Managing employee leave is a critical aspect of human resource management that directly impacts productivity, compliance, and employee satisfaction. An effective leave tracking system streamlines this process, ensuring accurate tracking, approval, and reporting of employee leave. Here are the key features that define an effective leave tracking system:

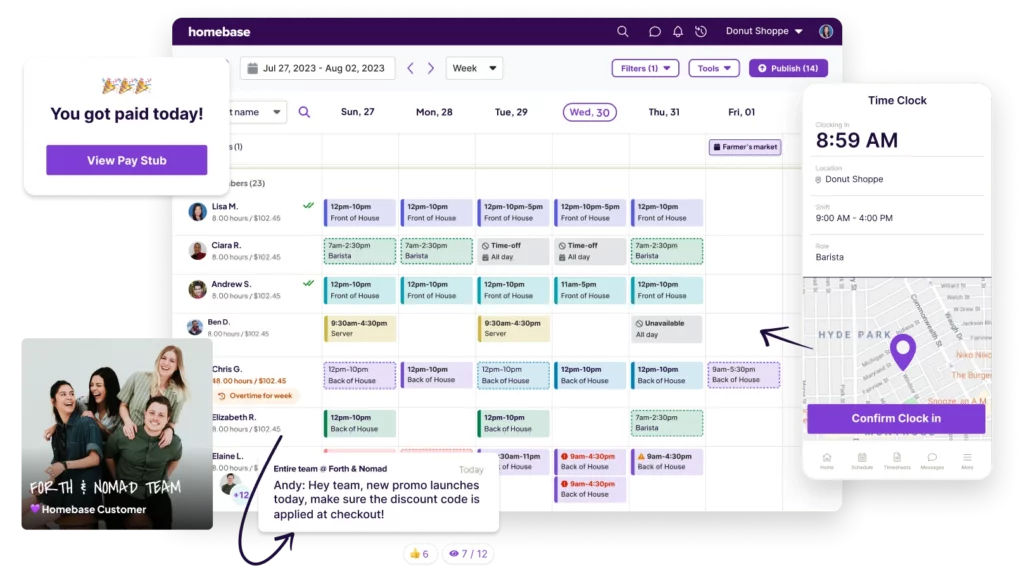

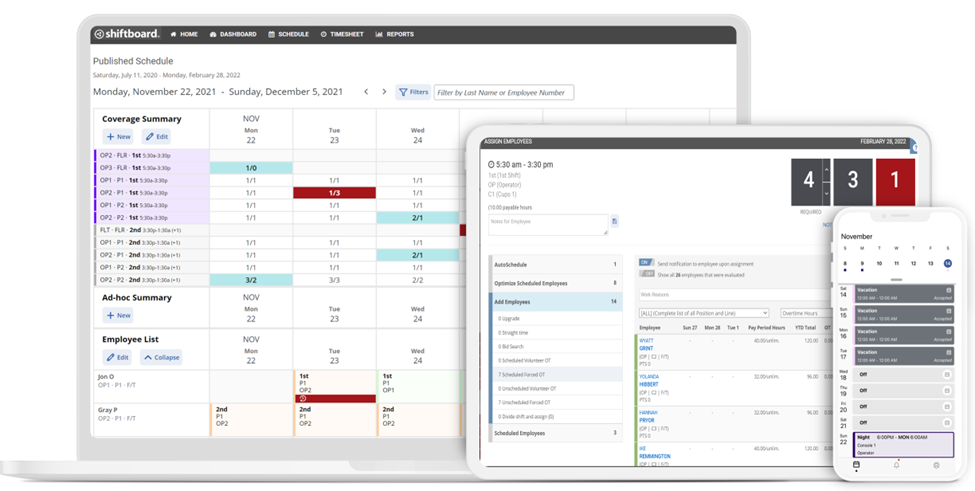

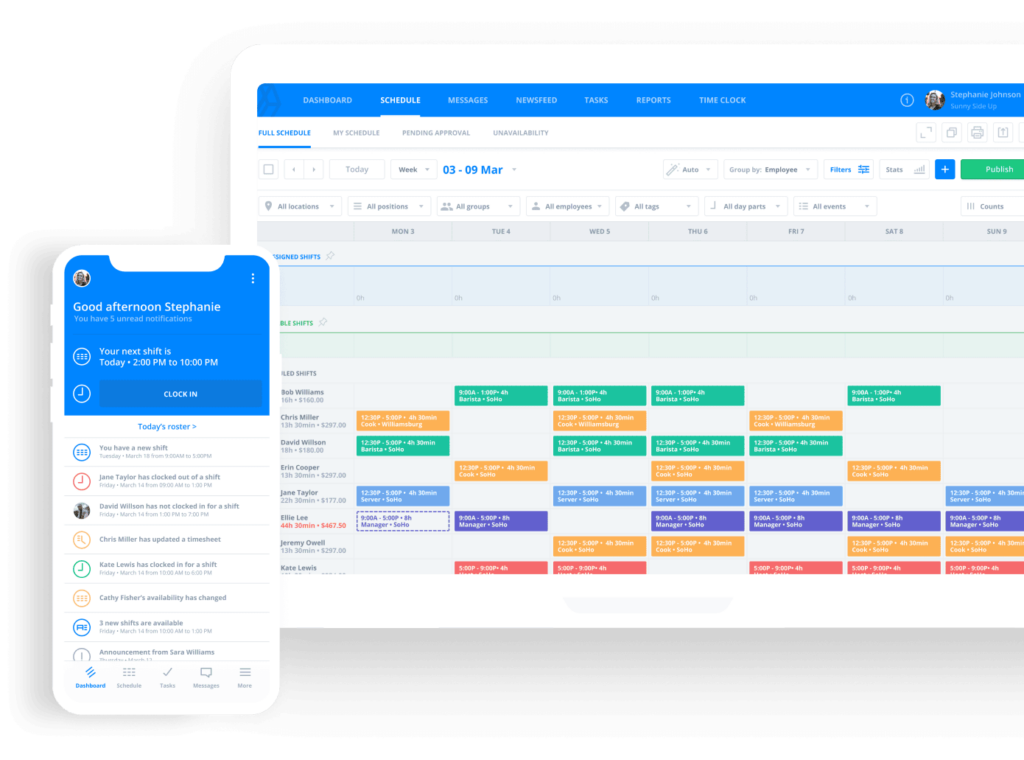

