining agreement specifies otherwise. However, some jurisdictions have implemented predictive scheduling laws that require employers to provide advance notice of schedule changes.

What is a compressed work schedule?

Answer: A compressed work schedule allows an employee to work the standard 40-hour week in fewer days than the traditional five. Common compressed schedules include four 10-hour days or three 13-hour shifts, which provides employees with an additional day or two off per week.

Are employers required to provide breaks during shifts?

Answer: Break requirements vary by state and the nature of the work. Federal law does not require lunch or coffee breaks. However, when employers do offer short breaks (usually lasting about 5 to 20 minutes), federal law considers the breaks as compensable work hours that would be included in the sum of hours worked during the work week and considered in determining if overtime was worked. Longer breaks or meal periods (typically 30 minutes or longer) do not need to be compensated as work time.

What legal protections exist for employees working night shifts or irregular hours?

Answer: Employees working night shifts or irregular hours are covered under the same federal and state labor laws that protect daytime workers. However, additional compensations, such as shift differentials, are generally not required by law but may be offered by employers as an incentive. Workers have the right to a safe and healthy work environment regardless of the time they work.

Can I request a flexible work schedule?

Answer: Employees can request a flexible work schedule, but employers are not obligated to grant it unless specific laws or company policies support such arrangements. In some regions, laws exist that allow employees to request flexible working arrangements for reasons like childcare or education, and employers must address these requests reasonably.

How do shift swaps work?

Answer: Shift swaps allow employees to trade shifts with each other, often with the requirement that a supervisor or manager approves the swap to ensure that all shifts are covered. This can provide additional flexibility for employees, helping them manage personal commitments alongside work responsibilities.

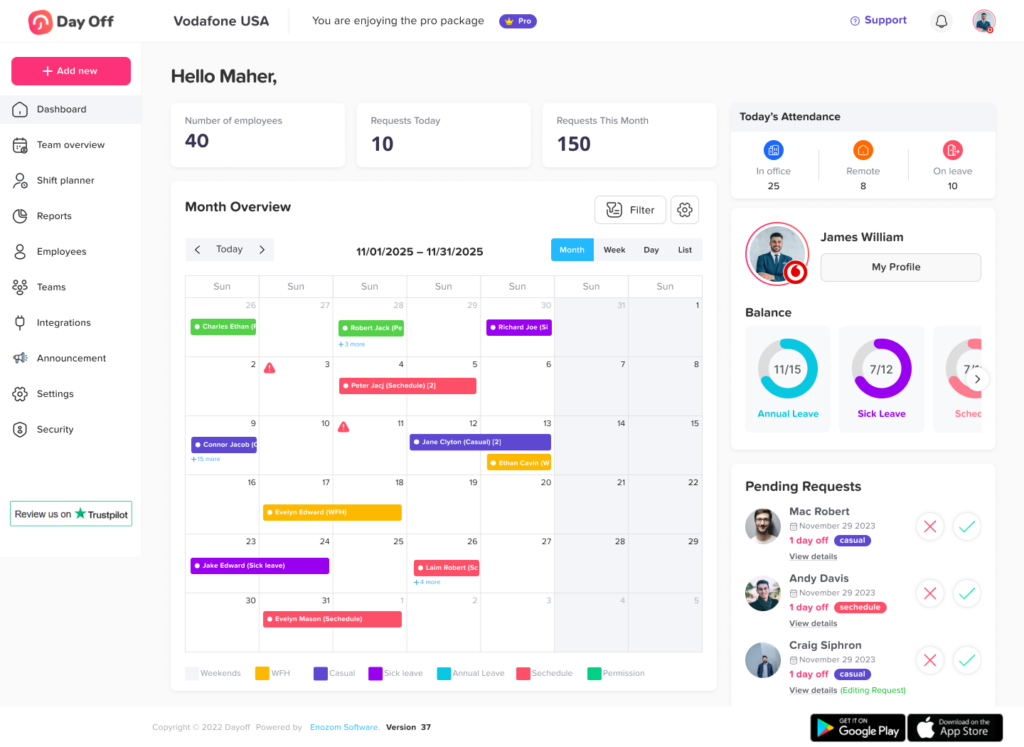

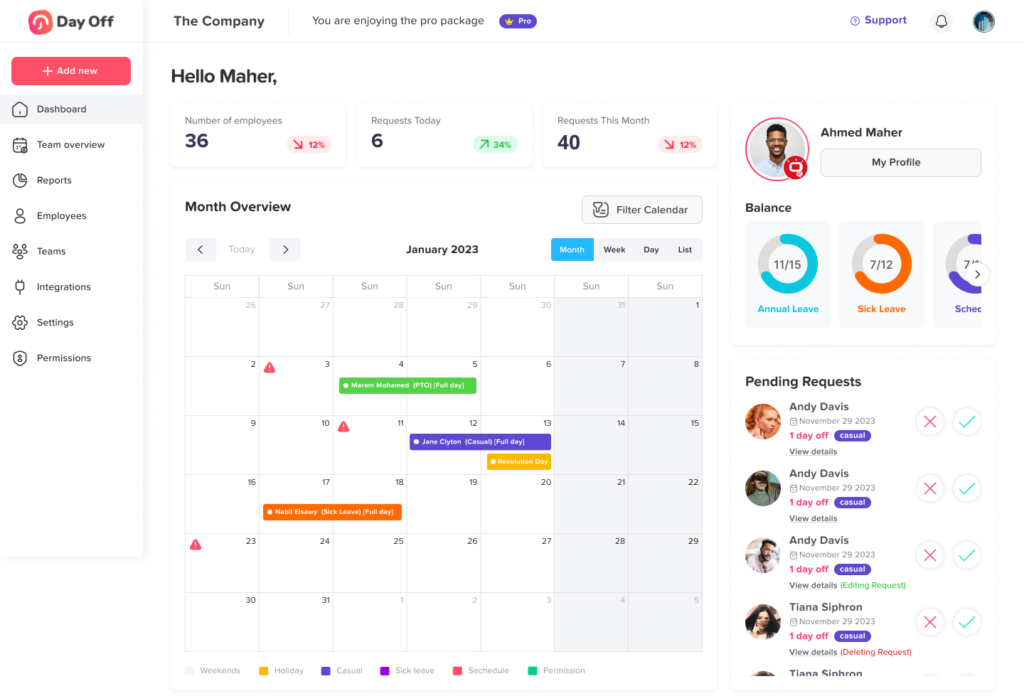

Implementing Effective Work Schedules

Choosing the right type of work schedule depends on the nature of the job, the company’s operational needs, and employee preferences. Implementing a successful work schedule involves clear communication, robust policy frameworks, and regular evaluations to ensure the arrangement meets the intended goals. Employers should consider using surveys or feedback tools to gauge employee satisfaction and productivity levels, making adjustments as necessary to optimize both.

In conclusion, as businesses continue to adapt to changing market conditions and employee expectations, understanding and effectively implementing various types of work schedules can be a significant advantage. By fostering an environment that values flexibility and productivity, organizations can not only enhance employee satisfaction but also drive greater success in their operations.