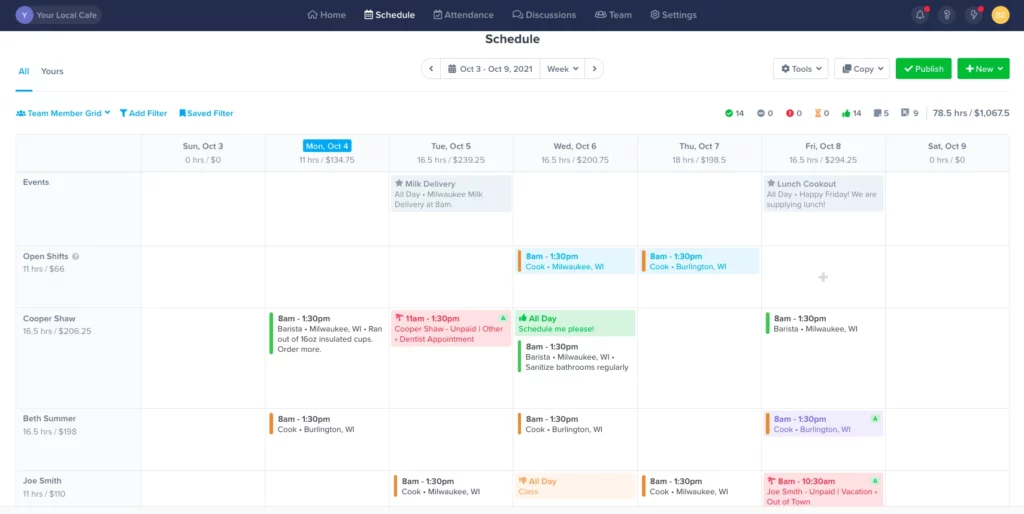

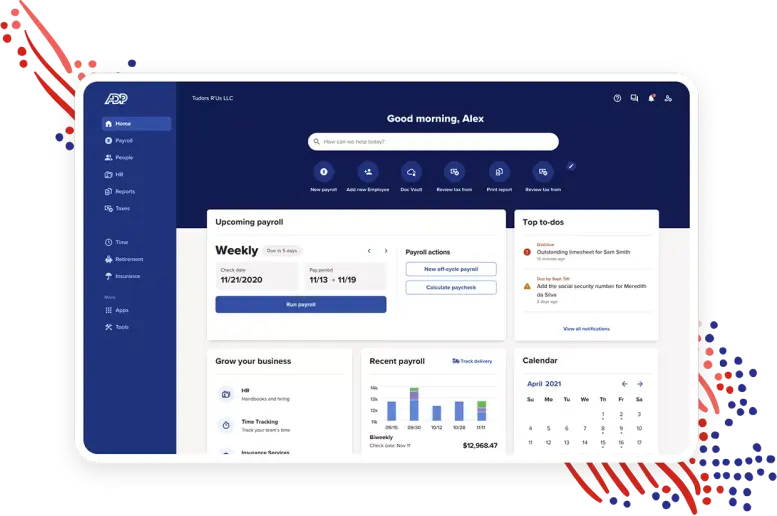

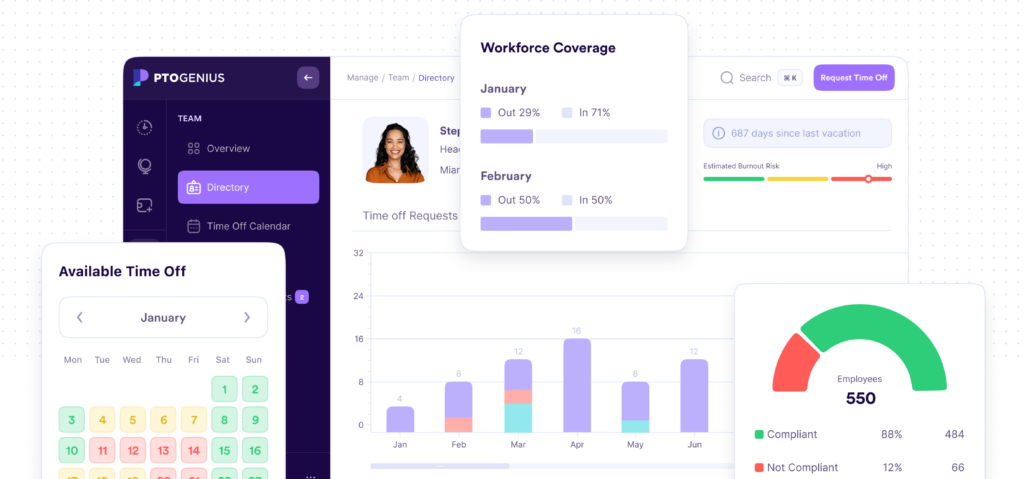

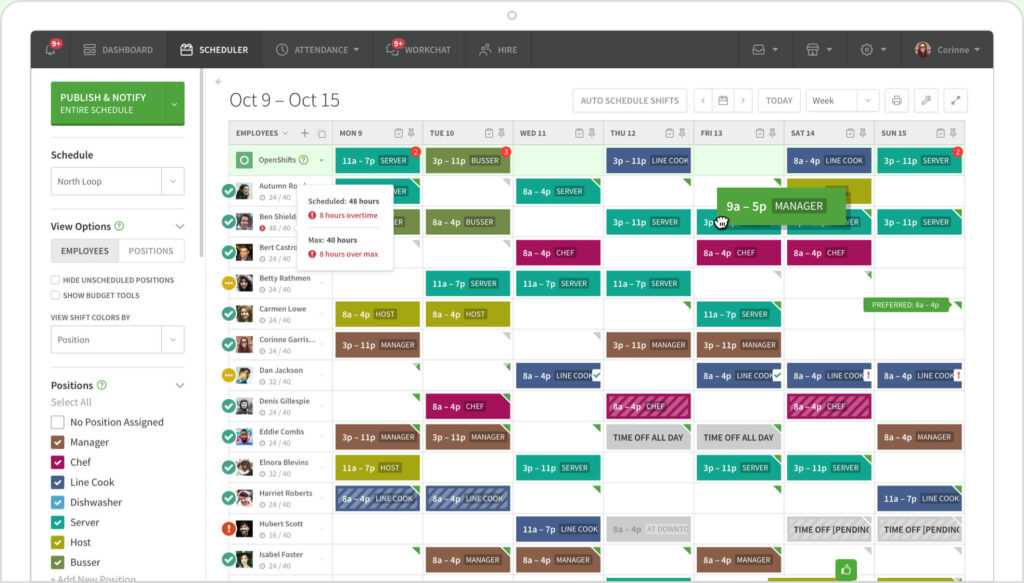

User Friendly Interface

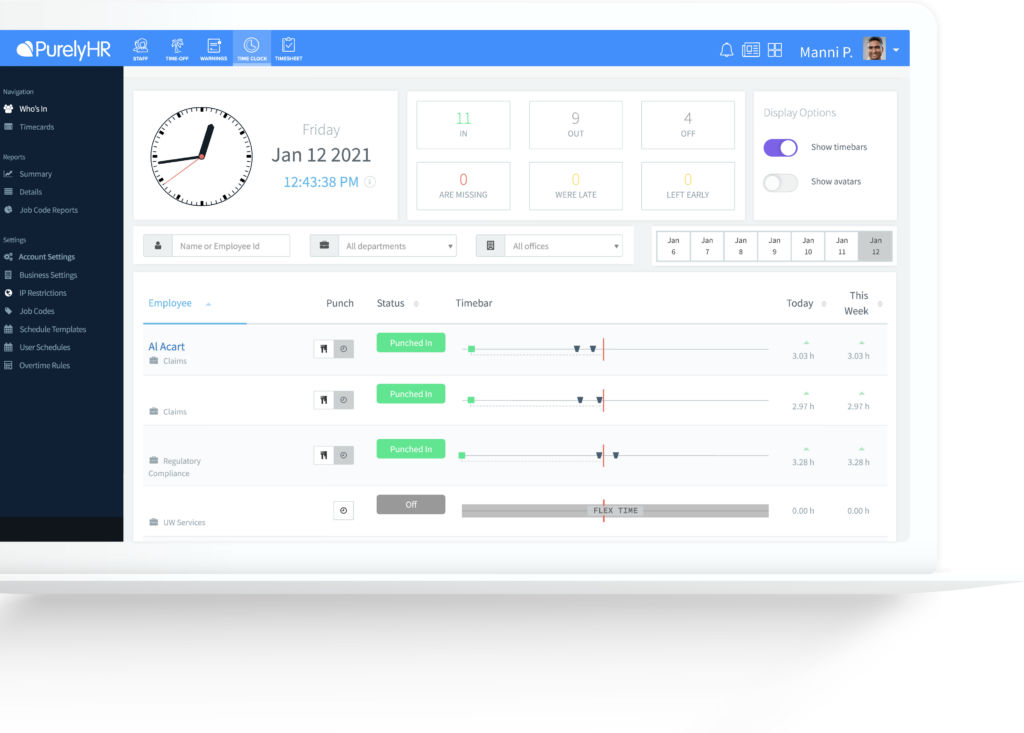

A user friendly interface is essential for any leave tracking system. Employees and managers should be able to navigate the system with ease, submit leave requests, and view leave balances without extensive training. A clean, intuitive design with clear instructions and easy navigation helps in minimizing errors and improving user adoption.

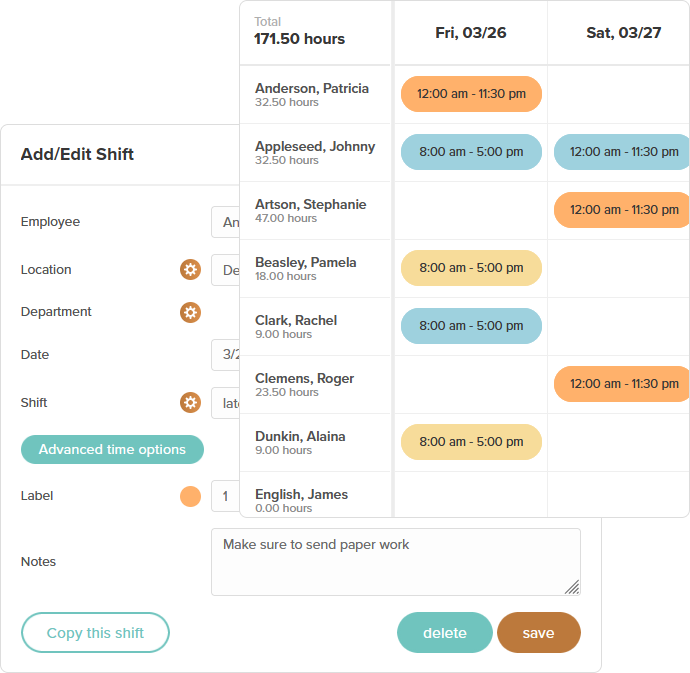

Customizable Leave Policies

Every organization has unique leave policies. An effective leave tracking system must allow customization to accommodate various types of leave (e.g., vacation, sick leave, parental leave), accrual rates, carry over rules, and other company specific policies. This ensures the system can adapt to the specific needs of the organization.

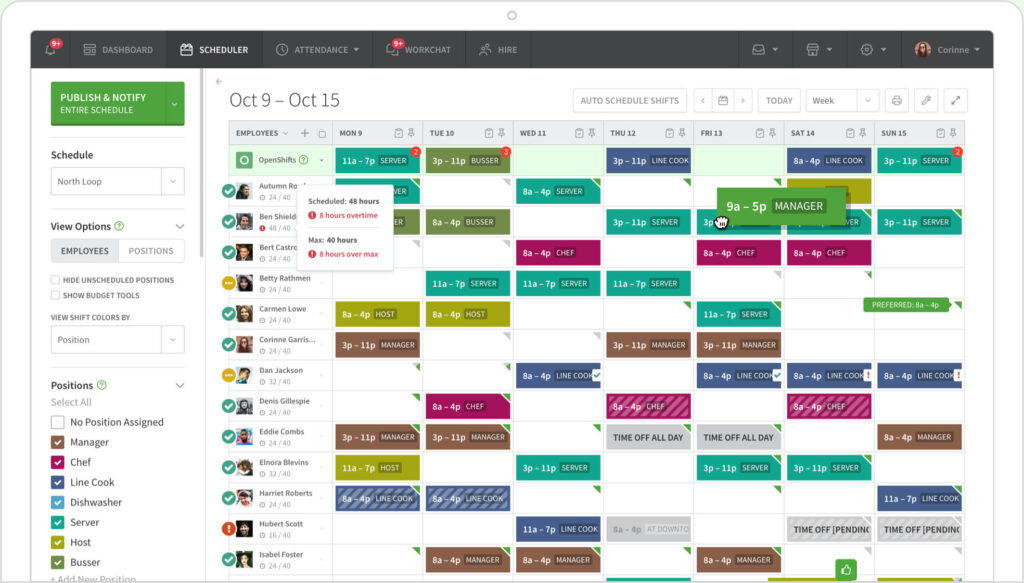

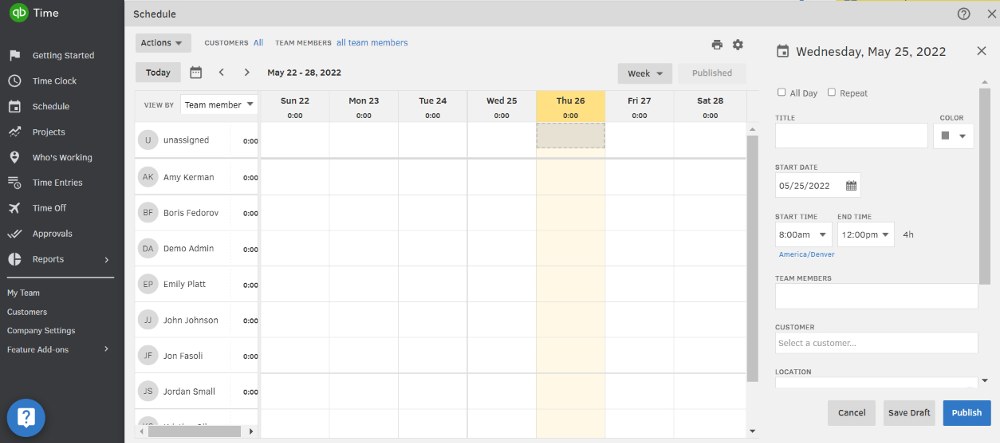

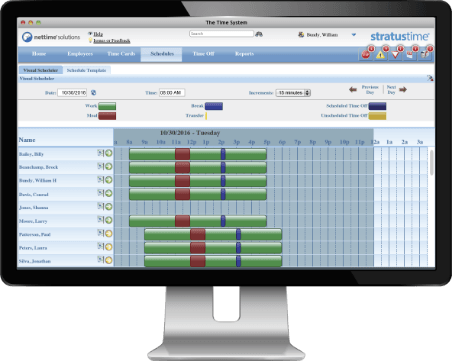

Automated Leave Requests and Approvals

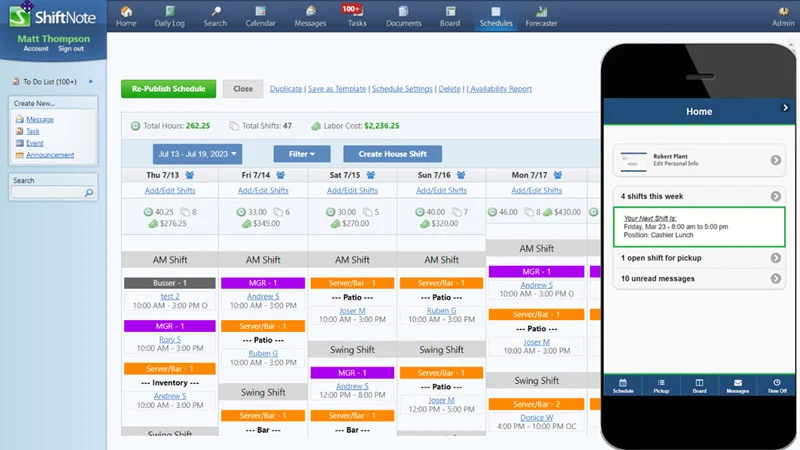

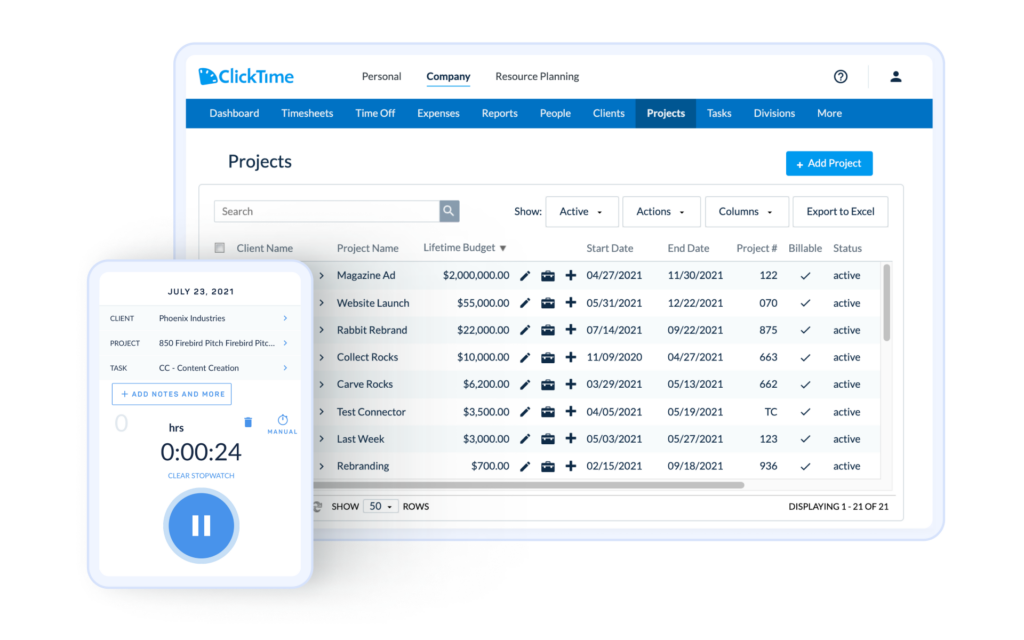

Automation is a key feature that simplifies the leave management process. Employees should be able to submit leave requests online, which are then automatically routed to the appropriate manager for approval. Automated notifications and reminders ensure that no request goes unnoticed, speeding up the approval process and reducing administrative workload.

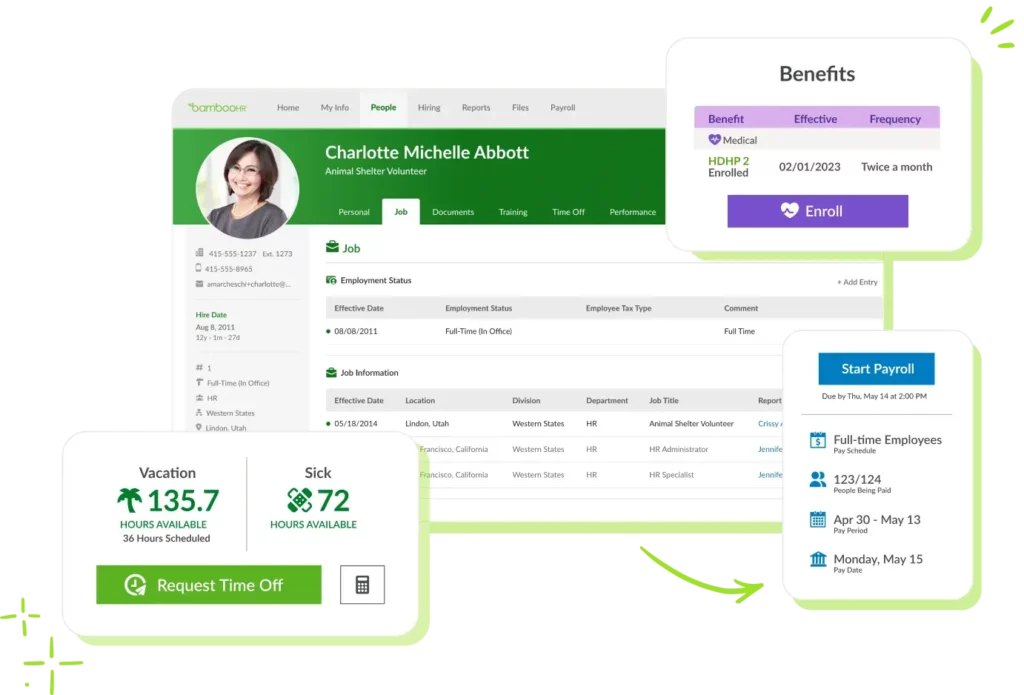

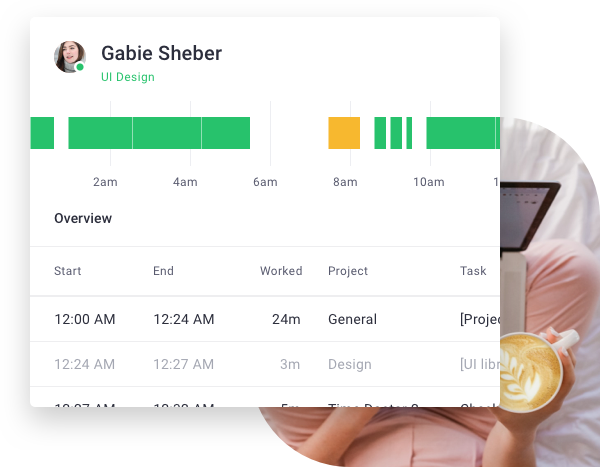

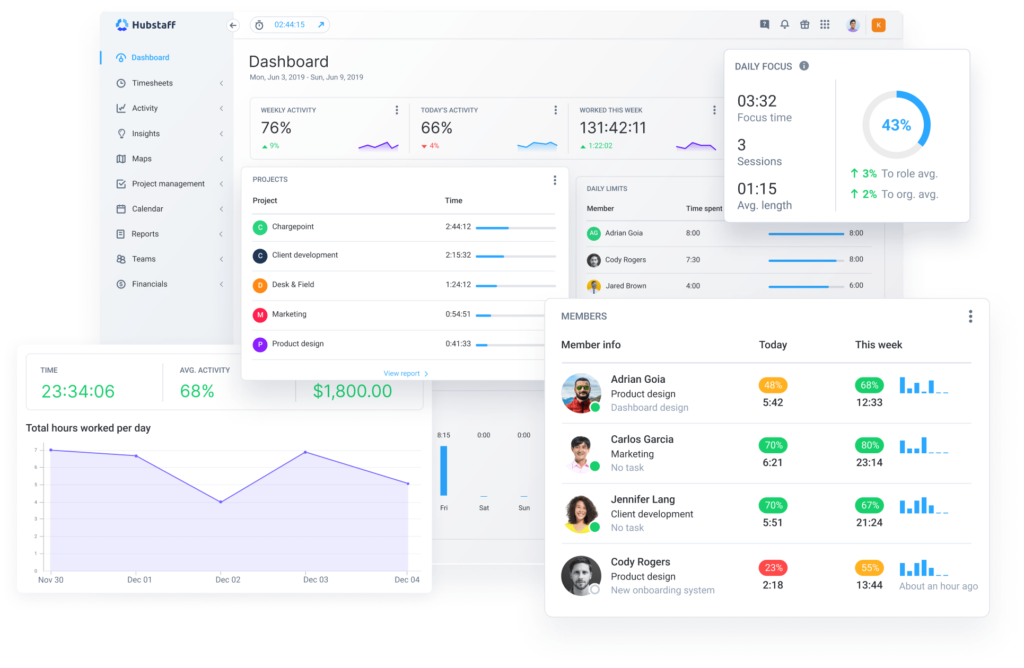

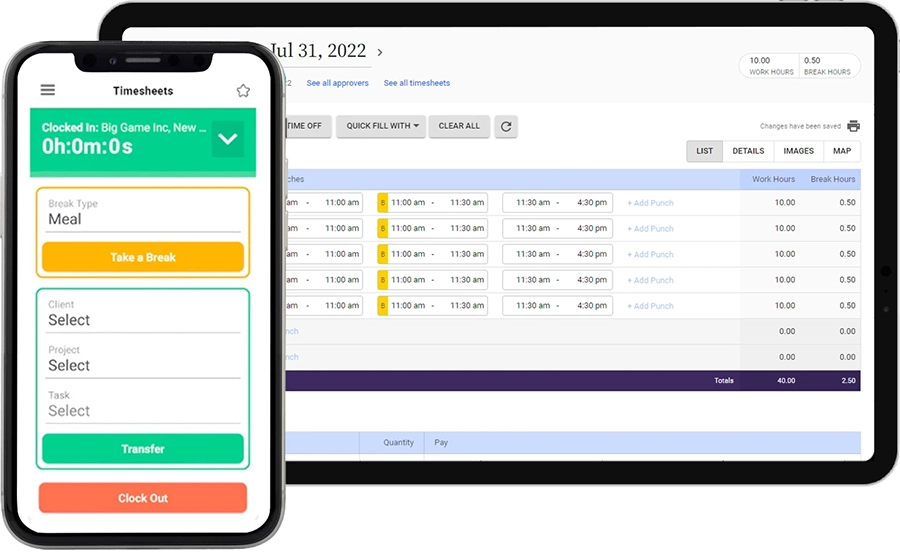

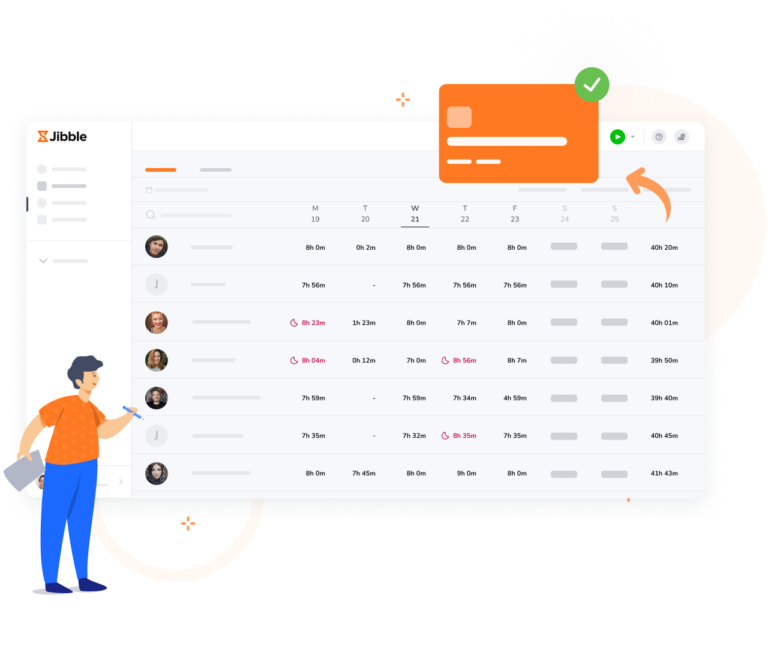

Real Time Leave Balances

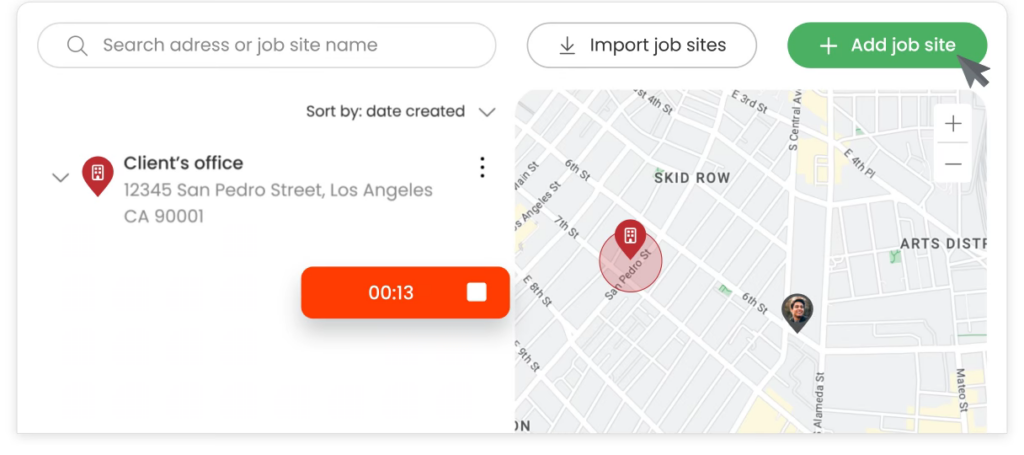

Employees and managers should have access to real time information about leave balances. This feature helps employees plan their leave effectively and enables managers to make informed decisions regarding leave approvals. Real time data also helps in preventing situations where employees take leave they are not entitled to.

Integrations

An effective leave tracking system should seamlessly integrate with calendars as Google calendar or Outlook Calendar. This integration allows employees to view their leave schedules alongside their work commitments in a single calendar interface, reducing the chances of scheduling conflicts. Managers gain a comprehensive view of team availability, facilitating better planning and resource allocation. Automated calendar updates ensure that any approved leave requests are immediately reflected, minimizing manual entry errors and administrative burden.

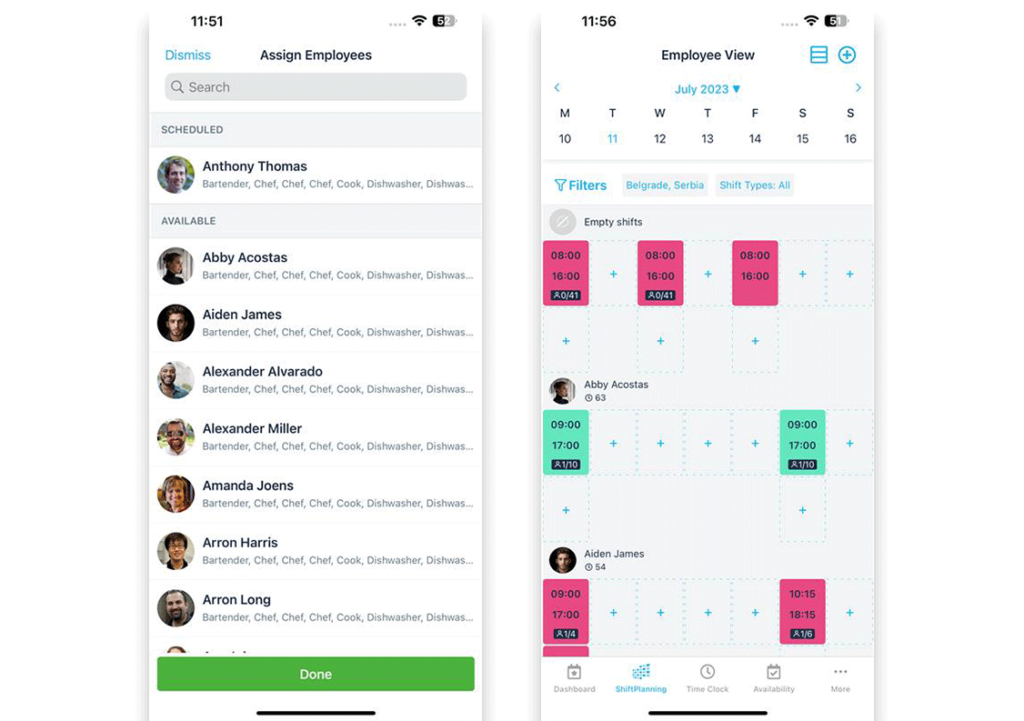

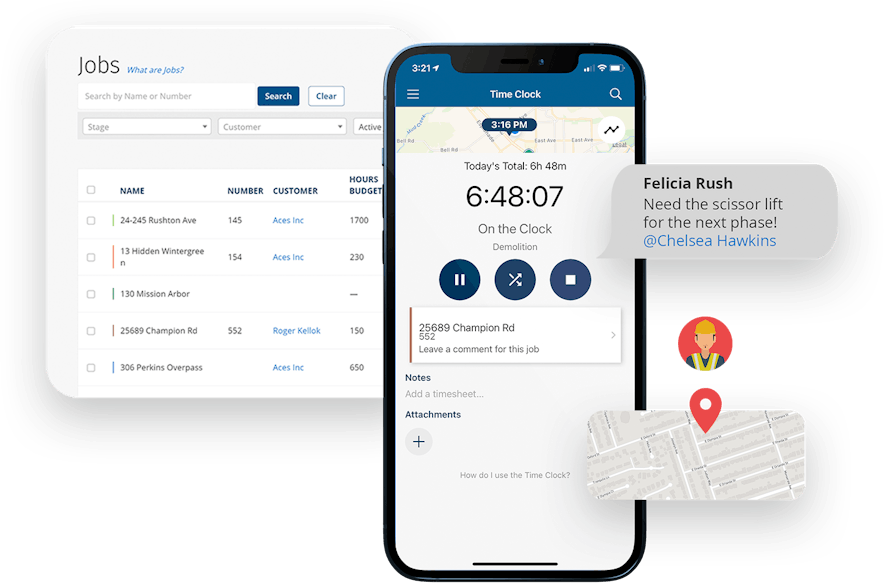

Mobile Accessibility

In today’s mobile centric world, having a mobile accessible leave tracking system is crucial. Employees should be able to submit leave requests, check leave balances, and view approval status from their smartphones or tablets. This flexibility enhances employee convenience and ensures that leave management is not restricted to office hours.

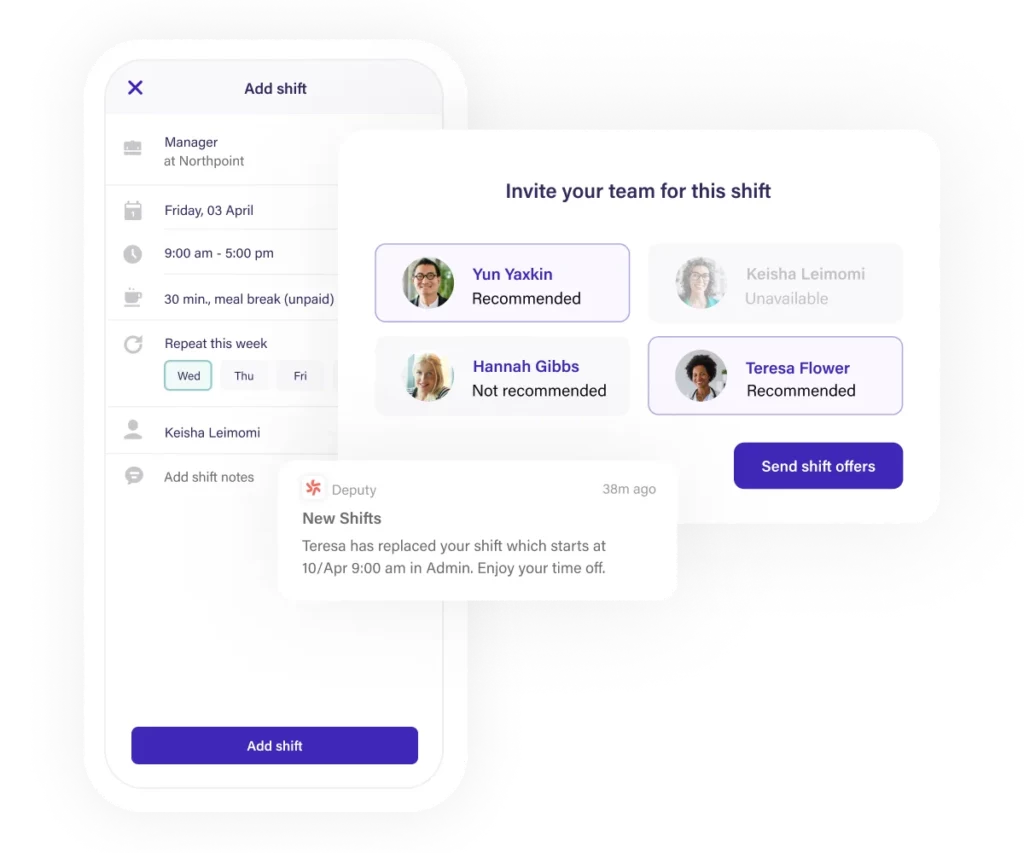

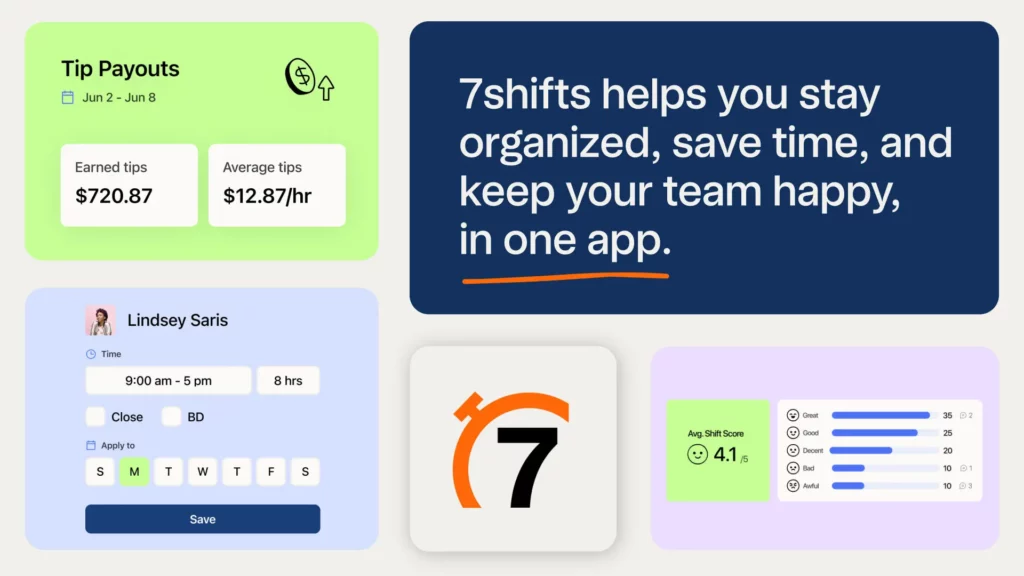

Day Off

The #1 tracker for your team’s PTO, vacations and absences, Day Off will help you track your team’s leaves and absences in one place. In seconds you will set up your leave policies, approval workflow and enjoy a unique experience. The “Day Off” app concept revolves around providing users a platform to manage their personal, sick, and vacation days more effectively. features aimed at both individual employees and organizations.

- Employees can track their balances up to date information about their available time off.

- You can add unlimited numbers of employees.

- Supports various leave types (e.g., annual, sick, maternity/paternity leave) and Supports Days and Hours balance, you can add unlimited numbers of leave types and leave policies.

- You can Customize your work schedule according to company’s working days and hours.

- Setting up public holidays specific to your country or region, by importing holidays from Google.

- The app can integrate with ( Slack, Google Calendar, Outlook Calendar and Teams)

- Supports Accruals & Carry overs.

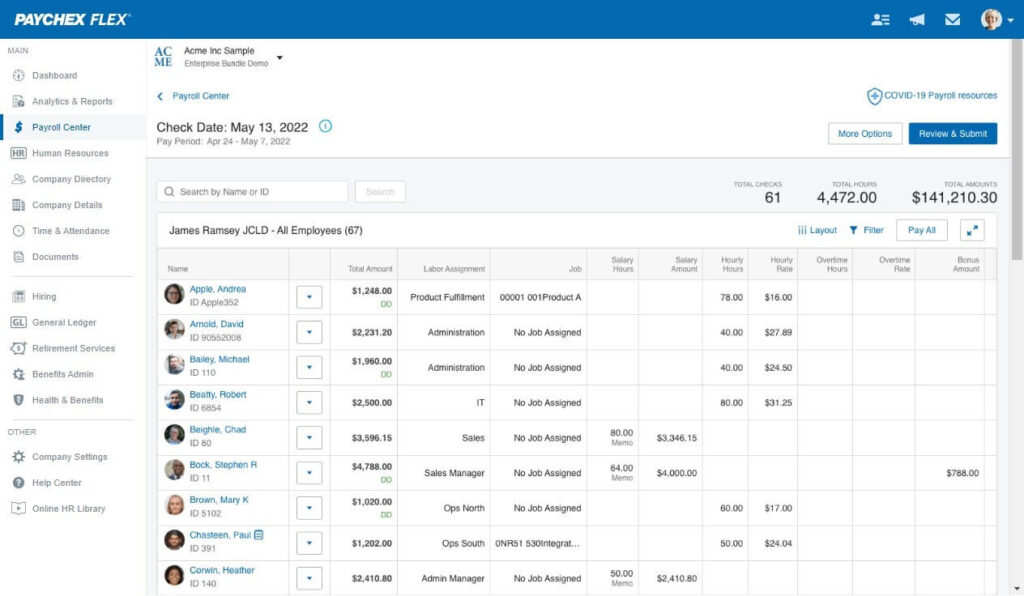

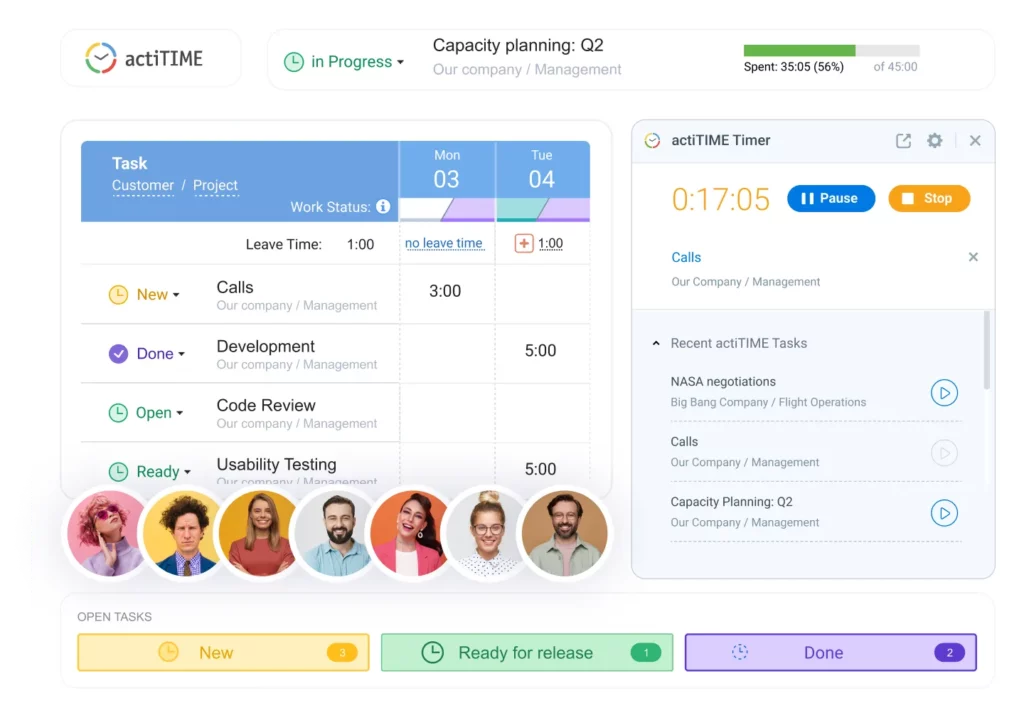

Comprehensive Reporting and Analytics

Detailed reporting and analytics capabilities are essential for effective leave management. The system should provide insights into leave trends, patterns of absenteeism, and overall leave utilization. Managers can use this data to identify potential issues, such as frequent absenteeism, and take proactive measures to address them.

Compliance Management

Compliance with labor laws and regulations is critical for any organization. An effective leave tracking system helps ensure compliance by automatically applying relevant legal requirements to leave policies. It should also maintain detailed records of leave transactions, which can be crucial in case of audits or disputes.

Scalability

As organizations grow, their leave management needs may change. A scalable leave tracking system can adapt to the changing size and requirements of the organization. Whether adding more employees, introducing new types of leave, or expanding to new locations, the system should be able to handle these changes seamlessly.

Security and Data Privacy

Protecting employee data is paramount. An effective leave tracking system must have robust security measures to protect sensitive information. This includes encryption, secure access controls, and regular security audits. Compliance with data privacy regulations, such as GDPR or CCPA, is also essential to avoid legal repercussions.

Employee Self Service Portal

An employee self service portal empowers employees to manage their leave independently. They can check leave balances, view leave history, and download relevant forms or documents. This reduces the administrative burden on HR and gives employees more control over their leave management.

Support and Training

Finally, effective leave tracking systems come with comprehensive support and training resources. Whether through detailed user manuals, online tutorials, or responsive customer support teams, providing adequate support ensures that users can maximize the system’s benefits and resolve any issues promptly.

FAQ

What is a leave tracking system?

A leave tracking system is a digital tool that helps businesses manage employee absences, including vacation, sick leave, and other types of time off. It automates leave requests, approvals, accruals, and reporting to improve accuracy and efficiency.

Why is a leave tracking system important for businesses?

It streamlines administrative work, reduces manual errors, ensures compliance with company policies, and provides transparency for both managers and employees. This helps maintain productivity while supporting work-life balance.

What are the essential features of a good leave tracking system?

An effective system should include features such as automated leave requests and approvals, real time balance tracking, multi policy support, calendar integration, detailed reporting, mobile access, and customizable settings.

How does automation improve leave management?

Automation eliminates the need for manual spreadsheets or paperwork. It speeds up approval workflows, reduces errors, and ensures that leave balances are updated instantly when time off is approved or taken.

Can a leave tracking system handle different leave policies?

Yes. A robust leave tracking system like Day Off supports multiple leave types and policies across departments, locations, and employment types, ensuring flexibility and compliance with local regulations.

How does calendar integration benefit employees and managers?

Integration with tools like Google Calendar, Outlook, and Teams helps everyone stay informed about team availability, prevents scheduling conflicts, and provides clear visibility into planned absences.

Is mobile accessibility important in a leave tracking system?

Absolutely. A mobile friendly system allows employees to request leave and managers to approve it anytime, anywhere, improving convenience and response time.

How does a leave tracking system improve compliance?

It helps organizations adhere to local labor laws and internal policies by automatically applying accrual rules, carryover limits, and approval hierarchies, reducing legal and HR risks.

Can leave tracking software integrate with other HR tools?

Yes. Many systems integrate with HR, payroll, and communication tools, ensuring data consistency and simplifying administrative tasks.

How does Day Off simplify leave tracking for companies?

Day Off automates leave management, supports customizable policies, integrates with calendars and communication tools, and provides insightful reports. It helps HR teams save time, reduce errors, and maintain a transparent leave process.

Conclusion

Implementing an effective leave tracking system is essential for any organization aiming to streamline its HR processes, ensure compliance, and enhance employee satisfaction. By incorporating features such as user friendliness, automation, integration, and robust security, organizations can manage employee leave efficiently and effectively, ultimately contributing to a more productive and compliant workplace.